UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 23, 2015

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

| | | | |

Ohio | | 1-4879 | | 34-0183970 |

| | | | |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio | | | | 44720-8077 |

| | | | |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

At the Annual Meeting of Shareholders of Diebold, Incorporated (the “Company”), held on April 23, 2015, the Company's shareholders approved the Diebold, Incorporated Annual Cash Bonus Plan (the “Cash Bonus Plan”), in order to, among other items, afford the Company’s Board of Directors and Compensation Committee the ability to offer compensatory cash awards designed to reward and incent the Company’s officers and key employees in advancement of the Company’s interests and long-term strategies. Cash bonus payments made by the Company under the Cash Bonus Plan are intended to qualify as “performance-based compensation” for purposes of 162(m) of the Internal Revenue Code, allowing for certain Company deductions of compensation expenses.

The Cash Bonus Plan will be administered by the Compensation Committee or other committee appointed by the Board in accordance with the plan (the “Committee”). Participation in the Cash Bonus Plan is limited to certain Eligible Executives, and the right to receive a bonus under the Cash Bonus Plan depends on the achievement of specific performance goals, referred to as Management Objectives. The Committee will establish the Management Objectives and amount of incentive bonus payable for a performance period. The Management Objectives from which the Committee may choose in setting performance goals are specified in the Cash Bonus Plan and were summarized, along with other plan and award terms, in the Company’s proxy statement on Schedule 14A filed with the Securities and Exchange Commission on March 11, 2015. The Committee will determine whether the Management Objectives have been achieved and the amounts payable following the end of the applicable performance period. The Cash Bonus Plan will remain effective until the first annual meeting of shareholders held in the 2020 fiscal year, subject to any further shareholder approvals (or re-approvals) mandated for performance-based compensation under Section 162(m) and subject to the Board’s right to terminate the plan, on a prospective basis only, at any time. The Committee may amend the Cash Bonus Plan from time to time, subject to shareholder approval to the extent required to satisfy Section 162(m).

The foregoing summary is qualified by reference to the full text of the Cash Bonus Plan, a copy of which is attached attached hereto as Exhibit 10.1, and is incorporated herein by reference. |

|

|

Item 5.07 Submission of Matters to a Vote of Security Holders |

At the Annual Meeting, the Company’s shareholders (1) elected each of the Board’s ten (10) nominees for director to serve one-year terms or until the election and qualification of a successor; (2) ratified the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year 2015; (3) approved, on an advisory basis, named executive officer compensation; and (4) approved the Cash Bonus Plan. These proposals are described in more detail in the Company’s definitive proxy statement on Schedule 14A dated March 11, 2015.

Set forth below are the final voting results for each proposal:

Proposal No. 1:Election of ten (10) directors |

| | | | | | | | | |

| | For | | | Withhold | | | Broker Non-Votes | |

Patrick W. Allender | 52,555,333 | 763,443 | 7,017,950 |

Phillip R. Cox | 52,218,665 | 1,100,111 | 7,017,950 |

Richard L. Crandall | 52,303,688 | 1,015,088 | 7,017,950 |

Gale S. Fitzgerald | 52,042,878 | 1,275,898 | 7,017,950 |

Gary G. Greenfield | 52,945,500 | 373,276 | 7,017,950 |

Andreas W. Mattes | 52,763,575 | 555,201 | 7,017,950 |

Robert S. Prather, Jr. | 52,559,881 | 758,895 | 7,017,950 |

Rajesh K. Soin | 52,686,656 | 632,120 | 7,017,950 |

Henry D. G. Wallace | 51,423,569 | 1,895,207 | 7,017,950 |

Alan J. Weber | 52,863,624 | 455,152 | 7,017,950 |

Proposal No. 2: Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year 2015

|

| | | | |

For | | Against | | Abstain |

59,597,889 | | 586,145 | | 152,692 |

Proposal No. 3: Approve, on an advisory basis, named executive officer compensation

|

| | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

51,463,142 | | 1,593,907 | | 261,727 | | 7,017,950 |

Proposal No. 4: Approve the Diebold, Incorporated Annual Cash Bonus Plan

|

| | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

50,991,235 | | 2,075,662 | | 251,879 | | 7,017,950 |

|

| | |

| | |

Item 9.01 Financial Statements and Exhibits | | |

|

| | | | |

(d) Exhibits. | | |

| | |

Exhibit | | |

Number | | Description |

10.1 | | Diebold, Incorporated Annual Cash Bonus Plan |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| Diebold, Incorporated | |

