UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | | | | | | | | | | | | |

Date of Report (Date of Earliest Event Reported): | December 23, 2015 |

| Diebold, Incorporated | |

(Exact name of registrant as specified in its charter) |

Ohio | 1-4879 | 34-0183970 |

| (State or other jurisdiction of incorporation) | | | (Commission File Number) | | | (I.R.S. Employer Identification No.) | |

5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio | | 44720-8077 |

(Address of principal executive offices) | | | (Zip Code) | |

Registrant’s telephone number, including area code: | (330) 490-4000 |

| Not Applicable | |

| Former name or former address, if changed since last report | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed in its Current Report on Form 8-K filed with the SEC on November 23, 2015, Diebold, Incorporated (the “Company”) entered into a revolving and term loan credit agreement (the “Credit Agreement”), dated as of November 23, 2015, among the Company and certain of the Company's subsidiaries, as borrowers, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders named therein. The Credit Agreement included, among other things, mechanics for the Company’s existing revolving and term loan A facilities to be refinanced under the Credit Agreement. On December 23, 2015 (the “Effective Date”), the Company entered into a Replacement Facilities Effective Date Amendment among the Company, certain of the Company’s subsidiaries, the lenders identified therein and JPMorgan Chase Bank, N.A., as Administrative Agent, pursuant to which the Company is refinancing its existing $520 million revolving and $230 million term loan A senior unsecured credit facilities (which have been terminated and repaid in full) with, respectively, a new secured revolving facility (the “Revolving Facility”) in an amount of up to $520 million and a new (non-delayed draw) secured term loan A facility (the “Term A Facility”) on substantially the same terms as the Delayed Draw Term Facility (as defined in the Credit Agreement) in the amount of up to $230 million. The Revolving Facility and Term A Facility will be subject to the same maximum consolidated net leverage ratio and minimum consolidated interest coverage ratio as the Delayed Draw Term Facility.

The Term A Facility will mature on the fifth anniversary of the Effective Date. The Revolving Facility will automatically terminate on the fifth anniversary of the Effective Date.

The Credit Agreement is guaranteed by certain of the Company’s domestic subsidiaries. Borrowings under the Credit Agreement will bear interest at, based on the Company’s election, the prime rate or LIBOR (subject to specified floors) plus an applicable margin, determined by reference to the Company’s total net leverage ratio.

The Credit Agreement contains affirmative and negative covenants usual and customary for facilities and transaction of this type including, but not limited to: delivery of financial information; use of proceeds; delivery of notices of default; conduct of business (including maintenance of existence and rights); taxes; insurance; compliance with laws; properties and inspection; collateral matters and further assurances; maintenance of ratings; guaranties; limitations on mergers, consolidations and fundamental changes; limitations on sales of assets; limitations on investments and acquisitions; limitations on liens; limitations on transactions with affiliates; limitations on indebtedness; limitations on negative pledge clauses; limitations on restrictions on subsidiary distributions; limitations on hedge agreements; limitations on receivables indebtedness; limitations on restricted payments; limitations on certain payments of indebtedness; limitations on amendments to organizational documents; “MFN” requirements regarding certain additional covenants; and covenants regarding the Company’s previously announced tender offer for the outstanding shares of and proposed business combination with Wincor Nixdorf Aktiengesellschaft (“Wincor Nixdorf”).

In addition, the Credit Agreement includes a maximum consolidated net leverage ratio and a minimum consolidated interest coverage ratio. The Credit Agreement also contains certain events of default regarding: inaccuracy of representations and warranties, certificates or other written information in any material respect; nonpayment of principal, interest, fees or other amounts; breach of covenants; cross payment default and cross default to indebtedness or net hedging obligations in excess of $50 million; voluntary and involuntary bankruptcy or insolvency proceedings; condemnation reasonably likely to have a material adverse effect; unpaid material judgments; certain pension and benefit events; certain environmental events reasonably expected to have a material adverse effect; change of control; and actual or asserted invalidity of the facilities documentation, guarantees or security documentation or, after effectiveness thereof, a domination agreement with respect to Wincor Nixdorf, and failure (after the grant thereof) to maintain a perfected first priority security interest on a material portion of the collateral, in each case with grace periods, thresholds, qualifications and exceptions detailed in the Credit Agreement.

The foregoing description of the Credit Agreement as amended by the Replacement Facilities Effective Date Amendment is qualified in its entirety by reference to the full text of the Replacement Facilities Effective Date Amendment, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

In the ordinary course of business, certain of the lenders under the Credit Agreement and their affiliates have provided, and may in the future provide, investment banking, commercial banking, cash management, foreign exchange or other financial services to the Company for which they have received, and may in the future receive, compensation.

