UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| o |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Strategic Investment Fund,

L.P.

Trian Partners Strategic Investment Fund

II, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund (ERISA), L.P.

Trian Partners Strategic Investment Fund-A,

L.P.

Trian Partners Strategic Investment Fund-D,

L.P.

Trian Partners Strategic Investment Fund-N,

L.P.

Trian SPV (SUB) VIII, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Fund (Sub)-G II, L.P.

Nelson Peltz

Peter W. May

Edward P. Garden

John H. Myers

Arthur B. Winkleblack

Robert J. Zatta

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

Trian Fund Management, L.P. (“Trian”) has provided,

and may from time to time in the future provide, the materials attached as Exhibit 1 to

stockholders of E.I. du Pont de Nemours and Company and/or certain other persons. These materials are being filed by Trian in HTML and PDF formats as a convenience for readers.

###

Exhibit 1

Trian Case Study: H.J. Heinz Company April 2015 © 2 015 T ri a n Fund M anag e men t , L. P . A ll rights rese r v ed.

Disclosure Statement And Disclai m ers Additional Information Trian Fund Management, L.P. (“Trian”) and the investment funds that it manages that hold shares of E.I. du Pont de Nemours an d C ompany (collectively, Trian with such funds, “Trian Partners”) together with other Participants (as defined below), filed a definitive proxy statem ent and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) on March 25, 2015 to be used to solicit proxies in connection wi th the 2015 Annual Meeting of Stockholders of E.I. du Pont de Nemours and Company (the “Company”), including any adjournments or postponements thereof o r a ny special meeting that may be called in lieu thereof (the “2015 Annual Meeting”). Information relating to the participants in such proxy solici tat ion (the “Participants”) has been included in that definitive proxy statement and in any other amendments to that definitive proxy statement. Stockholders are adv ised to read the definitive proxy statement and any other documents related to the solicitation of stockholders of the Company in connection with the 201 5 A nnual Meeting because they contain important information, including additional information relating to the Participants. Trian Partners’ definitive pr oxy statement and a form of proxy have been mailed to stockholders of the Company. These materials and other materials filed by Trian Partners in connection wi th the solicitation of proxies are available at no charge at the SEC’s website at www.sec.gov. The definitive proxy statement and other relevant documents filed by Trian Partners with the SEC are also available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners, Inc. 105 M adi son Avenue, New York, New York 10016 (call collect: 212 - 929 - 5500; call toll free: 800 - 322 - 2885) or email: proxy@mackenziepartners.com General Considerations This presentation is for general informational purposes only, is not complete and does not constitute an agreement, offer, a sol icitation of an offer, or any advice or recommendation to enter into or conclude any transaction or confirmation thereof (whether on the terms shown herein or otherwise). This presentation should not be construed as legal, tax, investment, financial or other advice. The views expressed in this presen ta tion represent the opinions of Trian Partners, and are based on publicly available information with respect to the Company and the other companies referred to herein. Trian Partners recognizes that there may be confidential information in the possession of the companies discussed in this presentation that cou ld lead such companies to disagree with Trian Partners’ conclusions. Certain financial information and data used herein have been derived or obtained f ro m filings made with the SEC or other regulatory authorities and from other third party reports. Trian Partners currently beneficially owns shares of the Com pany. Trian Partners has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indica ti ng the support of such third party for the views expressed herein. Trian Partners does not endorse third - party estimates or research which are used in this presentation solely for illustrative purposes. No warranty is made that data or information, whether derived or obtained from filings made with the S EC or any other regulatory agency or from any third party, are accurate. Past performance is not an indication of future results. Neither the Participants nor any of their affiliates shall be responsible or have any liability for any misinformation contai ned in any third party, SEC or other regulatory filing or third party report. Unless otherwise indicated, the figures presented in this presentation, including re tur n on invested capital (“ROIC”) and investment values have not been calculated using generally accepted accounting principles (“GAAP”) and have not been audited by independent accountants. Such figures may vary from GAAP accounting in material respects and there can be no assurance that the unrealize d v alues reflected in this presentation will be realized. This is not meant to be, nor is it, a prediction of the future trading price or market value o f s ecurities of the Company. There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities m ay not trade at prices that may be implied herein. The estimates, projections, pro forma information and potential impact of the opportunities identified by Tri an Partners herein are based on assumptions that Trian Partners believes to be reasonable as of the date of this presentation, but there can be no assuran ce or guarantee that actual results or performance of the Company will not differ, and such differences may be material. This presentation does not recom men d the purchase or sale of any security. Trian Partners reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Trian P art ners disclaims any obligation to update the data, information or opinions contained in this presentation. Note: Disclosure Statement and Disclaimers are continued on the next page 2

