UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 3, 2015

CRAWFORD & COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

| | |

| | |

1-10356 | | 58-0506554 |

|

(Commission File Number) | | (IRS Employer Identification No.) |

| | |

1001 Summit Blvd., Atlanta, Georgia | | 30319 |

|

(Address of Principal Executive Offices) | | (Zip Code) |

(404) 300-1000

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TABLE OF CONTENTS

|

| | | | | | | | |

| | | | | | | | |

ITEM 2.02. Results of Operations and Financial Condition |

ITEM 7.01. Regulation FD Disclosure |

ITEM 9.01. Financial Statements and Exhibits |

SIGNATURES |

EXHIBIT INDEX |

EX-99.1 |

EX-99.2 |

ITEM 2.02. Results of Operations and Financial Condition

On August 3, 2015, Crawford & Company (the "Company") issued a press release containing information about the Company's financial results for the second quarter 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

ITEM 7.01. Regulation FD Disclosure

The Company has made available on the Company's website at www.crawfordandcompany.com a presentation designed to enhance the information presented at its quarterly earnings conference call on Monday, August 3, 2015 at 3:00 p.m. Eastern Time. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by this reference.

ITEM 9.01. Financial Statements and Exhibits

|

| | | | | |

(c) | | Exhibits | | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release dated August 3, 2015 |

| | |

99.2 | | Slide Presentation |

The information contained in this current report on Form 8-K and in the accompanying exhibits shall not be incorporated by reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation by reference language in such filing, unless expressly incorporated by specific reference to such filing. The information, including the exhibits hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| CRAWFORD & COMPANY (Registrant) | |

| By: | /s/ W. BRUCE SWAIN | |

| | W. Bruce Swain | |

| | Executive Vice President - Chief Financial Officer | |

|

Dated: August 3, 2015

EXHIBIT INDEX

|

| | |

| | |

Number | | Descriptions |

99.1 | | Press Release dated August 3, 2015 |

| | |

99.2 | | Slide Presentation |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

FOR IMMEDIATE RELEASE

Crawford & Company Reports 2015 Second Quarter Results

Revises 2015 Guidance

ATLANTA, GA. (August 3, 2015) -- Crawford & Company (www.crawfordandcompany.com) (NYSE: CRDA and CRDB), the world's largest independent provider of claims management solutions to insurance companies and self-insured entities, today announced its financial results for the second quarter ended June 30, 2015.

The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class.

Second Quarter 2015 Summary

| |

• | Revenues before reimbursements of $304.4 million, up from $288.2 million for the second quarter of 2014 |

| |

• | Net income attributable to shareholders of $4.1 million, down from $10.5 million in the same period last year |

| |

• | Diluted earnings per share of $0.08 for CRDA and $0.06 for CRDB, after special charges |

| |

• | Diluted earnings per share of $0.14 for CRDA and $0.12 for CRDB on a non-GAAP basis, before special charges |

| |

• | Americas segment achieved 10% operating margin target during second quarter 2015 |

| |

• | Broadspire segment delivered 10% revenue growth with operating earnings up over 100% |

as compared to the 2014 period

| |

• | Incurred special charges of $4.2 million due to the ongoing implementation of the Global Business Services Center in Manila, integration costs for the GAB Robins acquisition, and restructuring activities in the EMEA/AP and Americas segments, all designed to reduce future costs |

| |

• | Overall corporate results were also negatively impacted in the 2015 period by a lack of weather-related claims in the U.S. and EMEA/AP, the expected runoff of certain large projects in Legal Settlement Administration, and an increase in our effective tax rate |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Mr. Jeffrey T. Bowman, chief executive officer of Crawford & Company, stated, "The market backdrop continued to be challenging through the second quarter given the persistent absence of claim volumes in the global property and casualty insurance industry, driven in part from a lack of severe weather. This environment has driven a further shift in our business to lower margin, high volume claims in the U.S., and has had a pronounced negative impact on our EMEA/AP operations. We are aggressively managing our business to drive margin expansion in this difficult operating environment, having implemented several cost reduction plans in the first quarter, as well as continuing to develop our Global Business Services Center in Manila. We are beginning to realize the benefits of these initiatives as our Americas segment achieved their operating margin target of 10% in the second quarter, and we expect our EMEA/ AP operations to show margin expansion over the second half of this year."

"Our Broadspire segment continued to perform well this quarter delivering 10% revenue growth with operating earnings more than doubling year over year. We are adding new accounts in the core workers' compensation arena and are gaining traction with our recently announced disability product," added Mr. Bowman. "Our Legal Settlement Administration segment continues to work through the run off of a few large cases which remains a headwind to our results that will continue through the balance of the year. We are pleased with how this transition is being managed in terms of operating profitability and are also encouraged with the progress being made in the mass tort marketplace."

Mr. Bowman concluded, "While I am disappointed with our results for the first half of the year, the progress that we have made realigning our cost structure provides optimism about where our Company is heading. Our cost reduction plans, when complete, should enable our businesses to achieve their operating margin targets in this high volume, low value claim environment. Looking forward, we are positioning our Company to create long-term shareholder value by focusing on profitable growth and leveraging the Company's numerous global resources."

Second Quarter 2015 Financial Results Compared to Prior Year Period

Second quarter 2015 consolidated revenues before reimbursements totaled $304.4 million, compared with $288.2 million for second quarter 2014. Second quarter 2015 net income attributable to shareholders of Crawford & Company was $4.1 million compared with net income of $10.5 million in the second quarter of 2014. Second quarter 2015 diluted earnings per share were $0.08 for CRDA and $0.06 for CRDB, compared with diluted earnings per share of $0.19 for CRDA and $0.18 for CRDB in the prior year quarter. Consolidated operating earnings, a non-GAAP financial measure, were $17.7 million in the 2015 second quarter, compared with $20.9 million in the 2014 period.