On the Effective Date, the Company terminated the credit agreement, dated as of June 30, 2011 (as amended), among the Company, the borrowing subsidiaries referred to therein, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders named therein.

| |

Item 1.02 | Termination of a Material Definitive Agreement. |

The disclosure required by this Item is included in Item 1.01, which is incorporated herein by reference.

| |

Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosure required by this Item is included in Item 1.01, which is incorporated herein by reference.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

Exhibit Number | | Description |

| | |

10.1 | | Replacement Facilities Effective Date Amendment, dated as of December 23, 2015, by and among Diebold, Incorporated and the subsidiary borrowers party thereto, as borrowers, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders party thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

By: | /s/ Christopher A. Chapman | |

| Christopher A. Chapman | |

| Senior Vice President and Chief Financial Officer | |

Date: December 28, 2015

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

| | |

10.1 | | Replacement Facilities Effective Date Amendment, dated as of December 23, 2015, by and among Diebold, Incorporated and the subsidiary borrowers party thereto, as borrowers, JPMorgan Chase Bank, N.A., as Administrative Agent, and the lenders party thereto.

|

Exhibit 10.1

REPLACEMENT FACILITIES EFFECTIVE DATE AMENDMENT

THIS REPLACEMENT FACILITIES EFFECTIVE DATE AMENDMENT, dated as of December 23, 2015 (this “Amendment”), is among DIEBOLD, INCORPORATED, an Ohio corporation (the “Company”), the SUBSIDIARY BORROWER party hereto (together with the Company, the “Borrowers”), the GUARANTORS party hereto, JPMORGAN CHASE BANK, N.A., a national banking association, as Administrative Agent and the Lenders party hereto. Terms used but not defined herein shall have the respective meanings ascribed thereto in the Credit Agreement (as hereinafter defined).

RECITALS

A. The Borrowers, the Lenders party thereto, the Administrative Agent and Credit Suisse AG, Cayman Islands Branch, as Syndication Agent, are parties to a Credit Agreement dated as of November 23, 2015 (the “Existing Credit Agreement”).

B. The Borrowers and the Administrative Agent desire to effect the Replacement Facilities Effective Date and make certain other amendments to the Existing Credit Agreement as set forth herein (the Existing Credit Agreement as amended by this Amendment and as further amended, restated, modified or supplemented from time to time, the “Credit Agreement”).

C. The Borrowers desire to waive certain notice requirements under Sections 2.4 and 2.6 of the Credit Agreement, dated as of June 30, 2011, among the Company, the subsidiary borrowers party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent (as amended, restated, modified or otherwise supplemented prior to the date hereof, the “Original Credit Agreement”).

TERMS

In consideration of the premises and of the mutual agreements herein contained, the parties agree as follows:

ARTICLE I. AMENDMENTS. Pursuant to Sections 8.2.2 and Section 17.1 of the Existing Credit Agreement, effective as of the Replacement Facilities Effective Date:

(i) the Existing Credit Agreement (excluding the Schedules and the Exhibits thereto) is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in the pages of the Credit Agreement attached as Annex I hereto;

(ii) Schedule 1.1(a) to the Existing Credit Agreement is amended and restated in full as set forth on Annex II hereto (and, for the avoidance of doubt, with respect to any Delayed Draw Term A Commitments, such Delayed Draw Term A Commitments are deemed assigned as of the date hereof to effect such amendment and restatement of Schedule 1.1(a)); and

(iii) the Issuers and the Issuer Sublimits are as set forth on Annex III hereto.

ARTICLE II. NEW LENDERS. Each of the Persons executing this Amendment as a “Lender” that was not a Lender under the Existing Credit Agreement immediately prior to the Replacement Facilities Effective Date hereby (a) represents and warrants that (i) it has full power and authority, and has taken all action necessary, to execute and deliver this Amendment and to consummate the transactions

contemplated hereby and to become a Lender under the Credit Agreement, (ii) it satisfies the requirements, if any, specified in the Credit Agreement that are required to be satisfied by it in order to become a Lender, (iii) from and after the Replacement Facilities Effective Date, it shall be bound by the provisions of the Credit Agreement as a Lender thereunder and shall have the obligations of a Lender thereunder, (iv) it has received a copy of the Credit Agreement, together with copies of the most recent financial statements delivered pursuant to Section 6.1 thereof, as applicable, and such other documents and information as it has deemed appropriate to make its own credit analysis and decision to enter into this Amendment and to become a Lender on the basis of which it has made such analysis and decision independently and without reliance on the Administrative Agent or any other Lender; and (b) agrees that (i) it will, independently and without reliance on the Administrative Agent or any other Lender, and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Loan Documents, and (ii) it will perform in accordance with their terms all of the obligations which by the terms of the Loan Documents are required to be performed by it as a Lender.

ARTICLE III. REPRESENTATIONS. Each of the Borrowers (insofar as such representations and warranties relate to such Subsidiary Borrower) makes the representations and warranties in Article V of the Credit Agreement.

ARTICLE IV. CONDITIONS OF EFFECTIVENESS. This Amendment shall become effective on the Replacement Facilities Effective Date, which shall be the first date on which (a) this Amendment is duly executed and delivered by the Borrowers, the Guarantors, the Lenders listed on Annex II hereof, the Required Lenders (as defined in the Original Credit Agreement) and the Administrative Agent and (b) all conditions precedent set forth in Section 4.2 of the Credit Agreement are satisfied or waived in accordance with Section 8.2 of the Credit Agreement.

