UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 3, 2015 (August 3, 2015)

COMMUNITY HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-15925 |

|

13-3893191 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

4000 Meridian Boulevard

Franklin, Tennessee 37067

(Address of principal executive offices)

Registrant’s telephone number, including area code: (615) 465-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On August 3, 2015, Community Health Systems, Inc. (the

“Company”) issued a press release announcing that it plans to create a new publicly traded hospital company by spinning off to Company stockholders a group of 38 hospitals and Quorum Health Resources, LLC. The spin-off is intended to be

tax-free to the Company and its stockholders and is expected to be completed in the first quarter of 2016. A copy of the press release making this announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is

incorporated herein by reference into this Item 7.01.

The Company will hold a conference call on Tuesday, August 4, 2015 at

10:00 a.m. Central, 11:00 a.m. Eastern, to discuss the proposed spin-off. A copy of the investor presentation for the conference call is furnished as Exhibit 99.2 hereto and is incorporated herein by reference into this Item 7.01.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

The following exhibits are furnished herewith:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Community Health Systems, Inc. Press Release, dated August 3, 2015. |

|

|

| 99.2 |

|

Investor Presentation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: August 3, 2015 |

|

|

|

COMMUNITY HEALTH SYSTEMS, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Wayne T. Smith |

|

|

|

|

|

|

Wayne T. Smith |

|

|

|

|

|

|

Chairman of the Board and Chief Executive Officer |

|

|

|

|

|

|

(principal executive officer) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Larry Cash |

|

|

|

|

|

|

W. Larry Cash |

|

|

|

|

|

|

President of Financial Services, Chief Financial Officer |

|

|

|

|

|

|

and Director |

|

|

|

|

|

|

(principal financial officer) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Kevin J. Hammons |

|

|

|

|

|

|

Kevin J. Hammons |

|

|

|

|

|

|

Senior Vice President and Chief Accounting Officer |

|

|

|

|

|

|

(principal accounting officer) |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Community Health Systems, Inc. Press Release, dated August 3, 2015. |

|

|

| 99.2 |

|

Investor Presentation. |

Exhibit 99.1

COMMUNITY HEALTH SYSTEMS ANNOUNCES PLANS TO

SPIN OFF 38 HOSPITALS AND QUORUM HEALTH RESOURCES

FRANKLIN, Tenn. (August 3, 2015) – Community Health Systems, Inc. (NYSE: CYH) (the “Company”) announced today that it plans to create a

new publicly traded hospital company by spinning off to Community Health Systems’ stockholders a group of 38 hospitals and Quorum Health Resources, LLC, a leading hospital management and consulting business. The new company will be named Quorum

Health Corporation to leverage the existing strength of the Quorum brand. The spin-off is intended to be tax-free to Community Health Systems and its stockholders and is expected to be completed in the first quarter of 2016.

Quorum Health Corporation will be headquartered in middle Tennessee and will operate independently with its own board of directors and management team. It

will include a diversified portfolio of 38 hospitals with an aggregate of 3,635 licensed beds across 16 states. The hospitals that will comprise Quorum Health Corporation have strong market positions and are primarily located in cities or counties

having populations of 50,000 or less. In 84 percent of these markets, the hospital is the sole provider of acute care hospital services. In 2014, The Joint Commission recognized 74 percent of the hospitals that will become part of Quorum Health

Corporation as Top Performers in Key Quality Measures. The new company will also include Quorum Health Resources, which provides hospital management and consulting services to 150 non-affiliated hospitals across the United States, most of which are

located in similar markets as Quorum Health Corporation’s sole provider hospitals.

In 2014, the businesses that will comprise Quorum Health

Corporation generated unaudited annual net revenue of approximately $2.1 billion and adjusted EBITDA of approximately $255 million.

