- Second quarter revenues of $5.0

billion, EBIT of 14.4 percent of sales

- Full year revenue expected to grow

between 2 and 4 percent and EBIT to be in the range of 13.5 to 14.0

percent of sales

Cummins Inc. (NYSE: CMI) today reported results for the second

quarter of 2015. Second quarter revenue of $5.0 billion increased 4

percent from the same quarter in 2014. The increase year-over-year

was driven by stronger demand in on-highway markets and distributor

acquisitions in North America. Currency negatively impacted

revenues by 4 percent compared to last year, primarily due to a

stronger US dollar.

Revenues in North America increased 12 percent while

international sales declined by 6 percent. Within international

markets, sales in Brazil fell the most due to the weak economy.

Earnings before interest and taxes (EBIT) increased to $721

million for the second quarter or 14.4 percent of sales, up from

$657 million or 13.6 percent of sales a year ago.

Net income attributable to Cummins grew 6 percent in the second

quarter to $471 million ($2.62 per diluted share), compared to $446

million ($2.43 per diluted share) in the second quarter of 2014.

The tax rate in the second quarter of 2015, including discrete

items, was 29.5 percent.

“We delivered strong results in the second quarter, despite

challenging economic conditions in a number of international

markets, and we increased cash returned to shareholders,” said

Cummins Chairman and CEO Tom Linebarger. “Earnings improved as a

result of good performance by our manufacturing and supply chain

organizations and solid execution on material cost reduction

initiatives. We returned $517 million to shareholders in the form

of dividends and share repurchases in the second quarter and we

recently announced a 25 percent increase in our quarterly

dividend.”

Based on the current forecast, Cummins expects full year 2015

revenues to grow between 2 and 4 percent, and EBIT to be in the

range of 13.5 to 14.0 percent of sales.

Other recent highlights:

- For the ninth consecutive year, Cummins

was named one of the Top 50 Companies for Diversity by Diversity

Inc.

- The Company announced new environmental

sustainability goals and pledged to reach an annual reduction of

3.5 million metric tons of carbon dioxide (CO2) by 2020, which

equates to 350 million gallons of fuel.

- John Wall, Cummins’ Vice President –

Chief Technical Officer, was honored by the California Air

Resources Board with the Haagen-Smit Clean Air Award, which

recognizes outstanding lifetime achievement in air-quality

research, science and technology.

- For the fourth consecutive year,

Cummins was recognized as a Top 25 Supply Chain company by

Gartner.

- Cummins announced that John Wall, Vice

President – Chief Technical Officer, will be retiring after nearly

30 years with the Company and that Jennifer Rumsey, Vice President

of Engineering for Cummins’ Engine Business, will take Wall’s

place.

- Cummins announced a 25 percent increase

in its quarterly dividend.

Second quarter 2015 detail (all comparisons to same period in

2014)

Engine Segment

- Sales - $2.8 billion, up 2

percent.

- Segment EBIT - $341 million, or 12.2

percent of sales, compared to $311 million or 11.3 percent of

sales.

- Strong demand in North American truck

and bus markets was partially offset by weaker demand in global

industrial markets and lower truck demand in Brazil.

Distribution Segment

- Sales - $1.5 billion, up 21 percent,

down 6 percent excluding acquisitions.

- Segment EBIT - $113 million, or 7.6

percent of sales, compared to $126 million or 10.2 percent of

sales.

- Currency movements negatively impacted

sales by 6 percent.

- Results in the second quarter of 2014

included a gain of $14 million related to the acquisition of

distributors in North America.

Components Segment

- Sales - $1.4 billion, up 9

percent.

- Segment EBIT - $223 million, or 16.0

percent of sales, compared to $185 million or 14.5 percent of

sales.

- Stronger demand in on-highway markets

in North America, Europe, and China more than offset weakness in

Brazil.

Power Generation Segment

- Sales - $747 million, up 1

percent.

- Segment EBIT - $57 million, or 7.6

percent of sales, compared to $61 million, or 8.2 percent of

sales.

- Increased international sales in the

Middle East, Asia Pacific and India more than offset lower sales in

North America and a 4 percent reduction in revenues due to currency

movements.

About Cummins

Cummins Inc., a global power leader, is a corporation of

complementary business units that design, manufacture, distribute

and service diesel and natural gas engines and related

technologies, including fuel systems, controls, air handling,

filtration, emission solutions and electrical power generation

systems. Headquartered in Columbus, Indiana, (USA) Cummins

currently employs approximately 54,600 people worldwide and serves

customers in approximately 190 countries and territories through a

network of approximately 600 company-owned and independent

distributor locations and approximately 7,200 dealer locations.

