UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 23, 2015

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

1-4879 |

|

34-0183970 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 5995 Mayfair Road, P.O. Box 3077,

North Canton, Ohio |

|

44720-8077 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (330) 490-4000

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 1 — Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

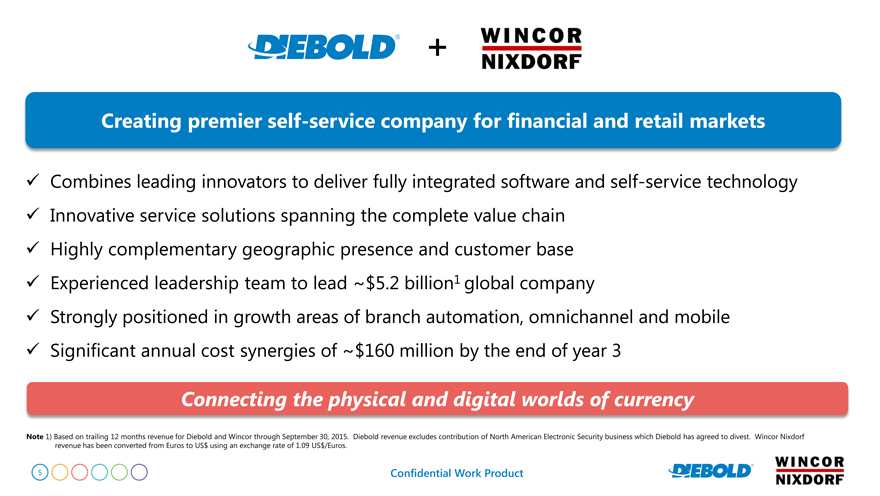

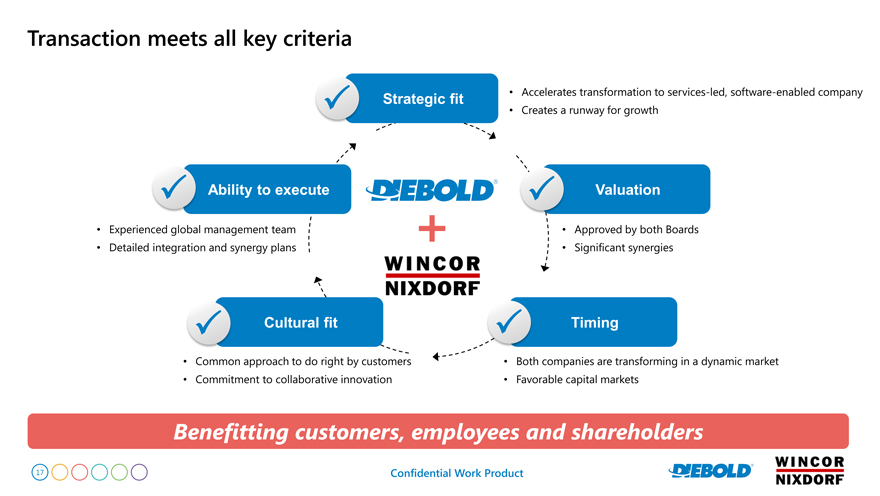

Business Combination Agreement

On

November 23, 2015, Diebold, Incorporated (“Diebold” or the “Company”), entered into a business combination agreement (the “Business Combination Agreement”) with Wincor Nixdorf Aktiengesellschaft, a German stock

corporation (“Wincor Nixdorf”). The Business Combination Agreement provides that, upon the terms and subject to the conditions set forth therein, Diebold and Wincor Nixdorf intend to form a combined enterprise (the “Business

Combination”).

Pursuant to the Business Combination Agreement, the Company will make a voluntary public takeover offer for 100% of

the outstanding ordinary shares of Wincor Nixdorf (the “Exchange Offer”) in exchange for €38.98 in cash and 0.434 new common shares of Diebold per Wincor Nixdorf ordinary share. Diebold will issue common shares in connection with the

Exchange Offer up to 19.91% of its total outstanding common shares at the time of entry in the Business Combination Agreement and at the time of issuance.

The Business Combination Agreement was unanimously approved by the Board of Directors of the Company and by the supervisory board and

management board of Wincor Nixdorf. The consummation of the Exchange Offer by Diebold is subject to customary closing conditions, including, among others, (i) receipt of all antitrust approvals for the transaction on or before November 21,

2016, (ii) authorization for listing on the New York Stock Exchange and the Frankfurt Stock Exchange of the Diebold common shares to be issued in the Exchange Offer, (iii) the declaration of effectiveness of the registration statement on

Form S-4 for the Diebold common shares to be issued in the Exchange Offer, with no stop orders in effect with respect thereto, (iv) the absence of any order, injunction or other legal restraint preventing the completion of the Exchange Offer or

making the consummation of the Business Combination illegal and (v) receipt of a total number of tendered Wincor Nixdorf shares that, together with Wincor Nixdorf shares held by Diebold or to which Diebold has a right to demand the transfer of

title, constitutes at least 67.6% of all issued Wincor Nixdorf ordinary shares. Diebold’s obligation to consummate the Exchange Offer is also subject to certain additional customary conditions, including (i) the absence of a market

material adverse change as defined in the Business Combination Agreement, (ii) the absence of a material adverse change for Wincor Nixdorf, as defined in the Business Combination Agreement, (iii) the absence of a violation or alleged

violation of law, in particular related to bribery, corruption, embezzlement, antitrust or money laundering, (iv) the absence of an increase in Wincor Nixdorf’s share capital or any disposal of Wincor Nixdorf’s treasury shares,

(v) the absence of any insolvency proceedings against Wincor Nixdorf or circumstances requiring the opening of insolvency proceedings and (vi) the lack of a competing offer which, as disclosed by Wincor Nixdorf, constitutes a superior

proposal.

Each of the Company and Wincor Nixdorf has agreed to various customary covenants and agreements, including covenants by Wincor

Nixdorf to conduct its business in the ordinary course consistent with past practice and to continue its announced restructuring program during the period between the execution of the Business Combination Agreement and the closing of the Business

Combination and not to engage in certain kinds of transactions during this period. Wincor Nixdorf has also agreed to a non-solicitation covenant restricting its ability to solicit or enter into discussions or negotiations concerning proposals

relating to alternative business combination transactions (subject to certain exceptions under the Business Combination Agreement).

The

Business Combination Agreement may be terminated by each of Diebold and Wincor Nixdorf under certain circumstances, including if (i) the Exchange Offer is not consummated by November 21, 2016 or (ii) the other party violates its

material obligations under the Business Combination Agreement and the violation was not cured within five business days. The Business Combination Agreement provides for customary termination rights for Wincor Nixdorf, including if (i) Diebold

does not publish its decision to launch the Exchange Offer without undue delay after the signing of the Business Combination Agreement, (ii) the approved Exchange Offer document has not been published by February 10, 2016, (iii) the

consideration offered in the Exchange Offer is lower than the amount agreed to in the Business Combination Agreement, (iv) the Exchange Offer contains closing conditions that are broader than the closing conditions specified in the Business

Combination Agreement, (v) Diebold’s disclosures of its strategy or intentions in the approved Exchange Offer document is materially different than those set forth in

the Business Combination Agreement, or (vi) the management board and/or supervisory board of Wincor Nixdorf no longer supports the Exchange Offer. The Business Combination Agreement also

provides for customary termination rights for Diebold, including if (i) the management board and/or supervisory board of Wincor Nixdorf does not issue its reasoned statement supporting the Exchange Offer, withdraws such statement or amend such

statement in a way that could jeopardized the success of the Exchange Offer or (ii) in compliance with the terms of the Business Combination Agreement, Diebold must refrain from publishing the Exchange Offer document following a SEC- or

BaFin-required amendment to the registration statement on Form S-4 or to the Exchange Offer document, respectively. In addition, the Business Combination Agreement provides for a reverse termination fee, payable by the Company to Wincor Nixdorf, of

(i) €20 million, if there was a failure to obtain the SEC’s declaration of effectiveness of the registration statement on Form S-4 for the Diebold common shares to be issued in the Exchange Offer by the end of the acceptance

period in the Exchange Offer, unless such failure arose in connection with a required modification of the recommendation statement of the Wincor Nixdorf boards or was caused by Wincor Nixdorf, (ii) €30 million, if there was a failure

of the market material adverse change condition, or (iii) €50 million, if there was a failure to receive all antitrust approvals for the Business Combination on or before November 21, 2016.