Benefits

of the Transaction

| |

• |

|

Creates New Healthcare Company Poised for Growth. With an attractive portfolio of high-quality community hospitals, streamlined management structure and independent access to capital markets, Quorum Health

Corporation is expected to have an enhanced ability to drive growth by capitalizing on acquisition opportunities consistent with its portfolio, developing facility specific operating strategies aligned with its community needs and better leveraging

its management and consulting capabilities. |

| |

• |

|

Community Health Systems to Sharpen Focus and Growth Profile. The spin-off will result in additional opportunities for profitable growth for Community Health Systems, as the Company will focus primarily on

larger markets and on investing in strengthening its regional healthcare networks, while maintaining the benefits of scale from being one of the largest hospital companies in the country. |

| |

• |

|

Designed to Increase Stockholder Value. Community Health Systems stockholders will have the opportunity to realize the unique growth potential of two focused healthcare companies that will be better

positioned to pursue their distinct business strategies. |

| |

• |

|

Tax-Free Transaction to Community Health Systems Stockholders. The distribution is intended to qualify as tax-free to Community Health Systems stockholders for U.S. federal income tax purposes.

|

-MORE-

CYH Announces Plans to Spin off 38 Hospitals and Quorum Health Resources

Page

2

August 3, 2015

“This significant transaction will realign our portfolio into two strong and focused companies that can

respond to market demands with greater agility and that are better positioned to take advantage of growth opportunities, while creating additional value for our stockholders,” said Wayne T. Smith, chairman and chief executive officer of

Community Health Systems, Inc. “Over the past 30 years, Community Health Systems has evolved from a collection of smaller hospitals into a much more complex and diversified portfolio of hospitals, outpatient services, and healthcare systems

across the country. We know how important hospitals are to their communities and recognize that smaller facilities have distinct opportunities and different challenges than those in larger markets, where the majority of our assets are located.”

Smith continued, “This transaction will allow Quorum Health Corporation’s hospitals to focus on the changes in the healthcare delivery system,

which are different in smaller community hospitals than in our larger and more urbanized markets. At the same time, the transaction will facilitate a sharper focus on the hospitals that are retained by Community Health Systems, especially in

high-opportunity markets and in areas where we are building regional healthcare networks.”

Smith concluded, “Our stockholders have benefited

from our acquisitiveness as we have grown the size and value of our company. We view this transaction as the best next step in our continuous effort to return value to our stockholders.”

Quorum Health Corporation will launch with the benefit of transitional services from Community Health Systems, including purchased services in select areas

such as information technology, billing and collections and payroll services. When the transaction is complete, Community Health Systems, Inc. will remain one of the largest publicly traded U.S. hospital companies with 160 affiliated hospitals in 22

states.

The transaction is expected to qualify as a tax-free distribution to Community Health Systems and its stockholders. Quorum Health Corporation

expects to file its Form 10 with the Securities and Exchange Commission before the end of the third quarter. The Form 10 will contain detailed information about the new company, its management team, the spin-off transaction, and other related

matters.

The transaction is subject to customary conditions, certain legal and valuation opinions, effectiveness of the Form 10 filing, and final

approval and declaration of the distribution by the Community Health Systems, Inc. Board of Directors. The transaction is not subject to a stockholder vote. There can be no assurance regarding the ultimate timing of the spin-off or that it will be

completed. Community Health Systems may, at any time, and for any reason until the proposed transaction is complete, abandon the spin-off or modify or change the terms. Quorum Health Corporation intends to have its common stock authorized for

listing on the New York Stock Exchange. The Contingent Value Rights issued in connection with the Health Management Associates, Inc. transaction in January 2014 will be unaffected by this transaction.

