Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 23, 2015

CRAWFORD & COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

| | |

| | |

1-10356 | | 58-0506554 |

|

(Commission File Number) | | (IRS Employer Identification No.) |

| | |

1001 Summit Blvd., Atlanta, Georgia | | 30319 |

|

(Address of Principal Executive Offices) | | (Zip Code) |

(404) 300-1000

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TABLE OF CONTENTS

|

| | | | | | | | |

| | | | | | | | |

ITEM 2.02. Results of Operations and Financial Condition |

ITEM 7.01. Regulation FD Disclosure |

ITEM 9.01. Financial Statements and Exhibits |

SIGNATURES |

EXHIBIT INDEX |

EX-99.1 |

EX-99.2 |

Table of Contents

ITEM 2.02. Results of Operations and Financial Condition

On February 23, 2015, Crawford & Company (the "Company") issued a press release containing information about the Company's financial results for the fourth quarter and full year 2014. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

ITEM 7.01. Regulation FD Disclosure

The Company has made available on the Company's website at www.crawfordandcompany.com a presentation designed to enhance the information presented at its quarterly earnings conference call on Monday, February 23, 2015 at 3:00 p.m. Eastern Time. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by this reference.

ITEM 9.01. Financial Statements and Exhibits

|

| | | | | |

(c) | | Exhibits | | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release dated February 23, 2015 |

| | |

99.2 | | Slide Presentation |

The information contained in this current report on Form 8-K and in the accompanying exhibits shall not be incorporated by reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation by reference language in such filing, unless expressly incorporated by specific reference to such filing. The information, including the exhibits hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Table of Contents

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| CRAWFORD & COMPANY (Registrant) | |

| By: | /s/ W. BRUCE SWAIN | |

| | W. Bruce Swain | |

| | Executive Vice President - Chief Financial Officer | |

|

Dated: February 23, 2015

Table of Contents

EXHIBIT INDEX

|

| | |

| | |

Number | | Descriptions |

99.1 | | Press Release dated February 23, 2015 |

| | |

99.2 | | Slide Presentation |

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

FOR IMMEDIATE RELEASE

Date: February 23, 2015

From: Jeffrey T. Bowman

Chief Executive Officer ____________________________________________________________________________________________

Crawford & Company Reports 2014 Fourth Quarter and Annual Results

Issues 2015 Guidance

Crawford & Company (www.crawfordandcompany.com) (NYSE: CRDA and CRDB), the world's largest independent provider of claims management solutions to insurance companies and self-insured entities, today announced its financial results for the fourth quarter and year ended December 31, 2014.

The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class.

Consolidated Results

Full year consolidated revenues before reimbursements totaled $1.143 billion for 2014, compared with $1.163 billion for 2013. Net income attributable to shareholders of Crawford & Company in 2014 was $30.6 million, compared with net income in 2013 of $51.0 million. Full year 2014 diluted earnings per share were $0.57 for CRDA and $0.52 for CRDB, compared with diluted earnings per share of $0.93 for CRDA and $0.90 for CRDB in the prior year.

Fourth quarter 2014 consolidated revenues before reimbursements totaled $285.5 million, compared with $284.9 million for 2013. Fourth quarter 2014 net income attributable to shareholders of Crawford & Company was $3.3 million, compared with net income of $10.8 million in the fourth quarter of 2013. Fourth quarter 2014 diluted earnings per share were $0.07 for CRDA and $0.05 for CRDB, compared with diluted earnings per share of $0.20 for CRDA and $0.19 for CRDB in the prior year quarter.

Consolidated operating earnings, a non-GAAP financial measure, were $73.1 million in 2014, compared with $94.9 million in 2013. For the 2014 fourth quarter, consolidated operating earnings totaled $15.3 million, compared with $20.2 million in the 2013 fourth quarter.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Balance Sheet and Cash Flow

Crawford & Company's consolidated cash and cash equivalents position as of December 31, 2014 totaled $52.5 million compared with $76.0 million at December 31, 2013.

The Company generated $6.6 million of cash from operations during 2014, compared with $77.8 million during 2013. The decrease in cash provided by operating activities in 2014 compared with 2013 was primarily due to lower net income, increased accounts receivable, and an increase in other working capital components in 2014 compared with 2013.

Management's Comments

Mr. Jeffrey T. Bowman, chief executive officer of Crawford & Company, stated, "Overall our financial performance for 2014 reflected declines in revenues, net income, and diluted earnings per share on a consolidated basis. Likewise, our fourth quarter 2014 consolidated earnings reflected a decline from the 2013 period’s operating results. This fourth quarter decline was primarily attributable to lower earnings in our Legal Settlement Administration and EMEA/AP segments and an increase in administrative costs related to our recently completed acquisition of GAB Robins Holdings UK Limited. Fourth quarter 2014 net income was further impacted by a higher effective tax rate resulting from changes in the mix of income, losses in certain countries, and other tax adjustments in the current quarter.

“In the Broadspire segment, we saw a steady and significant improvement in both revenue and operating profitability throughout 2014, and we were pleased with the improved performance we accomplished in this business. For the year, Broadspire’s operating earnings were up nearly 90% as compared to 2013. This improvement carried into the 2014 fourth quarter results with strong growth in revenues and operating earnings. We believe these trends in Broadspire are sustainable and expect continued growth in the coming year.

"As we indicated at the beginning of the year, our expectation was that our EMEA/AP segment results would show a decline compared to 2013, when we substantially completed claims arising from the 2011 catastrophic flood losses in Thailand. For the 2014 fourth quarter, our EMEA/AP segment operating results reflected a lower level of activity both due to the absence of Thai flood-related claims and a relatively benign global claims environment as a result of fewer weather-related events. In addition, during the 2014 quarter we continued to invest in our specialty markets operations across this business, which further affected profitability.

"The Americas segment grew year-over-year in 2014 as a result of improvements in our Canadian operating results and continued growth in our North American Contractor Connection managed repair network. This performance came despite an absence of major weather events in this region over the past year and particularly during the 2014 fourth quarter.

"Results from our Legal Settlement Administration segment during 2014 continued to include activity from the Deepwater Horizon class action settlement, as well as a number of other meaningful class action and bankruptcy matters. However, anticipated declines in volumes associated with these large projects negatively impacted results in the 2014 fourth quarter. These trends are expected to continue into 2015, although at a slower level of decline."

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Mr. Bowman concluded, "Although a relatively benign global claim environment weighed on results in 2014, Crawford made significant progress on many fronts. We saw improved performance in our Broadspire and Americas segments. We grew our existing market share through acquisitions and entered new markets, which greatly expanded our global capabilities. We continued to build on our ability to serve clients by establishing a global business services center, enabling consistent response for our clients and producing expected long term cost savings for the corporation. Looking forward, we continue to foster a supportive corporate culture that is results-oriented and focused on creating long-term shareholder value."

Segment Results for the Fourth Quarter and Full Year

Americas

Americas revenues before reimbursements were $85.6 million in the fourth quarter of 2014, increasing from $79.5 million in the 2013 fourth quarter. In the fourth quarter of 2014, the U.S. dollar strengthened against most foreign currencies in the segment, resulting in a negative exchange rate impact on segment revenues of approximately 3%. Operating earnings were $1.6 million in the 2014 fourth quarter, compared with $1.2 million in the 2013 fourth quarter, representing an operating margin of 2% and 1% in the 2014 and 2013 periods, respectively.