April 28, 2015 | By: | /s/ Jonathan B. Leiken | |

| | Name: | Jonathan B. Leiken | |

| | Title: | Senior Vice President, Chief Legal Officer and Secretary | |

EXHIBIT INDEX

|

| | |

| | |

Exhibit | | |

Number | | Description |

10.1 | | Diebold, Incorporated Annual Cash Bonus Plan |

Appendix A

DIEBOLD, INCORPORATED

ANNUAL CASH BONUS PLAN

1.Purpose. The purpose of the Diebold, Incorporated Annual Cash Bonus Plan (As Amended and Restated April 23, 2015) (the “Plan”) is to attract and retain key executives for Diebold, Incorporated, an Ohio corporation (the “Corporation”), and its Subsidiaries and to provide such persons with incentives for superior performance. Incentive Bonus payments made under the Plan are intended to constitute Performance-Based Compensation, and the Plan shall be construed consistently with such intention.

2.Definitions. As used in this Plan,

“Board” means the Board of Directors of the Corporation.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Committee” means the Compensation Committee of the Board or any other committee appointed by the Board to administer the Plan; provided, however, that in any event the Committee shall be comprised of not less than two directors of the Corporation, each of whom shall qualify as an “outside director” for purposes of Section 162(m) and Section 1.162-27(e)(3) of the Regulations.

“Covered Employee” means for any calendar fiscal year of the Corporation, an employee who is, or who the Committee determines is reasonably likely to be, a “covered employee” within the meaning of Section 162(m) with the interpretation contained in Internal Revenue Service Notice 2007-49.

“Eligible Executive” means a Covered Employee and any other executive officer or other employee of the Corporation or its Subsidiaries designated by the Committee.

“Incentive Bonus” shall mean, for each Eligible Executive, a bonus opportunity amount determined by the Committee pursuant to Section 5 below.

“Management Objectives” means the achievement of a performance objective or objectives for a Performance Period established pursuant to this Plan for Eligible Executives. Management Objectives may be described in terms of Corporation-wide objectives or objectives that are related to the performance of the individual Eligible Executive or of the Subsidiary, division, department or function within the Corporation or Subsidiary in which the Eligible Executive is employed. The Management Objectives shall be limited to specified levels of, growth in or relative peer company performance in one or more of the following (and, subject to compliance with Section 162(m), the Committee may, for a Performance Period, amend or adjust the applicable Management Objective(s) or other terms and conditions relating thereto in recognition of (1) asset write-downs; (2) litigation or claim judgments or settlements; (3) the effect of changes in tax laws, accounting principles, regulations, or other laws or regulations affecting reported results; (4) any reorganization and restructuring programs; (5) acquisitions or divestitures; (6) unusual, nonrecurring or extraordinary items identified in the Corporations' audited financial statements, including footnotes; or (7) capital charges):

| |

(i) | Sales, including (i) net sales, (ii) unit sales volume, and (iii) aggregate product price; |

| |

(ii) | Share price, including (i) market price per share, and (ii) share price appreciation; |

| |

(iii) | Earnings, including (i) earnings per share, reflecting dilution of shares, (ii) gross or pre-tax profits, (iii) post-tax profits, (iv) operating profit, (v) earnings net of or including dividends, (vi) earnings net of or including the after-tax cost of capital, (vii) earnings before (or after) interest and taxes (“EBIT”), (viii) earnings per share from continuing operations, diluted or basic, (ix) earnings before (or after) interest, taxes, depreciation and amortization (“EBITDA”), (x) pre-tax operating earnings after interest and before incentives, service fees and extraordinary or special items, (xi) operating earnings, (xii) growth in earnings or growth in earnings per share, (xiii) total earnings; |

| |

(iv) | Return on equity, including (i) return on equity, (ii) return on invested capital, (iii) return or net return on assets, (iv) return on net assets, (v) return on equity, (vi) return on gross sales, (vii) return on investment, (viii) return on capital, (ix) return on invested capital, (x) return on committed capital, (xi) financial return ratios, (xii) value of assets, and (xiii) change in assets; |

| |

(v) | Cash flow(s), including (i) operating cash flow, (ii) net cash flow, (iii) free cash flow, and (iv) cash flow on investment; |

| |

(vi) | Revenue, including (i) gross or net revenue, and (ii) changes in annual revenues; |

| |

(vii) | Margins, including (i) adjusted pre-tax margin, and (ii) operating margins; |

| |

(viii) | Income, including (i) net income, and (ii) consolidated net income; |

| |

(ix) | Economic value added; |

| |

(x) | Costs, including (i) operating or administrative expenses, (ii) operating expenses as a percentage of revenue, (iii) expense or cost levels, (iv) reduction of losses, loss ratios or expense ratios, (v) reduction in fixed costs, (vi) expense reduction levels, (vii) operating cost management, and (viii) cost of capital; |