ARTICLE V. WAIVER TO THE ORIGINAL CREDIT AGREEMENT. The Required Lenders (as defined in the Original Credit Agreement) hereby waive the prior notice and minimum amount requirements in respect of prepayments of Loans (as defined in the Original Credit Agreement) and termination of Commitments (as defined in the Original Credit Agreement) set forth in Sections 2.4 and 2.6 of the Original Credit Agreement solely in respect of the prepayment and termination to be effected as of the Replacement Facilities Effective Date and acknowledge that as of the Replacement Facilities Effective Date that the Original Credit Agreement is terminated.

ARTICLE VI. WAIVER TO THE CREDIT AGREEMENT. The Required Lenders (as defined in the Credit Agreement) hereby waive the prior notice and minimum amount requirements in respect of the borrowings of Loans set forth in Sections 2.3 and 4.2(d) of the Credit Agreement solely in respect of the borrowings on the Replacement Facilities Effective Date.

ARTICLE VII. MISCELLANEOUS.

7.1 References in the Credit Agreement or in any other Loan Document to the Credit Agreement shall be deemed to be references to the Credit Agreement as amended hereby and as further amended, restated, modified or supplemented from time to time. This Amendment shall constitute a Loan Document.

7.2 Except as expressly amended hereby, each of the Loan Parties agrees that the Credit Agreement and the other Loan Documents are ratified and confirmed and shall remain in full force and effect in accordance with their terms and that they are not aware of any set off, counterclaim, defense or other claim or dispute with respect to any of the foregoing. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any Lender or the

-2-

Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. Nothing herein shall be deemed to entitle any Loan Party to any future consent to, or waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances.

7.3 This Amendment may be executed in any number of counterparts, all of which taken together shall constitute one agreement, and any of the parties hereto may execute this Amendment by signing any such counterpart. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or electronic mail message shall be effective as delivery of a manually executed counterpart of this Amendment.

7.4 This Amendment shall be construed in accordance with and governed by the law of the State of New York.

7.5 Any provision in this Amendment that is held to be inoperative, unenforceable, or invalid in any jurisdiction shall, as to that jurisdiction, be inoperative, unenforceable, or invalid without affecting the remaining provisions in that jurisdiction or the operation, enforceability, or validity of that provision in any other jurisdiction, and to this end the provisions of this Amendment are declared to be severable.

[Remainder of page intentionally blank]

-3-

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first above written.

DIEBOLD, INCORPORATED

By: /s/ Christopher A. Chapman

Name: Christopher A. Chapman

Title: Senior Vice President and Chief Financial Office

DIEBOLD SELF-SERVICE SOLUTIONS S.ar.l.

By: /s/ Jonathan B. Leiken

Name: Jonathan B. Leiken

Title: Authorized Signatory

DIEBOLD SST HOLDING COMPANY, INC.

DIEBOLD HOLDING COMPANY, INC.

DIEBOLD GLOBAL FINANCE CORPORATION

DIEBOLD SELF SERVICE SYSTEMS

DIEBOLD SOUTHEAST MANUFACTURING, INC.

