UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2015

____________________________

DUCOMMUN INCORPORATED

(Exact name of registrant as specified in its charter)

____________________________

|

| | | |

Delaware | 001-08174 | | 95-0693330 |

(State or other jurisdiction of incorporation) | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 23301 Wilmington Avenue, Carson, California | | 90745-6209 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (310) 513-7200

N/A

(Former name or former address, if changed since last report.)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

Ducommun Incorporated issued a press release on August 5, 2015 in the form attached hereto as Exhibit 99.1.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

|

| |

Exhibit No. | Exhibit Title or Description |

99.1 | Ducommun Incorporated press release issued on August 5, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | DUCOMMUN INCORPORATED (Registrant) |

Date: August 5, 2015 | | By: | /s/ James S. Heiser |

| | | James S. Heiser |

| | | Vice President and General Counsel |

EXHIBIT 99.1

|

| | |

23301 Wilmington Avenue | | |

Carson, CA 90745-6209 | |

310.513.7200 | |

www.ducommun.com | |

NEWS RELEASE

FOR IMMEDIATE RELEASE

Ducommun Reports Results for the

Second Quarter Ended July 4, 2015

Completes New Credit Facility, Strengthens Balance Sheet, and Continues to Streamline Operations

LOS ANGELES, California (August 5, 2015) – Ducommun Incorporated (NYSE:DCO) (“Ducommun” or the “Company”) today reported results for its second quarter ended July 4, 2015.

Second Quarter 2015 Recap

| |

• | Second quarter revenue was $174.8 million |

| |

• | Net income was $1.8 million, or $0.16 per diluted share |

| |

• | EBITDA for the quarter was $18.9 million |

| |

• | New $475 million credit facility completed and, on July 27, redeemed all $200 million of the Company’s senior unsecured notes |

“During the second quarter, Ducommun made solid progress on a number of fronts to further strengthen the Company’s position going forward,” said Anthony J. Reardon, chairman and chief executive officer. “While again posting revenue growth in commercial aerospace and winning new business on several key aircraft, we are executing on initiatives to right-size certain operations, reduce costs and working capital, and expand overall margins. Our military and oil and gas end-use markets continue to be down year-over-year, but we expect to see run rates stabilize in the second half of 2015.

“Cash flow remains strong, and we completed a new credit facility that is expected to save Ducommun a significant amount of interest expense annually -- a major accomplishment that will have an immediate, positive impact on net income. Given our improved financial profile, continued focus on margins, and additional streamlining activities, we are setting the stage for Ducommun to be on sound footing heading into 2016.”

Second Quarter Results

Net revenue for the second quarter of 2015 was $174.8 million compared to $186.5 million for the second quarter of 2014. The net revenue decrease year-over-year primarily reflects 16.9% lower revenue in the Company’s military and space end-use markets and 4.3% lower revenue in the Company’s non-aerospace and defense (“non-A&D”) end-use markets, partially offset by 9.4% higher revenue in the Company’s commercial aerospace end-use markets.

The net income for the second quarter of 2015 was $1.8 million, or $0.16 per diluted share compared to $6.6 million, or $0.60 per diluted share, for the second quarter of 2014. The lower net income for the second quarter of 2015 was primarily due to lower revenue, loss of efficiencies resulting from lower manufacturing volume, loss on extinguishment of debt, unfavorable product mix, and higher forward loss reserves, partially offset by lower income tax expense, lower compensation and benefit costs, insurance recoveries related to property and equipment, and lower interest expense. The current quarter effective income tax rate was 41.8% compared to an effective income tax rate of 32.6% for the comparable prior year’s quarter.

Operating income for the second quarter of 2015 was $10.8 million, or 6.2% of revenue, compared to $16.8 million, or 9.0% of revenue, in the comparable period last year. The decrease in operating income in the second quarter of 2015 was primarily due to

lower revenue, loss of efficiencies resulting from lower manufacturing volume, unfavorable product mix, and higher forward loss reserves, partially offset by lower compensation and benefit costs.

During the three months ended July 4, 2015, the Company recorded a $2.8 million loss on extinguishment of debt as part of paying off the existing senior secured term loan and $1.5 million of other income for insurance recoveries related to property and equipment and none in the comparable prior year period.