During the 2015 second quarter, the Company recorded special charges of $4.2 million, or $0.06 per share, associated with the ongoing implementation of its Global Business Services Center in Manila, Philippines, integration costs of the GAB Robins acquisition, and restructuring activities in the Americas and EMEA/AP segments. Before these special charges, second quarter 2015 diluted earnings per share on a non-GAAP basis were $0.14 for CRDA and $0.12 for CRDB.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Segment Results

Americas

Americas revenues before reimbursements were $99.2 million in the second quarter of 2015, increasing from $93.6 million in the second quarter of 2014. The increase in U.S. Claims Services revenues in the second quarter 2015 compared with the second quarter 2014 was primarily due to an increase in the U.S. Catastrophe Services service line resulting from an outsourcing project for a major U.S.insurance carrier, partially offset by a decrease in the U.S. Claims Field Operations service line due to a reduction of weather-related case volumes. Changes in foreign exchange rates reduced our Americas revenues by approximately 5% for the three months ended June 30, 2015.Operating earnings were $9.9 million in the 2015 second quarter, compared with $8.1 million in the second quarter of 2014, representing an operating margin of 10% and 9% in the 2015 and 2014 periods, respectively.

EMEA/AP

Second quarter 2015 revenues before reimbursements for the EMEA/AP segment totaled $97.2 million, compared with $87.2 million in the 2014 second quarter. This increase was due to the inclusion of $21.8 million in revenues from the acquisition of GAB Robins in the U.K. Changes in foreign exchange rates negatively impacted revenues in this segment by approximately 13% in the second quarter of 2015 compared with the prior year period. EMEA/AP operating earnings were $1.1 million in the 2015 second quarter, compared with $4.3 million in the 2014 quarter. The segment's operating margin was 1% in the 2015 period as compared to 5% in the 2014 quarter.

Broadspire

Broadspire segment revenues before reimbursements were $73.7 million in the 2015 second quarter, up from $66.7 million in the 2014 second quarter. Broadspire recorded operating earnings of $6.0 million in the second quarter of 2015, representing an operating margin of 8%, compared with $2.7 million, or 4% of revenues, in the 2014 second quarter. The overall increase in 2015 revenues was primarily due to organic growth, new clients, higher client retention, the transfer of accident and health cases from our U.S. Claims Services service line in the Americas segment, and increased medical management services referrals.

Legal Settlement Administration

Legal Settlement Administration revenues before reimbursements were $34.3 million in the second quarter of 2015, compared with $40.7 million in the same period of 2014. The decrease in revenues was primarily due to anticipated declines in volumes associated with several large cases. Operating earnings were $3.7 million in the 2015 second quarter as compared to $5.7 million in the 2014 period, with the related operating margin decreasing from 14% in the 2014 period to 11% in the 2015 period.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Balance Sheet and Cash Flow

Crawford & Company's consolidated cash and cash equivalents position as of June 30, 2015 totaled $62.5 million compared with $52.5 million at December 31, 2014.

The Company provided $10.2 million of cash from operations during the first six months of 2015, compared with $59.6 million used during the first six months of 2014. The $69.8 million improvement in cash provided by operating activities in the first six months of 2015 compared with the 2014 period, was primarily due to improved collections of accounts receivable and lower payments for accrued liabilities, including incentive compensation.

The Company's effective tax rate increased during the second quarter and first six months of 2015, as compared to the 2014 periods, due primarily to our inability to recognize tax benefits for certain international net operating losses, fluctuations in the mix of income earned, and changes in enacted tax rates.

2015 Guidance

Crawford & Company is revising its guidance for 2015 as follows:

| |

• | Consolidated revenues before reimbursements between $1.16 and $1.18 billion; |

| |

• | Consolidated operating earnings between $70.0 and $80.0 million; |

| |

• | Consolidated cash provided by operating activities between $30.0 and $40.0 million; |

| |

• | After special charges, net income attributable to shareholders of Crawford & Company between $20.0 and $25.0 million, or $0.37 to $0.47 diluted earnings per CRDA share, or $0.30 to $0.40 diluted earnings per CRDB share; |

| |

• | Before special charges, net income attributable to shareholders of Crawford & Company between $34.5 and $39.5 million, or $0.63 to $0.73 diluted earnings per CRDA share, or $0.56 to $0.66 diluted earnings per CRDB share. |

The Company expects to incur pretax special charges in 2015, currently estimated at approximately $7.0 million for the integration of GAB Robins and $9.0 million related to the establishment of a Global Business Services Center in Manila, Philippines. In addition, the Company expects to incur an additional special charge in 2015, currently estimated at $4.0 million, related to restructuring activities in the EMEA/AP and Americas segments.

To a significant extent, Crawford's business depends on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of claims and revenue for the Company, are generally not subject to accurate forecasting.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

In recent periods the Company has derived a material portion of its revenues and operating earnings from a limited number of client engagements and special projects within its Legal Settlement Administration segment, specifically its work on the gulf-related class action settlement. Although the Company continued to earn revenues from the Legal Settlement Administration projects in the second quarter 2015, these revenues, and related operating earnings, were at a reduced rate as compared to 2014. The projects continue to wind down, and the Company expects these revenues, and related operating earnings, to be at a reduced rate in all future periods, as compared to 2014. No assurances of timing of the project end dates and, therefore, continued revenues or operating earnings, can be provided. In the event the Company is unable to replace revenues and related operating earnings from these projects as they wind down, or upon the termination or other expiration thereof, with revenues and operating earnings from new projects and customers within this or other segments, there could be a material adverse effect on the Company's results of operations.

Conference Call

Crawford & Company's management will host a conference call with investors on Monday, August 3, 2015 at 3:00 p.m. Eastern Time to discuss second quarter 2015 results. The call will be recorded and available for replay through September 3, 2015. You may dial 1-800-374-2518 to listen to the replay. The access code is 23943884. Alternatively, please visit our web site at www.crawfordandcompany.com for a live audio web cast and related financial presentation.

Non-GAAP Presentation

In the normal course of business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In the foregoing discussion and analysis of segment results of operations, we do not include a gross up of segment expenses and revenues for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our results of operations with no impact to our net income or operating earnings. A reconciliation of revenues before reimbursements to consolidated revenues determined in accordance with GAAP is self-evident from the face of the accompanying unaudited condensed consolidated statements of income.

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker ("CODM") to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Unlike net income, segment operating earnings is not a standard performance measure found in GAAP. We believe this measure is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria used by our senior management and CODM. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, any special charges or credits, income taxes, and net income or loss attributable to noncontrolling interests. The reconciliation of operating earnings to net income attributable to shareholders of Crawford & Company on a GAAP basis is presented below.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Unallocated corporate and shared costs and credits represent expenses and credits related to our chief executive officer and Board of Directors, certain provisions for bad debt allowances or subsequent recoveries such as those related to bankrupt clients, defined benefit pension costs or credits for our frozen U.S. pension plan, and certain self-insurance costs and recoveries that are not allocated to our individual operating segments but are included in our financial performance measure of consolidated operating earnings. Special charges or credits are non-core items not directly related to our normal business or operations, or our future performance.

