Loan Worries Clip Capital One -- WSJ

January 25 2017 - 3:02AM

Dow Jones News

By Anne Steele

Capital One Financial Corp.'s profit dropped 14% in the final

quarter of the year amid a jump in protection for loan losses,

though revenue improved as the lender registered loan growth.

Shares fell 2.2% to $86.80 in after-hours trading. Capital One,

one of the country's largest credit-card lenders, also offers

traditional bank accounts, mortgages, auto loans and commercial

loans.

Capital One said period-end loans held for investment rose 3% in

the fourth quarter to $245.6 billion; however, the company's

provision for credit losses shot up 27% to $1.75 billion from a

year earlier.

In all for the December quarter, Capital One posted a profit of

$791 million, or $1.45 a share, compared with $920 million, or

$1.58 a share, a year earlier. Revenue climbed 6% to $6.57

billion.

Analysts polled by Thomson Reuters expected earnings of $1.60 a

share on revenue of $6.67 billion.

"In 2016, Capital One posted a second consecutive year of

double-digit growth in domestic card loans and purchase volume,"

Chief Executive Richard Fairbank said in a news release, strong

growth over the past two years and a reduced share count should

help the company to deliver "solid EPS growth in 2017."

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 25, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

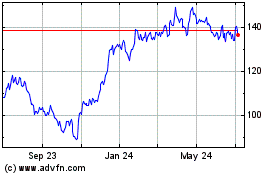

Capital One Financial (NYSE:COF)

Historical Stock Chart

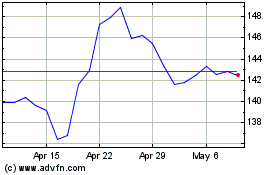

From Mar 2024 to Apr 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024