For the year, Americas revenues before reimbursements increased 5% to $359.3 million compared with $342.2 million in 2013. During 2014, the U.S. dollar strengthened against most foreign currencies in the segment, resulting in a negative exchange rate impact on segment revenues of approximately 3% from 2013 to 2014. Operating earnings increased from $18.5 million in 2013 to $23.7 million in 2014, representing an operating margin of 5% and 7% in 2013 and 2014, respectively.

EMEA/AP

Fourth quarter 2014 revenues before reimbursements for the EMEA/AP segment totaled $90.6 million, compared with $91.0 million in the 2013 fourth quarter. Changes in foreign exchange rates negatively impacted revenues in this segment by approximately 1% in the fourth quarter of 2014 compared with the prior year period. EMEA/AP operating earnings were $9.3 million in the 2014 fourth quarter, compared with 2013 fourth quarter operating earnings of $12.7 million. The segment operating margin was 10% in the 2014 fourth quarter and 14% in the 2013 fourth quarter.

For the year, revenues before reimbursements in our EMEA/AP segment totaled $344.4 million, compared with $350.2 million in 2013. Foreign exchange rates had a negligible positive impact on this segment for the 2014 full-year period compared with the 2013 full-year period. EMEA/AP operating earnings were $19.7 million in 2014, compared with $32.2 million in 2013, representing operating margins of 6% in 2014 compared with 9% in 2013.

Broadspire

Broadspire segment revenues before reimbursements were $69.2 million in the 2014 fourth quarter, up from $65.4 million in the 2013 fourth quarter. Broadspire recorded operating earnings of $6.3 million in the 2014 fourth quarter, representing an operating margin of 9%, compared with $3.8 million, or 6% of revenues, in the 2013 fourth quarter.

For the year, Broadspire segment revenues before reimbursements increased 7% to $268.9 million compared with $252.2 million in 2013. Broadspire recorded operating earnings of $15.5 million for the year, or 6% of revenues, compared with $8.2 million, or 3% of revenues, for 2013.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Legal Settlement Administration

Legal Settlement Administration revenues before reimbursements were $40.0 million in the 2014 fourth quarter, compared with $49.1 million in the 2013 fourth quarter. Operating earnings were $4.5 million in the 2014 fourth quarter, compared with $8.0 million in the 2013 fourth quarter, with the related operating margin decreasing from 16% in the 2013 period to 11% in the 2014 period.

For the year, Legal Settlement Administration revenues before reimbursements were $170.3 million, compared with $218.8 million in 2013. Operating earnings were $22.8 million, compared with $46.8 million in 2013, with the related operating margin decreasing from 21% in 2013 to 13% in 2014. At December 31, 2014 there was a backlog of projects awarded totaling approximately $102.0 million, compared with $108.2 million at December 31, 2013.

Subsequent Events

On December 1, 2014, the Company borrowed $78.4 million under its Credit Facility to acquire 100% of the capital stock of GAB Robins Holdings UK Limited ("GAB Robins"), a loss adjusting and claims management provider headquartered in the U.K. which will report through the EMEA/AP segment. Because the financial results of certain of the Company's international subsidiaries, including those in the U.K. through which GAB Robins will report, are included in the Company's consolidated financial statements on a two-month delayed basis as permitted by ASC 810, "Consolidation," the results of GAB Robins' business since the acquisition date have not been included in the Company's consolidated results of operations. In addition, the Credit Facility borrowings used to complete the GAB Robins acquisition are not included in outstanding borrowings on the Company's Consolidated Balance Sheet at December 31, 2014, because the U.K.-based borrowing entity has an October 31 fiscal year end, and the balance sheet of that entity was consolidated as of October 31, 2014.

On January 22, 2015, the Company announced the establishment of a wholly-owned global business services center (the "Center") in Manila, Philippines. The Center provides the Company a venue for global consolidation of certain business functions, shared services, and currently outsourced processes. The Center, which is expected to be phased in through 2018, is expected to allow the Company to continue to strengthen its client service, realize additional operational efficiencies, and invest in new capabilities for growth.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

2015 Guidance

The Company expects to incur pretax special charges in 2015, currently estimated at approximately $7.0 million for the integration of GAB Robins and $9.0 million related to the establishment of a global business services center in Manila, Philippines. Crawford & Company is providing a guidance range for 2015 as follows:

| |

• | Consolidated revenues before reimbursements between $1.16 and $1.19 billion; |

| |

• | Consolidated operating earnings between $85.5 and $95.0 million; |

| |

• | Consolidated cash provided by operating activities between $40.0 and $50.0 million; |

| |

• | After special charges, net income attributable to shareholders of Crawford & Company between $29.5 and $35.0 million, or $0.57 to $0.67 diluted earnings per CRDA share, or $0.50 to $0.60 diluted earnings per CRDB share; |

| |

• | Before special charges, net income attributable to shareholders of Crawford & Company between $39.0 and $44.5 million, or $0.75 to $0.85 diluted earnings per CRDA share, or $0.68 to $0.78 diluted earnings per CRDB share. |

To a significant extent, Crawford's business depends on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of claims and revenue for the Company, are generally not subject to accurate forecasting.

In recent periods the Company has derived a material portion of its revenues and operating earnings from a limited number of client engagements and special projects within its EMEA/AP and Legal Settlement Administration segments, specifically their work on the Thailand flooding claims and the gulf-related class action settlement, respectively. The Thailand flooding claims project within the EMEA/AP segment was substantially completed in 2013. Although the Company continued to earn revenues from the Legal Settlement Administration projects in 2014, these revenues, and related operating earnings, were at a reduced rate as compared to 2013. The projects continue to wind down, and the Company expects these revenues, and related operating earnings, to be at a reduced rate in all future periods, as compared to 2014. No assurances of timing of the project end dates and, therefore, continued revenues or operating earnings, can be provided. In the event the Company is unable to replace revenues and related operating earnings from these projects as they wind down, or upon the termination or other expiration thereof, with revenues and operating earnings from new projects and customers within this or other segments, there could be a material adverse effect on the Company's results of operations.

Conference Call

Crawford & Company's management will host a conference call with investors on Monday, February 23, 2015 at 3:00 p.m. EST to discuss fourth quarter and full year 2014 results. The call will be recorded and available for replay through March 25, 2015. You may dial 1-855-859-2056 (404-537-3406 international) to listen to the replay. The access code is 23943882. Alternatively, please visit our web site at www.crawfordandcompany.com for a live audio web cast and related financial presentation.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Non-GAAP Presentation

In the normal course of business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In the foregoing discussion and analysis of segment results of operations, we do not include a gross up of segment expenses and revenues for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our results of operations with no impact to our net income or operating earnings. A reconciliation of revenues before reimbursements to consolidated revenues determined in accordance with GAAP is self-evident from the face of the accompanying unaudited condensed consolidated statements of income.

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker (“CODM”) to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Unlike net income, segment operating earnings is not a standard performance measure found in GAAP. We believe this measure is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria used by our senior management and CODM. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, income taxes, and net income or loss attributable to noncontrolling interests. The reconciliation of operating earnings to net income attributable to shareholders of Crawford & Company on a GAAP basis is presented below.