Disclosure Statement And Disclai m ers (cont’d ) Forward - Looking Statements This presentation contains forward - looking statements. All statements contained in this presentation that are not clearly histor ical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportun ity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward - looking statements. The projected results and statements containe d in this presentation that are not historical facts are based on current expectations, speak only as of the date of this presentation and involve risks, un certainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achi eve ments expressed or implied by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, am ong other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predic t accurately and many of which are beyond the control of Trian Partners. Although Trian Partners believes that the assumptions underlying the projected resu lts or forward - looking statements are reasonable as of the date of this presentation, any of the assumptions could be inaccurate and, therefore, the re can be no assurance that the projected results or forward - looking statements included in this presentation will prove to be accurate. In light of the sig nificant uncertainties inherent in the projected results and forward - looking statements included in this presentation, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and initiatives expressed or implied by such projected results and fo rward - looking statements will be achieved. Trian Partners will not undertake and specifically declines any obligation to disclose the results of any revisions th at may be made to any projected results or forward - looking statements in this presentation to reflect events or circumstances after the date of such p rojected results or statements or to reflect the occurrence of anticipated or unanticipated events. Not An Offer to Sell or a Solicitation of an Offer to Buy Under no circumstances is this presentation intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security. Funds managed by Trian are in the business of trading -- buying and selling -- securities. It is possible that there will be dev elopments in the future that cause one or more of such funds from time to time to sell all or a portion of their holdings in open market transactions or o the rwise (including via short sales), buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, cal ls or other derivative instruments relating to such shares. Consequently, Trian Partners’ beneficial ownership of shares of, and/or economic interest in, the Co mpa ny‘s common stock may vary over time depending on various factors, with or without regard to Trian Partners’ views of the Company’s business, prosp ect s or valuation (including the market price of the Company’s common stock), including without limitation, other investment opportunities available to Trian Par tners, concentration of positions in the portfolios managed by Trian, conditions in the securities markets and general economic and industry conditio ns. Trian Partners also reserves the right to change its intentions with respect to its investments in the Company and take any actions with respect to investments in the Company as it may deem appropriate. Concerning Intellectual Property All registered or unregistered service marks, trademarks and trade names referred to in this presentation are the property of th eir respective owners, and Trian Partners’ use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademar ks and trade names. 3

H.J. Heinz Company – Trian Case Study Situation Overview (Feb. 2006 – Feb. 2013) ▪ Despite world - class assets and strong cash flow, total shareholder returns at Heinz had underperformed peers ▪ After purchasing a stake in the company, Trian filed a Schedule 13D that included a white paper recommending: – Reducing annual costs, including COGS (1) and SG&A (2) , which had grown faster than sales – Reducing deals and allowances (i.e., competing on price) and reinvesting in direct consumer marketing and innovation – Increasing focus on key brands and geographies, as well as a more efficient capital structure ▪ Trian conducted a proxy contest in mid - 2006 and won two seats on the Board. ▪ The ensuing seven years produced very strong results as Heinz prioritized investment and saw accelerated topline growth, improved profitability and peer - leading total shareholder returns (see slide 6) Excerpts From Trian White Paper: May 23, 2006 “Great brands define markets. As a leading branded consumer products company, Heinz must make marketing and innovation its core competency… Trian believes Heinz should reduce the amount that it currently spends on deals and allowances (20% of gross revenue) and reinvest those funds in creative consumer advertising, innovative new products and packaging and cross - marketing initiatives” x Marketing spend increased 74%, more than twice the rate of sales (3) , while deals and allowances declined as a percentage of sales x Positive organic sales growth every quarter; annual revenue growth of +3.8% (3) Source: SEC filings. (1) Cost of goods sold. (2) Selling general and administrative costs. (3) From 2006 - 2012 as only time frame available for which marketing information is available. Note: While Nelson Peltz is a former director of H.J. Heinz Company, none of the information set forth herein is based on no n - p ublic information of H.J. Heinz Company. 4