By:/s/ David S. Kuhl

Name: David S. Kuhl

Title: Authorized Signatory

DIEBOLD LATIN AMERICA HOLDING COMPANY, LLC

By:/s/ Mary M. Swann

Name: Mary M. Swann

Title: Authorized Signatory

Diebold Amendment

JPMORGAN CHASE BANK, N.A., as

Administrative Agent, Issuer and Lender

By:/s/ Antje B. Focke

Name: Antje B. Focke

Title: Vice President

Diebold Amendment

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH, as Issuer and Lender

By:/s/ Mikhail Faybusovich

Name: Mikhail Faybusovich

Title: Authorized Signatory

By: /s/ Max Wallins

Name: Max Wallins

Title: Authorized Signatory

Diebold Amendment

PNC BANK, NATIONAL ASSOCIATION, as Lender

By: /s/ John Broeren

Name: John Broeren

Title: Senior Vice President

Diebold Amendment

U.S. BANK NATIONAL ASSOCIATION, as Lender

By: /s/ Patrick McGraw

Name: Patrick McGraw

Title: Senior Vice President

Diebold Amendment

THE BANK OF TOKYO-MITSUBISHI, LTD., as Lender

By/s/ Victor Pierzchalski

Name: Victor Pierzchalski

Title: Authorized Signatory

Diebold Amendment

BANK OF AMERICA, N.A., as Lender

By: /s/ Sara Just

Name: Sara Just

Title: Vice President

Diebold Amendment

HSBC BANK USA, NATIONAL ASSOCIATION, as Lender

By: /s/ Ross P. Graney

Name: Ross P Graney

Title: AVP

Diebold Amendment

THE BANK OF NOVA SCOTIA, as Lender

By: /s/ Rafael Tobon

Name: Rafael Tobon

Title: Director

Diebold Amendment

FIFTH THIRD BANK, as Lender

By: /s/ John Di Legge

Name: John Di Legge

Title: Managing Director

Diebold Amendment

DEUTSCHE BANK AG NEW YORK BRANCH, as Lender

By: /s/ Marcus Tarkington

Name: Marcus Tarkington

Title: Director

By: /s/ Benjamin South

Name: Benjamin South

Title: Vice President

Diebold Amendment

COMMERZBANK AG, NEW YORK BRANCH, as Lender

By: /s/ Barbara Stacks

Name: Barbara Stacks

Title: Vice President

By: /s/ Vanessa De La Ossa

Name: Vanessa De La Ossa

Title: Associate

Diebold Amendment

ING BANK N.V. DUBLIN BRANCH, as Lender

By: /s/ Sean Hassett

Name: Sean Hassett

Title: Director

By: /s/ Cormac Langford

Name: Cormac Langford

Title: Vice President

Diebold Amendment

THE GOVERNOR AND COMPANY OF THE BANK OF IRELAND, as Lender

By: /s/ Conor Linehan

Name: Conor Linehan

Title: Authorised Signatory

By: /s/ Keith Hucther

Name: Keith Hucther

Title: Authorised Signatory

Diebold Amendment

ANNEX I

See attached

Execution versionAnnex I

DIEBOLD, INCORPORATED,

THE SUBSIDIARY BORROWERS,

______________________________________

CREDIT AGREEMENT

dated as of November 23, 2015

______________________________________

JPMORGAN CHASE BANK, N.A.,

as Administrative Agent

and

THE LENDERS PARTY HERETO

______________________________________

J.P. MORGAN SECURITIES LLC,

and and

CREDIT SUISSE SECURITIES (USA) LLC,

as Joint Lead Arrangers and Bookrunners

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH,

PNC BANK, NATIONAL ASSOCIATION and U.S. BANK NATIONAL ASSOCIATION,

as Co-Syndication Agents

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.,

as SyndicationDocumentation Agent

TABLE OF CONTENTS

ARTICLE I DEFINITIONS ………………………………………………………………..…1

1.1 Defined Terms……………………………………………………….…………....1

1.2 Rules of Construction……………………………………………………...…….54

1.3 Accounting Terms; GAAP……………………………………………………....55

1.4 Redenomination of Certain Foreign Currencies………………………………….55

1.5 Foreign Currency Calculations……………………………………………….....56

ARTICLE II THE CREDITS ……………………………………………………………….57

2.1 Commitments …………………………………………………………………...57

2.2 Repayment of Loans; Evidence of Debt ………………………………………..58

2.3 Procedures for Borrowing Loans …………………………………………….…61

2.4 Termination or Reduction ……………………………………………………… 61

2.5 Commitment, Ticking and other Fees …………………………………………. 62

2.6 Optional and Mandatory Principal Payments ………………………………….. 63

2.7 Conversion and Continuation of Outstanding Advances ……………………… 66

2.8 Interest Rates, Interest Payment Dates; Interest and Fee Basis …………………67

2.9 Rates Applicable After Default ………………………………………………… 68

2.10 Pro Rata Payment, Method of Payment; Proceeds of Collateral ………………..68

2.11 Telephonic Notices ……………………………………………………………....70

2.12 Notification of Advances, Interest Rates, Prepayments and Commitment

Reductions…………………………………………………………...…………...70

2.13 Lending Installations ………………………………………………………….....70

2.14 Non‑Receipt of Funds by the Administrative Agent …………………………....71

2.15 Facility Letters of Credit ………………………………………………………...71

2.16 Swing Loans ……………………………………………………………………..78

2.17 Defaulting Lenders ……………………………………………………………....80

2.18 Guaranties …………………………………………………………………….....82

2.19 Incremental Credit Extensions …………………………………………………..83

2.20 Inability to Determine Rates ……………………………………………………...87

ARTICLE III CHANGE IN CIRCUMSTANCES, TAXES………………………………..... 88

3.1 [Reserved]………………………………………………………………………..88

3.2 Increased Costs …………………………………………………………………. 88

3.3 Break Funding Payments ………………………………………………………..90

3.4 Withholding of Taxes; Gross-Up…………………………………………….…..90

3.5 Mitigation Obligations; Replacement of Lenders…………………………….…. 95

ARTICLE IV CONDITIONS PRECEDENT ……………………………………………….96

4.1 Execution Date …………………………………………………………………..96

4.2 Replacement Facilities Effective Date …………………………………………..99

4.3 Acquisition Closing Date ……………………………………………………….101

4.4 Each Advance under the Revolving Credit Facility ……………………………102

4.5 Each Advance under the Delayed Draw Term A Commitments after the

Acquisition Closing Date ………………………………………………………103

4.6 Actions by Lenders During the Certain Funds Period……………………………103

i

CREDIT AGREEMENT

THIS CREDIT AGREEMENT (this “Agreement”), dated as of November 23, 2015, is among DIEBOLD, INCORPORATED, an Ohio corporation (the “Company”), the SUBSIDIARY BORROWERS (as hereinafter defined) from time to time parties hereto (together with the Company, the “Borrowers”), the Lenders from time to time parties hereto (as defined below), and JPMORGAN CHASE BANK, N.A., as Administrative Agent.

The parties hereto agree as follows:

ARTICLE I

DEFINITIONS

1.1 Defined Terms. As used in this Agreement, the following terms shall have the following meanings:

“Acquisition” means the initial acquisition by AcquisitionCo (and/or, if applicable, the Company) of a number of shares in the Target which represent (after taking into account any treasury shares held by the Target subject to the Non-Tender Agreement) at least 75% of the voting rights in the Target via a tender offer completed pursuant to the Acquisition Documentation.