Interest expense decreased to $6.4 million in the second quarter of 2015, compared to $7.0 million in the previous year’s second quarter, primarily due to lower outstanding debt balances as a result of voluntary principal prepayments on the term loan each quarter during 2014 and the first quarter of 2015 as the Company continued to de-lever its balance sheet.

EBITDA for the second quarter of 2015 was $18.9 million, or 10.8% of revenue, compared to $24.5 million, or 13.1% of revenue, for the comparable period in 2014.

During the second quarter of 2015, the Company generated $14.1 million of cash from operations compared to $25.3 million during the second quarter of 2014.

The Company’s firm backlog as of July 4, 2015 was approximately $524 million.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the current second quarter was $76.1 million, compared to $78.6 million for the second quarter of 2014. The lower net revenue was primarily due to a 25.5% decrease in military and space revenue, partially offset by a 10.8% increase in commercial aerospace revenue.

DAS segment operating income for the current second quarter was $6.9 million, or 9.0% of revenue, compared to operating income of $10.1 million, or 12.8% of revenue, for the second quarter of 2014. The lower operating income was primarily due to unfavorable product mix, higher forward loss reserves, loss of efficiencies resulting from lower manufacturing volume, and lower revenue, partially offset by lower compensation and benefit costs. EBITDA was $10.5 million for the current quarter, or 13.8% of revenue, compared to $13.6 million, or 17.3% of revenue, for the comparable quarter in the prior year.

Ducommun LaBarge Technologies (“DLT”)

The Company’s DLT segment net revenue for the current second quarter was $98.8 million, compared to $107.9 million for second quarter 2014. The lower net revenue reflected a 12.8% decrease in military and space revenue and a 4.3% decrease in non-A&D revenue.

DLT’s operating income for the current second quarter was $7.7 million, or 7.8% of revenue, compared to $10.8 million, or 10.0% of revenue, for the second quarter of 2014, primarily due to loss of efficiencies resulting from lower manufacturing volume and lower revenue. EBITDA was $12.1 million for the current quarter, or 12.2% of revenue, compared to $14.8 million, or 13.7% of revenue, in the comparable quarter of the prior year.

Corporate General and Administrative Expenses (“CG&A”)

CG&A expenses for the second quarter of 2015 were $3.7 million, or 2.1% of total Company revenue, a decrease from $4.0 million, or 2.2% of total Company revenue in the comparable prior-year period. CG&A expenses decreased primarily due to lower compensation and benefit costs.

New Five Year, $475 Million Credit Facility

As announced on June 26, 2015, the Company completed a new five year, $475 million credit agreement (“New Credit Facility”) consisting of a $200 million revolving credit facility (“New Revolving Credit Facility”) and a $275 million term loan facility (“New Term Loan Facility”). The New Credit Facility has a final maturity date of June 2020. Upon closing of the New Credit Facility, the Company repaid the $80 million existing term loan. Subsequent to the quarter end, on July 27, 2015, the Company completed the redemption of all $200 million of its senior unsecured notes by paying a call premium of $9.75 million and will also write off the associated unamortized debt issuance costs of approximately $2.1 million in the Company’s fiscal third quarter. The variable interest rate on the New Revolving Credit Facility and the New Term Loan Facility will initially be at LIBOR plus

2.50%, subject to adjustments based on the Company’s leverage ratio. The Company estimates the initial effective interest rate will be approximately 3.50%.

Year-To-Date Results

Net revenue for the six months ended July 4, 2015 was $347.8 million compared to $366.3 million for the six months ended June 28, 2014. The net revenue decrease year-over-year primarily reflects 19.7% lower revenue in the Company’s military and space end-use markets partially offset by 12.4% higher revenue in the Company’s commercial aerospace end-use markets and 5.2% higher revenue in the Company’s non-A&D end-use markets.