Unallocated corporate and shared costs and credits represent expenses and credits related to our chief executive officer and Board of Directors, certain provisions for bad debt allowances or subsequent recoveries such as those related to bankrupt clients, defined benefit pension costs or credits for our frozen U.S. pension plan, and certain self-insurance costs and recoveries that are not allocated to our individual operating segments but are included in our financial performance measure of consolidated operating earnings.

Income taxes, net corporate interest expense, stock option expense, and amortization of customer-relationship intangible assets are recurring components of our net income, but they are not considered part of our consolidated or segment operating earnings because they are managed on a corporate-wide basis. Income taxes are calculated for the Company on a consolidated basis based on statutory rates in effect in the various jurisdictions in which we provide services, and varies significantly by jurisdiction. Net corporate interest expense results from capital structure decisions made by senior management and the Board of Directors and affecting the Company as a whole. Stock option expense represents the non-cash costs generally related to stock options and employee stock purchase plan expenses which are not allocated to our operating segments. Amortization expense is a non-cash expense for finite-lived customer-relationship and trade name intangible assets acquired in business combinations. None of these costs relate directly to the performance of our services or operating activities and, therefore, are excluded from segment operating earnings in order to better assess the results of each segment’s operating activities on a consistent basis.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

Following is a reconciliation of segment and consolidated operating earnings to net income attributable to shareholders of Crawford & Company on a GAAP basis and the related margins as a percentage of revenues before reimbursements for all periods presented (in thousands, except percentages):

|

| | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Year ended |

| December 31, 2014 | % Margin | December 31, 2013 | % Margin | | December 31, 2014 | % Margin | December 31, 2013 | % Margin |

Operating Earnings: | | | | | | | | | |

Americas | $ | 1,551 |

| 2 | % | $ | 1,177 |

| 1 | % | | $ | 23,663 |

| 7 | % | $ | 18,532 |

| 5 | % |

EMEA/AP | 9,285 |

| 10 | % | 12,672 |

| 14 | % | | 19,720 |

| 6 | % | 32,158 |

| 9 | % |

Broadspire | 6,329 |

| 9 | % | 3,770 |

| 6 | % | | 15,469 |

| 6 | % | 8,245 |

| 3 | % |

Legal Settlement Administration | 4,514 |

| 11 | % | 8,038 |

| 16 | % | | 22,849 |

| 13 | % | 46,752 |

| 21 | % |

Unallocated corporate and shared costs and credits, net | (6,392 | ) | (2 | )% | (5,474 | ) | (2 | )% | | (8,582 | ) | (1 | )% | (10,829 | ) | (1 | )% |

Consolidated Operating Earnings | 15,287 |

| 5 | % | 20,183 |

| 7 | % | | 73,119 |

| 6 | % | 94,858 |

| 8 | % |

Deduct: | | | | | | | | | |

Net corporate interest expense | (1,499 | ) | (1 | )% | (1,661 | ) | (1 | )% | | (6,031 | ) | (1 | )% | (6,423 | ) | (1 | )% |

Stock option expense | (179 | ) | — | % | (296 | ) | — | % | | (859 | ) | — | % | (948 | ) | — | % |

Amortization expense | (1,595 | ) | (1 | )% | (1,602 | ) | (1 | )% | | (6,341 | ) | (1 | )% | (6,385 | ) | (1 | )% |

Income taxes | (8,286 | ) | (3 | )% | (5,545 | ) | (2 | )% | | (28,780 | ) | (3 | )% | (29,766 | ) | (3 | )% |

Net income attributable to non-controlling interests | (412 | ) | — | % | (253 | ) | — | % | | (484 | ) | — | % | (358 | ) | — | % |

Net income attributable to shareholders of Crawford & Company | $ | 3,316 |

| 1 | % | $ | 10,826 |

| 4 | % | | $ | 30,624 |

| 3 | % | $ | 50,978 |

| 4 | % |

| | | | | | | | | |

Further information regarding the Company's financial position, operating results, and cash flows for the quarter and year ended December 31, 2014 is shown on the attached unaudited condensed consolidated financial statements.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD ATLANTA, GEORGIA 30319 (404) 300-1000

About Crawford & Company

Based in Atlanta, Georgia, Crawford & Company (www.crawfordandcompany.com) is the world's largest (based on annual revenues) independent provider of claims management solutions to the risk management and insurance industry, as well as to self-insured entities, with an expansive global network serving clients in more than 70 countries. The Crawford SolutionSM offers comprehensive, integrated claims services, business process outsourcing and consulting services for major product lines including property and casualty claims management, workers’ compensation claims and medical management, and legal settlement administration. The Company's shares are traded on the NYSE under the symbols CRDA and CRDB.

The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting CRDA than on the voting CRDB, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class.

Earnings per share may be different between CRDA and CRDB due to the payment of a higher per share dividend on CRDA than CRDB, and the impact that has on the earnings per share calculation according to generally accepted accounting principles.

|

|

This press release contains forward-looking statements, including statements about the financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not historical facts may be “forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. For further information regarding Crawford & Company, including factors that could cause our actual financial condition, results or earnings to differ from those described in any forward-looking statements, please read Crawford & Company's reports filed with the SEC and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. |

FOR FURTHER INFORMATION REGARDING THIS PRESS RELEASE, PLEASE CALL BRUCE SWAIN AT (404) 300-1051.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