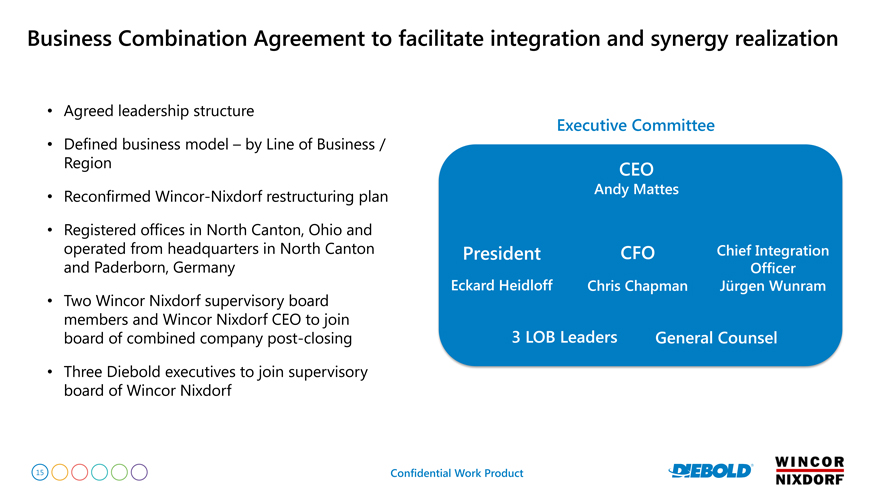

The Business Combination Agreement also provides that following the consummation of the Exchange Offer and closing of the Business

Combination, the Company will appoint to its board of directors Wincor Nixdorf’s chief executive officer, Mr. Eckard Heidloff, and two current members of the Wincor Nixdorf supervisory board, Drs. Alexander Dibelius and Dieter

Düsedau, and nominate and recommend Mr. Heidloff, Dr. Dibelius and Dr. Düsedau for election to the board of directors by Diebold shareholders thereafter. Furthermore, the Company will appoint Wincor Nixdorf’s chief

executive officer as Diebold’s president upon his election to the Diebold board of directors.

The foregoing description of the

Business Combination Agreement does not purport to be complete and is qualified in its entirety by reference to the Business Combination Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

Section 7 — Regulation FD

| Item 7.01. |

Regulation FD Disclosure. |

On November 23, 2015, Diebold issued a press release announcing its

entry into the Business Combination Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

Diebold will conduct a webcast conference call with financial analysts on Monday, November 23, 2015, beginning at 8:30 a.m. Eastern Time / 2:30 p.m.

Central European Time. Diebold’s executive management will present an overview of the Business Combination Agreement followed by a question and answer session. Interested parties, including analysts, investors and the media, may listen live via

the internet by logging onto the Investors section of Diebold’s website at http://www.diebold.com/DieboldNixdorf.

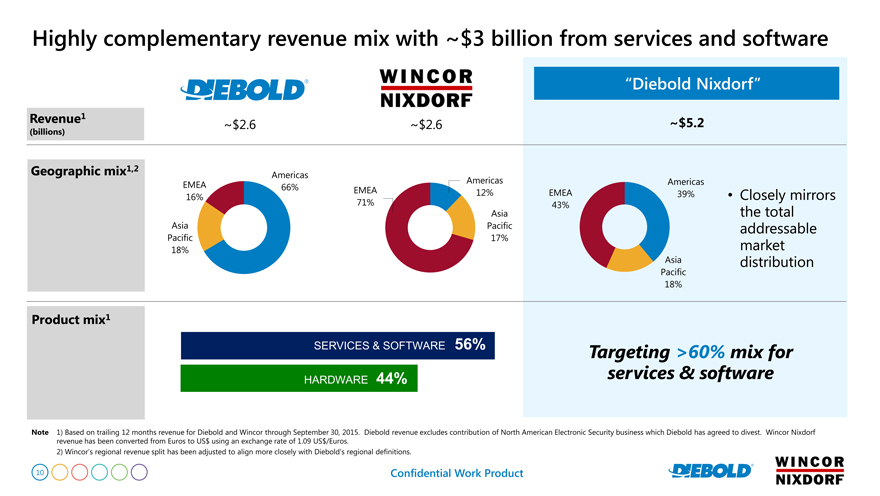

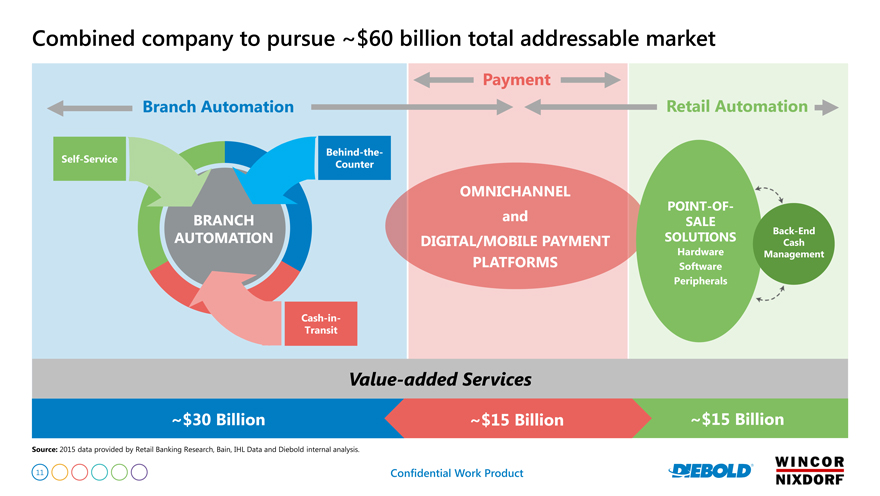

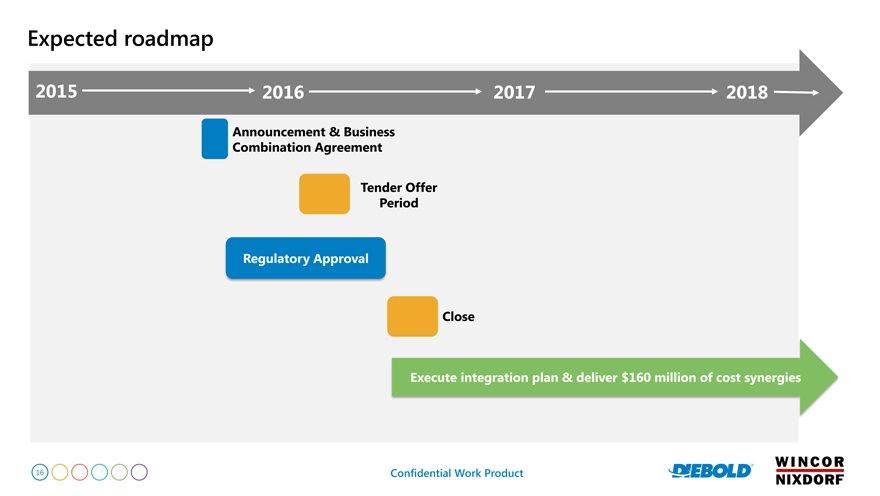

A copy of the Diebold’s

investor presentation for the webcast conference call is attached hereto and incorporated by reference into this Item 7.01 as Exhibit 99.2.

Diebold

is furnishing the information in this Item 7.01 and in Exhibits 99.1 and 99.2 to comply with Regulation FD. The information contained in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for any

purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the

Securities Act of 1933, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this report:

|

|

|

| 2.1 |

|

Business Combination Agreement, dated November 23, 2015, by and among Diebold, Incorporated and Wincor Nixdorf Aktiengesellschaft. |

|

|

| 99.1 |

|

Press release issued by Diebold, dated November 23, 2015, concerning the Business Combination Agreement (furnished and not filed for purposes of Item 7.01). |

|

|

| 99.2 |

|

Investor Presentation (furnished and not filed for purposes of Item 7.01). |

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING STATEMENTS

Certain statements contained in this communication regarding matters that are not historical facts are forward-looking statements (as defined in the Private

Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future including, without limitation, the proposed business combination with Wincor Nixdorf

and the offer. Such forward-looking statements are based on the current expectations of Diebold and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such

forward-looking statements may include statements about the business combination and the offer, the likelihood that such transaction is consummated and the effects of any transaction on the businesses and financial conditions of Diebold or Wincor