The net loss for the six months ended July 4, 2015 was $(0.2) million, or $(0.02) per share compared to net income of $11.8 million, or $1.06 per diluted share, for the six months ended June 28, 2014. The lower net income for the first six months of 2015 was primarily due to unfavorable product mix, lower revenue, loss of efficiencies resulting from lower manufacturing volume, loss on extinguishment of debt, and higher professional service fees, partially offset by lower income tax expense, insurance recoveries related to property and equipment, and lower interest expense. The current six month period effective income tax rate was 807.4% compared to an income tax rate of 32.8% for the comparable period of 2014.

Operating income for the six months ended July 4, 2015 was $14.5 million, or 4.2% of revenue, compared to $31.6 million, or 8.6% of revenue, in the comparable period last year. The decrease in operating income in the first six months of 2015 was primarily due to unfavorable product mix, lower revenue, loss of efficiencies resulting from lower manufacturing volume, higher compensation and benefit costs, and higher professional service fees.

During the six months ended July 4, 2015, the Company recorded a $2.8 million loss on extinguishment of debt as part of paying off the existing senior secured term loan and $1.5 million of other income for insurance recoveries related to property and equipment and none in the comparable prior year period.

Interest expense decreased to $13.1 million for the six months ended July 4, 2015, compared to $14.1 million in the previous year’s comparable six months, primarily due to lower outstanding debt balances as a result of voluntary principal prepayments on the term loan each quarter during 2014 and the first quarter of 2015 as the Company continued to de-lever its balance sheet.

EBITDA for the six months ended July 4, 2015 was $29.4 million, or 8.5% of revenue, compared to $46.8 million, or 12.8% of revenue, for the comparable period in 2014.

During the six months ended July 4, 2015, the Company generated $17.6 million of cash from operations compared to $15.5 million during the comparable period in 2014.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the six months ended July 4, 2015 was $148.1 million, compared to $160.3 million for the six months ended June 28, 2014. The lower net revenue was primarily due to a 34.9% decrease in military and space revenue, partially offset by a 10.8% increase in commercial aerospace revenue.

DAS segment operating income for the six months ended July 4, 2015 was $9.0 million, or 6.1% of revenue, compared to operating income of $21.2 million, or 13.2% of revenue, for the six months ended June 28, 2014. The lower operating income was primarily due to unfavorable product mix, loss of efficiencies resulting from lower manufacturing volume, higher forward loss reserves, and lower revenue. EBITDA was $15.1 million for the current six month period, or 10.2% of revenue, compared to $27.1 million, or 16.9% of revenue, for the comparable six month period in the prior year.

Ducommun LaBarge Technologies (“DLT”)

The Company’s DLT segment net revenue for the six months ended July 4, 2015 was $199.6 million, compared to $206.0 million for six months ended June 28, 2014. The lower net revenue reflected a 11.5% decrease in military and space revenue, partially offset by a 19.7% increase in commercial aerospace electronics revenue and a 5.2% increase in non-A&D revenue.

DLT’s operating income for the six months ended July 4, 2015 was $14.0 million, or 7.0% of revenue, compared to $17.8 million, or 8.6% of revenue, for the six months ended June 28, 2014, primarily due to loss of efficiencies resulting from lower manufacturing volume, lower revenue, higher forward loss reserves, and unfavorable product mix. EBITDA was $22.7 million for the current

six month period, or 11.4% of revenue, compared to $26.9 million, or 13.0% of revenue, in the comparable six month period of the prior year.

Corporate General and Administrative Expenses (“CG&A”)

CG&A expenses for the six months ended July 4, 2015 were $8.5 million, or 2.4% of total Company revenue, an increase from $7.3 million, or 2.0% of total Company revenue in the comparable six month period in prior-year. CG&A expenses increased primarily due to higher professional service fees and higher compensation and benefit costs.

Conference Call

A teleconference hosted by Anthony J. Reardon, the Company’s chairman and chief executive officer, and Joseph P. Bellino, the Company’s vice president, chief financial officer and treasurer, will be held today, August 5, 2015 at 2:00 p.m. PT (5:00 p.m. ET) to review these financial results. To participate in the teleconference, please call 866-271-6130 (international 617-213-8894) approximately ten minutes prior to the conference time. The participant passcode is 23701061. Mr. Reardon and Mr. Bellino will be speaking on behalf of the Company and anticipate the meeting and Q&A period to last approximately 45 minutes.

