ATM Makers Look For New Revenue As Big Banks Complete Upgrade

April 14 2010 - 9:29AM

Dow Jones News

ATM manufacturers, which for the last five years or so have

relied on major equipment upgrades by banks, may experience some

withdrawal symptoms as this large revenue stream dries up.

NCR Corp. (NCR), Diebold Inc. (DBD) and Wincor Nixdorf AG's

(WIN.XE) American unit have all benefited greatly as Bank of

America Corp. (BAC), J.P. Morgan Chase & Co. (JPM) and Wells

Fargo & Co. (WFC) upgraded their fleets of automatic teller

machines with "intelligent deposit" machines, or ATMs that allow

for envelope-free deposits. Bank of America changed out its 13,800

deposit-capable machines in late 2009, and Chase is set to complete

its upgrade of 10,000 ATMs by Thursday. Wells Fargo expects to

finish upgrading its fleet of more than 12,000 in 2012.

Gil Luria, vice president of equity research at Wedbush

Securities, says the manufacturers will have to replace up to 7% of

their ATM revenue as the upgrades are completed. Luria estimates

ATMs account for between 50% and 60% of NCR's revenue and nearly

three-quarters of Diebold's. He said the banking segment makes up

70% of Wincor Nixdorf's revenue.

The ATM manufacturers are expecting other areas, including

fixed-contract services, to fill some of the void. They are also

hoping more banks will start adopting the machines soon to keep

North American earnings afloat.

Diebold is potentially the most vulnerable on that front, as the

company has a large presence with cash-strapped regional and

community banks via its security and services businesses. With

banks not committing to time lines for adoption, Diebold investors

may need patience. That said, Diebold shares, as well as those of

NCR and Wincor, are all trading near 52-week highs, and analysts

say they don't expect the shares to fall off a cliff.

NCR, meanwhile, can look to its retail operations to offset some

losses, according to Michael Saloio of Sidoti & Co. NCR is also

expanding its entertainment business, which operates Blockbuster

Express-licensed DVD rental kiosks.

Wincor Nixdorf, the main vendor for Wells Fargo, is potentially

the safest of the bunch as it has two years before that rollout is

complete.

To be sure, other financial institutions have shown interest in

the ATMs. SunTrust Banks Inc. (STI) says it is planning on

providing deposit automation services down the line. PNC Financial

Services Group Inc. (PNC) already has 1,000 such machines and will

change out ATMs at recently acquired branches in the future. And

Citigroup Inc. (C) said it will convert 85% of its 3,051 machines.

None would provide a schedule for the moves.

"The midsized banks, the regional banks, the national banks

certainly will not pick up all of the slack that will be left by

the large banks, but we think they're going to start to become very

active this year and going into 2011," NCR Chief Executive Bill

Nuti said in a February call with investors.

NCR declined to update its estimates of when more small banks

would sign contracts, citing its quiet period before reporting

quarterly earnings later this month. Diebold also wouldn't provide

details of its work with other banks, though spokesman Michael

Jacobsen said there will be "some" demand from small banks this

year.

Even when those banks do act, they likely won't affect the

manufacturers' earnings on the same scale as did Bank of America,

Chase or Wells Fargo.

For example, HSBC Holdings PLC (HBC) has switched more than half

of its ATMs to envelope-free machines since launching a pilot in

2008. But it only has 800 ATMs. The company, which declined to name

its manufacturing partner, said it hopes to move to full automation

by the end of this year.

Credit unions, which industry insiders say are starting to show

more interest as technology improves at their back-end check

processors, will also provide little comfort. A handful of very

large organizations may have at most 300 ATMs, according to Stan

Hollen, president and chief executive of CO-OP Financial Services,

a network manager for credit unions. Just under 4,700 credit unions

had ATMs at the end of 2009.

To help cushion themselves, the ATM manufacturers are bulking up

their services businesses, which provide recurring revenue via

fixed contracts to help with maintenance and software. They also

see strong growth prospects internationally, as Diebold and NCR

both note opportunities in Brazil and other emerging markets.

"We're betting on many different parts of the world," said Bob

Tramantano, vice president of marketing for NCR Financial

Services.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

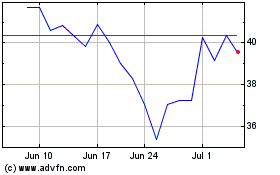

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2024 to May 2024

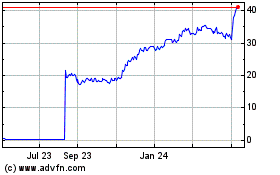

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From May 2023 to May 2024