Nixdorf, including synergies, pro forma revenue, targeted operating margin, net debt to EBITDA ratios, accretion to earnings and other financial or operating measures. By their nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance and actual results of operations, financial condition and liquidity, and the

development of the industries in which Diebold and Wincor Nixdorf operate may differ materially from those made in or suggested by the forward-looking statements contained in this document. In addition, risks and uncertainties related to the

contemplated business combination between Diebold and Wincor Nixdorf include, but are not limited to, the expected timing and likelihood of the completion of the contemplated business combination, including the timing, receipt and terms and

conditions of any required governmental and regulatory approvals of the contemplated business combination that could reduce anticipated benefits or cause the parties not to consummate, or to abandon the transaction, the ability to successfully

integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the business combination agreement or the contemplated offer, the risk that the parties may not be willing or able to

satisfy the conditions to the contemplated business combination or the contemplated offer in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the contemplated business combination, the

risk that any announcements relating to the contemplated business combination could have adverse effects on the market price of Diebold’s common shares, and the risk that the contemplated transaction or the potential announcement of such

transaction could have an adverse effect on the ability of Diebold to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally. These risks, as well as other risks associated

with the contemplated business combination, are more fully discussed in a prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the contemplated business combination and the

offer. Additional risks and uncertainties are identified and discussed in Diebold’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Any forward-looking statements speak

only as at the date of this document. Except as required by applicable law, neither Diebold nor Wincor Nixdorf undertakes any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future

events or otherwise. This communication outlines certain key German tax principles related to the participation in the voluntary public tender offer that may be or may become relevant to holders of shares of Wincor Nixdorf. The discussion of German

tax considerations is of a general nature only and does not constitute a comprehensive or definitive explanation of all possible aspects of German taxation that may be relevant for shareholders of Wincor Nixdorf. Furthermore, this communication does

not address non-German tax considerations that may apply to a shareholder that is a tax resident of a jurisdiction other than Germany. This communication is based upon domestic German tax laws in effect as of the date hereof. It is important to note

that the legal situation may change, possibly with retroactive effect, and that no assurance can be given regarding the tax treatment of this transaction by fiscal authorities and the courts.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Diebold, Incorporated |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: November 23, 2015 |

|

|

|

By: |

|

/s/ Jonathan B. Leiken |

|

|

|

|

|

|

Name: |

|

Jonathan B. Leiken |

|

|

|

|

|

|

Title: |

|

Senior Vice President, Chief Legal Officer and Secretary |

INDEX TO EXHIBITS

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Business Combination Agreement, dated November 23, 2015, by and among Diebold, Incorporated and Wincor Nixdorf Aktiengesellschaft. |

|

|

| 99.1 |

|

Press release issued by Diebold, dated November 23, 2015, concerning the Business Combination Agreement (furnished and not filed for purposes of Item 7.01). |

|

|

| 99.2 |

|

Investor Presentation (furnished and not filed for purposes of Item 7.01). |

Exhibit 2.1

Business Combination Agreement

Execution Copy

BUSINESS COMBINATION AGREEMENT

RELATING TO THE BUSINESS COMBINATION

OF

DIEBOLD

AND

WINCOR NIXDORF

Dated as of November 23, 2015

Business Combination Agreement

(this “Agreement”)

by and among

– the “Bidder”” –

and

| 2. |

Wincor Nixdorf Aktiengesellschaft |

– the “Company” –

– the Bidder and the Company hereinafter also

collectively referred to as the “Parties” and individually as a “Party” –

-2-

Table of Contents

|

|

|

|

|

|

|

| Section 1 |

|

Current Status and Transaction Structure |

|

|

4 |

|

|

|

|

| Section 2 |

|

Announcement of the Tender Offer; Press Statements |

|

|

6 |

|

|

|

|

| Section 3 |

|

Disclosure Documents relating to the Transaction |

|

|

7 |

|

|

|

|

| Section 4 |

|

Tender Offer |

|

|

11 |

|

|

|

|

| Section 5 |

|

Support of the Tender Offer by the Company and Mutual Actions to Support the Transaction |

|

|

16 |

|

|

|

|

| Section 6 |

|

Reasoned Statement by the Company’s Corporate Bodies on the Tender Offer |

|

|

18 |

|

|

|

|

| Section 7 |

|

Covenants |

|

|

19 |

|

|

|

|

| Section 8 |

|

Antitrust; Regulatory Approvals |

|

|

24 |

|

|

|

|

| Section 9 |

|

Closing Failure; Revised Transaction |

|

|

26 |

|

|

|

|

| Section 10 |

|

Preparation for Integration |

|

|

27 |

|

|

|

|

| Section 11 |

|

Name; Brand |

|

|

29 |

|

|

|

|

| Section 12 |

|

Headquarters; Reporting |

|

|

29 |

|

|

|

|

| Section 13 |

|

Global Responsibilities; Structure of the Business Operations |

|

|

29 |

|

|

|

|

| Section 14 |

|

Composition of Boards |

|

|

31 |

|

|

|

|

| Section 15 |

|

Senior Management and Management System of the Combined Group |

|

|

33 |

|

|

|

|

| Section 16 |

|

Employment Matters; Labor Law |

|

|

34 |

|

|

|

|

| Section 17 |

|

Corporate Measures |

|

|

35 |

|

|

|

|

| Section 18 |

|

Approval by Corporate Bodies |

|

|

35 |

|

|

|

|

| Section 19 |

|

Effectiveness, Term and Termination |

|

|

36 |

|

|

|

|

| Section 20 |

|

Break Fee |

|

|

37 |

|

|

|

|

| Section 21 |

|

Notices |

|

|

39 |

|

|

|

|

| Section 22 |

|

Miscellaneous |

|

|

40 |

|

|

|

|

| Section 23 |

|

Index of Definitions |

|

|

47 |

|

-3-

Section 1

Current Status and Transaction Structure

| 1.1. |

The Company is a German stock corporation (Aktiengesellschaft) incorporated under the laws of Germany, having its corporate seat and its registered offices in Paderborn, Germany. The Company is registered in the

commercial register (Handelsregister) at the Local Court (Amtsgericht) of Paderborn under HRB 6846 (together with its Subsidiaries from time to time, hereinafter referred to as “Wincor Nixdorf Group”). The

Company’s share capital amounts to EUR 33,084,988.00 (in words: Euro thirty-three million eighty-four thousand nine hundred eighty-eight) and is divided into 33,084,988 no-par value ordinary bearer shares (auf den Inhaber lautende

Stammaktien ohne Nennbetrag – all shares issued by the Company from time to time, the “Wincor Nixdorf Shares”). |

| 1.2. |

As of the date of this Agreement, the Company holds 3,268,777 Wincor Nixdorf Shares as treasury shares (eigene Aktien – the “Wincor Nixdorf Treasury Shares”) representing

approximately 9.88% of the Company’s current share capital. Further, the Company has issued 2,609,010 stock options as part of several stock option plans (collectively, the “Wincor Nixdorf Stock Option Plan”), of which

589,525 grant the right to purchase or subscribe for Wincor Nixdorf Shares in a number representing in total approximately 1.78% of the Company’s current share capital until the later of (i) the Expiration Date (as defined below) or

(ii) the lapse of the tender right period, if any, pursuant to Section 39c German Takeover Act (the “Tender Right Period”), as the case may be. The Wincor Nixdorf Shares are listed on the regulated market (Prime Standard)

of the Frankfurt Stock Exchange (ISIN: DE000A0CAYB2). |

| 1.3. |

The Bidder is a company incorporated under the laws of the State of Ohio, United States, having its headquarters in Canton, Ohio (the Bidder together with its Subsidiaries from time to time hereinafter referred to as

“Diebold Group”). As of the date of this Agreement, the Bidder has a total of 64,993,700 shares outstanding (all shares issued by the Bidder from time to time, the “Diebold Shares”). The Diebold Shares are listed on

New York Stock Exchange (ISIN: US2536511031; ticker symbol: DBD). |

| 1.4. |

The Parties intend to form a combined enterprise (the “Combined Group”) which shall strive to be a leading company in the Integrated Self Service, Banking and Retail Industry and to expand its

consolidated services and software business while developing innovative hardware, which will be an important enabler for the Combined Group. |

| 1.5. |

The Parties further intend the Combined Group to |

| |

(a) |

continue the Company’s and the Bidder’s respective restructuring programs with the objective of an accelerated transition to an enterprise that is services-led, software-enabled and supported by innovative

hardware; and |

| |

(b) |

use its global reach to achieve economies of scale and adjust its cost structure, while re-investing in new solution offerings (software and services) to accelerate growth. |

-4-

| 1.6. |

With a view to realizing these shared objectives for the Combined Group and to mutually strengthen each other’s business, the Parties intend to bring about a business combination of Wincor Nixdorf Group and Diebold

Group (the “Business Combination”) by way of the Bidder making a voluntary public takeover offer (Übernahmeangebot) in exchange for a mix of cash and Diebold Shares (the “Tender Offer”) within the

meaning of Section 29 para. 1 German Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – “German Takeover Act”) to the shareholders of the Company for all Wincor Nixdorf Shares (the

