Additional Proxy Soliciting Materials (definitive) (defa14a)

March 31 2015 - 4:10PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant x Filed by a

Party other than the Registrant ¨

Check the

appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

The Dow Chemical Company

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

2015

ANNUAL MEETING OF STOCKHOLDERS

OF THE DOW CHEMICAL COMPANY

This Proxy Statement Supplement dated March 31, 2015 is issued in connection with the 2015 Annual Meeting of Stockholders of The Dow Chemical

Company to be held on May 14, 2015. This supplement to the proxy statement filed by The Dow Chemical Company with the Securities and Exchange Commission on March 27, 2015 for use at the annual meeting of stockholders on May 14,

2015 (the “Proxy Statement”) is being filed solely to correct errors in the “Total” and “Total Without Change in Pension Value” columns to the Summary Compensation Table appearing on page 35 of the Proxy Statement and

the “# of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (1))” column of the Equity Compensation Plan Information table appearing on page 46 of the Proxy

Statement.

The “Summary Compensation Table” is amended to read as follows:

Summary Compensation Table

The following table summarizes the compensation of our CEO, CFO, and our three

other most highly compensated executive officers for the fiscal year ended December 31, 2014. On October 1, 2014, Mr. Weideman stepped down as CFO and Mr. Ungerleider became CFO.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name and Principal Position |

|

Year |

|

|

Salary ($) |

|

|

Bonus

($) |

|

|

Stock

Awards

($) (a) |

|

|

Option

Awards

($) (b) |

|

|

Non-Equity

Incentive Plan

Compensation

($) (c) |

|

|

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($) (d)

|

|

|

All Other

Compensation

($) (e) |

|

|

Total

($) |

|

|

Total

Without

Change in

Pension

Value ($) |

|

| Andrew Liveris, |

|

|

2014 |

|

|

|

1,921,433 |

|

|

|

0 |

|

|

|

9,369,108 |

|

|

|

3,630,036 |

|

|

|

4,232,314 |

|

|

|

7,135,205 |

|

|

|

410,276 |

|

|

|

26,698,372 |

|

|

|

19,563,167 |

|

| CEO & Chairman |

|

|

2013 |

|

|

|

1,865,500 |

|

|

|

0 |

|

|

|

8,312,228 |

|

|

|

5,324,003 |

|

|

|

4,559,027 |

|

|

|

3,212 |

|

|

|

388,907 |

|

|

|

20,452,877 |

|

|

|

20,449,665 |

|

|

|

|

2012 |

|

|

|

1,808,333 |

|

|

|

0 |

|

|

|

8,446,171 |

|

|

|

4,840,080 |

|

|

|

1,368,640 |

|

|

|

6,160,388 |

|

|

|

366,055 |

|

|

|

22,989,668 |

|

|

|

16,829,280 |

|

| Howard Ungerleider, |

|

|

2014 |

|

|

|

932,278 |

|

|

|

0 |

|

|

|

2,853,865 |

|

|

|

1,105,568 |

|

|

|

1,516,743 |

|

|

|

3,013,541 |

|

|

|

76,130 |

|

|

|

9,498,125 |

|

|

|

6,484,584 |

|

| CFO & Exec. VP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| William Weideman, |