Cummins earned $1.65 billion on sales of $19.2 billion in 2014.

Press releases can be found on the Web at www.cummins.com. Follow Cummins on Twitter at

www.twittter.com/cummins and on

YouTube at www.youtube/cumminsinc.

Forward-looking disclosure statement

Information provided in this release that is not purely

historical are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding our forecasts, guidance, preliminary results,

expectations, hopes, beliefs and intentions on strategies regarding

the future. These forward looking statements include, without

limitation, statements relating to our plans and expectations for

our revenues for the full year of 2015. Our actual future results

could differ materially from those projected in such

forward-looking statements because of a number of factors,

including, but not limited to: the adoption and implementation of

global emission standards; the price and availability of energy;

the pace of infrastructure development; increasing global

competition among our customers; general economic, business and

financing conditions; governmental action; changes in our

customers’ business strategies; competitor pricing activity;

expense volatility; labor relations; and other risks detailed from

time to time in our Securities and Exchange Commission filings,

including particularly in the Risk Factors section of our 2014

Annual Report on Form 10-K. Shareholders, potential investors and

other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. The

forward-looking statements made herein are made only as of the date

of this press release and we undertake no obligation to publicly

update any forward-looking statements, whether as a result of new

information, future events or otherwise. More detailed information

about factors that may affect our performance may be found in our

filings with the Securities and Exchange Commission, which are

available at http://www.sec.gov or at

http://www.cummins.com in the Investor

Relations section of our website.

Presentation of Non-GAAP Financial Information

EBIT is a non-GAAP measure used in this release, and is defined

and reconciled to what management believes to be the most

comparable GAAP measure in a schedule attached to this release.

Cummins presents this information as it believes it is useful to

understanding the Company's operating performance, and because EBIT

is a measure used internally to assess the performance of the

operating units.

Webcast information

Cummins management will host a teleconference to discuss these

results today at 10 a.m. EST. This teleconference will be

webcast and available on the Investor Relations section of the

Cummins website at www.cummins.com . Participants wishing to view

the visuals available with the audio are encouraged to sign-in a

few minutes prior to the start of the teleconference.

CUMMINS INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (Unaudited) (a)

Three months ended In millions, except per share

amounts

June 28, 2015

June 29, 2014

NET SALES $ 5,015 $ 4,835 Cost of sales

3,683 3,630

GROSS MARGIN 1,332

1,205

OPERATING EXPENSES AND INCOME Selling, general

and administrative expenses

537 513 Research, development

and engineering expenses

166 179 Equity, royalty and

interest income from investees

94 105 Other operating

(expense) income, net

— (6 )

OPERATING INCOME

723 612 Interest income

6 6 Interest expense

17 15 Other (expense) income, net

(8 ) 39

INCOME BEFORE INCOME TAXES 704 642

Income tax expense

208 170

CONSOLIDATED NET

INCOME 496 472 Less: Net income attributable to

noncontrolling interests

25 26

NET INCOME

ATTRIBUTABLE TO CUMMINS INC. $ 471 $ 446

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO CUMMINS

INC. Basic

$ 2.63 $ 2.44 Diluted

$

2.62 $ 2.43

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic

179.2 182.8 Diluted

179.6 183.2

CASH DIVIDENDS DECLARED PER COMMON SHARE $

0.78 $ 0.625

___________________________________________________________

(a) Prepared on an unaudited basis in accordance with accounting

principles generally accepted in the United States of America.

CUMMINS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited) (a)

Six months ended In millions, except per share

amounts

June 28, 2015

June 29, 2014

NET SALES $ 9,724 $ 9,241 Cost of sales

7,197 6,937

GROSS MARGIN 2,527

2,304

OPERATING EXPENSES AND INCOME Selling, general

and administrative expenses

1,054 998 Research, development

and engineering expenses

361 369 Equity, royalty and

interest income from investees

162 195 Other operating

(expense) income, net

(3 ) (7 )

OPERATING

INCOME 1,271 1,125 Interest income

11 11

Interest expense

31 32 Other income, net

1 49

INCOME BEFORE INCOME TAXES 1,252 1,153

Income tax expense

352 323

CONSOLIDATED NET

INCOME 900 830 Less: Net income attributable to

noncontrolling interests

42 46

NET INCOME

ATTRIBUTABLE TO CUMMINS INC. $ 858 $ 784

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO CUMMINS

INC. Basic

$ 4.77 $ 4.27 Diluted

$

4.76 $ 4.26

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic

179.9 183.5 Diluted

180.3 183.9

CASH DIVIDENDS DECLARED PER COMMON SHARE $

1.56 $ 1.25

___________________________________________________________

(a) Prepared on an unaudited basis in accordance with accounting

principles generally accepted in the United States of America.