“Transaction”). |

| 1.7. |

The Company’s management board (Vorstand – the “Management Board”) and its supervisory board (Aufsichtsrat – the “Supervisory Board”) have, based on the

information available to date, taken the view that the Business Combination contemplated by this Agreement is in the best interest of the Company, the Company’s stockholders, employees and other stakeholders. |

| 1.8. |

The Bidder’s board of directors (the “Board of Directors”) has, based on the information available to date, determined that the Business Combination contemplated by this Agreement is consistent

with, and will advance, the business strategies and goals of the Bidder, and is in the best interest of the Bidder’s stockholders. |

| 1.9. |

On or prior to the date hereof, by means of entry into certain credit agreements by and among the Bidder, JPMorgan Chase Bank, N.A. and Credit Suisse AG (collectively, the “Banks”) and the other parties

thereto, the Bidder has obtained certain funds financing in an aggregate amount of up to USD 2,341,000,000 (in words: US Dollar two billion and three hundred forty-one million) for (i) the Cash Component and (ii) for any shareholder

loans to be provided by the Bidder to the Company following the consummation of the Tender Offer (the “Closing”) pursuant to the terms of this Agreement to secure any refinancing needs of Wincor Nixdorf Group in an amount of up to

EUR 175,000,000 (in words: Euro one hundred and seventy-five million) (“Certain Funds Financing”); it being understood that the Company shall use commercially reasonable efforts to avoid refinancing needs resulting from a

consummation of the Transaction. The Company has been afforded the opportunity to review, and comment on, draft documentation relating to the Certain Funds Financing, including, for the avoidance of doubt, the related guarantee agreements,

commitment letter and redacted fee letters, and the Bidder has delivered to the Company true, complete and correct copies of the executed credit agreements for the Certain Funds Financing (the “Financing Agreements) as well as the

related guarantee agreements, commitment letter and redacted fee letters. The Financing Agreements together with the related guarantee agreements, commitment letter and redacted fee letters, constitute the entire and complete agreement of the

parties thereto with respect to the Certain Funds Financing as of the date of this Agreement. |

-5-

| 1.10. |

This Agreement sets forth the principal terms and conditions of the Transaction as well as the mutual intentions and agreements of the Parties with regard thereto, the future organizational and corporate governance

structure of the Combined Group and the business strategy to be pursued by the Combined Group. The Parties will pursue the following steps in chronological order to consummate the Transaction, using their best efforts to complete the Transaction in

a timely manner: |

|

|

|

| — Step 1: |

|

Signing of this Agreement |

|

|

| — Step 2: |

|

Announcement of the Intention to Launch Tender Offer |

|

|

| — Step 3: |

|

Filing of the Registration Statement with the SEC |

|

|

| — Step 4: |

|

Filing of the Offer Document with BaFin |

|

|

| — Step 5: |

|

Approval of the Offer Document by BaFin and Launch of the Tender Offer |

|

|

| — Step 6: |

|

Early Commencement / Declaration of Effectiveness of the Registration Statement by the SEC |

|

|

| — Step 7: |

|

Receipt of All Required Antitrust Clearances |

|

|

| — Step 8: |

|

Closing / Settlement of the Tender Offer |

Section 2

Announcement of the Tender Offer; Press Statements

| 2.1. |

Immediately after the signing of this Agreement, |

| |

(a) |

the Bidder will (i) notify the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleitungsaufsicht – “BaFin”) of its intention to make the Tender Offer

and (ii) publish its decision regarding the launch of the Tender Offer, including a statement regarding the offered consideration, pursuant to Section 10 German Takeover Act (the “Offer Announcement”) substantially in the

form set forth in Annex 2.1(a); and |

| |

(b) |

concurrently, the Company will publish an ad hoc announcement pursuant to Section 15 para. 1 German Securities Trading Act (Wertpapierhandelsgesetz – “German Securities Trading Act”)

substantially in the form set forth in Annex 2.1(b). |

-6-

| 2.2. |

Promptly after the Bidder’s publication of the Offer Announcement pursuant to Section 2.1(a) and the Company’s publication of the ad hoc announcement pursuant to Section 2.1(b), the Company and the

Bidder will publish a joint press release in respect of the Transaction as set forth in Annex 2.2. |

| 2.3. |

The Company hereby agrees that |

| |

(a) |

the Bidder will disclose the entire content of this Agreement as part of its filing on the Form 8-K with the United States Securities and Exchange Commission (the “SEC”) in connection with the entry

into this Agreement; |

| |

(b) |

the Bidder will disclose the material terms of this Agreement as part of the publication of an offer document relating to the Wincor Nixdorf Shares within the meaning of Section 11 German Takeover Act (the

“Offer Document”) and the Registration Statement (as defined below); |

| |

(c) |

the Bidder will disclose the material terms of this Agreement in press releases issued by them in connection with the Tender Offer and the Transaction (in addition to the press release referred to in Section 2.2).

|

| 2.4. |

Conversely, the Bidder hereby agrees that the Company is at any time permitted to disclose the entire content of this Agreement to stakeholders and the press (in addition to the press release referred to in

Section 2.2) as well as in (i) the reasoned statement(s) of the Management Board and the Supervisory Board which may be combined in one (1) statement pursuant to Section 27 German Takeover Act (any such statement, a

“Reasoned Statement”) regarding the Tender Offer and (ii) any filing or statement required to be made by the Company pursuant to the rules and regulations of the SEC in respect of the Tender Offer including the statement

required by Rule 14e-2 of Regulation 14E as promulgated by the SEC. |

Section 3

Disclosure Documents relating to the Transaction

| 3.1. |

As promptly as practicable after, but in any event no later than seven (7) Business Days following, the signing of this Agreement, the Bidder

will prepare and cause to be filed with the SEC, and both Parties shall take all reasonable steps within their respective powers to have filed with the SEC by November 24, 2015, a registration statement including a prospectus on the Form S-4 in connection with the issuance by the Bidder of the Diebold Offer Shares (as defined below) (the “Registration Statement”, and together with the Offer Document, the

“Disclosure Documents”) to (i) be used as an exchange offer prospectus sent to U.S. holders of the Wincor Nixdorf Shares and (ii) register with the SEC the offer and sale of the Diebold Offer Shares (as defined below) to

the holders of Wincor Nixdorf Shares, provided, however, that the Bidder may delay the filing of the Registration Statement if the Bidder has (i) not received from the Company financial information

solely relating to the Company’s |

-7-

| |

fiscal year that ended on September 30, 2015 if this information is required to file the Registration Statement, and (ii) requested such information from the Company in writing,

including via email, in reasonable detail describing the requested information and with sufficient time in advance for the Company to respond to such request and (iii) at all times complied with its obligations pursuant to this Section 3.1

to have the Registration Statement filed by November 24, 2015 or, as the case may be, at least no later than seven (7) Business Days following the date of this Agreement and (iv) has afforded the Company and its advisors sufficient

time to review, and comment on, any revised drafts of the Registration Statement prior to its envisaged filing, unless the Bidder has not been able to afford the Company such sufficient time for review because it has not received from the Company

material comments or information, which (a) is required to finalize the draft, and (b) solely relates to the Company and can only be provided by the Company and (c) has been requested by the Bidder due time in advance. The Bidder

undertakes to use its best efforts to have the Registration Statement declared effective under the United States Securities Act of 1933 (as amended) (the “Securities Act”), and the rules and regulations thereunder, as promptly as

reasonably practicable. |

| 3.2. |

The Bidder will prepare the Offer Document in accordance with the provisions of the German Takeover Act and the German Takeover Act Offer Ordinance (Angebotsverordnung – “German Takeover Act Offer

Ordinance”) and in accordance with the terms of this Agreement commence the Tender Offer as laid out in more detail in Section 4 of this Agreement. In case of any contradiction between legally mandatory provisions under the German

Takeover Act as interpreted by BaFin (including any regulation promulgated thereunder) and this Agreement, the respective provisions under, and interpretation of, the German Takeover Act shall prevail and this Agreement shall be amended to reflect

the Parties’ intentions to the utmost extent. |

| 3.3. |

As promptly as reasonably practicable, subject to each of the Management Board’s and the Board of Directors’ fiduciary duties as well as to

the extent legally permissible, each Party will use reasonable efforts to, and will use reasonable efforts to ensure that its Subsidiaries, and its and their employees and advisors will, without undue delay (unverzüglich) and upon

reasonable request of the respective other Party, furnish, keep updated and cooperate with the respective other Parties in respect of all information concerning itself (including, but not limited to, all information relating to historical and pro

forma financials or other disclosure information) or the Transaction as may reasonably be required by the SEC (be it formally or informally), or by BaFin (be it formally or informally) or by the respective advisors of the Bidder or the Company, as

the case may be, under the U.S. securities laws, the German Takeover Act or the German Securities Prospectus Act (Wertpapierprospektgesetz) or otherwise, in connection with (i) the preparation of the Disclosure Documents and