This call is being webcast by Thomson Reuters and can be accessed directly at the Ducommun website at www.ducommun.com. Conference call replay will be available after that time at the same link or by dialing 888-286-8010, passcode 65449729.

About Ducommun Incorporated

Founded in 1849, Ducommun Incorporated provides engineering and manufacturing services to the aerospace, defense, and other industries through a wide spectrum of electronic and structural applications. The company is an established supplier of critical components and assemblies for commercial aircraft and military and space vehicles as well as for the energy market, medical field, and industrial automation. It operates through two primary business units – Ducommun AeroStructures (“DAS”) and Ducommun LaBarge Technologies (“DLT”). Additional information can be found at www.ducommun.com.

Statements contained in this press release regarding other than recitation of historical facts are forward-looking statements. These statements are identified by words such as “may,” “will,” “ begin,” “ look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,” “estimate,” “continue,” “momentum” and other words referring to events to occur in the future. These statements reflect the Company’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, including, but not limited to, the state of the world financial, credit, commodities and stock markets, and uncertainties regarding the Company, its businesses and the industries in which it operates, which are described in the Company’s filings with the Securities and Exchange Commission. The Company is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

CONTACTS:

|

| | | | | | |

Joseph P. Bellino, Vice President, Chief Financial Officer and Treasurer, 310.513.7211 |

Chris Witty, Investor Relations, 646.438.9385, cwitty@darrowir.com |

[Financial Tables Follow]