| |

(xi) | Financial ratings, including (i) credit rating, (ii) capital expenditures, (iii) debt, (iv) debt reduction, (v) working capital, (vi) average invested capital, and (vii) attainment of balance sheet or income statement objectives; |

| |

(xii) | Market or category share, including (i) market share, (ii) volume, (iii) unit sales volume, and (iv) market share or market penetration with respect to specific designated products or product groups and/or specific geographic areas; |

| |

(xiii) | Shareholder return, including (i) total shareholder return, stockholder return based on growth measures or the attainment of a specified share price for a specified period of time, and (ii) dividends; and |

| |

(xiv) | Objective nonfinancial performance criteria measuring either (i) regulatory compliance, (ii) productivity and productivity improvements, (iii) inventory turnover, average inventory turnover or inventory controls, (iv) net asset turnover, (v) customer satisfaction based on specified objective goals or company-sponsored customer surveys, (vi) employee satisfaction based on specified objective goals or company-sponsored employee surveys, (vii) objective employee diversity goals, (viii) employee turnover, (ix) specified objective environmental goals, (x) specified objective social goals, (xi) specified objective goals in corporate ethics and integrity, (xii) specified objective safety goals, (xiii) specified objective business expansion goals or goals relating to acquisitions or divestitures, and (xiv) succession plan development and implementation. |

“Performance-Based Compensation” means qualified “performance-based compensation” within the meaning of Section 162(m) including, without limitation, Regulations Section 1.162.27.

“Performance Period” means the period for which performance is calculated, which shall be the Plan Year unless otherwise specified by the Committee.

“Plan Year” means the Corporation’s fiscal year which begins on January 1 and ends on December 31, with the first Plan Year of the Plan commencing January 1, 2015 and ending December 31, 2015.

“Pro-rated Incentive Bonus” means an amount equal to the Incentive Bonus otherwise payable to an Eligible Executive for a Performance Period in which the Eligible Executive was actively employed by the Corporation or a Subsidiary, multiplied by a fraction, the numerator of which is the number of days the Eligible Executive was actively employed by the Corporation or a Subsidiary during the Performance Period and the denominator of which is the number of days in the Performance Period.

“Regulations” mean the Treasury Regulations promulgated under the Code, as amended from time to time.

“Section 162(m)” means Section 162(m) of the Code and the Regulations and other guidance promulgated thereunder.

“Subsidiary” means a corporation, partnership, joint venture, unincorporated association or other entity in which the Corporation has a direct or indirect ownership or other equity interest.

“Termination for Cause” means a termination employment of an Eligible Executive by the Corporation or a Subsidiary for the reasons set forth in the definition of Termination for Cause in the Corporation’s Amended and Restated 1991 Equity and Performance Incentive Plan.

3.Administration of the Plan. The Plan shall be administered by the Committee, which shall have full power and authority to construe, interpret and administer the Plan and shall have the exclusive right to establish Management Objectives for a Performance Period and the amount of Incentive Bonus payable to each Eligible Executive upon the achievement of the specified Management Objectives.

4.Eligibility. Eligibility under this Plan is limited to Eligible Executives designated by the Committee in its sole and absolute discretion.

5.Awards.

(a)Not later than the earlier (i) of the ninetieth (90th) day after the beginning of the applicable Performance Period, or (ii) the expiration of twenty-five percent (25%) of the applicable Performance Period (and upon which date the outcome of the Management Objective(s) applicable to such Incentive Bonus are substantially uncertain), the Committee shall establish the Management Objective(s) for each Eligible Executive and the amount of Incentive Bonus payable (or formula for determining such amount) upon full achievement of the specified Management Objective(s). The Committee may further specify in respect of the specified Management Objective(s) a minimum acceptable level of achievement below which no Incentive Bonus payment will be made and shall set forth a formula for determining the amount of any payment to be made if performance is at or above the minimum acceptable level but falls short of full achievement of the specified Management Objective(s). The Committee may not modify any terms of awards established pursuant to this Section 5, (other than in connection with an Eligible Executive's death or disability, or a change in control), except to the extent that after such modification the Incentive Bonus would continue to constitute Performance-Based Compensation.

(b)The Committee retains the discretion to reduce the amount of any Incentive Bonus that would be otherwise payable to an Eligible Executive (including a reduction in such amount to zero), provided that the Committee’s exercise of such discretion does not cause the Incentive Bonus to fail to qualify as Performance-Based Compensation.

(c)To comply with Section 162(m), the maximum amount of the Incentive Bonus payable to an Eligible Executive under the Plan for a calendar year is Ten Million Dollars ($10,000,000).