(ii) the review process of the Registration Statement by the SEC or of the Offer Document by BaFin (it being understood that nothing under the aforementioned rules and regulations shall require either Party to permit any access to offices,

properties, management, |

-8-

| |

employees, books, records and any other information; Section 7.5 shall remain unaffected), in each case provided, however, that the Wincor Nixdorf Group and its

directors, employees and advisors shall not be liable to the Bidder for the correctness and completeness of any disclosure or information provided by it or them under or in connection with this Agreement, including under Section 3.4 (except for

any material incorrectness resulting from willful misconduct of any member of the Wincor Nixdorf Group). The Bidder acknowledges and agrees that neither the Company nor its legal counsel will provide any legal opinion, comfort letter or similar

statement in respect of, or in connection with, the Disclosure Documents. Furthermore and notwithstanding the foregoing, the Company shall not be required to disclose any insider information until such information has been publicly disclosed or

otherwise ceased to constitute insider information in accordance with German law; it being understood, however, that subject to the fiduciary duties of the Management Board and the Supervisory Board and to the extent permitted by law, the Company

shall upon reasonable request inform the Bidder whether or not a self-exemption pursuant to Section 15 para 3 German Securities Trading Act is in place at the time of the Bidder’s corresponding request (such self-exemption, a

“Company Financing Self-Exemption”). Such information shall be subject to customary confidentiality undertakings by the Bidder. In light of potentially severe consequences prompted by a delayed drawing of funds under the Certain

Funds Financing or a delayed Refinancing, as the case may be, for both the Bidder and the Combined Group following the time of Closing, the Company undertakes to publish the insider information or to revoke the Company Financing Self-Exemption as

soon as legally practicable after being informed about the need to draw funds under the Certain Funds Financing or the Refinancing, or the Bidder’s intent to launch a Refinancing, as the case may be, provided, however, that

the Company has concluded that such publication or revocation is in the Company’s best interest in light of all circumstances. |

| 3.4. |

The Bidder will afford the Company and its advisors the reasonable opportunity to, and the Company and its advisors shall without undue delay

(unverzüglich), review and comment on the Disclosure Documents prior to each submission to BaFin or the SEC, as the case may be. The Bidder shall without undue delay (unverzüglich) notify the Company upon the receipt of any

comments from BaFin or the SEC relating to any request for amendments or supplements to the Disclosure Documents and shall provide the Company with copies of all written comments received from BaFin or the SEC. To the extent practicable, the Bidder

shall (i) provide the Company with drafts of the responses to comments from BaFin or the SEC at a time reasonably prior to submitting such responses, (ii) give due consideration to the Company’s comments and (iii) use its

reasonable commercial efforts to respond as promptly as reasonably possible to any comments from BaFin or the SEC, as the case may be, with respect to the Disclosure Documents. Furthermore, if the Bidder can reasonably foresee that an interaction

with BaFin or the SEC will concern material terms of this Agreement or |

-9-

| |

other material interests of the Company or if the Bidder’s advisors deem it advisable, the Bidder shall reasonably seek for the Company and its advisors to be granted an opportunity to

participate in physical meetings or telephone calls with BaFin or the SEC. In case of dispute with respect to the content of the Disclosure Document or any documentation relating thereto, the Bidder will have the right to make the ultimate decision,

except that with respect to any comments from the SEC on (i) the Company’s financial statements, the Company shall be entitled to determine if and how to modify its financial statements in response to such comments unless such

determination could reasonably be expected to delay the declaration of effectiveness of the Registration Statement (each case of a modification of the financial statements of the Company not determined by the Company pursuant to this sentence a

“Required Financial Statement Modification”) and (ii) the recommendation by the Management Board and the Supervisory Board and/or the related section on Wincor Nixdorf’s reasons for the transaction which form part of the

Registration Statement, the Company shall be entitled to solely decide whether and how such recommendation and/or section is modified (such required modification, a “Required Recommendation Statement Modification”),

provided, however, that the respective Disclosure Document materially complies with the terms and conditions of this Agreement. Likewise, the Bidder will, subject to Section 22.2, have such ultimate decision right with

respect to any amendment, supplement or subsequent modification of a Disclosure Document that the Bidder is required to publish in connection with the Tender Offer. |

| 3.5. |

If BaFin approves the publication of the Offer Document, or if the SEC will declare the Registration Statement effective, only in a form that is not in accordance with the provisions of this Agreement, the Parties will

in good faith cooperate to amend the relevant Disclosure Document for it to comply with the requirements as set forth by BaFin or the SEC, as the case may be, while reflecting the original intent of the Parties to the greatest extent permissible.

However, nothing in this Agreement will require either Party to amend or waive any of the terms or conditions of the Tender Offer as contemplated by this Agreement without the prior written consent of both the Bidder and the Company, which, in

particular, applies to any modifications or amendments to the form or amount of the Offer Consideration, the Share Component, the Closing Conditions (as defined below), or the duration of the Acceptance Period (as defined below), provided,

however, that each Party shall agree, and undertake to, implement even in such cases such amendment as required by BaFin or the SEC and necessary to consummate the Transaction (the “Required Amendment”) |

| |

(a) |

to the extent the Required Amendment does not materially negatively affect the interests of such Party (it being understood that the Required Amendments relating to the relevant time periods in, or the choice of words

describing, the Closing Conditions (as defined below) shall not be considered to have a material negative effect), and |

| |

(b) |

that if and to the extent required under the Financing Agreements, the requisite Financing Sources have granted their prior written consent to the implementation of the Required Amendment in the respective Disclosure

Documents, which the Bidder shall use reasonable commercial efforts to obtain. |

-10-

It being understood that the Bidder shall in any event be obligated to accept an amendment, and

procure that any required consent from a Financing Source is obtained in respect of such amendment, relating to the Closing Condition pursuant to Section 4.5(a) if and to the extent that BaFin or the SEC, as the case may be, does not accept a

reference to hold-separate arrangements in connection with such Closing Condition.

In no event shall the Bidder be obligated to pay the

Break Fee (as defined below) if it refrains from publishing the Offer Document due to a Required Amendment in compliance with this Agreement and an objective third party would have to conclude that none of the Closing Failures set out in Sections

9.1(a) through 9.1(c) will occur.

| 3.6. |

The Bidder shall cause, prior to the Registration Statement becoming effective, the Prospective Board Members (as defined below) to be named as insured persons under the Bidder’s existing management liability

insurance policy, or any similar policy (the “D&O Policy”), on the same basis as the current members of the Board of Directors, in particular, but not limited to, with regard to the Registration Statement. In particular, the

D&O Policy either must cover individuals who provide a consent to be named as directors in a Registration Statement or must be amended to cover such individuals (so that the D&O Policy will cover these individuals in advance of becoming

directors). For the avoidance of doubt, the Prospective Board Members shall be added as insured persons under the D&O Policy in this respect prior to the Registration Statement becoming effective irrespective of if or when after the signing of

this Agreement any claims are alleged or pursued by any party in relation to the Registration Statement. |

Section 4

Tender Offer

| 4.1. |

In accordance with Section 14 para. 1 sentence 3 German Takeover Act the Bidder will apply to BaFin for an extension of the statutory interim period between Offer Announcement and submission of the Offer

Document to BaFin from four (4) to eight (8) weeks. |

| 4.2. |

Following approval of the Offer Document by BaFin (or the expiration of the review period required under the German Takeover Act), the Bidder will

(i) publish the Offer Document without undue delay (ohne schuldhaftes Zögern) in accordance with Section 14 para. 2 German Takeover Act and (ii) on the date of such publication, disseminate the prospectus contained in the

Registration Statement to the holders of |

-11-

| |

Wincor Nixdorf Shares in compliance with the United States Securities Exchange Act of 1934 (as amended) (the “Exchange Act”) and the rules and regulations promulgated by the SEC.

|

| 4.3. |

In accordance with Section 16 para. 1 German Takeover Act, the Parties envisage that the Tender Offer will have an acceptance period (the last date thereof, as it may be extended in accordance with this

Agreement and Sections 16 para. 3, 21 para. 5 sentence 1, 22 para. 2 sentence 1 German Takeover Act, the “Expiration Date”) of four (4) to eight (8) weeks after either the day following approval of the

Offer Document by BaFin or the day following expiration of the BaFin review period as required under the German Takeover Act (the earlier of such dates, the “Commencement Date”), provided, however, that

|

| |

(a) |

the Expiration Date shall occur no earlier than 20 business days (as defined in Rule 14d-1(g)(3) under the Exchange Act) after (and including the day of) the Commencement