Growth - Led Strategy 5 Accelerated Organic Growth ▪ 32 consecutive quarters of organic sales growth from 2006 through sale of the Company to Berkshire Hathaway and 3G Capital in 2013 ▪ Organic sales CAGR of 3.8% from 2006 - 2012; >2x the rate of the prior 6 - years (1.7% organic sales CAGR) Invested For The Future ▪ Emerging markets grew from 11% of sales in 2006 to 21% by 2012 ▪ Marketing grew >2x faster than sales during this period ▪ Capex grew >2x faster than sales during this period Reduced One - Time Items ▪ Zero “ addbacks ” to EPS for 5 consecutive years beginning in 2007 high earnings quality ▪ Heinz had reported significant “ addbacks ” to EPS in 6 of 7 years from 2000 - 2006 Improved Returns on Capital ▪ ROIC up 560bps (+38%) from 14.8% in 2006 to 20.4% in 2012 ▪ SG&A ex marketing down ~100bps Enhanced Cash Flow ▪ Adj. o perating cash flow (2) grew at 1.4x the rate of sales growth ▪ Avg. working capital declined from 13% of sales in 2006 to 9% in 2012 ▪ Enabled dividend to grow at an 8% CAGR Drove EPS Growth ▪ EPS grew at an 8% CAGR from 2006 - 2012, in spite of the challenging consumer environment during the downturn. This compared to - 3% EPS growth over the 6 years pre - dating Trian’s investment After Trian invested in Heinz, the Company (1) : Source: SEC filings. Uses 2012 as end date for all financial data unless otherwise specified, since Company announced an ag ree ment to be acquired during FY 2013 and thus provided less financial detail. (1) Performance since investment reflects results from FY 2006 - 2012 except organic growth which reflects results from FY 2006 throug h the end of FY 2013. (2) Excludes cash for productivity initiatives. Note: While Nelson Peltz is a former director of H.J. Heinz Company, none of the information set forth herein is based on no n - p ublic information of H.J. Heinz Company.

6 Significantly Improved Performance and TSR Key Financial Metrics Up Across the Board Source : Financials based on Company filings, press releases and investor presentations . Heinz Shareholder Returns Led the S&P 500 (5) Performance for 2/6/2001 - 2/6/2006 Performance for the 7 years since then Source : Bloomberg . Source : SEC filings . (1) Earnings before interest, taxes, depreciation and amortization . (2) Selling, general and administrative expenses . (3) Earnings per share . (4) Return on invested capital per the 2012 proxy . (5) Shareholder returns from Bloomberg include dividends . Note : February 6 , 2006 represents the date when published reports first surfaced on CNBC of activist involvement . While Trian may believe that the rise in share price during the period of Trian’s active involvement was attributable in large part to the cumulative effects of the implementation of operational and strategic changes under Trian’s leadership, there is no objective method to confirm what portion of the stock’s appreciation was attributable to Trian’s efforts during this period and what was attributable to the overall rise in the markets or other factors . Note : February 14 , 2013 was the day the Heinz acquisition by Berkshire Hathaway and 3 G Capital was announced . Note : Market conditions at the time of the events reflected above may differ materially from current and future market conditions . The performance of this example should therefore not be construed as an indication of the Issuer’s performance . Past performance is not an indication of future results . Note : While Nelson Peltz is a former director of H . J . Heinz Company, none of the information set forth herein is based on non - public information of H . J . Heinz Company . $mm, except per share FY06A FY12A Change Net Revenue $8,643 $11,649 35% Em. Markets (% of Total) 11.0% 21.0%1,000bps EBITDA ex Marketing $1,866 $2,486 33% Marketing Spend $269 $468 74% SG&A % of Sales (ex Marketing) 18.1% 17.1% -98bps Diluted EPS $2.10 $3.35 60% Annual Dividend $1.20 $1.92 60% FY13A $3.62 73% FY14E $3.80 81% After-Tax ROIC 14.8% 20.4% 560bps (1) (2) (3) (4) 6

“We think like private equity people because Nelson forces us to think like private equity.. I said to another CEO that if I were to form a board today, Nelson [Peltz] would be one of the first directors I’d ask to serve… [Trian’s] team had good questions and good suggestions.” – Former CEO, Bill Johnson, CEO Magazine (3/08) Trian Was a Positive and Constructive Force on the Board Heinz Management Commentary Union Commentary “We have come to truly respect and highly value your impressive approach to sales and marketing, which has led to long - term shareholder value… and economic security for our members… If more companies I interacted with were able to follow the Heinz model, I believe we would have…fewer wasted resources.” – Bill Dempsey, Director of UFCW Capital Stewardship, in letters to Trian dated 10/07/08 and 10/23/08 Research Analyst Commentary “Having activist investor Nelson Peltz on the Board of Directors has turned out to be a valuable asset. He is an operator at heart, so he asks the right questions in meetings and pushes managers to share and learn from each other.” – Credit Suisse, 3/26/08 7

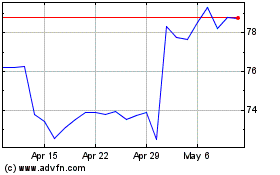

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024