-MORE-

CYH Announces Plans to Spin off 38 Hospitals and Quorum Health Resources

Page

3

August 3, 2015

|

|

|

| Quorum Health Corporation Hospitals |

|

|

| Cherokee Medical Center |

|

Centre, Alabama |

| DeKalbRegional Medical Center |

|

Fort Payne, Alabama |

| L.V. Stabler Memorial Hospital |

|

Greenville, Alabama |

| Forrest City Medical Center |

|

Forrest City, Arkansas |

| Helena Regional Medical Center |

|

Helena, Arkansas |

| Barstow Community Hospital |

|

Barstow, California |

| Watsonville Community Hospital |

|

Watsonville, California |

| Trinity Hospital of Augusta |

|

Augusta, Georgia |

| Fannin Regional Hospital |

|

Blue Ridge, Georgia |

| Clearview Regional Medical Center |

|

Monroe, Georgia |

| Barrow Regional Medical Center |

|

Winder, Georgia |

| Union County Hospital |

|

Anna, Illinois |

| Metro South Medical Center |

|

Blue Island, Illinois |

| Galesburg Cottage Hospital |

|

Galesburg, Illinois |

| Gateway Regional Medical Center |

|

Granite City, Illinois |

| Heartland Regional Medical Center |

|

Marion, Illinois |

| Crossroads Community Hospital |

|

Mt. Vernon, Illinois |

| Red Bud Regional Hospital |

|

Red Bud, Illinois |

| Vista Medical Center |

|

Waukegan, Illinois |

| Vista Medical Center – West |

|

Waukegan, Illinois |

| Kentucky River Medical Center |

|

Jackson, Kentucky |

| Three Rivers Medical Center |

|

Louisa, Kentucky |

| Paul B. Hall Regional Medical Center |

|

Paintsville, Kentucky |

| Mesa View Regional Hospital |

|

Mesquite, Nevada |

| Mimbres Memorial Hospital |

|

Deming, New Mexico |

| Alta Vista Regional Hospital |

|

Las Vegas, New Mexico |

| Sandhills Regional Medical Center |

|

Hamlet, North Carolina |

| Martin General Hospital |

|

Williamston, North Carolina |

| Affinity Medical Center |

|

Massillon, Ohio |

| McKenzie-Willamette Medical Center |

|

Springfield, Oregon |

| Lock Haven Hospital |

|

Lock Haven, Pennsylvania |

| Sunbury Community Hospital |

|

Sunbury, Pennsylvania |

| Henderson County Community Hospital |

|

Lexington, Tennessee |

| McKenzie Regional Hospital |

|

McKenzie, Tennessee |

| Big Bend Regional Medical Center |

|

Alpine, Texas |

| Scenic Mountain Medical Center |

|

Big Spring, Texas |

| Mountain West Medical Center |

|

Tooele, Utah |

| Evanston Regional Hospital |

|

Evanston, Wyoming |

-MORE-

CYH Announces Plans to Spin off 38 Hospitals and Quorum Health Resources

Page

4

August 3, 2015

Conference Call

Community Health Systems, Inc. will hold a conference call on Tuesday, August 4, 2015 at 10:00 a.m. Central, 11:00 a.m. Eastern, to discuss this

transaction and to review financial and operating results for the second quarter ended June 30, 2015. Investors will have the opportunity to listen to a live internet broadcast of the conference call by clicking on the Investor Relations link

of the Company’s website at www.chs.net. To listen to the live call, please go to the website at least fifteen minutes early to register, download and install any necessary audio software. For those who cannot listen to the live

broadcast, a replay will be available shortly after the call and will continue to be available through September 5, 2015.

Advisors

Credit Suisse is serving as Community Health Systems’ financial advisor, and Bass, Berry & Sims PLC and Bradley Arant Boult Cummings LLP are

serving as legal advisors to Community Health Systems in connection with the proposed spin-off.

About Community Health Systems, Inc.

Community Health Systems, Inc. is one of the largest publicly traded hospital companies in the United States and a leading operator of general acute care

hospitals in communities across the country. Through its subsidiaries, the company currently owns, leases or operates 198 affiliated hospitals in 29 states with an aggregate of approximately 30,000 licensed beds. The Company’s headquarters are

located in Franklin, Tennessee, a suburb of south Nashville. Shares in Community Health Systems, Inc. are traded on the New York Stock Exchange under the symbol “CYH.” More information about the Company can be found on its website at

www.chs.net.

