Additional Proxy Soliciting Materials (definitive) (defa14a)

March 30 2015 - 7:34AM

Edgar (US Regulatory)

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A INFORMATION |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

x |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

E. I. du Pont de Nemours and Company |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

Set forth below is a factsheet to be used in calls to investors.

DUPONT ANNUAL MEETING FACT SHEET

Your Board urges you to use the enclosed WHITE proxy card to vote. —Pg. 3

|

MEETING INFO |

|

…DuPont’s 2015 Annual Meeting on Wednesday, May 13, 2015, (8:30am EDT) at 974 Centre Road, Chestnut Run Plaza, Building 730, Wilmington, DE 19805. (Inside Letter, time from Proxy Notice) |

|

PROXY / MAIL DATES |

|

…first distributed beginning on or about March 23, 2015… (Pg. 1) |

|

RECORD DATE |

|

…as of the close of business on March 17, 2015, the record date… (Inside Letter 2) |

|

OUTSTANDING COMMON STOCK |

|

On the record date, 905,946,751 shares of DuPont Common Stock were entitled to vote… (Pg. 3) |

|

PROPOSALS |

|

1. |

Election of Directors (Board recommending a vote FOR) |

|

|

|

Nominees: (01) Lamberto Andreotti; (02) Edward D. Breen; (03) Robert A. Brown; (04) Alexander M. Cutler; (05) Eleuthère I. du Pont; (06) James L. Gallogly; (07) Marillyn A. Hewson; (08) Lois D. Juliber; (09) Ellen J. Kullman; (10) Ulf M. Schneider; (11) Lee M. Thomas; (12) Patrick J. Ward (Proxy Card, Page 27) |

|

|

|

|

|

|

|

|

2. |

On Ratification of Independent Registered Public Accounting Firm (Proxy Card, Page 34) |

|

|

|

3. |

To Approve, by Advisory Vote, Executive Compensation (Proxy Card, Page 75) |

|

|

|

|

|

|

|

Shareholder Proposals: (Board recommending a vote AGAINST) |

|

|

|

4. |

On Lobbying (Proxy Card, Page 76) |

|

|

|

5. |

On Grower Compliance (Proxy Card, Page 79) |

|

|

|

6. |

On Plant Closures (Proxy Card, Page 82) |

|

|

|

7. |

On Repealing Certain Amendments to the Bylaws Adopted by the Board without Stockholder Approval (Proxy Card, Page 84) |

|

BOARD RECOMMENDATION |

|

The Board of Directors recommends that you vote FOR all the nominees listed in Proposal 1 and FOR Proposals 2 and 3. The Board of Directors recommends that you vote AGAINST the following Proposals: 4, 5, 6, & 7.

(Proxy Card)

The Board of Directors does NOT endorse any Trian nominees and…urges you NOT to sign or return any proxy card sent to you by Trian. If you have previously submitted a Gold proxy card sent to you by Trian, you can revoke that proxy and vote…by using the enclosed WHITE proxy card. (Inside Letter) |

|

BACKGROUND OF THE SOLICITATION |

|

For a background discussion including dates and contacts with Trian Partners, direct shareholders to the Proxy Statement, Pages 8-12 |

|

REASONS TO VOTE FOR DUPONT’S NOMINEES |

|

· Under the current management team, DuPont has executed a transformative strategy. DuPont has outperformed — delivering total shareholder returns of 266%, outperforming the S&P 500 and the Company’s proxy peers — and returned approximately $14 billion in total capital, including quarterly dividends and share repurchases (3/23/15 Letter to Shareholders pages 3 and 4).

· The strength of DuPont’s business is evident in the underlying growth of its on-going core businesses — in that context, annual Adjusted Operating Earnings Per Share growth has been 19.3% from December 31, 2008 to December 31, 2014 and 16.0% from December 31, 2011 to December 31, 2014. (3/23/15 Letter to Shareholders page 8).