DUCOMMUN INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

|

| | | | | | | | |

| | July 4,

2015 | | December 31,

2014 |

Assets | | | | |

Current Assets | | | | |

Cash and cash equivalents | | $ | 26,842 |

| | $ | 45,627 |

|

Accounts receivable, net | | 91,194 |

| | 91,060 |

|

Inventories | | 138,014 |

| | 142,842 |

|

Production cost of contracts | | 9,772 |

| | 11,727 |

|

Deferred income taxes | | 12,371 |

| | 13,783 |

|

Other current assets | | 16,835 |

| | 23,702 |

|

Total Current Assets | | 295,028 |

| | 328,741 |

|

Property and Equipment, Net | | 99,347 |

| | 99,068 |

|

Goodwill | | 157,569 |

| | 157,569 |

|

Intangibles, Net | | 150,088 |

| | 155,104 |

|

Other Assets | | 7,938 |

| | 7,117 |

|

Total Assets | | $ | 709,970 |

| | $ | 747,599 |

|

Liabilities and Shareholders’ Equity | | | | |

Current Liabilities | | | | |

Current portion of long-term debt | | $ | 27 |

| | $ | 26 |

|

Accounts payable | | 55,313 |

| | 58,979 |

|

Accrued liabilities | | 41,901 |

| | 52,066 |

|

Total Current Liabilities | | 97,241 |

| | 111,071 |

|

Long-Term Debt, Less Current Portion | | 265,012 |

| | 290,026 |

|

Deferred Income Taxes | | 69,613 |

| | 69,448 |

|

Other Long-Term Liabilities | | 19,583 |

| | 20,484 |

|

Total Liabilities | | 451,449 |

| | 491,029 |

|

Commitments and Contingencies | | | | |

Shareholders’ Equity | | | | |

Common stock | | 111 |

| | 110 |

|

Additional paid-in capital | | 74,069 |

| | 72,206 |

|

Retained earnings | | 190,714 |

| | 190,905 |

|

Accumulated other comprehensive loss | | (6,373 | ) | | (6,651 | ) |

Total Shareholders’ Equity | | 258,521 |

| | 256,570 |

|

Total Liabilities and Shareholders’ Equity | | $ | 709,970 |

| | $ | 747,599 |

|

DUCOMMUN INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 4,

2015 | | June 28,

2014 | | July 4,

2015 | | June 28,

2014 |

| | | | As Restated | | | | As Restated |

Net Revenues | | $ | 174,845 |

| | $ | 186,516 |

| | $ | 347,765 |

| | $ | 366,269 |

|

Cost of Sales | | 143,638 |

| | 148,838 |

| | 289,797 |

| | 292,676 |

|

Gross Profit | | 31,207 |

| | 37,678 |

| | 57,968 |

| | 73,593 |

|

Selling, General and Administrative Expenses | | 20,368 |

| | 20,868 |

| | 43,502 |

| | 41,955 |

|

Operating Income | | 10,839 |

| | 16,810 |

| | 14,466 |

| | 31,638 |

|

Interest Expense | | (6,446 | ) | | (6,994 | ) | | (13,107 | ) | | (14,119 | ) |

Loss on Extinguishment of Debt | | (2,842 | ) | | — |

| | (2,842 | ) | | — |

|

Other Income | | 1,510 |

| | — |

| | 1,510 |

| | — |

|

Income Before Taxes | | 3,061 |

| | 9,816 |

| | 27 |

| | 17,519 |

|

Income Tax Expense | | 1,279 |

| | 3,197 |

| | 218 |

| | 5,741 |

|

Net Income (Loss) | | $ | 1,782 |

| | $ | 6,619 |

| | $ | (191 | ) | | $ | 11,778 |

|

Earnings (Loss) Per Share | | | | | | | | |

Basic earnings (loss) per share | | $ | 0.16 |

| | $ | 0.61 |

| | $ | (0.02 | ) | | $ | 1.08 |

|

Diluted earnings (loss) per share | | $ | 0.16 |

| | $ | 0.60 |

| | $ | (0.02 | ) | | $ | 1.06 |

|

Weighted-Average Number of Common Shares Outstanding | | | | | | | | |

Basic | | 11,062 |

| | 10,871 |

| | 11,012 |

| | 10,864 |

|

Diluted | | 11,276 |

| | 11,045 |

| | 11,012 |

| | 11,122 |

|

| | | | | | | | |

Gross Profit % | | 17.8 | % | | 20.2 | % | | 16.7 | % | | 20.1 | % |

SG&A % | | 11.6 | % | | 11.2 | % | | 12.5 | % | | 11.5 | % |

Operating Income % | | 6.2 | % | | 9.0 | % | | 4.2 | % | | 8.6 | % |

Net Income (Loss) % | | 1.0 | % | | 3.5 | % | | (0.1 | )% | | 3.2 | % |

Effective Tax Rate | | 41.8 | % | | 32.6 | % | | 807.4 | % | | 32.8 | % |

DUCOMMUN INCORPORATED AND SUBSIDIARIES

BUSINESS SEGMENT PERFORMANCE

(Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | % Change | | July 4,

2015 | | June 28,

2014 | | % of Net Revenues 2015 | | % of Net Revenues 2014 | | % Change | | July 4,

2015 | | June 28,

2014 | | % of Net Revenues 2015 | | % of Net Revenues 2014 |

| | | | | | As Restated | | | | As Restated | | | | | | As Restated | | | | As Restated |

Net Revenues | | | | | | | | | | | | | | | | | | | | |

DAS | | (3.2 | )% | | $ | 76,078 |

| | $ | 78,616 |

| | 43.5 | % | | 42.1 | % | | (7.6 | )% | | $ | 148,136 |

| | $ | 160,270 |

| | 42.6 | % | | 43.8 | % |

DLT | | (8.5 | )% | | 98,767 |

| | 107,900 |

| | 56.5 | % | | 57.9 | % | | (3.1 | )% | | 199,629 |

| | 205,999 |

| | 57.4 | % | | 56.2 | % |

Total Net Revenues | | (6.3 | )% | | $ | 174,845 |

| | $ | 186,516 |

| | 100.0 | % | | 100.0 | % | | (5.1 | )% | | $ | 347,765 |

| | $ | 366,269 |

| | 100.0 | % | | 100.0 | % |

Segment Operating Income | | | | | | | | | | | | | | | | | | | | |

DAS | | | | $ | 6,870 |

| | $ | 10,068 |

| | 9.0 | % | | 12.8 | % | | | | $ | 9,008 |

| | $ | 21,159 |

| | 6.1 | % | | 13.2 | % |

DLT | | | | 7,692 |

| | 10,757 |

| | 7.8 | % | | 10.0 | % | | | | 13,977 |

| | 17,801 |

| | 7.0 | % | | 8.6 | % |

| | | | 14,562 |

| | 20,825 |

| | | | | | | | 22,985 |

| | 38,960 |

| | | | |

Corporate General and Administrative Expenses (1) | | | | (3,723 | ) | | (4,015 | ) | | (2.1 | )% | | (2.2 | )% | | | | (8,519 | ) | | (7,322 | ) | | (2.4 | )% | | (2.0 | )% |