| | | | | | | | | | |

| | | |

Three Months Ended December 31, | 2014 |

| 2013 |

| % Change |

|

|

|

|

|

|

Revenues: | |

| |

|

|

| |

| |

|

|

Revenues Before Reimbursements | $ | 285,455 |

|

| $ | 284,879 |

|

| — | % |

Reimbursements | 20,187 |

|

| 21,841 |

|

| (8 | )% |

Total Revenues | 305,642 |

|

| 306,720 |

|

| — | % |

| |

| |

|

|

Costs and Expenses: | |

| |

|

|

| |

| |

|

|

Costs of Services Provided, Before Reimbursements | 215,118 |

|

| 208,393 |

|

| 3 | % |

Reimbursements | 20,187 |

|

| 21,841 |

|

| (8 | )% |

Total Costs of Services | 235,305 |

|

| 230,234 |

|

| 2 | % |

| |

| |

|

|

Selling, General, and Administrative Expenses | 57,900 |

|

| 58,230 |

|

| (1 | )% |

Corporate Interest Expense, Net | 1,499 |

|

| 1,661 |

|

| (10 | )% |

Total Costs and Expenses | 294,704 |

|

| 290,125 |

|

| 2 | % |

|

|

|

|

|

|

Other Income | 1,076 |

|

| 29 |

|

| nm |

|

| |

| |

|

|

Income before Income Taxes | 12,014 |

|

| 16,624 |

|

| (28 | )% |

Provision for Income Taxes | 8,286 |

|

| 5,545 |

|

| 49 | % |

|

|

|

|

|

|

Net Income | 3,728 |

|

| 11,079 |

|

| (66 | )% |

|

|

|

|

|

|

Net Income Attributable to Noncontrolling Interests | (412 | ) |

| (253 | ) |

| 63 | % |

|

|

|

|

|

|

Net Income Attributable to Shareholders of Crawford & Company | $ | 3,316 |

|

| $ | 10,826 |

|

| (69 | )% |

|

|

|

|

|

|

| |

| |

|

|

Earnings Per Share - Basic: |

|

|

|

|

|

Class A Common Stock | $ | 0.07 |

|

| $ | 0.20 |

|

| (65 | )% |

Class B Common Stock | $ | 0.05 |

|

| $ | 0.19 |

|

| (74 | )% |

|

|

|

|

|

|

Earnings Per Share - Diluted: |

|

|

|

|

|

Class A Common Stock | $ | 0.07 |

|

| $ | 0.20 |

|

| (65 | )% |

Class B Common Stock | $ | 0.05 |

|

| $ | 0.19 |

|

| (74 | )% |

| |

| |

|

|

Cash Dividends Per Share: |

|

|

|

|

|

Class A Common Stock | $ | 0.07 |

|

| $ | 0.05 |

|

| 40 | % |

Class B Common Stock | $ | 0.05 |

|

| $ | 0.04 |

|

| 25 | % |

|

|

|

|

|

|

|

nm = not meaningful

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

| | | | | | | | | | |

| | | | | |

Year Ended December 31, | 2014 | | 2013 | | % Change |

| | | | | |

Revenues: | | | | | |

| |

| | |

| | |

Revenues Before Reimbursements | $ | 1,142,851 |

| | $ | 1,163,445 |

| | (2 | )% |

Reimbursements | 74,112 |

| | 89,985 |

| | (18 | )% |

Total Revenues | 1,216,963 |

| | 1,253,430 |

| | (3 | )% |

| | | | | |

Costs and Expenses: | | | | | |

| | | | | |

Costs of Services Provided, Before Reimbursements | 840,702 |

| | 846,442 |

| | (1 | )% |

Reimbursements | 74,112 |

| | 89,985 |

| | (18 | )% |

Total Costs of Services | 914,814 |

| | 936,427 |

| | (2 | )% |

| | | | | |

Selling, General, and Administrative Expenses | 237,880 |

| | 232,307 |

| | 2 | % |

Corporate Interest Expense, Net | 6,031 |

| | 6,423 |

| | (6 | )% |

Total Costs and Expenses | 1,158,725 |

| | 1,175,157 |

| | (1 | )% |

| | | | | |

Other Income | 1,650 |

| | 2,829 |

| | (42 | )% |

| | | | | |

Income Before Income Taxes | 59,888 |

| | 81,102 |

| | (26 | )% |

Provision for Income Taxes | 28,780 |

| | 29,766 |

| | (3 | )% |

| | | | | |

Net Income | 31,108 |

| | 51,336 |

| | (39 | )% |

| | | | | |

Net Income Attributable to Noncontrolling Interests | (484 | ) | | (358 | ) | | 35 | % |

| | | | | |

Net Income Attributable to Shareholders of Crawford & Company | $ | 30,624 |

| | $ | 50,978 |

| | (40 | )% |

| | | | | |

| | | | | |

Earnings Per Share - Basic: | | | | | |

Class A Common Stock | $ | 0.58 |

| | $ | 0.95 |

| | (39 | )% |

Class B Common Stock | $ | 0.52 |

| | $ | 0.91 |

| | (43 | )% |

| | | | | |

Earnings Per Share - Diluted: | | | | | |

Class A Common Stock | $ | 0.57 |

| | $ | 0.93 |

| | (39 | )% |

Class B Common Stock | $ | 0.52 |

| | $ | 0.90 |

| | (42 | )% |

| | | | | |

Cash Dividends Per Share: | | | | | |

Class A Common Stock | $ | 0.24 |

| | $ | 0.18 |

| | 33 | % |

Class B Common Stock | $ | 0.18 |

| | $ | 0.14 |

| | 29 | % |

| | | | | |

`

Press Release

`CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

SUMMARY RESULTS BY OPERATING SEGMENT

Unaudited

(In Thousands, Except Percentages)

Three Months Ended December 31,

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | % | EMEA/AP | % | Broadspire | % | Legal Settlement Administration | % |

| 2014 | 2013 | Change | 2014 | 2013 | Change | 2014 | 2013 | Change | 2014 | 2013 | Change |

| | | | | | | | | | | | |

Revenues Before Reimbursements | $ | 85,646 |

| $ | 79,483 |

| 8 | % | $ | 90,595 |

| $ | 90,975 |

| — | % | $ | 69,184 |

| $ | 65,354 |

| 6 | % | $ | 40,030 |

| $ | 49,067 |

| (18 | )% |

| | | | | | | | | | | | |

Direct Compensation, Fringe Benefits & Non-Employee Labor | 60,027 |

| 54,169 |

| 11 | % | 58,868 |

| 57,080 |

| 3 | % | 36,875 |

| 36,225 |

| 2 | % | 26,648 |

| 32,624 |

| (18 | )% |

% of Revenues Before Reimbursements | 70 | % | 68 | % | | 65 | % | 63 | % | | 53 | % | 55 | % | | 67 | % | 66 | % | |

| | | | | | | | | | | | |

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor | 24,068 |

| 24,137 |

| — | % | 22,442 |

| 21,223 |

| 6 | % | 25,980 |

| 25,359 |

| 2 | % | 8,868 |

| 8,405 |

| 6 | % |

% of Revenues Before Reimbursements | 28 | % | 30 | % | | 25 | % | 23 | % | | 38 | % | 39 | % | | 22 | % | 17 | % | |

| | | | | | | | | | | | |

Total Operating Expenses | 84,095 |

| 78,306 |

| 7 | % | 81,310 |

| 78,303 |

| 4 | % | 62,855 |

| 61,584 |

| 2 | % | 35,516 |

| 41,029 |

| (13 | )% |

| | | | | | | | | | | | |

Operating Earnings (1) | $ | 1,551 |

| $ | 1,177 |

| 32 | % | $ | 9,285 |

| $ | 12,672 |

| (27 | )% | $ | 6,329 |

| $ | 3,770 |

| 68 | % | $ | 4,514 |

| $ | 8,038 |

| (44 | )% |

% of Revenues Before Reimbursements | 2 | % | 1 | % | | 10 | % | 14 | % | | 9 | % | 6 | % | | 11 | % | 16 | % | |