Income taxes, net corporate interest expense, stock option expense, and amortization of customer-relationship intangible assets are recurring components of our net income, but they are not considered part of our consolidated or segment operating earnings because they are managed on a corporate-wide basis. Income taxes are calculated for the Company on a consolidated basis based on statutory rates in effect in the various jurisdictions in which we provide services, and varies significantly by jurisdiction. Net corporate interest expense results from capital structure decisions made by senior management and the Board of Directors and affecting the Company as a whole. Stock option expense represents the non-cash costs generally related to stock options and employee stock purchase plan expenses which are not allocated to our operating segments. Amortization expense is a non-cash expense for finite-lived customer-relationship and trade name intangible assets acquired in business combinations. None of these costs relate directly to the performance of our services or operating activities and, therefore, are excluded from segment operating earnings in order to better assess the results of each segment's operating activities on a consistent basis.

Following is a reconciliation of segment and consolidated operating earnings to net income attributable to shareholders of Crawford & Company on a GAAP basis and the related margins as a percentage of revenues before reimbursements for all periods presented (in thousands, except percentages):

|

| | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended |

| June 30, 2015 | % Margin | June 30, 2014 | % Margin | | June 30, 2015 | % Margin | June 30, 2014 | % Margin |

Operating Earnings: | | | | | | | | | |

Americas | $ | 9,896 |

| 10 | % | $ | 8,142 |

| 9 | % | | $ | 14,872 |

| 8 | % | $ | 15,076 |

| 8 | % |

EMEA/AP | 1,106 |

| 1 | % | 4,310 |

| 5 | % | | 2,634 |

| 1 | % | 6,210 |

| 4 | % |

Broadspire | 6,006 |

| 8 | % | 2,715 |

| 4 | % | | 9,543 |

| 7 | % | 4,718 |

| 4 | % |

Legal Settlement Administration | 3,721 |

| 11 | % | 5,700 |

| 14 | % | | 8,672 |

| 12 | % | 10,667 |

| 13 | % |

Unallocated corporate and shared costs and credits, net | (3,046 | ) | (1 | )% | 53 |

| — | % | | (7,342 | ) | (1 | )% | (1,690 | ) | — | % |

Consolidated Operating Earnings | 17,683 |

| 6 | % | 20,920 |

| 7 | % | | 28,379 |

| 5 | % | 34,981 |

| 6 | % |

Deduct: | | | | | | | | | |

Net corporate interest expense | (2,042 | ) | (1 | )% | (1,551 | ) | (1 | )% | | (3,906 | ) | (1 | )% | (2,852 | ) | (1 | )% |

Stock option expense | (178 | ) | — | % | (202 | ) | — | % | | (327 | ) | — | % | (496 | ) | — | % |

Amortization expense | (2,334 | ) | (1 | )% | (1,611 | ) | (1 | )% | | (4,432 | ) | (1 | )% | (3,203 | ) | (1 | )% |

Special charges | (4,242 | ) | (1 | )% | — |

| — | % | | (5,305 | ) | (1 | )% | — |

| — | % |

Income taxes | (4,709 | ) | (2 | )% | (6,962 | ) | (2 | )% | | (6,950 | ) | (1 | )% | (11,250 | ) | (2 | )% |

Net income attributable to non-controlling interests | (124 | ) | — | % | (130 | ) | — | % | | (419 | ) | — | % | (64 | ) | — | % |

Net income attributable to shareholders of Crawford & Company | $ | 4,054 |

| 1 | % | $ | 10,464 |

| 4 | % | | $ | 7,040 |

| 1 | % | $ | 17,116 |

| 3 | % |

| | | | | | | | | |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Further information regarding the Company's operating results for the quarter and six months ended June 30, 2015, financial position as of June 30, 2015, and cash flows for the six months ended June 30, 2015 is shown on the attached unaudited condensed consolidated financial statements.

About Crawford & Company

Based in Atlanta, Georgia, Crawford & Company (www.crawfordandcompany.com) is the world's largest (based on annual revenues) independent provider of claims management solutions to the risk management and insurance industry, as well as to self-insured entities, with an expansive global network serving clients in more than 70 countries. The Crawford SolutionSM offers comprehensive, integrated claims services, business process outsourcing and consulting services for major product lines including property and casualty claims management, workers' compensation claims and medical management, and legal settlement administration. The Company's shares are traded on the NYSE under the symbols CRDA and CRDB.

The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting CRDA than on the voting CRDB, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class.

Earnings per share may be different between CRDA and CRDB due to the payment of a higher per share dividend on CRDA than CRDB, and the impact that has on the earnings per share calculation according to generally accepted accounting principles.

FOR FURTHER INFORMATION REGARDING THIS PRESS RELEASE, PLEASE CALL BRUCE SWAIN AT (404) 300-1051.

|

|

This press release contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not historical facts may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. For further information regarding Crawford & Company, including factors that could cause our actual financial condition, results or earnings to differ from those described in any forward-looking statements, please read Crawford & Company's reports filed with the SEC and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

| | | | | | | | | | |

| | | | | |

Three Months Ended June 30, | 2015 | | 2014 | | % Change |

| | | | | |

Revenues: | | | | | |

| |

| | |

| | |

Revenues Before Reimbursements | $ | 304,398 |

| | $ | 288,216 |

| | 6 | % |

Reimbursements | 20,018 |

| | 18,837 |

| | 6 | % |

Total Revenues | 324,416 |

| | 307,053 |

| | 6 | % |

| | | | | |

Costs and Expenses: | | | | | |

| | | | | |

Costs of Services Provided, Before Reimbursements | 232,108 |

| | 208,249 |

| | 11 | % |

Reimbursements | 20,018 |

| | 18,837 |

| | 6 | % |

Total Costs of Services | 252,126 |

| | 227,086 |

| | 11 | % |

| | | | | |

Selling, General, and Administrative Expenses | 57,221 |

| | 60,902 |

| | (6 | )% |

Corporate Interest Expense, Net | 2,042 |

| | 1,551 |

| | 32 | % |

Special Charges | 4,242 |

| | — |

| | nm |

|

Total Costs and Expenses | 315,631 |

| | 289,539 |

| | 9 | % |

| | | | | |

Other Income | 102 |

| | 42 |

| | 143 | % |

| | | | | |

Income Before Income Taxes | 8,887 |

| | 17,556 |

| | (49 | )% |

Provision for Income Taxes | 4,709 |

| | 6,962 |

| | (32 | )% |

| | | | | |

Net Income | 4,178 |

| | 10,594 |

| | (61 | )% |

| | | | | |

Net Income Attributable to Noncontrolling Interests | (124 | ) | | (130 | ) | | nm |