Date; and |

| |

(b) |

the Bidder may decide in its reasonable judgment prior to the approval of the Offer Document by BaFin to extend the acceptance period to up to ten (10) weeks if (i) there are reasonable concerns that the

Registration Statement will not be declared effective prior to the envisaged Expiration Date of eight (8) weeks after the Commencement Date and (ii) both the Material Adverse Change and the Material Compliance Violation Closing Conditions

(each as defined below) will only apply through the first eight (8) weeks of an acceptance period so extended. |

(in each

case as agreed and extended pursuant to this Agreement, the time between and including Commencement Date and Expiration Date, the “Acceptance Period”).

| 4.4. |

The consideration offered to the holders of Wincor Nixdorf Shares under the Tender Offer will be a cash consideration in the amount of EUR 38.98 (in words: Euro thirty eight and ninety-eight cents) (the

“Cash Component”) along with a stock consideration consisting of 0.434 Diebold Offer Shares (the “Stock Component”, together with the Cash Component the “Offer Consideration”) per Wincor Nixdorf

Share, subject to any increases made either voluntarily or in accordance with the provisions of the German Takeover Act (including any claims under Section 31 para. 3 through 6 German Takeover Act). |

| 4.5. |

The obligation of the Bidder to consummate the Tender Offer will be subject solely to the following conditions (the “Closing Conditions”): |

| |

(a) |

On or before November 21, 2016 (the “Drop Dead Date”), the transaction pursued with this Tender Offer has been approved by the

antitrust authorities listed in Annex 4.5(a) (each an “Antitrust Authority”) or the statutory waiting periods in the relevant jurisdictions have lapsed, or hold-separate

|

-12-

| |

arrangements shall have been put in place, with the result that the transaction pursued with this Tender Offer may be completed without the approval by the relevant Antitrust Authority (all such

approvals and expiration of waiting periods, the “Antitrust Clearances”). |

| |

(b) |

(i) The Registration Statement regarding the Diebold Offer Shares shall (a) have been declared effective by the SEC prior to the expiration of the Acceptance Period, and (b) not be subject of any stop order by

the SEC pursuant to Section 8(d) of the Securities Act or any proceeding initiated by the SEC seeking such a stop order at the time of the consummation of the Tender Offer as described in more detail in the Offer Document, and, (ii) the

Diebold Offer Shares have been authorized for listing on the New York Stock Exchange and the Frankfurt Stock Exchange and all existing Diebold shares have been authorized for listing on the Frankfurt Stock Exchange, subject to official notice of

issuance. This Closing Condition is hereinafter referred to as the “S-4 Condition”. |

| |

(c) |

At the time of the expiration of the Acceptance Period, the sum of the number of (i) tendered Wincor Nixdorf Shares (including those Wincor Nixdorf Shares for which the acceptance of this Tender Offer has been

declared during the Acceptance Period but only becomes effective after the end of the Acceptance Period by transferring the Wincor Nixdorf Shares to an ISIN designated for Wincor Nixdorf Shares that will trade “as tendered” for which the

right to withdrawal, if any, has not been validly exercised in accordance with the Offer Document; (ii) Wincor Nixdorf Shares held directly or indirectly by Bidder, any member of the Diebold Group or any person acting in concert with Bidder

within the meaning of Section 2 para. 5 German Takeover Act, (iii) Wincor Nixdorf Shares that must be attributed to Bidder or any member of the Diebold Group in corresponding application of Section 30 German Takeover Act, and

(iv) Wincor Nixdorf Shares for which Bidder, any member of Diebold Group or any person acting in concert with Bidder within the meaning of Section 2 para. 5 German Takeover Act has entered into an agreement outside of this Tender

Offer, giving them the right to demand the transfer of title of such Wincor Nixdorf Shares (Wincor Nixdorf Shares that fall within the scope of several of (i) to (iv) are counted only once) equals at least 67.6% of all existing Wincor

Nixdorf Shares, in each case at the time of approval of the Offer Document by BaFin (the “Minimum Acceptance Rate”). |

| |

(d) |

Between the publication of the Offer Document and the expiration of the Acceptance Period, trading on the Frankfurt Stock Exchange shall not have been

suspended for more than three (3) consecutive trading days for all shares admitted to trading at the entire Frankfurt Stock Exchange. Furthermore, the closing quotations of the DAX (ISIN DE0008469008), as determined by Deutsche Börse AG,

Frankfurt am Main, Germany, or a successor thereof, and |

-13-

| |

published on its internet website (currently: www.deutsche-boerse.com), of the two (2) trading days prior to the end of the Acceptance Period is no more than 28.5% below the closing

quotation of the DAX on the trading day immediately preceding the day of the publication of the Tender Offer. This Offer Condition is hereinafter referred to as the “No Market Material Adverse Change Condition”. |

| |

(e) |

Between the publication of the Offer Document and the expiration of the Acceptance Period, neither (i) has the Company published new circumstances pursuant to Section 15 German Securities Trading Act, nor

(ii) have circumstances occurred that would have had to be published by the Company pursuant to Section 15 German Securities Trading Act or that the Company did not publish because of a self-exception pursuant to Section 15

para. 3 German Securities Trading Act, that, in case of a one-time event, result in a negative effect on the annual EBITDA (as defined in the Company’s annual report for the fiscal year ended September 30, 2015) of the Company in an

amount of at least EUR 50 million, and/or, in case of a recurring event, result in a recurring negative effect on the annual EBITDA (as defined in the Company’s annual report for the fiscal year ended September 30, 2015) of the

Company in an amount of at least EUR 18 million for the fiscal years 2015/2016, 2016/2017 and 2017/2018, or that, in each case, could reasonably be expected to have such effect (“Material Adverse Change”).

|

| |

(f) |

Between the publication of the Offer Document and the expiration of the Acceptance Period, no criminal or material administrative offense (Ordnungswidrigkeit) relating to applicable corruption, anti-bribery,

money laundering or cartel laws by a member of a governing body or officer of the Company or a subsidiary of the Company, while any such person was operating in their official capacity at, or on behalf of, the Company or a subsidiary of the Company

(be it an offense under any applicable administrative, criminal or equivalent laws in the United States, Germany or any other jurisdiction whose laws apply to operations of the Company or a subsidiary of the Company) is known to have occurred, if

any such criminal or material administrative offense constitutes insider information for the Company pursuant to Section 13 German Securities Trading Act or has constituted insider information prior to its publication (“Material

Compliance Violation”). |

| |

(g) |

Between the publication of the Offer Document and the expiration of the Acceptance Period, the Company shall not have (i) increased its share capital, or (ii) granted, delivered, sold, committed to sell,

transferred, or in any other way disposed of any or all of the Wincor Nixdorf Treasury Shares. |

| |

(h) |

Between the publication of the Offer Document and the expiration of the Acceptance Period (i) no insolvency proceedings under German law have

been |

-14-

| |

opened in respect of the assets of the Company; moreover the Management Board has not applied for such proceedings to be opened and (ii) there are no grounds that would require an

application for the opening of insolvency proceedings. |

| |

(i) |

Between the publication of the Offer document and the expiration of the Acceptance Period, no competing offer was announced by a third party within in the meaning of Section 22 German Takeover Act (a

“Competing Offer”) which according to an ad hoc notification by the Company pursuant to Section 15 German Securities Trading Act (i) offers an overall consideration exceeding the consideration offered by the Tender Offer

or (ii) is otherwise determined by the Management Board and the Supervisory Board to be in the best interest of the Company (such Competing Offer, a “Superior Proposal”). |

| |

(j) |

The absence of any temporary restraining order or preliminary or permanent injunction or other order by any governmental authority of competent jurisdiction preventing consummation of the Tender Offer or the Business

Combination. |

The Bidder shall be entitled, at its free discretion, to waive any Closing Condition to the extent legally

permissible and subject to any applicable consent by the requisite Financing Sources.

| 4.6. |

To the extent the determination of whether a Closing Condition is satisfied depends on the opinion of a third party neutral expert (the “Neutral Expert”), the Company will to the extent legally

permissible provide (i) reasonable support to the Neutral Expert and (ii) all requisite information regarding the Company, its Subsidiaries and the business they operate, provided, however, that all expenses incurred

thereby by the Company or its Subsidiaries will be borne by the Bidder. |

| 4.7. |

The Bidder will refrain from having the Tender Offer predicated on the satisfaction of additional closing conditions absent the Company’s prior consent. To the extent permissible and permitted under the Certain