|

|

2014 |

|

|

|

935,888 |

|

|

|

0 |

|

|

|

2,723,673 |

|

|

|

1,055,357 |

|

|

|

1,303,468 |

|

|

|

2,927,610 |

|

|

|

19,071 |

|

|

|

8,965,066 |

|

|

|

6,037,456 |

|

| Former CFO & Exec VP |

|

|

2013 |

|

|

|

904,447 |

|

|

|

0 |

|

|

|

2,301,569 |

|

|

|

1,474,051 |

|

|

|

1,601,053 |

|

|

|

393,911 |

|

|

|

16,024 |

|

|

|

6,691,054 |

|

|

|

6,297,143 |

|

|

|

|

2012 |

|

|

|

836,815 |

|

|

|

0 |

|

|

|

2,408,410 |

|

|

|

1,380,079 |

|

|

|

407,001 |

|

|

|

3,465,782 |

|

|

|

29,469 |

|

|

|

8,527,557 |

|

|

|

5,061,774 |

|

| James Fitterling, |

|

|

2014 |

|

|

|

965,922 |

|

|

|

0 |

|

|

|

2,853,865 |

|

|

|

1,105,568 |

|

|

|

1,539,213 |

|

|

|

2,897,381 |

|

|

|

63,598 |

|

|

|

9,425,547 |

|

|

|

6,528,166 |

|

| Vice Chairman |

|

|

2013 |

|

|

|

903,997 |

|

|

|

0 |

|

|

|

2,301,569 |

|

|

|

1,474,051 |

|

|

|

1,676,915 |

|

|

|

1,135 |

|

|

|

36,293 |

|

|

|

6,393,961 |

|

|

|

6,392,826 |

|

|

|

|

2012 |

|

|

|

836,636 |

|

|

|

35,518 |

|

|

|

2,408,410 |

|

|

|

1,380,079 |

|

|

|

424,879 |

|

|

|

2,853,921 |

|

|

|

53,243 |

|

|

|

7,992,687 |

|

|

|

5,138,765 |

|

| Joe Harlan, |

|

|

2014 |

|

|

|

972,220 |

|

|

|

0 |

|

|

|

2,723,673 |

|

|

|

1,055,357 |

|

|

|

1,505,508 |

|

|

|

165,278 |

|

|

|

114,037 |

|

|

|

6,536,073 |

|

|

|

6,370,795 |

|

| Vice Chairman |

|

|

2013 |

|

|

|

943,902 |

|

|

|

0 |

|

|

|

2,301,569 |

|

|

|

1,474,051 |

|

|

|

1,663,205 |

|

|

|

91,910 |

|

|

|

65,434 |

|

|

|

6,540,071 |

|

|

|

6,448,161 |

|

|

|

|

2012 |

|

|

|

902,067 |

|

|

|

0 |

|

|

|

2,199,134 |

|

|

|

1,260,015 |

|

|

|

435,116 |

|

|

|

75,987 |

|

|

|

56,555 |

|

|

|

4,928,873 |

|

|

|

4,852,886 |

|

| Charles Kalil, |

|

|

2014 |

|

|

|

1,024,661 |

|

|

|

0 |

|

|

|

2,594,026 |

|

|

|

1,005,030 |

|

|

|

1,427,107 |

|

|

|

2,991,336 |

|

|

|

70,200 |

|

|

|

9,112,360 |

|

|

|

6,121,024 |

|

| General Counsel & Exec. VP |

|

|

2013 |

|

|

|

995,131 |

|

|

|

0 |

|

|

|

2,499,820 |

|

|

|

1,407,017 |

|

|

|

1,752,920 |

|

|

|

2,613 |

|

|

|

76,834 |

|

|

|

6,734,334 |

|

|

|

6,731,721 |

|

| |

|

2012 |

|

|

|

951,618 |

|

|

|

0 |

|

|

|

2,408,410 |

|

|

|

1,380,079 |

|

|

|

459,478 |

|

|

|

2,798,980 |

|

|

|

70,339 |

|

|

|

8,068,904 |

|

|

|

5,269,923 |

|

Note: In order to show the effect that the year-over-year change in pension value had on total compensation, as determined under

applicable SEC rules, we have included an additional column to show total compensation minus the change in pension value. The amounts reported in the Total Without Change in Pension Value column may differ substantially from the amounts reported in

the Total column required under SEC rules and are not a substitute for total compensation. Total without Change in Pension Value represents total compensation, as determined under applicable SEC rules, minus the change in pension value reported in

the Change in Pension Value and Nonqualified Deferred Compensation Earnings column. The change in pension value is subject to many external variables, such as interest rates, that are not related to Company performance. Therefore, we do not believe

a year-over-year change in pension value is helpful in evaluating compensation for comparative purposes.

| (a) |

Amounts represent the aggregate grant date fair value of awards in the year of grant in accordance with the same standard applied for financial accounting purposes. If valued

assuming a maximum payout on the Performance Share program, the value of the awards would be: Liveris $12,687,402; Ungerleider $3,864,554; Weideman $3,688,248; Fitterling $3,864,544; Harlan $3,688,248; Kalil $3,513,032. |

| (b) |

Dow’s valuation for financial accounting purposes uses the widely accepted lattice-binomial model. The option value calculated for the NEOs’ grants was $11.49 for

the grant date of February 14, 2014. The exercise price of $46.71 is the closing Dow stock price on the date of grant. |

| (c) |

Individual results for Non-Equity Incentive Plan Compensation are detailed in the Performance Award section of the 2014 Executive Compensation Program in Detail and reflect

income paid in 2015 under our annual Performance Award (PA) program for performance achieved in 2014. |

| (d) |

Reflects the aggregate change in the actuarial present value of accumulated pension benefits at age 65 using the actuarial assumptions included in the

Company’s audited financial statements. The amounts recorded in this column vary with a number of factors, including the discount rate applied to determine the value of future payment streams. An analysis of the Change in Pension Value for 2014

is shown below. As a result of a decrease in prevailing interest rates in the credit markets in 2014, the discount rate used pursuant to pension accounting rules to calculate the present value of future payments decreased from 5.00% for fiscal year

2013 to 4.10% for fiscal year 2014. The increase in pension value resulting from the change in interest rates does not |

| |

result in any increase to the underlying benefits payable to participants under the plan. Mr. Harlan participates in the Personal Pension Account plan. The $165,278 represents the increase

in his 2014 cash balance account due to the increase in annual pay and interest credits. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Change in Discount