|

| | | | | |

Net Income Attributable to Shareholders of Crawford & Company | $ | 4,054 |

| | $ | 10,464 |

| | (61 | )% |

| | | | | |

| | | | | |

Earnings Per Share - Basic: | | | | | |

Class A Common Stock | $ | 0.08 |

| | $ | 0.19 |

| | (58 | )% |

Class B Common Stock | $ | 0.06 |

| | $ | 0.18 |

| | (67 | )% |

| | | | | |

Earnings Per Share - Diluted: | | | | | |

Class A Common Stock | $ | 0.08 |

| | $ | 0.19 |

| | (58 | )% |

Class B Common Stock | $ | 0.06 |

| | $ | 0.18 |

| | (67 | )% |

| | | | | |

Cash Dividends Per Share: | | | | | |

Class A Common Stock | $ | 0.07 |

| | $ | 0.05 |

| | 40 | % |

Class B Common Stock | $ | 0.05 |

| | $ | 0.04 |

| | 25 | % |

| | | | | |

nm = not meaningful | | | | | |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

| | | | | | | | | | |

| | | | | |

Six Months Ended June 30, | 2015 | | 2014 | | % Change |

| | | | | |

Revenues: | | | | | |

| |

| | |

| | |

Revenues Before Reimbursements | $ | 592,175 |

| | $ | 563,565 |

| | 5 | % |

Reimbursements | 38,857 |

| | 32,846 |

| | 18 | % |

Total Revenues | 631,032 |

| | 596,411 |

| | 6 | % |

| | | | | |

Costs and Expenses: | | | | | |

| | | | | |

Costs of Services Provided, Before Reimbursements | 451,431 |

| | 412,142 |

| | 10 | % |

Reimbursements | 38,857 |

| | 32,846 |

| | 18 | % |

Total Costs of Services | 490,288 |

| | 444,988 |

| | 10 | % |

| | | | | |

Selling, General, and Administrative Expenses | 117,608 |

| | 120,632 |

| | (3 | )% |

Corporate Interest Expense, Net | 3,906 |

| | 2,852 |

| | 37 | % |

Special Charges | 5,305 |

| | — |

| | nm |

|

Total Costs and Expenses | 617,107 |

| | 568,472 |

| | 9 | % |

| | | | | |

Other Income | 484 |

| | 491 |

| | (1 | )% |

| | | | | |

Income Before Income Taxes | 14,409 |

| | 28,430 |

| | (49 | )% |

Provision for Income Taxes | 6,950 |

| | 11,250 |

| | (38 | )% |

| | | | | |

Net Income | 7,459 |

| | 17,180 |

| | (57 | )% |

| | | | | |

Net Income Attributable to Noncontrolling Interests | (419 | ) | | (64 | ) | | nm |

|

| | | | | |

Net Income Attributable to Shareholders of Crawford & Company | $ | 7,040 |

| | $ | 17,116 |

| | (59 | )% |

| | | | | |

| | | | | |

Earnings Per Share - Basic: | | | | | |

Class A Common Stock | $ | 0.15 |

| | $ | 0.32 |

| | (53 | )% |

Class B Common Stock | $ | 0.11 |

| | $ | 0.30 |

| | (63 | )% |

| | | | | |

Earnings Per Share - Diluted: | | | | | |

Class A Common Stock | $ | 0.14 |

| | $ | 0.32 |

| | (56 | )% |

Class B Common Stock | $ | 0.11 |

| | $ | 0.30 |

| | (63 | )% |

| | | | | |

Cash Dividends Per Share: | | | | | |

Class A Common Stock | $ | 0.14 |

| | $ | 0.10 |

| | 40 | % |

Class B Common Stock | $ | 0.10 |

| | $ | 0.08 |

| | 25 | % |

| | | | | |

nm = not meaningful | | | | | |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