Funds Financing, the Bidder will be entitled to waive any and all of the Closing Conditions in whole or part. |

| 4.8. |

Following the Expiration Date and the satisfaction or waiver by the Bidder of the Closing Conditions (other than the Antitrust Clearances), the Bidder will conduct an additional acceptance period for the Tender Offer

(weitere Annahmefrist – the “Additional Acceptance Period”) in accordance with the German Takeover Act, during which the Bidder will offer to acquire all remaining Wincor Nixdorf Shares. |

| 4.9. |

Prior to the time of the settlement of the Tender Offer and depending on the number of Wincor Nixdorf Shares tendered into the Tender Offer, the

Bidder will ensure that (i) the total number of new Diebold Shares issued in connection with the Tender Offer will not exceed, upon issuance, 12,940,236 which will correspond with 19.91% of the

|

-15-

| |

total number of Diebold Shares outstanding as of the date of this Agreement (such newly issued Diebold Shares, the “Diebold Offer Shares”), (ii) the Diebold Offer Shares

will be fully fungible with the Diebold Shares, including with respect to dividend entitlements (based on the Bidder’s quarterly dividend distribution) and (iii) the Diebold Offer Shares will be admitted to trading on (a) the New York

Stock Exchange and (b) the Frankfurt Stock Exchange. |

Section 5

Support of the Tender Offer by the Company and Mutual Actions to Support the Transaction

| 5.1. |

Subject to the terms of this Section 5, from the time of signing this Agreement to the earlier of (i) the termination of this Agreement, and (ii) the Closing, including, if applicable, the expiration of

the Tender Right Period, the Company, in consideration of the Bidder agreeing and undertaking to comply with its obligations under this Agreement and to pursue the Tender Offer and the Transaction in accordance with this Agreement, shall support the

Tender Offer and the Transaction in any and all publications and communications that relate to the Transaction. |

| 5.2. |

In addition to the ad hoc announcement pursuant to Section 2.1(b) and the press release pursuant to Section 2.2, the obligation of the Company as set forth in Section 5.1, also in consideration of the

Bidder agreeing and undertaking to comply with its obligations under this Agreement and to pursue the Tender Offer and the Transaction in accordance with this Agreement, extends, subject to the qualifications and restrictions set out in this

Agreement, to (i) the response statement under the Rule 14e-2 of the Exchange Act (the “Response Statement”) that the Company shall publish no later than five (5) Business Days following publication of the Offer Document

and (ii) all public statements, press conferences, interviews, (joint) roadshows, investor conferences and other opportunities to support the Tender Offer, if and to the extent these relate to the Transaction. |

| 5.3. |

To the extent permitted by law and it has the power to do so, the Company shall, from the time of signing this Agreement to the earlier of (i) the termination of this Agreement, and (ii) the Closing, refrain,

and shall use reasonable efforts to procure that any other member of Wincor Nixdorf Group as well as the members of the representative bodies (Vertretungsorgane) of such members of the Wincor Nixdorf Group will refrain, from initiating any

measures or steps which could jeopardize the success of the Tender Offer (including the satisfaction of any of the Closing Conditions). Further, the Company shall not and, to the extent legally possible and it has the power to do so, shall procure

that no other member of the Wincor Nixdorf Group will, directly or indirectly: |

| |

(a) |

solicit, i.e. actively asking for, a Competing Offer, or another transaction, proposal or approach which is economically or otherwise comparable to a Competing Offer and that, if implemented, could jeopardize the

success of the Tender Offer; and |

| |

(b) |

unless actively approached with a proposal that is reasonably likely to result in a Superior Offer or another transaction which is economically or otherwise comparable to a Competing Offer and in relation to which no

member of the Wincor Nixdorf Group breached Section 5.3(a), enter into any communications, discussions, negotiations, correspondence or arrangements or make any confidential documents relating to Wincor Nixdorf Group or its business available

with a view to soliciting any Competing Offer or any other transaction that if implemented could jeopardize the success of the Tender Offer. |

-16-

| 5.4. |

The Company will inform the Bidder as soon as reasonably practical if it has been approached by a third party in relation to a situation which could reasonably be expected to end in a Competing Offer or other

transactions that, if implemented, would jeopardize the success of the Tender Offer. |

| 5.5. |

Nothing in this Agreement shall prevent the Company, the Management Board, the Supervisory Board or any other member of the Wincor Nixdorf Group from: |

| |

(a) |

providing information duly requested or required by a regulatory authority; |

| |

(b) |

engaging with a third party that submits a bona fide, unsolicited proposal that is reasonably likely to result in a Superior Proposal for the Wincor Nixdorf Shares, provided, however, that

the Company will as soon as reasonably practically make available to the Bidder any material non-public information made available to such third party to the extent such information was not previously provided to the Bidder; |

| |

(c) |

(i) referring to potentially adverse tax consequences for German retail shareholders resulting from acceptances of the Tender Offer, (ii) advising German retail investors to consider that a disposal of their shares

in the market or otherwise might be more beneficial than accepting the Tender Offer, (iii) disposing of their Wincor Nixdorf Shares outside of the Tender Offer by selling their Wincor Nixdorf Shares via or outside the stock exchange at a price

and at a time that is, at their sole discretion, reasonably satisfactory to them, it being understood that such Wincor Nixdorf Shares shall not be sold to any member of the Wincor Nixdorf Group prior to Closing and (iv) informing investors and

the press accordingly (in the Reasoned Statement, the Response Statement (as defined below) and/or otherwise); |

| |

(d) |

acting in accordance with (i) their fiduciary duties under German law, in particular, the duty of care and loyalty under Section 93 German Stock Corporation Act (Aktiengesetz – “German

Stock Corporation Act”); (ii) the concept of managerial neutrality (Section 33 German Takeover Act) and (iii) the business judgment rule (Section 76 German Stock Corporation Act). |

-17-

Section 6

Reasoned Statement by the Company’s Corporate Bodies on the Tender Offer

| 6.1. |

Without undue delay (unverzüglich), and in any case no later than five (5) Business Day following the Commencement Date, the Management Board and the Supervisory Board will each publish a Reasoned

Statement or a joint Reasoned Statement pursuant to Sections 27 para. 3, 14 para. 3 German Takeover Act. |

| 6.2. |

The Company will afford the Bidder and their advisors the opportunity to, and the Bidder and their advisors shall, review and comment on each Reasoned Statement and on the Response Statement, including all additions and

modifications thereto, prior to their publication. In case of any dispute with respect to the content of any Reasoned Statement or Response Statement or any documentation relating thereto, the Company will have the right to make the ultimate

decision, provided, however, that the Reasoned Statement and the Response Statement, as the case may be, materially comply with the terms and conditions of this Agreement. Likewise, the Company will have such ultimate decision

right with respect to any amendment, supplement or subsequent modification of any Reasoned Statement of the Management Board and the Supervisory Board. |

| 6.3. |

Subject to Section 5.5(c) above, the Management Board and the Supervisory Board will confirm in their Reasoned Statement that, in their opinion and subject to review of the Offer Document, (i) the Offer

Consideration is fair and adequate, (ii) they support the Tender Offer, (iii) they recommend to the holders of Wincor Nixdorf Shares to tender their Wincor Nixdorf Shares into the Tender Offer; and (iv) the members of the Management

Board will either tender their Wincor Nixdorf Shares into the Tender Offer or sell their Wincor Nixdorf Shares via or outside the stock exchange at a price and at a time that is, at their sole discretion, reasonably satisfactory to them.

|

| 6.4. |

Such support and recommendation of the Tender Offer in the Reasoned Statement as set forth in Section 6.3 shall be subject to the following (together the “Recommendation Requirements”):

|

| |

(a) |

no Competing Offer, or the intention thereof, has been announced or launched by a third party that the Management Board and the Supervisory Board have determined to be a Superior Proposal, provided,

however, that the Company has without undue delay (unverzüglich) after both such determinations have been made, informed the Bidder accordingly; and |

| |

(b) |

no other circumstances exist that would cause, or as confirmed in writing by an external legal counsel of recognized standing would reasonably be likely to cause, the members of the Management Board and/or the

Supervisory Board to violate their duties under applicable law, including any obligations of the members of the Management Board and/or the Supervisory Board to observe their duty of care and fiduciary duty vis-à-vis the Company, including

their obligations under Sections 27 and 33 German Takeover Act and under Sections 76, 93 and 116 German Stock Corporation Act. |