Year Ended December 31,

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Americas | % | EMEA/AP | % | Broadspire | % | Legal Settlement Administration | % |

| 2014 | 2013 | Change | 2014 | 2013 | Change | 2014 | 2013 | Change | 2014 | 2013 | Change |

| | | | | | | | | | | | |

Revenues Before Reimbursements | $ | 359,319 |

| $ | 342,240 |

| 5 | % | $ | 344,350 |

| $ | 350,164 |

| (2 | )% | $ | 268,890 |

| $ | 252,242 |

| 7 | % | $ | 170,292 |

| $ | 218,799 |

| (22 | )% |

| | | | | | | | | | | | |

Direct Compensation, Fringe Benefits & Non-Employee Labor | 236,283 |

| 230,651 |

| 2 | % | 237,661 |

| 234,775 |

| 1 | % | 149,353 |

| 142,937 |

| 4 | % | 117,625 |

| 142,961 |

| (18 | )% |

% of Revenues Before Reimbursements | 66 | % | 67 | % | | 69 | % | 67 | % | | 56 | % | 57 | % | | 69 | % | 65 | % | |

| | | | | | | | | | | | |

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor | 99,373 |

| 93,057 |

| 7 | % | 86,969 |

| 83,231 |

| 4 | % | 104,068 |

| 101,060 |

| 3 | % | 29,818 |

| 29,086 |

| 3 | % |

% of Revenues Before Reimbursements | 28 | % | 27 | % | | 25 | % | 24 | % | | 39 | % | 40 | % | | 18 | % | 13 | % | |

| | | | | | | | | | | | |

Total Operating Expenses | 335,656 |

| 323,708 |

| 4 | % | 324,630 |

| 318,006 |

| 2 | % | 253,421 |

| 243,997 |

| 4 | % | 147,443 |

| 172,047 |

| (14 | )% |

| | | | | | | | | | | | |

Operating Earnings (1) | $ | 23,663 |

| $ | 18,532 |

| 28 | % | $ | 19,720 |

| $ | 32,158 |

| (39 | )% | $ | 15,469 |

| $ | 8,245 |

| 88 | % | $ | 22,849 |

| $ | 46,752 |

| (51 | )% |

% of Revenues Before Reimbursements | 7 | % | 5 | % | | 6 | % | 9 | % | | 6 | % | 3 | % | | 13 | % | 21 | % | |

NOTE: "Direct Compensation, Fringe Benefits & Non-Employee Labor" and "Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor" components are not comparable across

segments, but are comparable within each segment across periods.

(1) A non-GAAP financial measurement which represents net income attributable to the applicable reporting segment excluding income taxes, net corporate interest expense, stock option expense,amortization of customer-relationship intangible assets, and certain unallocated corporate and shared costs and credits. See pages 6-7 for additional information about segment operating earnings.

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

As of December 31, 2014 and December 31, 2013

(In Thousands, Except Par Values) |

| | | | | | | |

| | | * |

| December 31 | | December 31, |

| 2014 | | 2013 |

ASSETS | | | |

| | | |

Current Assets: | | | |

Cash and Cash Equivalents | $ | 52,456 |

| | $ | 75,953 |

|

Accounts Receivable, Net | 180,096 |

| | 160,350 |

|

Unbilled Revenues, at Estimated Billable Amounts | 103,163 |

| | 105,791 |

|

Income Taxes Receivable | 2,779 |

| | 5,150 |

|

Prepaid Expenses and Other Current Assets | 29,089 |

| | 22,437 |

|

Total Current Assets | 367,583 |

| | 369,681 |

|

| | | |

Property and Equipment | 143,273 |

| | 155,326 |

|

Less Accumulated Depreciation | (102,414 | ) | | (109,643 | ) |

Net Property and Equipment | 40,859 |

| | 45,683 |

|

| | | |

Other Assets: | | | |

Goodwill | 131,885 |

| | 132,777 |

|

Intangible Assets Arising from Business Acquisitions, Net | 75,895 |

| | 82,103 |

|

Capitalized Software Costs, Net | 75,536 |

| | 72,761 |

|

Deferred Income Tax Assets | 66,927 |

| | 61,375 |

|

Other Noncurrent Assets | 30,634 |

| | 25,678 |

|

Total Other Assets | 380,877 |

| | 374,694 |

|

| | | |

Total Assets | $ | 789,319 |

| | $ | 790,058 |

|

| | | |

LIABILITIES AND SHAREHOLDERS’ INVESTMENT | | | |

| | | |

Current Liabilities: | | | |

Short-Term Borrowings | $ | 2,002 |

| | $ | 35,000 |

|

Accounts Payable | 48,597 |

| | 50,941 |

|

Accrued Compensation and Related Costs | 82,151 |

| | 98,656 |

|

Self-Insured Risks | 14,491 |

| | 13,100 |

|

Income Taxes Payable | 2,618 |

| | 3,476 |

|

Deferred Income Taxes | 14,523 |

| | 15,063 |

|

Deferred Rent | 13,576 |

| | 16,062 |

|

Other Accrued Liabilities | 35,784 |

| | 34,270 |

|

Deferred Revenues | 45,054 |

| | 49,950 |

|

Current Installments of Long-Term Debt and Capital Leases | 763 |

| | 875 |

|

Total Current Liabilities | 259,559 |

| | 317,393 |

|

| | | |

Noncurrent Liabilities: | | | |

Long-Term Debt and Capital Leases, Less Current Installments | 154,046 |

| | 101,770 |

|

Deferred Revenues | 26,706 |

| | 26,893 |

|

Self-Insured Risks | 10,041 |

| | 12,530 |

|

Accrued Pension Liabilities | 142,343 |

| | 102,960 |

|

Other Noncurrent Liabilities | 17,271 |

| | 20,979 |

|

Total Noncurrent Liabilities | 350,407 |

| | 265,132 |

|

| | | |

Shareholders’ Investment: | | | |

Class A Common Stock, $1.00 Par Value | 30,497 |

| | 29,875 |

|

Class B Common Stock, $1.00 Par Value | 24,690 |

| | 24,690 |

|

Additional Paid-In Capital | 38,617 |

| | 39,285 |

|

Retained Earnings | 301,091 |

| | 285,165 |

|

Accumulated Other Comprehensive Loss | (221,958 | ) | | (179,210 | ) |

Shareholders’ Investment Attributable to Shareholders of Crawford & Company | 172,937 |

| | 199,805 |

|

Noncontrolling Interests | 6,416 |

| | 7,728 |

|

Total Shareholders’ Investment | 179,353 |

| | 207,533 |

|

| | | |

Total Liabilities and Shareholders' Investment | $ | 789,319 |

| | $ | 790,058 |

|

* Derived from the audited Consolidated Balance Sheet

Press Release

CRAWFORD & COMPANY 1001 SUMMIT BOULEVARD, ATLANTA, GEORGIA 30319 (404) 300-1000

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31, 2014 and December 31, 2013

Unaudited

(In Thousands) |

| | | | | | | | |

| | 2014 | | 2013 |

Cash Flows From Operating Activities: | | | | |

Net Income | | $ | 31,108 |

| | $ | 51,336 |

|

Reconciliation of Net Income to Net Cash Used In Operating Activities: | | | | |

Depreciation and Amortization | | 37,644 |

| | 33,903 |

|

Deferred Income Taxes | | 15,189 |

| | 15,625 |

|

Gain on Former Corporate Headquarters Property | | (836 | ) | | — |

|

Stock-Based Compensation | | 1,189 |

| | 3,835 |

|

(Gain)/Loss on Disposals of Property and Equipment, Net | | (239 | ) | | 273 |

|

Changes in Operating Assets and Liabilities, Net of Effects of Acquisitions and Dispositions: | | | | |