As of June 30, 2015 and December 31, 2014

(In Thousands, Except Par Values) |

| | | | | | | |

| | | * |

| June 30, | | December 31, |

| 2015 | | 2014 |

ASSETS | | | |

| | | |

Current Assets: | | | |

Cash and Cash Equivalents | $ | 62,454 |

| | $ | 52,456 |

|

Accounts Receivable, Net | 181,387 |

| | 180,096 |

|

Unbilled Revenues, at Estimated Billable Amounts | 117,169 |

| | 103,163 |

|

Income Taxes Receivable | 2,779 |

| | 2,779 |

|

Prepaid Expenses and Other Current Assets | 29,628 |

| | 29,089 |

|

Total Current Assets | 393,417 |

| | 367,583 |

|

| | | |

Property and Equipment | 148,205 |

| | 143,273 |

|

Less Accumulated Depreciation | (107,204 | ) | | (102,414 | ) |

Net Property and Equipment | 41,001 |

| | 40,859 |

|

| | | |

Other Assets: | | | |

Goodwill | 142,402 |

| | 131,885 |

|

Intangible Assets Arising from Business Acquisitions, Net | 110,314 |

| | 75,895 |

|

Capitalized Software Costs, Net | 78,770 |

| | 75,536 |

|

Deferred Income Tax Assets | 70,357 |

| | 66,927 |

|

Other Noncurrent Assets | 34,614 |

| | 30,634 |

|

Total Other Assets | 436,457 |

| | 380,877 |

|

| | | |

Total Assets | $ | 870,875 |

| | $ | 789,319 |

|

| | | |

LIABILITIES AND SHAREHOLDERS' INVESTMENT | | | |

| | | |

Current Liabilities: | | | |

Short-Term Borrowings | $ | 3,320 |

| | $ | 2,002 |

|

Accounts Payable | 49,723 |

| | 48,597 |

|

Accrued Compensation and Related Costs | 72,289 |

| | 82,151 |

|

Self-Insured Risks | 13,601 |

| | 14,491 |

|

Income Taxes Payable | 4,616 |

| | 2,618 |

|

Deferred Income Taxes | 14,228 |

| | 14,523 |

|

Deferred Rent | 12,464 |

| | 13,576 |

|

Other Accrued Liabilities | 39,870 |

| | 35,784 |

|

Deferred Revenues | 45,623 |

| | 45,054 |

|

Current Installments of Long-Term Debt and Capital Leases | 1,885 |

| | 763 |

|

Total Current Liabilities | 257,619 |

| | 259,559 |

|

| | | |

Noncurrent Liabilities: | | | |

Long-Term Debt and Capital Leases, Less Current Installments | 249,447 |

| | 154,046 |

|

Deferred Revenues | 26,800 |

| | 26,706 |

|

Self-Insured Risks | 10,110 |

| | 10,041 |

|

Accrued Pension Liabilities | 126,929 |

| | 142,343 |

|

Other Noncurrent Liabilities | 18,861 |

| | 17,271 |

|

Total Noncurrent Liabilities | 432,147 |

| | 350,407 |

|

| | | |

Shareholders' Investment: | | | |

Class A Common Stock, $1.00 Par Value | 30,706 |

| | 30,497 |

|

Class B Common Stock, $1.00 Par Value | 24,690 |

| | 24,690 |

|

Additional Paid-in Capital | 40,113 |

| | 38,617 |

|

Retained Earnings | 301,254 |

| | 301,091 |

|

Accumulated Other Comprehensive Loss | (227,686 | ) | | (221,958 | ) |

Shareholders' Investment Attributable to Shareholders of Crawford & Company | 169,077 |

| | 172,937 |

|

Noncontrolling Interests | 12,032 |

| | 6,416 |

|

Total Shareholders' Investment | 181,109 |

| | 179,353 |

|

| | | |

Total Liabilities and Shareholders' Investment | $ | 870,875 |

| | $ | 789,319 |

|

* Derived from the audited Consolidated Balance Sheet

Press Release

`CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

SUMMARY RESULTS BY OPERATING SEGMENT

Unaudited

(In Thousands, Except Percentages)

Three Months Ended June 30,

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Americas | % | EMEA/AP | % | Broadspire | % | Legal Settlement Administration | % |

| 2015 | 2014 | Change | 2015 | 2014 | Change | 2015 | 2014 | Change | 2015 | 2014 | Change |

| | | | | | | | | | | | |

Revenues Before Reimbursements | $ | 99,190 |

| $ | 93,601 |

| 6 | % | $ | 97,191 |

| $ | 87,246 |

| 11 | % | $ | 73,693 |

| $ | 66,706 |

| 10 | % | $ | 34,324 |

| $ | 40,663 |

| (16 | )% |

| | | | | | | | | | | | |

Direct Compensation, Fringe Benefits & Non-Employee Labor | 63,873 |

| 58,917 |

| 8 | % | 64,398 |

| 60,894 |

| 6 | % | 39,509 |

| 37,488 |

| 5 | % | 23,923 |

| 28,911 |

| (17 | )% |

% of Revenues Before Reimbursements | 64 | % | 63 | % | | 66 | % | 70 | % | | 54 | % | 56 | % | | 70 | % | 71 | % | |

| | | | | | | | | | | | |

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor | 25,421 |

| 26,542 |

| (4 | )% | 31,687 |

| 22,042 |

| 44 | % | 28,178 |

| 26,503 |

| 6 | % | 6,680 |

| 6,052 |

| 10 | % |

% of Revenues Before Reimbursements | 26 | % | 28 | % | | 33 | % | 25 | % | | 38 | % | 40 | % | | 19 | % | 15 | % | |

| | | | | | | | | | | | |

Total Operating Expenses | 89,294 |

| 85,459 |

| 4 | % | 96,085 |

| 82,936 |

| 16 | % | 67,687 |

| 63,991 |

| 6 | % | 30,603 |

| 34,963 |

| (12 | )% |

| | | | | | | | | | | | |

Operating Earnings (1) | $ | 9,896 |

| $ | 8,142 |

| 22 | % | $ | 1,106 |

| $ | 4,310 |

| (74 | )% | $ | 6,006 |

| $ | 2,715 |

| 121 | % | $ | 3,721 |

| $ | 5,700 |

| (35 | )% |

% of Revenues Before Reimbursements | 10 | % | 9 | % | | 1 | % | 5 | % | | 8 | % | 4 | % | | 11 | % | 14 | % | |

Six Months Ended June 30,

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Americas | % | EMEA/AP | % | Broadspire | % | Legal Settlement Administration | % |

| 2015 | 2014 | Change | 2015 | 2014 | Change | 2015 | 2014 | Change | 2015 | 2014 | Change |

| | | | | | | | | | | | |

Revenues Before Reimbursements | $ | 188,657 |

| $ | 181,492 |

| 4 | % | $ | 188,454 |

| $ | 167,582 |

| 12 | % | $ | 143,365 |

| $ | 131,464 |

| 9 | % | $ | 71,699 |

| $ | 83,027 |

| (14 | )% |

| | | | | | | | | | | | |

Direct Compensation, Fringe Benefits & Non-Employee Labor | 125,695 |

| 115,668 |

| 9 | % | 126,316 |

| 118,806 |

| 6 | % | 78,950 |

| 75,107 |

| 5 | % | 49,325 |

| 58,986 |

| (16 | )% |

% of Revenues Before Reimbursements | 67 | % | 64 | % | | 67 | % | 71 | % | | 55 | % | 57 | % | | 69 | % | 71 | % | |

| | | | | | | | | | | | |

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor | 48,090 |

| 50,748 |

| (5 | )% | 59,504 |

| 42,566 |

| 40 | % | 54,872 |

| 51,639 |

| 6 | % | 13,702 |

| 13,374 |

| 2 | % |

% of Revenues Before Reimbursements | 25 | % | 28 | % | | 32 | % | 25 | % | | 38 | % | 39 | % | | 19 | % | 16 | % | |

| | | | | | | | | | | | |

Total Operating Expenses | 173,785 |

| 166,416 |

| 4 | % | 185,820 |

| 161,372 |

| 15 | % | 133,822 |

| 126,746 |

| 6 | % | 63,027 |

| 72,360 |

| (13 | )% |

| | | | | | | | | | | | |

Operating Earnings (1) | $ | 14,872 |

| $ | 15,076 |

| (1 | )% | $ | 2,634 |

| $ | 6,210 |

| (58 | )% | $ | 9,543 |

| $ | 4,718 |

| 102 | % | $ | 8,672 |

| $ | 10,667 |

| (19 | )% |

% of Revenues Before Reimbursements | 8 | % | 8 | % | | 1 | % | 4 | % | | 7 | % | 4 | % | | 12 | % | 13 | % | |

NOTE: "Direct Compensation, Fringe Benefits & Non-Employee Labor" and "Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor" components are not comparable across

segments, but are comparable within each segment across periods.