CUMMINS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (a)

In millions, except par value

June 28, 2015

December 31, 2014

ASSETS Current assets Cash and cash equivalents

$

1,760 $ 2,301 Marketable securities

89 93

Total cash, cash equivalents and marketable securities

1,849 2,394 Accounts and notes receivable, net

3,422

2,946 Inventories

2,986 2,866 Prepaid expenses and other

current assets

746 849 Total current assets

9,003 9,055 Long-term assets Property, plant

and equipment

7,151 7,123 Accumulated depreciation

(3,498 ) (3,437 ) Property, plant and equipment, net

3,653 3,686 Investments and advances related to equity

method investees

995 981 Goodwill

473 479 Other

intangible assets, net

339 343 Prepaid pensions

784

637 Other assets

631 595 Total assets

$

15,878 $ 15,776

LIABILITIES

Current liabilities Accounts payable (principally trade)

$

1,974 $ 1,881 Loans payable

70 86 Current portion of

accrued product warranty

405 363 Accrued compensation,

benefits and retirement costs

432 508 Deferred revenue

402 401 Other accrued expenses

739 759 Current

maturities of long-term debt

31 23 Total

current liabilities

4,053 4,021 Long-term

liabilities Long-term debt

1,576 1,589 Postretirement

benefits other than pensions

351 369 Pensions

291 289

Other liabilities and deferred revenue

1,393 1,415

Total liabilities

$ 7,664 $ 7,683

EQUITY Cummins Inc. shareholders’ equity

Common stock, $2.50 par value, 500 shares authorized, 222.3 and

222.3 shares issued

$ 2,164 $ 2,139 Retained earnings

10,123 9,545 Treasury stock, at cost, 43.7 and 40.1 shares

(3,350 ) (2,844 ) Common stock held by employee

benefits trust, at cost, 1.0 and 1.1 shares

(12 ) (13

) Accumulated other comprehensive loss

(1,071 )

(1,078 ) Total Cummins Inc. shareholders’ equity

7,854 7,749

Noncontrolling interests

360 344 Total equity

$ 8,214 $ 8,093

Total liabilities and equity

$ 15,878 $ 15,776

___________________________________________________________

(a) Prepared on an unaudited basis in accordance with accounting

principles generally accepted in the United States of America.

CUMMINS INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (a)

Six months ended In millions

June 28, 2015

June 29, 2014

CASH FLOWS FROM OPERATING ACTIVITIES Consolidated net income

$ 900 $ 830 Adjustments to reconcile consolidated net

income to net cash provided by operating activities Depreciation

and amortization

254 217 Deferred income taxes

(63

) (88 ) Equity in income of investees, net of dividends

(68 ) (108 ) Pension contributions in excess of

expense

(122 ) (127 ) Other post-retirement benefits

payments in excess of expense

(15 ) (14 ) Stock-based

compensation expense

17 21 Translation and hedging

activities

27 (9 ) Changes in current assets and

liabilities, net of acquisitions Accounts and notes receivable

(426 ) (321 ) Inventories

(127 ) (223 )

Other current assets

18 4 Accounts payable

97 289

Accrued expenses

(21 ) 120 Changes in other

liabilities and deferred revenue

133 116 Other, net

(35 ) (6 ) Net cash provided by operating activities

569 701

CASH FLOWS FROM INVESTING

ACTIVITIES Capital expenditures

(247 ) (245 )

Investments in internal use software

(22 ) (26 )

Investments in and advances to equity investees

(17 )

(11 ) Acquisitions of businesses, net of cash acquired

(15

) (193 ) Investments in marketable securities—acquisitions

(173 ) (179 ) Investments in marketable

securities—liquidations

155 179 Cash flows from derivatives

not designated as hedges

5 4 Other, net

14 8

Net cash used in investing activities

(300 )

(463 )

CASH FLOWS FROM FINANCING ACTIVITIES Proceeds

from borrowings

12 17 Payments on borrowings and capital

lease obligations

(31 ) (39 ) Net payments under

short-term credit agreements

(10 ) (48 )

Distributions to noncontrolling interests

(14 ) (32 )

Dividend payments on common stock

(280 ) (229 )

Repurchases of common stock

(514 ) (430 ) Other, net

8 5 Net cash used in financing activities

(829 ) (756 )

EFFECT OF EXCHANGE RATE CHANGES ON

CASH AND CASH EQUIVALENTS 19 38 Net

decrease in cash and cash equivalents

(541 ) (480 )

Cash and cash equivalents at beginning of year

2,301

2,699

CASH AND CASH EQUIVALENTS AT END OF PERIOD

$ 1,760 $ 2,219

___________________________________________________________

(a) Prepared on an unaudited basis in accordance with accounting

principles generally accepted in the United States of America.

