EU Opens Antitrust Probe on Dow Chemical, DuPont Merger -- 2nd Update

August 11 2016 - 4:02PM

Dow Jones News

By Valentina Pop and Natalia Drozdiak

BRUSSELS -- The European Union's antitrust authority on Thursday

opened a full-blown investigation into a planned merger between Dow

Chemical Co. and DuPont Co., citing concerns the deal could lead to

higher prices for crop seeds and pesticides.

The European Commission said it would investigate whether the

deal may reduce competition in areas such as crop protection, seeds

and certain petrochemicals. The proposed merger, announced in

December, would unite the two industrial giants with a combined

market cap of about $122 billion, before splitting into three

separate companies.

The move raises the prospect that the companies may make further

concessions to win approval in the EU, after Dow and DuPont last

month outlined plans to address antitrust concerns there.

In-depth antitrust inquiries are common in Brussels for large

merger reviews and don't necessarily mean a deal will be blocked.

If the EU confirms its concerns, the companies can sell assets or

make other adjustments to assuage regulators.

"The livelihood of farmers depends on access to seeds and crop

protection at competitive prices. We need to make sure that the

proposed merger does not lead to higher prices or less innovation

for these products," said European competition commissioner

Margrethe Vestager.

The commission said it found the concessions Dow and DuPont

outlined on July 20 "insufficient to clearly dismiss its serious

doubts" about the merger being in line with EU rules. In

particular, the commission said it was concerned about the

concentration of both companies' herbicide and insecticide

businesses, among other product lines.

The companies on Thursday said they had anticipated "a thorough

review" by regulators and still expected the deal would close by

the end of the year. Last month, DuPont Chief Executive Ed Breen

said he anticipated the deal closing in November.

A final EU decision is expected by Dec. 20. Given the scale of

the two companies, the commission said it was "cooperating closely"

with competition authorities in the U.S., Brazil and Canada that

are also scrutinizing the deal.

Shares of Dow climbed 0.1% to $53.49 while DuPont gained 0.4% to

$69 in late-afternoon trading.

The EU's statement comes as other agriculture companies signal

plans to merge, partly due to sliding commodity prices. If

successful, those deals could ratchet up concentration in the $100

billion global market for seeds and pesticides, placing more than

80% of U.S. corn-seed sales and 70% of the global pesticide market

in the hands of just three companies.

China National Chemical Corp., which maintains a pesticide

division, has already agreed to acquire Swiss pesticide and seed

company Syngenta AG. Germany's Bayer AG is pursuing a takeover of

Monsanto Co., the world's largest crop seed company by sales,

though the companies haven't come to terms on a deal.

The rapid consolidation of the agriculture market poses a

challenge for regulators who normally conduct thorough reviews of

such mergers, seeking to keep prices competitive while safeguarding

innovation.

In a letter to members of European Parliament in late June, Ms.

Vestager suggested the EU would consider that several mergers are

taking place at once when reviewing a Bayer-Monsanto deal.

The proposed Dow and DuPont merger is the only deal so far that

has progressed far enough to officially notify EU regulators. But

EU regulators are also likely to be stricter than their peers in

other regions in weighing whether the merger creates unreasonably

high barriers to entry for rivals, said Ioannis Lianos, a professor

of global competition law at University College London.

"(Antitrust regulators) don't have an industry approach in their

merger reviews, they have to develop a targeted approach," Mr.

Lianos said.

--Jacob Bunge contributed to this article.

Write to Valentina Pop at valentina.pop@wsj.com and Natalia

Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

August 11, 2016 15:47 ET (19:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

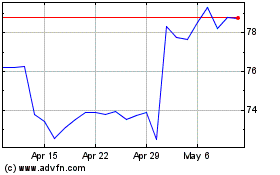

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024