(1) A non-GAAP financial measurement which represents net income attributable to the applicable reporting segment excluding income taxes, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, special charges, and certain unallocated corporate and shared costs and credits. See pages 5-6 for additional information about segment operating earnings.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Six Months Ended June 30, 2015 and June 30, 2014

Unaudited

(In Thousands) |

| | | | | | | | |

| | 2015 | | 2014 |

Cash Flows From Operating Activities: | | | | |

Net Income | | $ | 7,459 |

| | $ | 17,180 |

|

Reconciliation of Net Income to Net Cash Provided By (Used In) Operating Activities: | | | | |

Depreciation and Amortization | | 21,407 |

| | 18,574 |

|

Stock-Based Compensation | | 1,280 |

| | 743 |

|

Loss on Disposals of Property and Equipment, Net | | 33 |

| | — |

|

Changes in Operating Assets and Liabilities, Net of Effects of Acquisitions and Dispositions: | | | | |

Accounts Receivable, Net | | 13,338 |

| | (26,366 | ) |

Unbilled Revenues, Net | | (11,507 | ) | | (13,564 | ) |

Accrued or Prepaid Income Taxes | | 2,371 |

| | 3,633 |

|

Accounts Payable and Accrued Liabilities | | (16,777 | ) | | (37,314 | ) |

Deferred Revenues | | (308 | ) | | (2,025 | ) |

Accrued Retirement Costs | | (12,794 | ) | | (15,423 | ) |

Prepaid Expenses and Other Operating Activities | | 5,718 |

| | (5,057 | ) |

Net Cash Provided By (Used In) Operating Activities | | 10,220 |

| | (59,619 | ) |

| | | | |

Cash Flows From Investing Activities: | | | | |

Acquisitions of Property and Equipment | | (5,333 | ) | | (5,691 | ) |

Proceeds from Disposals of Property and Equipment | | — |

| | 1,289 |

|

Capitalization of Computer Software Costs | | (10,871 | ) | | (7,930 | ) |

Payments for Acquisitions, Net of Cash Acquired | | (66,077 | ) | | — |

|

Cash Surrendered in Sale of Business | | — |

| | (1,554 | ) |

Net Cash Used In Investing Activities | | (82,281 | ) | | (13,886 | ) |

| | | | |

Cash Flows From Financing Activities: | | | | |

Cash Dividends Paid | | (6,757 | ) | | (4,991 | ) |

Payments Related to Shares Received for Withholding Taxes Under Stock-Based Compensation Plans | | (2 | ) | | (1,361 | ) |

Proceeds from Shares Purchased Under Employee Stock-Based Compensation Plans | | 444 |

| | 518 |

|

Repurchases of Common Stock | | (137 | ) | | (2,791 | ) |

Increases in Short-Term and Revolving Credit Facility Borrowings | | 117,672 |

| | 79,142 |

|

Payments on Short-Term and Revolving Credit Facility Borrowings | | (24,951 | ) | | (24,424 | ) |

Payments on Capital Lease Obligations | | (1,072 | ) | | (440 | ) |

Dividends Paid to Noncontrolling Interests | | — |

| | (142 | ) |

Other Financing Activities | | (2 | ) | | (32 | ) |

Net Cash Provided By Financing Activities | | 85,195 |

| | 45,479 |

|

| | | | |

Effects of Exchange Rate Changes on Cash and Cash Equivalents | | (3,136 | ) | | (193 | ) |

Increase (Decrease) in Cash and Cash Equivalents | | 9,998 |

| | (28,219 | ) |

Cash and Cash Equivalents at Beginning of Year | | 52,456 |

| | 75,953 |

|

Cash and Cash Equivalents at End of Period | | $ | 62,454 |

| | $ | 47,734 |

|

Second Quarter 2015 Earnings Conference Call August 3, 2015 Crawford & Company

PAGE 2 • Forward-Looking Statements —This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. —Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. —In recent periods the Company has derived a material portion of its revenues and operating earnings from a limited number of client engagements and special projects within its Legal Settlement Administration segment, specifically its work on the gulf-related class action settlement. These projects continue to wind down, and related revenues and operating earnings have been and are expected to continue to be at a reduced rate in future periods as compared to 2014. No assurances of timing of the project end dates and, therefore, continued revenues or operating earnings, can be provided. • Revenues Before Reimbursements ("Revenues") —Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. • Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, special charges, stock option expense, earnings or loss attributable to non-controlling interests, and certain unallocated corporate and shared costs and credits. Consolidated operating earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. • Earnings Per Share —The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class. —In certain periods, the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two- class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. • Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

PAGE 3 • The world's largest independent provider of global claims management solutions • Multiple globally recognized brand names: Crawford, Broadspire, GCG • Clients include multinational insurance carriers, brokers and local insurance firms as well as 200 of the Fortune 500 GLOBAL BUSINESS SERVICES LEADER EMEA-A/P 1 Serves the U.K., European, Middle Eastern, African and Asia Pacific markets BROADSPIRE 3 Serves large national accounts, carriers and self-insured entities AMERICAS 2 Serves the U.S., Canadian and Latin American markets LEGAL SETTLEMENT ADMINISTRATION 4 Provides administration for class action settlements and bankruptcy matters

TODAY'S AGENDA --- Welcome and Opening Comments --- Second Quarter 2015 Financial Review --- Updated Guidance

PAGE 5 20.9 304 288 Revenues ($ in millions) Consolidated Operating Earnings ($ in millions) • Revenues of $304.4 million • Consolidated operating earnings of $17.7 million • Diluted earnings per share of $0.08 for CRDA and $0.06 for CRDB • Diluted earnings per share on a non-GAAP basis (1) of $0.14 for CRDA and $0.12 for CRDB, before the impact of $4.2 million in special charges in second quarter 2015 • Strategic cost reduction program underway for Americas and EMEA/AP, costs and savings to continue through 2015 • Americas segment achieved 10% operating margin target during quarter • Broadspire revenues up 10% and operating earnings more than double • Runoff of large projects in Legal Settlement Administration • Global Business Services Center initiative continues with Broadspire already showing benefits SECOND QUARTER 2015 BUSINESS SUMMARY 17.7 (1) See Appendix for non-GAAP explanation and reconciliation