6.Committee Certification. In compliance with Section 162(m), as soon as reasonably practicable after the end of each Performance Period, the Committee shall determine whether the applicable Management Objective(s) has/have been achieved and the amount of the Incentive Bonus to be paid to each Eligible Executive for such Performance Period and shall certify such determinations in writing.

7.Payment of Incentive Bonuses. Incentive Bonuses shall be paid within thirty (30) days after Committee’s written certification pursuant to Section 6, but in no event later than two and a half months from the end of the Performance Period. Notwithstanding the foregoing, the Committee in its discretion may permit an Eligible Executive to defer the payment of an Incentive Bonus; provided that an election to defer payment of all or any part of an Incentive Bonus under the Plan shall be made in accordance with such rules as may be established by the Committee in order to comply with Section 409A of the Code and such other requirements as the Committee shall deem applicable to the deferral.

8.Termination of Employment.

(a)Except as otherwise provided in Section 8(b), if an Eligible Executive’s employment with the Corporation and its Subsidiaries terminates prior to the last day of a Performance Period, all of the Eligible Executive’s rights to an Incentive Bonus for such Performance Period shall be forfeited.

(b)If an Eligible Executive’s employment with the Corporation and its Subsidiaries is terminated by reason of the Eligible Employee’s death or disability (or, in the Committee’s discretion any other termination other than a Termination for Cause, to the extent not established by another applicable agreement) during a Performance Period, the Eligible Executive (or the Eligible Executive’s estate) will be paid a Pro-rated Incentive Bonus. Payment of such Pro-rated Incentive Bonus will be made at the same time and in the manner as Incentive Bonuses are paid to other Eligible Executives pursuant to Section 7 of the Plan.

9.No Right to Bonus or Continued Employment. Neither the establishment of the Plan, the provision for or payment of any amounts hereunder nor any action of the Corporation, the Board or the Committee with respect to the Plan shall be held or construed to confer upon any person (a) any legal right to receive, or any interest in, an Incentive Bonus or any other benefit under the Plan or (b) any legal right to continue to serve as an officer or employee of the Corporation or any Subsidiary of the Corporation.

10.Withholding. The Corporation shall have the right to withhold, or require an Eligible Executive to remit to the Corporation, an amount sufficient to satisfy any applicable federal, state, local or foreign withholding tax requirements imposed with respect to the payment of any Incentive Bonus.

11.Nontransferability. Except as expressly provided by the Committee, the rights and benefits under the Plan shall not be transferable or assignable other than by will or the laws of descent and distribution.

12.Amendment and Termination. The Committee may amend the Plan from time to time, provided that any such amendment is subject to approval by the shareholders of the Corporation to the extent required to satisfy the requirements of Section 162(m), and provided further that any such amendment shall not, after the end of the ninety (90) day/25% period described in Section 5(a) of the Plan, cause the amount payable under an Incentive Bonus to be increased as compared to the amount that would have been paid in accordance with the terms established within such period. The Committee may also terminate the Plan at any time; provided, however, that no termination shall adversely affect the rights of any Eligible Executive with respect to any Performance Period that commenced prior to such termination.

13.Governing Law. The Plan shall be construed, administered and enforced in accordance with the laws of the State of Ohio without regard to conflicts of law.

14.Code Section 409A. It is intended that payments of Incentive Bonuses under the Plan qualify as short-term deferrals exempt from the requirements of Section 409A of the Code. In the event the Committee permits deferrals pursuant to Section 7 of the Plan, it is intended that such deferrals of Incentive Bonuses will be deferred and paid in a manner that complies with the requirements of Section 409A of the Code and the Regulations promulgated thereunder.

15.Clawback. All Incentive Bonuses paid under the Plan are subject to any clawback policy of the Corporation as in effect from time to time and, in accordance with such policy, may be subject to the requirement that such Incentive Bonuses be repaid to the Corporation after they have been paid.

16.Unfunded Plan. The Plan is an unfunded compensation plan, and all payments to be made hereunder shall be paid from the general funds of the Corporation.

17.Effective Date. Subject to its approval by the shareholders, this Plan shall remain effective until the first annual meeting of the Corporation’s shareholders held in the Corporation’s 2020 calendar fiscal year, subject to any further stockholder approvals (or re-approvals) mandated for Performance-Based Compensation, and subject to the right of the Board to terminate the Plan, on a prospective basis only, at any time.

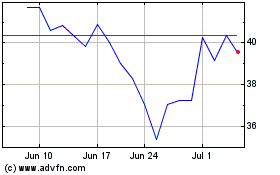

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024