· DuPont’s world-class Board is comprised of highly qualified and active independent directors who hold management accountable and are focused on building value (3/23/15 Letter to Shareholders page 5) |

|

REASONS NOT TO VOTE FOR TRIAN’S NOMINEES |

|

· Trian has nominated directors to advance its singular, value-destructive agenda to break up and add excessive debt to DuPont, which we believe would put shareholder value at risk. (3/23/15 Letter to Shareholders page 6)

· Our efforts to reach a constructive resolution that does not involve a Trian principal joining the Board were met with threats and ultimatums. (3/23/15 Letter to Shareholders page 9)

· Trian has recent experience at only one company in the chemicals sector, Chemtura — 15 months after Ed Garden (Founding Partner and Chief Investment Officer of Trian) joined the Board, Chemtura filed for Chapter 11 bankruptcy (02/27/15 Important Facts Presentation) |

|

NAMES TO KNOW |

|

Ellen J. Kullman: Chair of the Board & Chief Executive Officer of DuPont and one of our nominees (Inside Letter)

Alexander (“Sandy”) M. Cutler: Lead Director of DuPont and nominee (Proxy Statement, page 17)

* * *

Trian Partners: a dissident stockholder, an activist hedge fund (Page 1, 02/17/15 Shareholder Letter)

Nelson Peltz: Chief Executive Officer and founding partner at Trian and one of their nominees (Proxy Statement, page 1)

|

|

CONTEST WITH TRIAN |

|

On January 8, 2015, Trian delivered a notice to the Company nominating four individuals (with Mr. Garden as an alternative nominee), including Mr. Peltz, to stand for election to the Board of Directors of the Company at the Annual Meeting, and stating that Trian would solicit proxies in support of such election. The notice also included a proposal to repeal any provisions or amendments to the Company’s Bylaws adopted without stockholder approval after August 12, 2013 and prior to the Company’s 2015 Annual Meeting. (Proxy Statement, page 10) |

|

TRIAN’S OWNERSHIP |

|

As of Trian’s preliminary proxy filing on February 12, 2015, Trian disclosed beneficial ownership of 24,563,084 shares of the Company’s outstanding common stock representing beneficial ownership of approximately 2.7% of the Company’s common stock. (Proxy Statement, Page 8, 5th paragraph) |

|

QUORUM |

|

A quorum exists if the holders of at least a majority of the shares of DuPont Common Stock entitled to vote are present either in person or by proxy at the meeting. Abstentions and broker non-votes will be counted in determining whether a quorum exists. (Proxy Statement, page 6) |

|

VOTE REQUIRED |

|

1. The twelve nominees for director who receive the most votes of all votes cast for directors will be elected.

2-7. The votes cast “for” this proposal must exceed the votes cast “against”… (Proxy Statement, page 5) |

|

ABSTENTIONS/BROKER NON-VOTES |

|

1. Abstentions and broker non-votes do not constitute a vote “for” or “against” a director.

2-7. Abstentions and broker non-votes do not constitute a vote “for” or “against” the proposal and will be disregarded in the calculation of “votes cast.” (Proxy Statement, page 5) |

|

VOTING METHODS |

|

By Telephone…By the Internet…By Mail…At the Annual Meeting… (Proxy Statement, page 3) |

|

ATTENDING THE MEETING |

|

Only our stockholders and invited guests may attend the Annual Meeting….please bring your most recent brokerage statement, along with picture identification, to the meeting. (Proxy Statement, page 3) |

|

NOMINEE BIOGRAPHICAL |

|

For biographies of DuPont’s nominees, direct shareholders to the Proxy Statement, Pages 28-32 |

|

MARKET INFO |

|

…common stock is listed on the New York Stock Exchange, Inc. (symbol DD) (10-K (Annual Report), Page 15) |

|

COMPANY INFO |

|

DuPont was founded in 1802 and was incorporated in Delaware in 1915. Today, DuPont is creating higher growth and higher value by extending the company’s leadership in agriculture and nutrition, strengthening and growing capabilities in advanced materials and leveraging cross-company skills to develop a world-leading bio-based industrial business. (10-K (Annual Report), Page 2) |

|

BENEFICIAL OWNERSHIP |

|

BlackRock: 57,240,194 shares (6.30%) — The Vanguard Group: 50,112,269 Shares (5.53%) (Proxy Statement, page 36) |

|

STOCK PRICES |

|

2014 |

|

High |

|

Low |

|

Dividends |

|

|

|

Fourth Quarter |

|

$ |

75.82 |

|

$ |

64.55 |

|

$ |

0.47 |

|

|

|

Third Quarter |

|

$ |

72.92 |

|

$ |

63.70 |

|

$ |

0.47 |

|

|

|

Second Quarter |

|

$ |

69.75 |

|

$ |

64.35 |

|

$ |

0.45 |

|

|

|

First Quarter |

|

$ |

67.95 |

|

$ |

59.35 |

|

$ |

0.45 |

|

|

|

(10-K (Annual Report), Page 15) |

|

DIVIDENDS |

|

…the company has continuously paid a quarterly dividend since the fourth quarter 1904.