Forward-Looking Statements

Certain

statements contained in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding the

expected timing of the completion of the spin-off transaction, the benefits of the spin-off transaction to either Community Health Systems or Quorum Health Corporation, the tax-free treatment of the spin-off transaction, the anticipated management

of the business to be spun off, the market position of the business to be spun off and other statements that are not historical facts. Such statements are based on the views and assumptions of the management of the Company and are subject to

significant risks and uncertainties. There can be no assurance that the proposed transaction or these future events will occur as anticipated, if at all, or that actual results will be as expected. Actual future events or results may differ

materially from these statements. Such differences may result from a number of factors, including but not limited to: the timing and completion of the proposed transaction; a failure to obtain necessary regulatory approvals; a failure to obtain

assurances of anticipated tax treatment; a deterioration in the business or prospects of the Company or Quorum Health Corporation; adverse developments in the Company or Quorum Health Corporation’s markets; adverse developments in the U.S. or

global capital markets, credit markets or economies generally; the risk that the benefits of the proposed transaction may not be fully realized or may take longer to realize than expected; the impact of the proposed transaction on the Company’s

third-party relationships; the Company’s ability following completion of the spin-off to identify and acquire additional hospitals in larger and more urbanized markets with terms that are attractive to the

-MORE-

CYH Announces Plans to Spin off 38 Hospitals and Quorum Health Resources

Page

5

August 3, 2015

Company and to integrate such acquired hospitals; and changes in regulatory, social and political conditions. Additional risks and factors that may affect results are set forth in the

Company’s filings with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K.

The

forward-looking statements speak only as of the date of this communication. The Company does not undertake any obligation to update these statements.

Non-GAAP Financial Measures

EBITDA is a non-GAAP

financial measure which consists of net income attributable to Quorum Health Corporation, before interest, income taxes, and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted to exclude impairment of long-lived assets, net income

attributable to noncontrolling interests, and expenses related to legal settlements and related costs. Community Health Systems believes that it is useful to present adjusted EBITDA because it clarifies for investors Quorum Health Corporation’s

portion of EBITDA generated by continuing operations. Community Health Systems uses adjusted EBITDA as a measure of liquidity. Community Health Systems has also presented Quorum Health Corporation’s adjusted EBITDA in this communication because

it believes it provides investors with additional information about Quorum Health Corporation’s ability to incur and service debt and make capital expenditures.

Adjusted EBITDA is not a measurement of financial performance or liquidity under U.S. GAAP. It should not be considered in isolation or as a substitute for

net income, operating income, cash flows from operating, investing or financing activities or any other measure calculated in accordance with U.S. GAAP. The items excluded from adjusted EBITDA are significant components in understanding and

evaluating financial performance and liquidity. This calculation of adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Because certain terms of the spin-off have not yet been determined, including as to the balance sheet and statement of cash flows of Quorum Health

Corporation, it is not reasonably possible at this time to provide the net income for Quorum Health Corporation or a reconciliation to the estimated adjusted EBITDA figure included in this communication. Historical GAAP financial information for

Community Health Systems is included in its most recent Annual Report on Form 10-K filed with the SEC, and historical GAAP financial information for Quorum Health Corporation will be included in the Form 10 registration statement relating to the

spin-off.

Investor Contact:

W. Larry Cash,

615-465-7000

President of Financial Services and Chief Financial Officer

or

Media Contact:

Tomi Galin, 615-628-6607

Senior Vice President, Corporate

Communications, Marketing and Public Affairs

-END-

| Proposed

Spin-Off of Quorum Health Corporation August 2015

Exhibit 99.2 |

|

Forward-Looking Statements

2 Certain statements contained in this presentation may constitute “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These statements include, but are

not limited to, statements regarding the expected timing of the

completion of the spin-off transaction, the benefits of the spin-off transaction, the tax-free treatment of the spin-off transaction, the anticipated management of the business to be spun off, the market

position of the business to be spun off and other statements that are not historical

facts. Such statements are based on the views and assumptions of the

management of the Community Health Systems, (“Company”) and are subject to significant risks and uncertainties. There can be no assurance that the proposed transaction or these future events

will occur as anticipated, if at all, or that actual results will be as expected.