“AcquisitionCo” means Diebold Holding Germany Incorporated & Co. KGaA a German partnership limited by shares (Kommanditgesellschaft auf Aktien - KGaA) that is a Wholly Owned Restricted Subsidiary of the Company and whose general partner is the Company.

“Acquisition Closing Date” means the first date on which all conditions precedent set forth in Section 4.3 are satisfied or waived in accordance with Section 8.2.

“Acquisition Documentation” means, collectively, the Offer Documentation and the Business Combination Agreement.

“Adjusted LIBO Rate” means, with respect to any Eurocurrency Advance for any Interest Period, an interest rate per annum (rounded upwards, if necessary, to the next 1/16 of 1%) equal to the sum of (i) (a) the LIBO Rate for such Interest Period divided by (b) one minus the Reserve Requirement (expressed as a decimal) applicable to such Interest Period, plus, without duplication, plus (ii) the amount of all reserves, costs or similar requirements relating to the funding of the relevant Available Foreign Currency (if any), as reasonably determined by the Administrative Agent.

“Administrative Agent” means JPMorgan Chase in its capacity as contractual representative of the Lenders pursuant to Article XI, and not in its individual capacity as a Lender, and any successor Administrative Agent appointed pursuant to Article XI.

1

by the Company and its Restricted Subsidiaries during such fiscal year (other than sales of inventory in the ordinary course of business) to the extent deducted in arriving at such Consolidated Net Income over (b) the sum, without duplication, of (i) the amount of all non-cash credits included in arriving at such Consolidated Net Income, (ii) the aggregate amount actually paid by the Company and its Restricted Subsidiaries in cash during such fiscal year on account of Capital Expenditures (except to the extent that such Capital Expenditures made in cash were financed with the proceeds of Indebtedness of the Company or the Subsidiaries and any such Capital Expenditures financed with the proceeds of any Reinvestment Deferred Amount), (iii) the aggregate amount of all prepayments of Revolving Credit Loans and Swing Loans during such fiscal year to the extent accompanying permanent optional reductions of the Revolving Credit Commitments and all optional prepayments of the Term Loans during such fiscal year[reserved], (iv) the aggregate amount of all regularly scheduled principal payments of Funded Debt (including the Term Loans) of the Company and its Restricted Subsidiaries made during such fiscal year (other than in respect of any revolving credit facility to the extent there is not an equivalent permanent reduction in commitments thereunder), (v) increases in Consolidated Working Capital for such fiscal year, (vi) the aggregate net amount of non-cash gain on the Disposition of property by the Company and its Restricted Subsidiaries during such fiscal year (other than sales of inventory in the ordinary course of business), (vii) the aggregate amount of any premium, make-whole or penalty payments actually paid in cash by the Company and its Restricted Subsidiaries during such period that are made in connection with any prepayment of Indebtedness, (viii) the amount of Taxes paid in cash or Tax reserves set aside or payable (without duplication) with respect to such period to the extent they exceed the amount of Tax expense deducted in determining net income for such period, (ix) cash expenditures in respect of Hedging Agreements during such fiscal year, (x) without duplication of amounts deducted pursuant to clause (xiii) below in prior fiscal years, the aggregate amount of cash consideration paid by the Company and its Restricted Subsidiaries (on a consolidated basis) in connection with Investments (including acquisitions) made during such period in respect of Future Acquisitions or other acquisitions of property or assets from third parties pursuant to Sections 6.15 (viii), (xi) and/or (x) or Acquisitions of Target Shares pursuant to Section 6.15(xii), in each case to the extent that such Investments were financed with internally generated cash of the Company and its Restricted Subsidiaries, (xii) the amount of Restricted Payments during such period (on a consolidated basis) by the Company and its Restricted Subsidiaries made in reliance on Section 6.25(b) and/or (f), in each case to the extent such Restricted Payments were financed with internally generated cash of the Company and its Restricted Subsidiaries) and (xiii) without duplication of amounts deducted from Excess Cash Flow in prior periods, the aggregate consideration required to be paid in cash by the Company or any of its Restricted Subsidiaries pursuant to binding contracts (the “Contract Consideration”) entered into prior to or during such period relating to Future Acquisitions or Capital Expenditures or acquisitions of intellectual property to be consummated or made during the period of four consecutive fiscal quarters of the Company following the end of such period, provided that to the extent the aggregate amount of internally generated cash actually utilized to finance such Future Acquisitions or Capital Expenditures during such period of four consecutive fiscal quarters is less than the Contract Consideration, the amount of such shortfall shall be added to the calculation of Excess Cash Flow at the end of such period of four consecutive fiscal quarters, in each case, to the extent included in arriving at such Consolidated Net Income. For the avoidance of doubt, for purposes of calculating ‘Excess

21

as a liability on the consolidated balance sheet of such Person, (g) Off-Balance Sheet Liabilities and Receivables Indebtedness, (h) Guarantee Obligations with respect to any of the foregoing and (i) all obligations of the kind referred to in the foregoing clauses secured by (or for which the holder of such obligation has an existing right, contingent or otherwise, to be secured by) any Lien on property (including accounts and contract rights) owned by such Person, whether or not such Person has assumed or become liable for the payment of such obligation, provided that, if such Person has not assumed such obligations, then the amount of Indebtedness of such Person for purposes of this clause (i) shall be equal to the lesser of the amount of the obligations of the holder of such obligations and the fair market value of the assets of such Person which secure such obligations.

“Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by any Loan Party under any Loan Document and (b) OtherTaxes.

“Indemnitee” is defined in Section 10.6(b).

“Indicative Company Rating” means the indicative public corporate credit rating or public corporate family rating, as applicable, in respect of the Company, from S&P and Moody’s, giving effect to the Transactions.

“Ineligible Person” means (a) a natural person or (b) other than as set forth and in accordance with Section 13.1(b)(iii), the Company or any of its Subsidiaries or other controlled Affiliates.

“Initial Acceptance Period” means the acceptance period (Annahmefrist) for the Offer pursuant to Section 16(1) of the German Takeover Code specified in the Offer Document (including any extensions thereof, if any, consented to by the Arrangers).

“Integrated Service Contract” means a contract pursuant to which the Company and/or a Subsidiary provides both equipment and services to ana customer.

“Integrated Service Contract Debt” means Indebtedness of a type described on Schedule 1.1(b).

“Interest Coverage Ratio” means, as of the end of any fiscal quarter, the ratio of (a) EBITDA to (b) Interest Expense, in each case calculated for the four consecutive fiscal quarters then ending, on a consolidated basis for the Company and its Restricted Subsidiaries in accordance with GAAP.

“Interest Expense” means, with respect to any period, the aggregate of all interest expense reported by the Company and its Restricted Subsidiaries in accordance with GAAP during such period, net of any cash interest income received by the Company and its Restricted Subsidiaries during such period from Investments, provided that any Interest Expense on the portion of Integrated Service Contract Debt that is excluded from Total Debt shall be excluded from Interest Expense. As used in this definition, the term “interest” shall include, without limitation, all interest, fees and costs payable with respect to the obligations under this Agreement (other than fees and costs which may be capitalized as transaction costs

31

under this Agreement, as such commitment may be reduced or increased from time pursuant to Section 13.1 or any other applicable provisions hereof. The initial amount of each Lender’s Replacement Term A Commitment shall be set forth in the applicable Replacement Facilities Effective Date Documentation, or otherwise, in the Assignment and Assumption pursuant to which such Lender shall have assumed its Replacement Term A Commitment, as the case may be. The aggregate amount of the Replacement Term A Commitments on the Execution Date is $0. The aggregate amount of the Replacement Term A Commitments on the Replacement Facilities Effective Date is $230,000,000.

“Replacement Term A Facility” means the Replacement Term A Commitments and the extensions of credit made thereunder.

“Replacement Term A Lender” means, at any time, any Lender that has a Replacement Term A Commitment or a Replacement Term A Loan at such time.

“Replacement Term A Loan Amortization Amount” means the aggregate principal amount of all Replacement Term A Loans made on the Replacement Facilities Effective Date.

“Replacement Term A Loans” means the term loans made by the Replacement Term A Lenders on the Replacement Facilities Effective Date to the Company pursuant to Section 2.1(a).

“Reportable Event” means a reportable event as defined in Section 4043 of ERISA and the regulations issued under such section with respect to a Plan subject to Title IV of ERISA, excluding, however, such events as to which the PBGC by regulation waived the requirement of Section 4043(a) of ERISA that it be notified within 30 days of the occurrence of such event, provided, however, that a failure to meet the minimum funding standard of Section 412 of the Code and of Section 302 of ERISA shall be a Reportable Event regardless of the issuance of any such waiver of the notice requirement in accordance with Section 4043(a) of ERISA or of the minimum funding standard under Section 412(c) of the Code.

“Repricing Event” means (i) any prepayment, repayment or replacement of the Term B Facility, in whole or in part, with the proceeds of indebtedness (or commitments in respect of indebtedness) with an All-in Yield less than the All-in Yield applicable to such portion of the Term B Facility (as such comparative yields are determined in the reasonable judgment of the Administrative Agent consistent with generally accepted financial practices) and (ii) any amendment to the Term B Facility which reduces the All-in Yield applicable to the Term B Facility), but in each case, excluding any repayment, replacement or amendment occurring in connection with a Change of Control or an acquisition or Investment not permitted under the Loan Documents.

“Required Lenders” means Lenders whose Aggregate Outstandings and Aggregate Commitments (without duplication) exceed 50% of the Aggregate Outstandings and Aggregate Commitments (without duplication) of all Lenders.

“Required Revolving Credit Lenders” means (a) at any time prior to the termination of

the Revolving Credit Commitments, Lenders holding greater than 50% of the Aggregate Revolving Credit Commitments; and (b) at any time after the termination of the Revolving

47

Credit Commitments, Revolving Credit Lenders whose Aggregate Revolving Credit Outstandings aggregate greater than 50% of the Aggregate Revolving Credit Outstandings of all Revolving Credit Lenders.

“Required Term A Lenders” means at any time, Term A Lenders holding in the aggregate more than 50% of the aggregate outstanding principal amount of all Term A Loans and Term A Commitments.

“Required Term B Lenders” means Term B Lenders holding in the aggregate more than 50% of the aggregate outstanding principal amount of all Term B Loans and Term B Commitments.