-18-

| 6.5. |

From the date of this Agreement and as long as the Recommendation Requirements remain fulfilled, the Management Board and the Supervisory Board shall not: |

| |

(a) |

withdraw or amend adversely to the Bidder or withdraw their intention, or otherwise breach their obligation, to give, the Reasoned Statement; |

| |

(b) |

act, including by making any public statement, in a manner that does not comply with the terms of this Agreement and (i) after its publication, is contrary to the Reasoned Statement and could adversely affect the

successful consummation of the Tender Offer or (ii) recommend that holders of Wincor Nixdorf Shares take or consider taking any action that could prevent, delay or otherwise adversely affect the implementation of the Tender Offer; and

|

| |

(c) |

recommend (or agree or resolve to recommend) a Competing Offer. |

Section 7

Covenants

| 7.1. |

During the period from the date of this Agreement to the earlier of (i) the termination of the Agreement and (ii) the Closing, the Company, subject to the fiduciary duties of the members of the Management

Board and the Supervisory Board as well as to the extent permitted by law and it has the power to do so and subject to the terms of this Agreement, shall, and shall use best efforts to ensure that the Company’s Subsidiaries will, subject to the

Bidder’s consent in all material respects consistent with past practice, carry on its and their business in the ordinary course including the continuation of the Company’s announced restructuring program entitled “delta” (such

program, the “Delta Program”), and, in addition to that, refrain from: |

| |

(a) |

entering into major joint ventures, partnerships or other forms of co-operations with third parties, if such transactions could adversely affect the consummation of the Tender Offer; |

| |

(b) |

purchasing, selling, acquiring, transferring or encumbering material assets of the Company or any of its Subsidiaries (including investments in intangible assets, fixed assets or financial assets), either directly or

indirectly, by way of a merger or another form of transformation, takeover, acquisition, transfer, disposal or similar transaction with one or more third parties or disposing of any such assets in another manner. |

-19-

| 7.2. |

Nothing in Section 7.1 shall prevent the Company or any of the Company’s Subsidiaries from (i) pursuing a project which the Company has initiated prior to the Offer Announcement, (ii) making an

investment or disinvestment with a value of less than EUR 50 million (in words: Euro fifty million) in each individual case, provided, however, that the aggregate amount of neither such investments nor

disinvestments exceeds EUR 200 million (in words: Euro two hundred million) (iii) taking any measures regarding the Wincor Nixdorf Stock Option Plan including the issuance of any additional option rights or shares thereunder, cash

settlement of the Wincor Nixdorf Stock Option Plan or any other amendment / supplement thereto, (iv) extending the appointments and service agreements of the members of the Management Board, (v) granting its employees, officers and/or members

of the Management Board retention bonuses or other incentives to continue their service with the Company or its Subsidiaries or bonuses for additional work relating to the Transaction, and/or (vi) in accordance with law (1) transferring

any of the Company’s Subsidiaries to the Company or to any of its other Subsidiaries, (2) implementing any mergers of any of the Company’s Subsidiaries within the Wincor Nixdorf Group, (3) entering into or terminating or

cancelling any enterprise agreements within the meaning of Section 291 German Stock Corporation Act within the Wincor Nixdorf Group and/or (4) implementing any other corporate reorganization measure within the Wincor Nixdorf Group.

|

| 7.3. |

Prior to the Closing, the Bidder shall refrain from initiating, and shall ensure that none of its Subsidiaries will initiate: |

| |

(a) |

(i) a split, reverse split, combination or reclassification of Diebold Shares or (ii) a redemption of Diebold Shares or any other outstanding equity securities; |

| |

(b) |

any amendments to its organization documents to the extent such amendment would reasonably be expected to adversely affect the holders of Wincor Nixdorf Shares; |

| |

(c) |

any action that would jeopardize the success of the Tender Offer (including the satisfaction of the Closing Conditions). |

| 7.4. |

The Bidder and the Company shall each continue to pay dividends not exceeding its past practice until the Closing. |

| 7.5. |

Subject to the restrictions imposed by mandatory law, in particular the German Stock Corporation Act and competition laws, and subject to the

Bidder’s consent regarding the reimbursement of reasonable costs pursuant to Section 7.6(a), the Company shall use, and shall ensure that its Subsidiaries use, their respective reasonable efforts to provide to the Banks or any other person

(actually or prospectively) providing, |

-20-

| |

underwriting or arranging, in the form of a syndication, refinancing or a security issuance, the Certain Funds Financing or any other financing or refinancing of, or in connection with, the

Transaction (such persons, collectively, the “Financing Sources”) all necessary cooperation in connection with the underwriting, marketing, arrangement and syndication of the Certain Funds Financing and of any other form of a

syndication, refinancing or a security issuance (the “Refinancing”), by any of the Financing Sources as may be reasonably requested by the Bidder, including without limitation: |

| |

(a) |

support by making available all financial and other information customarily made available in comparable transactions to borrowers, issuers, arrangers, underwriters, initial purchasers or placement agents in connection

with the Certain Funds Financing and the Refinancing by any of the Financing Sources, in particular to support the preparation of the syndication and offering documents and materials including information memoranda, offering memoranda, prospectuses,

lender and investor presentations and other marketing documents for senior notes, bridge facilities, revolving facilities, term loan facilities, any hedging instruments or any other form of debt or equity financing; |

| |

(b) |

by offering a management presentation, support by making available as requested information and personnel with obtaining indicative and final ratings for any debt instruments and credit facilities, including

presentations, meetings and answering follow-up questions (such presentations and meetings to be at reasonable times and not to unduly interfere with the operation of the Company’s business); |

| |

(c) |

support with obtaining, signing, and executing certificates, waivers, and auditor consents; |

| |

(d) |

delivering, or contributing to the delivery of, (i) an audit opinion and consent of KPMG AG (“KPMG AG”), the Company’s independent auditor, for inclusion in the Registration Statement or any

other offering document in connection with the Certain Funds Financing or Refinancing and (ii) draft and final comfort letters (including bring down comfort letters) by KPMG AG with customary negative assurance, in each case, if and to the

extent customary in connection with debt or equity offerings in Europe and/or the United States (it being understood, with respect to (i) and (ii) that the Company shall in no way be liable for procuring any act or omission by

KPMG AG); |

| |

(e) |

not engaging or undertaking to engage in competing material issuances, offerings, placements or arrangements of debt securities or commercial bank or other credit facilities in the United States of America exceeding an

aggregate amount of EUR 50,000,000 (in words: Euro fifty million) prior to completion of syndication of the Certain Funds Financing; |

-21-

| |

(f) |

providing the Financing Sources direct contact with the Management Board available for a reasonable number of due diligence sessions and meetings with actual and potential Financing Sources; and |

| |

(g) |

permitting the use of the Company’s logos in connection with any such financing presentation, provided, however, such logos are used solely in a manner that is not intended to nor reasonably

likely to harm or disparage the Company or the reputation or goodwill of the Company. |

| 7.6. |

In respect of Wincor Nixdorf Group’s cooperation obligations pursuant to this Agreement, the following shall apply: |

| |

(a) |

Upon (i) notification in writing or via email of the terms and conditions of retaining external assistance and (ii) the Bidder’s consent in writing or via email (which consent shall not unreasonably be

withheld or delayed), the Bidder assumes all reasonable out-of-pocket costs and other expenses vis-à-vis the Company and its Subsidiaries incurred by each of them relating to any cooperation and assistance, (y) provided for by

Sections 3.3 and 3.4 to the extent pro forma financial information is concerned, including all fees and expenses of KPMG AG, and (z) pursuant to Section 7.5 in connection with the Certain Funds Financing and the Refinancing,

including, without limitation, such reasonable fees and expenses of KPMG AG and counsel for the Company incurred in connection with its assistance in obtaining the Certain Fund Financing and the Refinancing, but excluding costs incurred by the

Company in relation to its assistance regarding any re-financing of the Company pursuant to Section 7.7 below in its own interest. |

| |

(b) |

None of the Company or any of its Subsidiaries shall be required by Section 7.5 to (i) pay any commitment or other similar fee or incur any

other liability or obligation of any kind, including under any guarantee or pledge or any other document relating to the Certain Funds Financing or any Refinancing, in connection with the Certain Funds Financing or any Refinancing, (ii) enter

into any binding agreement or commitment, or adopt any resolution or otherwise take any corporate or similar action, in connection with the Certain Funds Financing or any Refinancing, or (iii) take any action that would reasonably be expected

to (1) unreasonably interfere with the ongoing operations of the Company and its Subsidiaries, (2) cause any covenant in this Agreement to be breached or any condition set forth in Section 4.5 to fail to be satisfied except where the

Bidder expressly waives in writing such breach or non-compliance, (3) cause any director, officer or employee of the Company or any of its Subsidiaries to incur any personal |

-22-

| |

liability, (4) result in the disclosure of insider information until such information has been publicly disclosed or otherwise ceased to constitute insider information in accordance with