Actual future events or results may differ materially from these

statements. Such differences may result from a number of factors, including but not limited to: the timing and completion of the proposed transaction; a failure to obtain necessary regulatory approvals; a failure to

obtain assurances of anticipated tax treatment; a deterioration in the business or

prospects of the Company or Quorum Health Corporation, (“Quorum

Health”); adverse developments in the Company or Quorum Health’s markets; adverse developments in the U.S. or global capital markets, credit markets or economies generally; the risk that the

benefits of the proposed transaction may not be fully realized or may take longer to

realize than expected; the impact of the proposed transaction on

the Company’s third-party relationships; the Company’s ability following completion of the spin-off to identify and acquire additional hospitals in larger and more urbanized markets with terms that are

attractive to the Company and to integrate such acquired hospitals; and changes in

regulatory, social and political conditions. Additional risks and factors

that may affect results are set forth in the Company’s filings with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K.

The forward-looking statements speak only as of the date of this communication. The

Company does not undertake any obligation to update these

statements. |

|

Spin-Off Transaction Overview

3 Spinning off a group of 38 hospitals and Quorum Health Resources, a leading hospital management and consulting business (collectively, “Quorum Health”) 2014 Revenue of $2.1 billion (1) 2014 Adjusted EBITDA of ~$255 million (1) Transaction intended to qualify as a tax-free distribution to CHS and its

stockholders

Spin-off expected to be in first quarter of 2016

Proposed Transaction Rationale CHS has evolved from a collection of smaller hospitals into a much more

complex and diversified portfolio of hospitals and healthcare

systems These 38 hospitals and Quorum Health Resources face

different challenges and distinct opportunities

Realign portfolio to reduce complexity and create two strong companies

that can respond to market demand with greater

flexibility (1)

Financials are unaudited and adjusted EBITDA excludes certain non-recurring

items. |

|

Creates Two Focused Companies

Executing Two Distinct Business Strategies

4 Benefits to CHS Enhance focus on larger markets Invest in and further strengthen regional healthcare networks Improve EBITDA margins Focus on cities and counties with populations of 50,000 or less Streamline management structure Direct access to capital and resources Optimize growth opportunities that might otherwise be lost Benefits to Quorum Health Provides CHS stockholders’ ownership in two focused hospital companies

Precedents suggest potential for value creation

Las Vegas, NM

Monroe, GA Watsonville, CA Helena, AR |

|

Quorum Health’s Two Complementary Businesses

5 Hospital Operations Quorum Health Resources 38 Hospitals; 16 states; 3,635 licensed beds Sole hospital provider in 84% of markets 74% of hospitals named Top Performers on Key Quality Measures by the Joint Commission 7 states with $100m or more in revenue Owns 32 of 38 hospitals Provides management and consulting services to 150 non-affiliated hospitals A leader in hospital management services One of the leading healthcare consulting firms Opportunity to capitalize on knowledge base, best practices and identify

acquisition candidates

Quorum Health (1) Financials are unaudited and adjusted EBITDA excludes certain non-recurring items.

2014 Revenue

$2.1 billion

(1) 2014 Adj. EBITDA ~$255 million (1) Managed hospitals located in similar markets as the group of 38 hospitals |

|

Attractive, Geographically Diversified Portfolio

6 Williamston Jackson Louisa Paintsville Sunbury Lock Haven Massillon Hamlet Lexington Monroe Winder Centre Blue Ridge Ft. Payne McKenzie Augusta Anna Marion Mt. Vernon Red Bud Granite City Waukegan (2) Blue Island Helena Galesburg Forrest City Greenville Alpine Big Spring Barstow Watsonville Deming Las Vegas Mesquite Springfield Tooele Evanston Quorum Health’s hospitals are typically located in cities and counties with

populations of 50,000 or less

38 Hospitals across 16 states with 3,635 licensed beds

|

|

Poised for Success

7 Strong Market Presence – sole hospital provider in 84% of markets Geographically diversified – 38 hospitals across 16 states Emphasis on Quality of Care – 28 hospitals (74%) named Top Performers on Key Quality Measures by Joint Commission Well Positioned Portfolio Compelling Growth Strategy Attractive Financial Profile Develop facility-specific operating and marketing strategies aligned with