“Required TLA/RC Lenders” means Lenders holding in the aggregate more than 50% of the sum of the aggregate outstanding principal amount of all Term A Loans, Term A Commitments and Revolving Credit Commitments (or if such Revolving Credit Commitments have terminated, the Aggregate Revolving Credit Outstandings).

“Requirement of Law” means as to any Person, the certificate of incorporation and by-laws or other organizational or governing documents of such Person, and any law, treaty, rule

or regulation or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such Person or any of its Property or to which such Person or any of its Property is subject.

“Reserve Requirement” means, with respect to an Interest Period for Eurocurrency Loans, the maximum aggregate reserve requirement (including all basic, supplemental, marginal and other reserves), assessments or similar requirements under any regulations of the Board of Governors of the Federal Reserve System or other Governmental Authority having jurisdiction with respect thereto dealing with reserve requirements prescribed for eurocurrency funding (currently referred to as “Eurocurrency Liabilities” in Regulation D).

“Restricted Indebtedness” is defined in Section 6.26.

“Restricted Subsidiary” means each Subsidiary other than an Unrestricted Subsidiary.

“Retained Percentage” means, with respect to any fiscal year, (a) 100% minus (b) the ECF Percentage with respect to such fiscal year.

“Revolving Credit Commitment” means, as to any Lender at any time, its obligation to make Revolving Credit Loans to the Borrowers under Section 2.1(d) in an aggregate amount not to exceed at any time outstanding the Dollar Equivalent Amount of the U.S. Dollar amount set forth with respect to such Lender in the applicable Replacement Facilities Effective Date Documentation, as such amount may be reduced or increased from time to time pursuant to Sections 2.4, 2.19, 13.1 or any other applicable provisions hereof. The aggregate amount of the Lenders’ Revolving Credit Commitments as of the Execution Date is $0. The aggregate amount of the Lenders’ Revolving Credit Commitments as of the Replacement Facilities Effective Date is $520,000,000.

48

the Agents shall, unless (x) a Certain Funds Event of Default has occurred and is continuing at the time of or immediately after giving effect to a proposed Advance or (y) a Certain Funds Representation remains incorrect in any material respect or, if a Certain Funds Representation contains a materiality concept, incorrect in any respect, be entitled to:

(a) cancel any of its Delayed Draw Term A Commitments or Term B Commitments (collectively, the “Certain Funds Commitments”; the Advances thereunder “Certain Funds Advances”), except as set forth in Section 2.4 above;

(b) rescind, terminate or cancel the Loan Documents or the Certain Funds Commitments or exercise any similar right or remedy or make or enforce any claim under the Loan Documents it may have to the extent to do so would prevent or limit the making of Certain Funds Advances, except as set forth in Section 2.4 above;

(c) refuse to participate in the making of Certain Funds Advances unless the conditions expressly applicable to drawing thereof set forth in Sections 4.1, 4.3 or 4.5, as applicable, have not been satisfied;

(d) exercise any right of set-off or counterclaim in respect of a Loan under the Certain Funds Commitments for Certain Funds Purposes to the extent to do so would prevent or limit the making of Certain Funds Advances; or

(e) cancel, accelerate or cause repayment or prepayment of any amounts owing under any Loan Document to the extent to do so would prevent or limit the making of Certain Funds Advances;

provided that immediately upon the expiry of the Certain Funds Period all such rights, remedies and entitlements shall be available to the Lenders and the Administrative Agent notwithstanding that they may not have been used or been available for use during the Certain Funds Period.

ARTICLE V

REPRESENTATIONS AND WARRANTIES

Each of the Company and the Subsidiary Borrowers (insofar as the representations and warranties set forth below relate to such Subsidiary Borrower) represents and warrants to the Lenders on the Execution Date, the Replacement Facilities Effective Date, the Acquisition Closing Date, each date Delayed Draw Term A Loans are made and each other date such representations and warranties are made pursuant to the Loan Documents (provided that prior to the Domination Agreement Effective Date such representations and warranties shall not apply to or otherwise include the Target or its Subsidiaries), that:

5.1 Corporate Existence and Standing. Each Borrower and, other than as would not reasonably be expected to have a Material Adverse Effect, their Restricted Subsidiaries is a corporation, partnership, limited liability company or other organization, duly organized and validly existing under the laws of its jurisdiction of organization and has all requisite corporate, partnership, company or similar authority to conduct its business as presently

107

procedures reasonably acceptable to the Administrative Agent). The Administrative Agent will notify the Term B Lenders of such borrowing notice and each Term B Lender shall be required to make the proceeds of their Term B Loans available to the Administrative Agent on such Borrowing Date as set forth in Section 2.3.

(xiv) Each Lender and Issuer consents to the terms of this Section 17.2 and agrees to fund its Term B Loans into escrow as set forth herein. Notwithstanding anything herein to the contrary, including Section 8.2, the Company and the Administrative Agent may make any changes to the Loan Documents with only the consent of the Company and the Administrative Agent (and no other Lender or Issuer) to ensure this Agreement adequately reflects the nature of the Term B Loans while in escrow and adequately reflects such Term B Loans after release from escrow on the Acquisition Closing Date, to the extent such amendments or modifications (y) only relate to the Term B Facility or (x) are not materially adverse to the interests of the other Lenders hereunder, as determined by the Administrative Agent in its sole discretion.

