Canadian Pacific Details Offer for Norfolk Southern--Update

November 18 2015 - 12:09PM

Dow Jones News

By Ben Dummett

Canadian Pacific Railway Ltd. made a cash-and-stock proposal to

merge with Norfolk Southern Corp. worth about $28 billion, but said

in a letter to its rival made public Wednesday that the deal could

ultimately be worth much more.

Calgary, Alberta-based CP, which hasn't launched a formal bid,

is offering $46.72 in cash and 0.348 shares of the merged company

for each share of Norfolk Southern. If the two companies achieve

more than $1 billion in cost savings by merging, the offer could

end up being worth as much as $42.64 billion, CP said in a letter

to Norfolk Southern chief executive James Squires that it released

Tuesday.

The two sides are already differing on the value of the

proposal, signaling that they are far apart on a potential

combination.

Norfolk, based in Norfolk, Va., said the stock component of the

offer is based on CP's share price, which makes the offer's value

worth a lot less based on the Canadian railroad's projected

valuation of the deal. In a release late Tuesday, Norfolk said it

would evaluate the bid, describing it as an "unsolicited,

low-premium, nonbinding and highly conditional indication of

interest."

The proposal is meant "to start a conversation," that would lead

to a deal, CP spokesman Marty Cej said. Norfolk Southern declined

to comment further on Wednesday.

CP made its proposal public after a meeting last week between

its chief executive, Hunter Harrison, and Norfolk's Mr. Squires, at

which CP met with a cool reception, according to a person familiar

with the matter.

A merger between the two railroads would create an industry

giant and a rail network that would stretch from the Canadian West

Coast to the Gulf of Mexico and U.S. Atlantic Seaboard.

CP said in its letter that the combined company could generate

more than $1.8 billion in annual cost savings over the next several

years as well as substantial tax benefits. CP didn't provide

specific cost or tax savings in the letter.

According to a person familiar with the matter, CP is making the

move in part because it believes its management could greatly boost

the margins at Norfolk, along the same lines that Mr. Harrison has

done since taking over CP in 2012. That followed a successful proxy

battle by New York activist investor William Ackman to replace

directors and management at CP, one of Canada's oldest and most

storied companies.

Mr. Harrison believes he can get to a combined operating ratio

in the mid-50% level, compared with Norfolk's approximately 70%

ratio at this point, the person said. The lower a railroad's

operating ratio, the more efficiently it runs and the more

profitable it can be.

According to the text of the letter, CP said the merged company

would be listed on both the New York and Toronto Stock exchanges,

with Norfolk Southern shareholders owning 41% of the new

company.

"We are ready to begin working with you and your team

immediately on this transformational opportunity and are prepared

to commit whatever resources may be necessary to complete the

proposed transaction expeditiously and in a manner which both

recognizes and fairly addresses any social considerations related

to the successful integration of our two great companies," CP said

in the letter.

Such a deal would face regulatory hurdles, and CP sought in its

letter to outline steps it could take to show regulators that a

combination could boost the North American rail network's

competitiveness.

Laura Stevens and David Benoit contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 18, 2015 11:54 ET (16:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

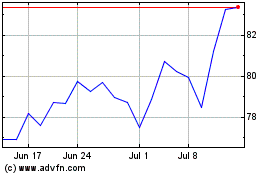

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024