SECOND QUARTER 2015 Financial Review

PAGE 7 Unaudited ($ in thousands, except per share amounts) Three Months Ended June 30, 2015 2014 % Change Revenues Before Reimbursements $304,398 $288,216 6 % Costs of Services Before Reimbursements 232,108 208,249 11 % Selling, General, and Administrative Expenses 57,221 60,902 (6 )% Corporate Interest Expense, Net 2,042 1,551 32 % Special Charges 4,242 — nm Total Costs and Expenses Before Reimbursements 295,613 270,702 9 % Other Income 102 42 143 % Income Before Income Taxes 8,887 17,556 (49 )% Provision for Income Taxes 4,709 6,962 (32 )% Net Income 4,178 10,594 (61 )% Net Income Attributable to Noncontrolling Interests (124 ) (130 ) nm Net Income Attributable to Shareholders of Crawford & Company $4,054 $10,464 (61 )% Earnings Per Share - Diluted: Class A Common Stock $0.08 $0.19 (58 )% Class B Common Stock $0.06 $0.18 (67 )% Cash Dividends per Share: Class A Common Stock $0.07 $0.05 40 % Class B Common Stock $0.05 $0.04 25 % INCOME STATEMENT HIGHLIGHTS nm=not meaningful

PAGE 8 U.S. Canada Latin America/ Caribbean Revenues by Geographic Region ($ in millions) Americas Cases Received (In thousands) U.S. Canada Latin America/ Caribbean Operating Results (2Q 2015 v. 2Q 2014) • Revenues of $99.2 million versus $93.6 million • Exchange rates reduced revenues by 4.9% • Operating earnings of $9.9 million versus $8.1 million • Operating earnings margins of 10.0% versus 8.7% • Cases received of 155,532 versus 169,983; 2014 period included 8,100 affinity cases, now handled by the Broadspire segment U.S. Property and Casualty • Long-term outsourcing project to assist major U.S. insurer offset decline in weather-related cases • Cost reduction initiatives will continue through 2015 Canada • Revenues increased on constant dollar basis, but declined slightly due to negative exchange rate impact • Canadian Contractor Connection network expansion continued Latin America & Caribbean • Cost reduction initiatives will continue through 2015 AMERICAS SEGMENT HIGHLIGHTS

PAGE 9 9.1 85.9 6.5 23.3 11.5 7.0 Revenues ($ in millions) Catastrophe Cases (In thousands) U.S. Catastrophe (CAT) Adjuster Activity • CAT revenues in the 2015 period included $13.6 million under an outsourcing arrangement with a major U.S. insurer where the Company supplies adjusters to the client's location without corresponding case referrals. • Revenues from this arrangement in the 2014 period were $3.0 million. AMERICAS SEGMENT HIGHLIGHTS (cont.) 11.9

PAGE 10 U.K. Europe U.K. Asia-Pacific Asia-Pacific Europe Revenues by Geographic Region ($ in millions) EMEA/AP Cases Received (In thousands) Operating Results (2Q 2015 v. 2Q 2014) • Revenues of $97.2 million versus $87.2 million • Exchange rates reduced revenues by 13.4% • Operating earnings of $1.1 million versus $4.3 million • Operating earnings margins of 1.1% versus 4.9% • Cases received of 139,667 versus 126,727 U.K. • U.K. acquisition of GAB Robins drove revenue and case growth • Acquisition integration underway with cost takeouts expected to benefit second half of year Europe • Claims volume increased in second quarter from high frequency claims • Continued focus on improving operating performance Asia-Pacific • Benign weather during 2015 EMEA/AP SEGMENT HIGHLIGHTS

PAGE 11 Revenues by Service Line ($ in millions) Broadspire Cases Received (In thousands) Risk Mgmt Info. Svcs. Other Medical Mgmt. Casualty Workers' Comp. Workers' Comp. Operating Results (2Q 2015 v. 2Q 2014) • Revenues of $73.7 million versus $66.7 million • Operating earnings of $6.0 million versus $2.7 million • Operating earnings margins of 8.2% versus 4.1% • Cases received of 107,940 versus 89,997, including 15,500 accident & health cases in the 2015 period, previously handled by the Americas segment Broadspire • Strong growth in casualty claims • Medical management revenues increased from greater utilization • Disability and absence management services products gaining traction in the market • Continuing to engage and develop employees Second BROADSPIRE SEGMENT HIGHLIGHTS

PAGE 12 Backlog ($ in millions) Operating Results (2Q 2015 v. 2Q 2014) • Revenues of $34.3 million versus $40.7 million • Operating earnings of $3.7 million versus $5.7 million • Operating earnings margins of 10.8% versus 14.0% • Backlog at $88 million versus $97 million Legal Settlement Administration • Deepwater Horizon class action settlement project continues to wind down • Remain focused on operating margin improvement as industry continues to experience price compression • Maintain new business pipeline with activities and events LEGAL SETTLEMENT ADMINISTRATION SEGMENT HIGHLIGHTS Revenues ($ in millions) 40.7 34.3 88 97

PAGE 13 Unaudited ($ in thousands) June 30, 2015 December 31, 2014 Change Cash and cash equivalents $62,454 $52,456 $9,998 Accounts receivable, net 181,387 180,096 1,291 Unbilled revenues, net 117,169 103,163 14,006 Total receivables 298,556 283,259 15,297 Goodwill and intangible assets arising from business acquisitions 252,716 207,780 44,936 Deferred revenues 72,423 71,760 663 Pension liabilities 126,929 142,343 (15,414 ) Current portion of long-term debt, capital leases and short-term borrowings 5,205 2,765 2,440 Long-term debt, less current portion 249,447 154,046 95,401 Total debt 254,652 156,811 97,841 Total stockholders' equity attributable to Crawford & Company 169,077 172,937 (3,860 ) Net debt (1) 192,198 104,355 87,843 Total debt / capitalization 60 % 48 % (1) See Appendix for non-GAAP explanation and reconciliation BALANCE SHEET HIGHLIGHTS