17.3 Facility Sizing. In connection with the syndication of the Replacement Facilities, the Delayed Draw Term A Facility and/or the Term B Facility, if agreed among the Arrangers and the Company, the amount of any such facility under this Agreement (each a “Facility”) may be increased in an aggregate amount for all such Facility increases not in excess of $100,000,000. Such increased amount shall be on the same terms as the remaining portion of the Facility and shall be documented pursuant to documentation in form and substance reasonably acceptable to the Company and the Arrangers, executed by the Company and the Administrative Agent, without the consent of any other party hereto.

17.4 Bifurcation. For the avoidance of doubt, the parties hereto acknowledge and agree that, notwithstanding anything to the contrary in this Agreement or any of the other Loan Documents, the Foreign Obligations shall be separate and distinct from the Domestic Obligations, and shall be expressly limited to the Foreign Obligations. In furtherance of the foregoing, each of the parties hereto acknowledges and agrees that (a) the liability of any Foreign Loan Party for the payment and performance of its covenants, representations and warranties set forth in this Agreement and the other Loan Documents shall be several from but not joint with the Domestic Obligations, (b) no Foreign Loan Party shall guarantee the Domestic Obligations, and (c) no Collateral, if any, of any Foreign Loan Party shall secure or be applied in satisfaction, by way of payment, prepayment, or otherwise, of all or any portion of the Domestic Obligations.

17.5 Acquisition Cancellation. If a Mandatory Cancellation Event occurs prior to the Acquisition Closing Date (a) the covenant set forth in Section 6.18 shall automatically be deemed modified so that it only limits Indebtedness of Restricted Subsidiaries that are not Guarantors and the covenants in Sections 6.9, 6.10, 6.19, 6.25, 6.26, 6.27, 6.29 and 6.31 shall automatically cease to apply, (b) the covenant in Section 6.22 shall automatically be modified to prohibit the Total Net Leverage Ratio to exceed 3.5: 1.0 with no step downs in such ratio and on the terms otherwise set forth in such Section 6.22, (c) the covenant in Section 6.23 shall automatically be modified to prohibit the Interest Coverage Ratio to exceedbe less than

176

IN WITNESS WHEREOF, the Borrowers, the Lenders and the Administrative Agent have executed this Agreement as of the date first above written.

DIEBOLD, INCORPORATED

By:________________________________

Print Name:_________________________

Title:______________________________

DIEBOLD Self-Service Solutions S.ar.l., as a Subsidiary Borrower

By:________________________________

Print Name:_________________________

Title: Authorized Signatory

Signature Page to Credit Agreement

ANNEX II

Schedule 1.1(a)

Commitments

|

| | | | |

Lender | Delayed Draw Term A Commitment | Replacement Term A Commitment | Revolving Credit Commitment | Term B Commitment |

JPMorgan Chase Bank, N.A. | $29,399,070.37 | $27,047,144.77 | $53,553,784.86 | $493,210,000.00 |

Credit Suisse AG, Cayman Islands Branch | $29,399,070.39 | $27,047,144.75 | $53,553,784.86 | $493,210,000.00 |

PNC Bank, National Association | $29,399,070.39 | $27,047,144.75 | $53,553,784.86 | $177,396,500.00 |

U.S. Bank National Association | $29,399,070.39 | $27,047,144.75 | $53,553,784.86 | $123,302,500.00 |

The Bank of Tokyo-Mitsubishi UFJ, Ltd. | $25,390,106.24 | $23,358,897.74 | $46,250,996.02 | $156,713,500.00 |

Bank of America, N.A. | $23,519,256.31 | $21,637,715.80 | $42,843,027.89 | $0 |

HSBC Bank USA, National Association | $17,500,000.00 | $16,1000,000.00 | $36,400,000.00 | $51,707,500.00 |

The Bank of Nova Scotia | $18,708,499.34 | $17,211,819.39 | $34,079,681.27 | $51,707,500.00 |

Fifth Third Bank | $16,035,856.57 | $14,752,988.05 | $29,211,155.38 | $43,752,500.00 |

Deutsche Bank AG New York Branch | $0 | $0 | $52,000,000.00 | $0 |

Commerzbank AG, New York Branch | $12,500,000.00 | $11,500,000.00 | $26,000,000.00 | $0 |

ING Bank N.V., Dublin Branch | $12,500,000.00 | $11,500,000.00 | $26,000,000.00 | $0 |

The Governor and Company of the Bank of Ireland | $6,250,000.00 | $5,750,000.00 | $13,000,000.00 | $0 |

Total | $250,000,000 | $230,000,000 | $520,000,000 | $1,591,000,000 |

ANNEX III

|

| |

Issuer | Issuer Sublimit |

JPMorgan Chase Bank, N.A. | $25,000,000 |

Credit Suisse AG, Cayman Islands Branch | $25,000,000 |

PNC Bank, National Association | $25,000,000 |

U.S. Bank National Association | $25,000,000 |

Total | $100,000,000 |

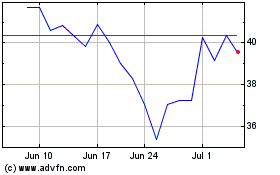

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024