Accounts Receivable, Net | | (24,358 | ) | | 2,102 |

|

Unbilled Revenues, Net | | (1,216 | ) | | 16,528 |

|

Accrued or Prepaid Income Taxes | | 3,099 |

| | (2,160 | ) |

Accounts Payable and Accrued Liabilities | | (23,100 | ) | | (22,328 | ) |

Deferred Revenues | | (4,645 | ) | | (5,895 | ) |

Accrued Retirement Costs | | (18,497 | ) | | (22,086 | ) |

Prepaid Expenses and Other Operating Activities | | (8,732 | ) | | 6,711 |

|

Net Cash Provided By Operating Activities | | 6,606 |

| | 77,844 |

|

| | | | |

Cash Flows From Investing Activities: | | | | |

Acquisitions of Property and Equipment | | (12,485 | ) | | (14,037 | ) |

Proceeds from Disposals of Property and Equipment | | 1,289 |

| | — |

|

Capitalization of Computer Software Costs | | (16,712 | ) | | (16,976 | ) |

Proceeds from Former Corporate Headquarters Property | | 836 |

| | — |

|

Payments for Acquisitions, Net of Cash Acquired | | (3,141 | ) | | (2,515 | ) |

Cash Surrendered in Sale of Business | | (1,554 | ) | | — |

|

Net Cash Used In Investing Activities | | (31,767 | ) | | (33,528 | ) |

| | | | |

Cash Flows From Financing Activities: | | | | |

Cash Dividends Paid | | (11,717 | ) | | (8,840 | ) |

Payments Related to Shares Received for Withholding Taxes Under Stock-Based Compensation Plans | | (2,085 | ) | | (1,322 | ) |

Proceeds from Shares Purchased Under Employee Stock-Based Compensation Plans | | 1,270 |

| | 1,884 |

|

Repurchases of Common Stock | | (3,390 | ) | | (3,631 | ) |

Increases in Short-Term and Revolving Credit Facility Borrowings | | 121,110 |

| | 88,460 |

|

Payments on Short-Term and Revolving Credit Facility Borrowings | | (98,821 | ) | | (99,461 | ) |

Payments on Capital Lease Obligations | | (856 | ) | | (15,823 | ) |

Capitalized Loan Costs | | (218 | ) | | (30 | ) |

Dividends Paid to Noncontrolling Interests | | (761 | ) | | (369 | ) |

Net Cash Provided By (Used In) Financing Activities | | 4,532 |

| | (39,132 | ) |

| | | | |

Effects of Exchange Rate Changes on Cash and Cash Equivalents | | (2,868 | ) | | (388 | ) |

(Decrease) Increase in Cash and Cash Equivalents | | (23,497 | ) | | 4,796 |

|

Cash and Cash Equivalents at Beginning of Year | | 75,953 |

| | 71,157 |

|

Cash and Cash Equivalents at End of Year | | $ | 52,456 |

| | $ | 75,953 |

|

Crawford & Company FOURTH QUARTER AND FULL YEAR 2014 EARNINGS CONFERENCE CALL February 23, 2015

• Forward-Looking Statements —This presentation contains forward-looking statements, including statements about the future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be “forward- looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company’s reports filed with the United States Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company’s website at www.crawfordandcompany.com. —Crawford’s business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. —In recent periods the Company has derived a material portion of its revenues and operating earnings from a limited number of client engagements and special projects within its EMEA/AP and Legal Settlement Administration segments, specifically their work on the Thailand flooding claims and the gulf-related class action settlement, respectively. The Thailand flooding claims project within the EMEA/AP segment was substantially completed in 2013. Although the Company continued to earn revenues from the Legal Settlement Administration projects in 2014, these revenues, and related operating earnings, were at a reduced rate as compared to 2013. The projects continue to wind down, and the Company expects these revenues, and related operating earnings, to be at a reduced rate in all future periods, as compared to 2014. No assurances of timing of the project end dates and, therefore, continued revenues or operating earnings, can be provided. In the event the Company is unable to replace revenues and related operating earnings from these projects as they wind down, or upon the termination or other expiration thereof, with revenues and operating earnings from new projects and customers within this or other segments, there could be a material adverse effect on the Company's results of operations. • Revenues Before Reimbursements (“Revenues”) —Revenues Before Reimbursements are referred to as “Revenues” in both consolidated and segment charts, bullets and tables throughout this presentation. • Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board’s Accounting Standards Codification ("ASC") Topic 280, “Segment Reporting,” the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, stock option expense, earnings or loss attributable to non-controlling interests, and certain unallocated corporate and shared costs and credits. Consolidated operating earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. 2 FORWARD-LOOKING STATEMENTS, ADDITIONAL INFORMATION, AND SUBSEQUENT EVENTS

Earnings Per Share —The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class. —In certain periods, the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two- class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. • Subsequent Events —On December 1, 2014, the Company borrowed $78.4 million under its Credit Facility to acquire 100% of the capital stock of GAB Robins Holdings UK Limited ("GAB Robins"), a loss adjusting and claims management provider headquartered in the U.K. which will report through the EMEA/AP segment. The acquisition is currently being reviewed by the CMA as a part of its routine acquisition review process, and the Company cannot begin the integration process until this review is completed. Although the Company currently expects that this review will be concluded during the first half of 2015, no assurances of the timing, or any material conditions being placed on this approval can be provided. The success of the GAB Robins acquisition will depend, in part, on the Company's ability to realize the anticipated synergies and cost savings from integrating GAB Robins on a timely basis. The integration process may be complex, costly and time-consuming.The Company expects to record special charges of approximately $7 million in 2015 related to these efforts. Because the financial results of certain of the Company's international subsidiaries, including those in the U.K. through which GAB Robins will report, are included in the Company's consolidated financial statements on a two-month delayed basis as permitted by ASC 810, "Consolidation,", the results of GAB Robins' business since the acquisition date have not been included in the Company's consolidated results of operations. In addition, the Credit Facility borrowings used to complete the GAB Robins acquisition are not included in outstanding borrowings on the Company's Consolidated Balance Sheet at December 31, 2014, because the U.K.-based borrowing entity has an October 31 fiscal year end, and the balance sheet of that entity was consolidated as of October 31, 2014. —On January 22, 2015, the Company announced the establishment of a wholly-owned global business services center (the "Center") in Manila, Philippines. The Center provides the Company a venue for global consolidation of certain business functions, shared services, and currently outsourced processes. The Center, which is expected to be phased in through 2018, is expected to allow the Company to continue to strengthen its client service, realize additional operational efficiencies, and invest in new capabilities for growth. Operations in the Center are expected to deliver cumulative expense savings of approximately $60 million through 2019 and annual cost savings of approximately $20 million per year thereafter. To achieve these savings, the Company expects to record charges totaling approximately $20 million through 2018. An initial estimated charge of approximately $9 million is expected to be incurred in 2015, which is expected to be partially offset by initial savings in 2015 of approximately $2 million. • Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. 3 FORWARD-LOOKING STATEMENTS, ADDITIONAL INFORMATION, AND SUBSEQUENT EVENTS (continued)

4 • The world’s largest independent provider of global claims management solutions • Multiple globally recognized brand names: Crawford, Broadspire, GCG • Clients include multinational insurance carriers, brokers and local insurance firms as well as 200 of the Fortune 500 EMEA-A/P Broadspire Legal Settlement Administration Americas Serves large national accounts, carriers and self-insured entities Serves the U.K., European, Middle Eastern, African and Asia Pacific markets Serves the U.S., Canadian and Latin American markets Provides administration for class action settlements and bankruptcy matters Global Business Services Leader