Interest Rate ($) |

|

|

Change in Deferral

Period, Benefits,

and Other ($) |

|

|

Change due to

Change in

Mortality Table |

|

|

Total Change ($) |

|

| Andrew Liveris |

|

|

3,924,306 |

|

|

|

2,437,810 |

|

|

|

773,089 |

|

|

|

7,135,205 |

|

| Howard Ungerleider |

|

|

1,533,993 |

|

|

|

1,376,219 |

|

|

|

103,329 |

|

|

|

3,013,541 |

|

| William Weideman |

|

|

1,476,858 |

|

|

|

1,163,473 |

|

|

|

287,279 |

|

|

|

2,927,610 |

|

| James Fitterling |

|

|

1,673,863 |

|

|

|

1,044,913 |

|

|

|

178,605 |

|

|

|

2,897,381 |

|

| Joe Harlan |

|

|

0 |

|

|

|

165,278 |

|

|

|

0 |

|

|

|

165,278 |

|

| Charles Kalil |

|

|

1,479,430 |

|

|

|

1,134,501 |

|

|

|

377,405 |

|

|

|

2,991,336 |

|

| (e) |

All Other Compensation includes the cost of Company provided automobile (which was discontinued in 2013 for the NEOs other than the CEO), personal use of corporate aircraft by

the CEO as required by Company policy for security and immediate availability purposes, Company contributions to employee savings plans, reimbursements of costs paid for financial and tax planning support, home security, executive health

examinations and personal excess liability insurance premiums. The incremental cost to the Company of personal use of Company aircraft is calculated based on the variable operating costs to the Company including fuel, landing, catering, handling,

aircraft maintenance and pilot travel costs. Fixed costs, which do not change based upon usage, such as pilot salaries or depreciation of the aircraft or maintenance costs not related to personal travel, are excluded. NEOs also are provided a tax

reimbursement for taxes incurred when a spouse travels for business purposes as it is sometimes necessary for spouses to accompany NEOs to business functions. These taxes are incurred because of the Internal Revenue Service’s rules governing

business travel by spouses and the Company reimburses the associated taxes. No NEO is provided a tax reimbursement for personal use of aircraft. |

The following “All Other Compensation” items exceeded $10,000 in value:

| |

– |

Liveris: Personal use of Company aircraft ($221,240), Company contributions to savings plans ($79,854), financial and tax planning ($56,238), tax reimbursements ($30,383)

|

| |

– |

Ungerleider: Company contributions to savings plans ($41,189), financial and tax planning ($25,153) |

| |

– |

Weideman: Company contributions to savings plans ($15,616) |

| |

– |

Kalil: Company contributions to savings plans ($47,422) |

| |

– |

Harlan: Company contributions to savings plans ($46,237), financial and tax planning ($38,596), tax reimbursement ($24,294) |

| |

– |

Fitterling: Company contributions to savings plans ($41,578), financial and tax planning ($15,723) |

The Equity Compensation Plan Information table is amended to read as follows:

Equity Compensation Plan

Information

The table below shows the Equity Compensation Plan Information as of December 31, 2014.

EQUITY COMPENSATION PLAN INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(1) |

|

|

(2) |

|

|

(3) |

|

| Plan Category |

|

# of securities to be

issued

upon

exercise of outstanding

options, warrants, rights |

|

|

Weighted-average exercise

price of

outstanding

options, warrants, rights ($) |

|

|

# of securities

remaining available for

future issuance

under

equity

compensation plans

(excluding securities

reflected in column (1)) |

|

| Equity Compensation Plans Approved by Security Holders |

|

|

67,497,037 |

|

|

|

35.75 |

(a) |

|

|

86,072,758 |

(b) |

| Equity Compensation Plans Not Approved by Security Holders (c) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

|

67,497,037 |

|

|

|

35.75 |

|

|

|

86,072,758 |

|

As of December 31, 2014

| (a) |

Calculation does not include outstanding Performance Shares that have no exercise price. |

| (b) |

The 2012 Stock Incentive Plan was approved by shareholders on May 10, 2012 with an initial share pool of 44,500,000 shares and another 50,500,000 shares approved by

shareholders on May 15, 2014. Shares available are calculated using the fungible method of counting shares which consumes 2.1 for each deferred stock and performance share awarded and 1 share for each stock option. The 2012 Plan also provides

that stock awards under the prior 1988 Award and Option Plan which are forfeited or expire shall be added back into this share pool at the fungible ratios. Total includes 62,725,432 shares available under the 2012 Stock Incentive Plan, 23,069,119

shares available under the 2012 Employee Stock Purchase Plan, and 278,207 shares available under the 1994 Executive Performance Plan. |

| (c) |

The 1994 Plan previously allowed the Company to grant up to 300,000 stock options. The Plan is limited to non-employee directors, and provided that stock options were granted

pursuant to a formula and had ten-year terms. No further grants will be issued under this plan and there are no longer outstanding shares. |

Except as specifically revised by the information contained herein, this supplement does not revise or update any of the other information set forth in the Proxy Statement. This supplement should be read in

conjunction with the Proxy Statement. From and after the date of this supplement, any references to the “Proxy Statement” are to the Proxy Statement as supplemented hereby.

™ Trademark of The Dow Chemical Company

|

|

|

|

|

2015 Proxy Statement Supplement |

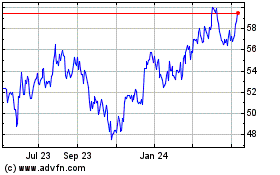

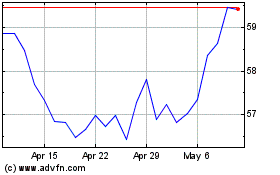

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024