PAGE 14 Unaudited ($ in thousands) 2015 2014 Variance Net Income Attributable to Shareholders of Crawford & Company $ 7,040 $ 17,116 $ (10,076 ) Depreciation and Other Non-Cash Operating Items 23,139 19,381 3,758 Unbilled and Billed Receivables Change 1,831 (39,930 ) 41,761 Working Capital Change (12,487 ) (40,804 ) 28,317 U.S. and U.K. Pension Contributions (9,303 ) (15,382 ) 6,079 Cash Flows from Operating Activities 10,220 (59,619 ) 69,839 Property & Equipment Purchases, net (5,333 ) (5,691 ) 358 Capitalized Software (internal and external costs) (10,871 ) (7,930 ) (2,941 ) Free Cash Flow (1) $ (5,984 ) $ (73,240 ) $ 67,256 For the six months ended June 30, OPERATING AND FREE CASH FLOW (1) See Appendix for non-GAAP explanation

PAGE 15 Crawford & Company is revising its guidance for 2015 as follows: YEAR ENDING DECEMBER 31, 2015 Low End High End Consolidated revenues before reimbursements $1.16 $1.18 billion Consolidated operating earnings $70.0 $80.0 million Consolidated cash provided by operating activities $30.0 $40.0 million After special charges, net income attributable to shareholders of Crawford & Company $20.0 $25.0 million Diluted earnings per share--CRDA $0.37 $0.47 per share Diluted earnings per share--CRDB $0.30 $0.40 per share Before special charges, net income attributable to shareholders of Crawford & Company $34.5 $39.5 million Diluted earnings per share--CRDA $0.63 $0.73 per share Diluted earnings per share--CRDB $0.56 $0.66 per share 2015 GUIDANCE The Company expects to incur pretax special charges in 2015, currently estimated at approximately $7.0 million for the integration of GAB Robins and $9.0 million related to the establishment of a Global Business Services Center in Manila, Philippines. In addition, the Company expects to incur an additional special charge in 2015, currently estimated at $4.0 million, related to restructuring activities in the EMEA/AP and Americas segments.

Appendix SECOND QUARTER 2015

PAGE 17 Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues,respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. The GAAP-required gross up of our revenues including these pass-through reimbursed expenses is self-evident in the accompanying reconciliation. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 14. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, special charges, income taxes, and net income or loss attributable to noncontrolling interests. Non-GAAP Adjusted Net Income and Diluted Earnings per Share Included in net income and earnings per share are special charges, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to others to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations. APPENDIX: NON-GAAP FINANCIAL INFORMATION

PAGE 18 Quarter Ended Quarter Ended Full Year June 30, June 30, Guidance Unaudited ($ in thousands) 2015 2014 2015 * Revenues Before Reimbursements Total Revenues $ 324,416 $ 307,053 $ 1,250,000 Reimbursements (20,018 ) (18,837 ) (80,000 ) Revenues Before Reimbursements $ 304,398 $ 288,216 $ 1,170,000 Costs of Services Before Reimbursements Total Costs of Services $ 252,126 $ 227,086 Reimbursements (20,018 ) (18,837 ) Costs of Services Before Reimbursements $ 232,108 $ 208,249 Revenues, Costs of Services, and Operating Earnings Quarter Ended Quarter Ended Full Year June 30, June 30, Guidance Unaudited ($ in thousands) 2015 2014 2015 * Operating Earnings: Americas $ 9,896 $ 8,142 EMEA/AP 1,106 4,310 Broadspire 6,006 2,715 Legal Settlement Administration 3,721 5,700 Unallocated corporate and shared costs and credits (3,046 ) 53 Consolidated Operating Earnings 17,683 20,920 75,000 Deduct: Net corporate interest expense (2,042 ) (1,551 ) (7,400 ) Stock option expense (178 ) (202 ) (500 ) Amortization expense (2,334 ) (1,611 ) (8,500 ) Special charges and credits (4,242 ) — (20,000 ) Income taxes (4,709 ) (6,962 ) (16,000 ) Net income attributable to non-controlling interests (124 ) (130 ) (100 ) Net Income Attributable to Shareholders of Crawford & Company $ 4,054 $ 10,464 $ 22,500 RECONCILIATION OF NON-GAAP ITEMS * Midpoints of Company's August 3, 2015 Guidance

PAGE 19 RECONCILIATION OF NON-GAAP ITEMS (cont.) Net Debt June 30, December 31, Unaudited ($ in thousands) 2015 2014 Net Debt Short-term borrowings $ 3,320 $ 2,002 Current installments of long-term debt and capital leases 1,885 763 Long-term debt and capital leases, less current installments 249,447 154,046 Total debt 254,652 156,811 Less: Cash and cash equivalents 62,454 52,456 Net debt $ 192,198 $ 104,355

PAGE 20 RECONCILIATION OF NON-GAAP ITEMS (cont.) Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Three Months Ended June 30, 2015 Unaudited ($ in thousands) Income Before Taxes Tax Expense Net Income Net Income Attributable to Crawford & Company Diluted Earnings per Share (CRDA) Diluted Earnings per Share (CRDB) GAAP $ 8,887 $ 4,709 $ 4,178 $ 4,054 $ 0.08 $ 0.06 Add back: Special charges 4,242 1,145 3,097 3,097 0.06 0.06 Non-GAAP Adjusted $ 13,129 $ 5,854 $ 7,275 $ 7,151 $ 0.14 $ 0.12 Full Year Guidance for 2015 * Unaudited ($ in thousands) Income Before Taxes Tax Expense Net Income Net Income Attributable to Crawford & Company Diluted Earnings per Share (CRDA) Diluted Earnings per Share (CRDB) GAAP $ 38,600 $ 16,000 $ 22,600 $ 22,500 $ 0.42 $ 0.35 Add back: Special charges 20,000 5,500 14,500 14,500 0.26 0.26 Non-GAAP Adjusted $ 58,600 $ 21,500 $ 37,100 $ 37,000 $ 0.68 $ 0.61 * Midpoints of Company's August 3, 2015 Guidance

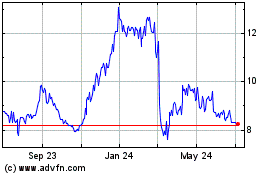

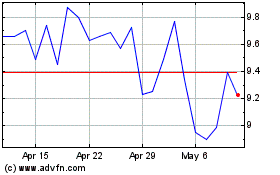

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024