Dividends on common stock and preferred stock have historically been declared in January, April, July and October. When dividends on common stock have been declared, they have historically been paid mid March, June, September and December.

4 Quarter of 2014 paid dividend: $ 0.47

(10-K (Annual Report), Page 15) |

|

WEBSITE |

|

For more information and up-to-date postings, please go to our special website, www.DuPontDelivers.com or www.dupont.com (Inside Letter, page 2) |

|

TRANSFER AGENT |

|

Computershare Trust Company 888 983-8766 (Annual Report, inside back cover) |

|

PROXY SOLICITOR |

|

Innisfree M&A Incorporated: name & number is located on the Proxy Statement Inside Letter, Notice, Pages 2 & 4; and on Page 85 without phone # |

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

Reconciliation of Adjusted Diluted EPS

|

|

|

2014 |

|

2011 |

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

GAAP EPS from continuing operations |

|

$ |

3.90 |

|

$ |

3.38 |

|

$ |

2.28 |

|

|

Add: Significant Items |

|

$ |

0.01 |

|

$ |

0.25 |

|

$ |

0.42 |

|

|

Add: Non-Operating Pension & OPEB Costs / (Credits) |

|

$ |

0.10 |

|

$ |

0.39 |

|

$ |

(0.28 |

) |

|

Operating EPS (Non-GAAP) |

|

$ |

4.01 |

|

$ |

4.02 |

|

$ |

2.42 |

|

|

|

|

|

|

|

|

|

|

|

Less: Performance Chemicals(a),(b) |

|

$ |

0.82 |

|

$ |

1.79 |

|

$ |

0.59 |

|

|

Less: Pharma(c) |

|

$ |

0.02 |

|

$ |

0.20 |

|

$ |

0.73 |

|

|

Adjusted Operating EPS (excluding Performance Chemicals, Pharma) (Non-GAAP) |

|

$ |

3.17 |

|

$ |

2.03 |

|

$ |

1.10 |

|

(a) Prior periods reflect the reclassifications of Viton® fluoroelastomers from Performance Materials to Performance Chemicals.

(b) Performance Chemicals operating earnings assumes a base income tax rate from continuing operations of 19.2%, 20.8%, 24.2%, 22.0%, 19.2%, 22.1% and 20.4% for 2014, 2013, 2012, 2011, 2010, 2009 and 2008 respectively.

(c) Pharma operating earnings assumes a 35% tax rate.

Forward Looking Statements

This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of

sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses and successful completion of the proposed spinoff of the Performance Chemicals segment including ability to fully realize the expected benefits of the proposed spinoff. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

DuPont has filed a definitive proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the 2015 Annual Meeting. DUPONT STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS), THE ACCOMPANYING WHITE PROXY CARD AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

DuPont, its directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies from DuPont stockholders in connection with the matters to be considered at DuPont’s 2015 Annual Meeting. Information about DuPont’s directors and executive officers is available in DuPont’s definitive proxy statement, filed with the SEC on March 23, 2015, for its 2015 Annual Meeting. To the extent holdings of DuPont’s securities by such directors or executive officers have changed since the amounts printed in the proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and, to the extent applicable, will be updated in other materials to be filed with the SEC in connection with DuPont’s 2015 Annual Meeting. Stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by DuPont with the SEC free of charge at the SEC’s website at www.sec.gov. Copies also will be available free of charge at DuPont’s website at www.dupont.com or by contacting DuPont Investor Relations at (302) 774-4994.

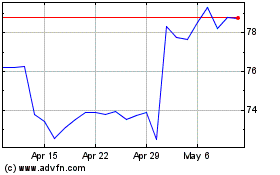

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024