Today’s Agenda Welcome and Opening Comments Fourth Quarter and Full Year 2014 Financial Review Fourth Quarter and Full Year 2014 Review and Outlook Guidance and Strategic Initiatives

6 94.9 1,143 1,163 Revenues ($ in millions) Consolidated Operating Earnings ($ in millions) • Revenues of $1.143 billion • Consolidated operating earnings of $73.1 million • Diluted earnings per share of $0.57 for CRDA and $0.52 for CRDB • Improvement in Broadspire and Americas operating results • Important acquisitions in EMEA/AP • Global Business Services Center initiative underway Full Year 2014 Business Summary 73.1

Fourth Quarter and Full Year 2014 Financial Review

Unaudited ($ in thousands, except per share amounts) Three Months Ended December 31, 2014 2013 % Change Revenues Before Reimbursements $285,455 $284,879 — % Costs of Services Before Reimbursements 215,118 208,393 3 % Selling, General, and Administrative Expenses 57,900 58,230 (1 )% Corporate Interest Expense, Net 1,499 1,661 (10 )% Total Costs and Expenses Before Reimbursements 274,517 268,284 2 % Other Income 1,076 29 nm Income Before Income Taxes 12,014 16,624 (28 )% Provision for Income Taxes 8,286 5,545 49 % Net Income 3,728 11,079 (66 )% Net Income Attributable to Noncontrolling Interests (412 ) (253 ) 63 % Net Income Attributable to Shareholders of Crawford & Company $3,316 $10,826 (69 )% Earnings Per Share - Diluted: Class A Common Stock $0.07 $0.20 (65 )% Class B Common Stock $0.05 $0.19 (74 )% Cash Dividends per Share: Class A Common Stock $0.07 $0.05 40 % Class B Common Stock $0.05 $0.04 25 % 8 Income Statement Highlights nm=not meaningful

Pro Forma 2014/2013 2014* 2014** 2013 % Change Revenues $ 88,365 $ 85,646 $ 79,483 7.8 % Total Operating Expenses 86,683 84,095 78,306 7.4 % Operating Earnings $ 1,682 $ 1,551 $ 1,177 31.8 % Operating Margin 1.9 % 1.8 % 1.5 % 85.9 6.5 95.9 85.6 79.5 1.2 9 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, *At 2013 average FX rates **At 2014 average FX rates Americas Fourth Quarter Financials 1.6 • Growth in Contractor Connection and Canadian revenues over 2013 period • Exchange rate impact reduced revenues by $2.7 million during the quarter

9.1 85.9 6.5 14.1 5.0 5.9 10 Revenues ($ in millions) Catastrophe Cases (In thousands) • CAT revenues in the 2014 period included $11.2 million under an outsourcing arrangement with a major U.S. insurer where the Company supplies adjusters to the client's location without corresponding case referrals • Apart from this outsourcing arrangement, U.S. CAT activity reflected weakness due to an overall lack of severe weather events U.S. Catastrophe (CAT) Adjuster Activity Fourth Quarter Financials 3.7

91.0 12.7 Pro Forma 2014/2013 2014* 2014** 2013 % Change Revenues $ 91,246 $ 90,595 $ 90,975 (0.4 )% Total Operating Expenses 81,714 81,310 78,303 3.8 % Operating Earnings $ 9,532 $ 9,285 $ 12,672 (26.7 )% Operating Margin 10.4 % 10.2 % 13.9 % 11 Operating Earnings ($ in millions) Revenues ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Strategic investment in Specialty Markets continued • Operating earnings decline reflected impact of Thailand flooding claims in 2013 period *At 2013 average FX rates **At 2014 average FX rates EMEA/AP Fourth Quarter Financials 9.3

69.2 65.4 6.3 2014 2013 % Change Revenues $ 69,184 $ 65,354 5.9 % Total Operating Expenses 62,855 61,584 2.1 % Operating Earnings $ 6,329 $ 3,770 67.9 % Operating Margin 9.1 % 5.8 % 12 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Revenues and operating earnings reflected market share gains and increased medical management services referrals Broadspire Fourth Quarter Financials 3.8

40.0 49.1 8.0 2014 2013 % Change Revenues $ 40,030 $ 49,067 (18.4 )% Total Operating Expenses 35,516 41,029 (13.4 )% Operating Earnings $ 4,514 $ 8,038 (43.8 )% Operating Margin 11.3 % 16.4 % 4.5 13 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Revenues and operating earnings reflected expected declines from the Deepwater Horizon class action project and other significant engagements Legal Settlement Administration Fourth Quarter Financials

14 Unaudited ($ in thousands) December 31, 2014 December 31, 2013 Change Cash and cash equivalents $52,456 $75,953 ($23,497 ) Accounts receivable, net 180,096 160,350 19,746 Unbilled revenues, net 103,163 105,791 (2,628 ) Total receivables 283,259 266,141 17,118 Goodwill 131,885 132,777 (892 ) Deferred revenues 71,760 76,843 (5,083 ) Pension liabilities 142,343 102,960 39,383 Current portion of long-term debt, capital leases and short-term borrowings 2,765 35,875 (33,110 ) Long-term debt, less current portion 154,046 101,770 52,276 Total debt 156,811 137,645 19,166 Total stockholders' equity attributable to Crawford & Company 172,937 199,805 (26,868 ) Net debt* 104,355 61,692 42,663 Total debt / capitalization 48 % 41 % *Net debt is defined by the Company as long-term debt, capital leases and short-term borrowings, net of cash and cash equivalents Balance Sheet Highlights

15 2014 2013 Variance Net Income Attributable to Shareholders of Crawford & Company $30,624 $50,978 ($20,354 ) Depreciation and Other Non-Cash Operating Items 39,078 38,096 982 Unbilled and Billed Receivables Change (25,574 ) 18,630 (44,204 ) Working Capital Change (22,672 ) (11,910 ) (10,762 ) U.S. Pension Contributions (14,850 ) (17,950 ) 3,100 Operating Cash Flow 6,606 77,844 (71,238 ) Property & Equipment Purchases, net (12,485 ) (14,037 ) 1,552 Capitalized Software (internal and external costs) (16,712 ) (16,976 ) 264 Free Cash Flow ($22,591 ) $46,831 ($69,422 ) Unaudited ($ in thousands) For the years ended December 31, Operating and Free Cash Flow

16 Share Repurchases: • During the 2014 fourth quarter, Crawford repurchased 27,000 shares of CRDA at an average cost of $8.64 per share • From inception of share repurchase programs authorized in May 2012 through December 31, 2014, Crawford has repurchased 1,571,527 shares of CRDA at an average cost of $6.26 per share and 7,000 shares of CRDB at an average cost of $3.83 per share Dividends: • During the 2014 fourth quarter, Crawford paid a dividend of $0.07 on CRDA and $0.05 on CRDB • For the year, Crawford paid dividends of $0.24 per share on CRDA and $0.18 per share on CRDB Other Financial Highlights

Fourth Quarter and Full Year 2014 Operational Review

18 Revenues ($ in millions) Cases Received (In thousands) • Results in Americas segment led by North American Contractor Connection expansion and Canadian growth • Continuing improvement in Broadspire revenues and operating earnings • EMEA/AP and Legal Settlement Administration results impacted by runoff of special projects • Case referrals up 6% over prior-year quarter, mainly reflecting growth in high-frequency, low- severity claims • Cost management initiatives underway in all operations Business Activities Fourth Quarter Operational Review