Total Operating Income | | | | $ | 10,839 |

| | $ | 16,810 |

| | 6.2 | % | | 9.0 | % | | | | $ | 14,466 |

| | $ | 31,638 |

| | 4.2 | % | | 8.6 | % |

EBITDA | | | | | | | | | | | | | | | | | | | | |

DAS | | | | | | | | | | | | | | | | | | | | |

Operating Income | | | | $ | 6,870 |

| | $ | 10,068 |

| | | | | | | | $ | 9,008 |

| | $ | 21,159 |

| | | | |

Other Income (2) | | | | 1,510 |

| | — |

| | | | | | | | 1,510 |

| | — |

| | | | |

Depreciation and Amortization | | | | 2,111 |

| | 3,554 |

| | | | | | | | 4,624 |

| | 5,970 |

| | | | |

| | | | 10,491 |

| | 13,622 |

| | 13.8 | % | | 17.3 | % | | | | 15,142 |

| | 27,129 |

| | 10.2 | % | | 16.9 | % |

DLT | | | | | | | | | | | | | | | | | | | | |

Operating Income | | | | 7,692 |

| | 10,757 |

| | | | | | | | 13,977 |

| | 17,801 |

| | | | |

Depreciation and Amortization | | | | 4,361 |

| | 4,043 |

| | | | | | | | 8,720 |

| | 9,051 |

| | | | |

| | | | 12,053 |

| | 14,800 |

| | 12.2 | % | | 13.7 | % | | | | 22,697 |

| | 26,852 |

| | 11.4 | % | | 13.0 | % |

Corporate General and Administrative Expenses | | | | | | | | | | | | | | | | | | | | |

Operating loss | | | | (3,723 | ) | | (4,015 | ) | | | | | | | | (8,519 | ) | | (7,322 | ) | | | | |

Depreciation and Amortization | | | | 42 |

| | 102 |

| | | | | | | | 84 |

| | 104 |

| | | | |

| | | | (3,681 | ) | | (3,913 | ) | | | | | | | | (8,435 | ) | | (7,218 | ) | | | | |

EBITDA | | | | $ | 18,863 |

| | $ | 24,509 |

| | 10.8 | % | | 13.1 | % | | | | $ | 29,404 |

| | $ | 46,763 |

| | 8.5 | % | | 12.8 | % |

Capital Expenditures | | | | | | | | | | | | | | | | | | | | |

DAS | | | | $ | 2,417 |

| | $ | 1,435 |

| | | | | | | | $ | 5,751 |

| | $ | 2,720 |

| | | | |

DLT | | | | 948 |

| | 2,078 |

| | | | | | | | 2,438 |

| | 2,975 |

| | | | |

Corporate Administration | | | | 2 |

| | 14 |

| | | | | | | | 6 |

| | 24 |

| | | | |

Total Capital Expenditures | | | | $ | 3,367 |

| | $ | 3,527 |

| | | | | | | | $ | 8,195 |

| | $ | 5,719 |

| | | | |

| |

(1) | Includes costs not allocated to either the DLT or DAS operating segments. |

| |

(2) | Insurance recoveries related to property and equipment. |

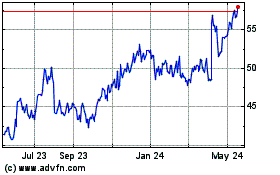

Ducommun (NYSE:DCO)

Historical Stock Chart

From Apr 2024 to May 2024

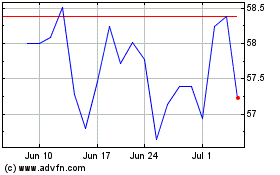

Ducommun (NYSE:DCO)

Historical Stock Chart

From May 2023 to May 2024