community needs

Expand service lines

Lower overhead costs and improve operating efficiency

Acquire similarly situated community hospitals and leverage resources

and relationships

Creates an independent company with access to capital and equity

currency Opportunity to drive revenue growth and margin expansion

ACA expansion; 9 of 16 states (78% of revenues) have expanded

Medicaid Coverage |

|

Experienced Leadership Team

8 Independent executive management team dedicated to Quorum Health Executive management will consist of current CHS executives with experience and knowledge of the industry, markets and facilities These executives, along with other executives, will be named when the Form-10 is filed Transitional services from CHS to include information technology, billing and collections, and payroll services Management Independent Board of Directors being identified Committed to best practices in corporate governance and building on CHS’ legacy Board of Directors |

|

Pro Forma CHS Better Positioned to Execute Growth Strategy

9 160 hospitals across 22 states with 27,700 licensed beds Sole hospital provider in approximately 60% of markets 12 of 22 states generate over $500 million of revenues Combined, these states contributed 84% of total revenues in 2014 Strong Market Presence Focused Operating Strategy Enhance focus on larger markets Leverage standardized and centralized practices Invest in high opportunity markets and further strengthen regional healthcare networks to drive greater profitability Senior leadership team largely unchanged and committed to growth CHS will remain as one of the largest publicly traded hospital companies Attractive Financial Profile Improved operating margin and profitability Cash from new debt raised by Quorum Health will be used to pay down secured indebtedness Total leverage remains largely unchanged |

|

Process Overview

10 Quorum Health intends to file initial Form 10 information statement with

the SEC before the end of the third quarter of 2015

Target completion in the first quarter of 2016

Transaction Timing Distribution Process Conditions Precedent Distribution of Quorum Health common shares via a special distribution to

CHS stockholders

Following the distribution, current CHS stockholders will own shares in both

CHS and Quorum Health

Number of CHS shares owned by each stockholder will not change as a result

of this distribution

Spin-off permitted under CHS debt documentation

Declaration by SEC that Quorum Health’s registration statement is

effective Filing and approval of Quorum Health listing by

NYSE Final approval and declaration of the distribution by

CHS’ Board of Directors Receipt of certain regulatory

approvals and other customary conditions Tax

Considerations Intended to qualify as tax-free distribution to CHS and stockholders Quorum Health 2014 tax basis estimated to be $1.27 billion |

|

Non-GAAP Financial Measures

12 EBITDA is a non-GAAP financial measure which consists of net income attributable to Quorum Health Corporation,

before interest, income taxes, and depreciation and amortization. Adjusted EBITDA is

EBITDA adjusted to exclude impairment of long-lived assets, net

income attributable to non-controlling interests, and expenses related to legal settlements and related costs. Community Health Systems believes that it is useful to present Adjusted EBITDA

because it clarifies for investors Quorum Health Corporation’s portion of EBITDA

generated by continuing operations. Community Health Systems uses

Adjusted EBITDA as a measure of liquidity. Community Health Systems has also presented Quorum Health Corporation’s Adjusted EBITDA in this presentation because it believes it provides

investors with additional information about Quorum Health Corporation’s ability to

incur and service debt and make capital expenditures.

Adjusted EBITDA is not a measurement of financial performance or liquidity under U.S.

GAAP. It should not be considered in isolation or as a substitute for net

income, operating income, cash flows from operating, investing or

financing activities or any other measure calculated in accordance with U.S. GAAP. The

items excluded from Adjusted EBITDA are significant components in

understanding and evaluating financial performance and liquidity. This

calculation of Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Because certain terms of the spin-off have not yet been determined, including as to the balance sheet and statement

of cash flows of Quorum Health Corporation, it is not reasonably possible at this time

to provide the net income for Quorum Health Corporation or a

reconciliation to the estimated Adjusted EBITDA figures included in this

presentation. Historical GAAP financial information for Community Health Systems

is included in its most recent Annual Report on Form 10-K filed with

the SEC, and historical GAAP financial information for Quorum Health

Corporation will be included in the Form 10 registration statement relating to the

spin-off. |

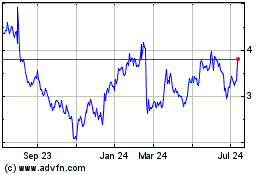

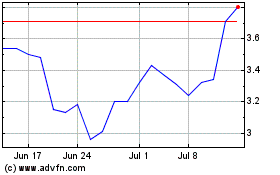

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Apr 2023 to Apr 2024