19 U.S. Canada Latin America/ Caribbean Revenues by Geographic Region ($ in millions) Americas Cases Received (In thousands) U.S. Canada Latin America/ Caribbean U.S. Property and Casualty Long-term outsourcing project to assist major U.S. insurer partially offset decline in weather-related cases U.S. Contractor Connection network expansion and growth in market share Canada New business wins drove case increases Canadian Contractor Connection network expansion and growth in market share Latin America & Caribbean Concentration on Brazil and region-wide accident and health product line Americas Fourth Quarter Operational Review

20 U.K. CEMEA U.K. Asia-Pacific Asia-Pacific CEMEA Revenues by Geographic Region ($ in millions) EMEA/AP Cases Received (In thousands) EMEA/AP U.K. U.K. improvement driven by weather-related claims Completed acquisition of GAB Robins CEMEA Claims volume increased in fourth quarter from high frequency claims Continued focus on improving operating performance Asia-Pacific 2013 period reflected benefits from completion of Thailand flooding claims Benign weather during 2014 Fourth Quarter Operational Review

21 Revenues by Service Line ($ in millions) Broadspire Cases Received (In thousands) Risk Mgmt Info. Svcs. Other Medical Mgmt. Casualty Workers' Comp. Workers' Comp. Broadspire • Broadspire case volume increased 7% over prior year fourth quarter • Client retention remained strong • Medical management revenues increased from new client wins • Disability and absence management services products announced to the market Fourth Quarter Operational Review

22 Backlog ($ in millions) Legal Settlement Administration • Deepwater Horizon and other significant class action projects continued to wind down • Backlog at $102 million as of December 31, 2014 • Focus on operating margin improvement • Activities to build new business pipeline ongoing Fourth Quarter Operational Review Revenues ($ in millions) 49.1 40.0 102 108

23 The Company expects to incur pretax special charges in 2015, currently estimated at approximately $7.0 million for the integration of GAB Robins and $9.0 million related to the establishment of a global business services center in Manila, Philippines. Crawford & Company is providing a guidance range for 2015 as follows: Year ending December 31, 2015 Low End High End Consolidated revenues before reimbursements $1.16 $1.19 billion Consolidated operating earnings $85.5 $95.0 million Consolidated cash provided by operating activities $40.0 $50.0 million After special charges, net income attributable to shareholders of Crawford & Company between $29.5 $35.0 million Diluted earnings per share--CRDA $0.57 $0.67 per share Diluted earnings per share--CRDB $0.50 $0.60 per share Before special charges, net income attributable to shareholders of Crawford & Company between $39.0 $44.5 million Diluted earnings per share--CRDA $0.75 $0.85 per share Diluted earnings per share--CRDB $0.68 $0.78 per share 2015 Guidance

24 • Execute on growth strategies • Successful integration of recent acquisitions • Enhance operational effectiveness and efficiency • Worldwide expense reduction program • Global Business Services Center implementation 2015 Operational Initiatives

Fourth Quarter and Full Year 2014 Appendix

26 Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out- of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues,respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include the GAAP-required gross up of our revenues and expenses for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). Unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company’s debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company’s defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker (“CODM”) to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings (loss) including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, income taxes, and net income or loss attributable to noncontrolling interests. Appendix: Non-GAAP Financial Information

Reconciliation of Non-GAAP Items Unaudited ($ in thousands) 2013 2014 Operating Earnings (Loss): Americas $ 18,532 $ 23,663 EMEA/AP 32,158 19,720 Broadspire 8,245 15,469 Legal Settlement Administration 46,752 22,849 Unallocated corporate and shared costs and credits (10,82 9 ) (8,582 ) Consolidated Operating Earnings 94,858 73,119 Deduct: Net corporate interest expense (6,423 ) (6,031 ) Stock option expense (948 ) (859 ) Amortization expense (6,385 ) (6,341 ) Special (charges) and credits, net — — Goodwill and intangible asset impairment charges — — Income taxes (29,76 6 ) (28,78 0 ) Net Income Attributable to Non-Controlling Interests (358 ) (484 ) Net Income Attributable to Shareholders of Crawford & Company $ 50,978 $ 30,624 27 Revenues and Operating Earnings Unaudited ($ in millions) 2013 2014 Revenues Before Reimbursements Total Revenues $ 1,253 $ 1,217 Reimbursements (90 ) (74 ) Revenues Before Reimbursements $ 1,163 $ 1,143

Quarter Ended Quarter Ended December 31, December 31, Unaudited ($ in thousands) 2014 2013 Revenues Before Reimbursements Total Revenues $ 305,642 $ 306,720 Reimbursements (20,187 ) (21,841 ) Revenues Before Reimbursements $ 285,455 $ 284,879 Costs of Services Before Reimbursements Total Costs of Services $ 235,305 $ 230,234 Reimbursements (20,187 ) (21,841 ) Costs of Services Before Reimbursements $ 215,118 $ 208,393 28 Fourth Quarter Revenues, Costs of Services, and Operating Earnings Quarter Ended Quarter Ended December 31, December 31, Unaudited ($ in thousands) 2014 2013 Operating Earnings: Americas $ 1,551 $ 1,177 EMEA/AP 9,285 12,672 Broadspire 6,329 3,770 Legal Settlement Administration 4,514 8,038 Unallocated corporate and shared costs and credits (6,392 ) (5,474 ) Consolidated Operating Earnings 15,287 20,183 Deduct: Net corporate interest expense (1,499 ) (1,661 ) Stock option expense (179 ) (296 ) Amortization expense (1,595 ) (1,602 ) Income taxes (8,286 ) (5,545 ) Net income attributable to non-controlling interests (412 ) (253 ) Net Income Attributable to Shareholders of Crawford & Company $ 3,316 $ 10,826 Reconciliation of Non-GAAP Items (cont.)

Reconciliation of Non-GAAP Items (cont.) 29 Quarterly Revenues and Net Debt Unaudited ($ in millions) 4Q 2014 3Q 2014 2Q 2014 1Q 2014 4Q 2013 Revenues Before Reimbursements Total Revenues $ 306 $ 315 $ 307 $ 289 $ 307 Reimbursements (21 ) (21 ) (19 ) (14 ) (22 ) Revenues Before Reimbursements $ 285 $ 294 $ 288 $ 275 $ 285 Unaudited ($ in thousands) 2013 2014 Net Debt Short-term borrowings $ 35,000 $ 2,002 Current installments of long-term debt and capital leases 875 763 Long-term debt and capital leases, less current installments 101,770 154,046 Total debt 137,645 156,811 Less: Cash and cash equivalents 75,953 52,456 Net debt $ 61,692 $ 104,355

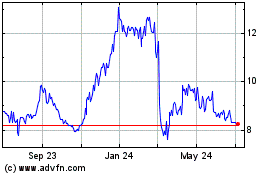

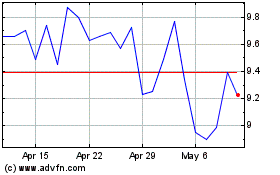

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024