CUMMINS INC. AND

SUBSIDIARIES SEGMENT INFORMATION (Unaudited)

In millions Engine Distribution

Components

PowerGeneration

Non-segment Items

(1)

Total Three months ended June 28, 2015 External sales

$ 2,058 $ 1,487 $ 1,017

$ 453 $ — $ 5,015

Intersegment sales

739 8 380

294 (1,421 ) —

Total sales

2,797 1,495 1,397 747

(1,421 ) 5,015 Depreciation and

amortization(2)

60 25 28 13 —

126 Research, development and engineering expenses

91

3 57 15 — 166 Equity, royalty

and interest income from investees

57 21 8

8 — 94 Interest income

3 1

1 1 — 6 Segment EBIT

341

113 223 57 (13 ) 721

Segment EBIT as a percentage of total sales

12.2

% 7.6 % 16.0 % 7.6

% 14.4 % Three months ended June 29,

2014 External sales $ 2,178 $ 1,229 $ 953 $ 475 $ — $ 4,835

Intersegment sales 566 9 327 268 (1,170

) — Total sales 2,744 1,238 1,280 743 (1,170 ) 4,835

Depreciation and amortization(2) 52 20 26 13 — 111 Research,

development and engineering expenses 105 3 53 18 — 179 Equity,

royalty and interest income from investees 45 42 9 9 — 105 Interest

income 4 — 1 1 — 6 Segment EBIT 311 126

(3)

185 61 (26 ) 657

Segment EBIT as a percentage of total sales 11.3 % 10.2 % 14.5 %

8.2 % 13.6 %

(1)

Includes intersegment sales and profit in inventory eliminations

and unallocated corporate expenses. There were no significant

unallocated corporate expenses for the three months ended June 28,

2015 and June 29, 2014.

(2)

Depreciation and amortization as shown on a segment basis excludes

the amortization of debt discount and deferred costs included in

the Condensed Consolidated Statements of Income as "Interest

expense."

(3)

Distribution segment EBIT included gains of $14 million on the fair

value adjustments resulting from the acquisitions of the

controlling interests in North American distributors for the three

months ended June 29, 2014.

In millions

Engine Distribution Components

PowerGeneration

Non-segment Items

(1)

Total Six months ended June 28, 2015 External

sales

$ 3,947 $ 2,956 $

1,948 $ 873 $ — $

9,724 Intersegment sales

1,446 15

748 554 (2,763 )

— Total sales

5,393 2,971 2,696

1,427 (2,763 ) 9,724 Depreciation and

amortization(2)

118 52 54 29 —

253 Research, development and engineering expenses

205 6 118 32 — 361

Equity, royalty and interest income from investees

87

41 17 17 — 162 Interest income

5 2 2 2 — 11 Segment EBIT

594 201 418 106 (36 )

1,283 Segment EBIT as a percentage of total sales

11.0 % 6.8 % 15.5 %

7.4 % 13.2 % Six months ended

June 29, 2014 External sales $ 4,268 $ 2,171 $ 1,875 $ 927 $ —

$ 9,241 Intersegment sales 1,039 17 635 455

(2,146 ) — Total sales 5,307 2,188 2,510 1,382 (2,146

) 9,241 Depreciation and amortization(2) 103 36 52 25 — 216

Research, development and engineering expenses 221 5 106 37 — 369

Equity, royalty and interest income from investees 77 83 18 17 —

195 Interest income 6 1 2 2 — 11 Segment EBIT 580 202 (3) 352 86

(35 ) 1,185 Segment EBIT as a percentage of total sales 10.9

% 9.2 % 14.0 % 6.2 % 12.8 %

(1)

Includes intersegment sales and profit in inventory eliminations

and unallocated corporate expenses. There were no significant

unallocated corporate expenses for the six months ended June 28,

2015 and June 29, 2014.

(2)

Depreciation and amortization as shown on a segment basis excludes

the amortization of debt discount and deferred costs included in

the Condensed Consolidated Statements of Income as "Interest

expense." The amortization of debt discount and deferred costs were

$1 million and $1 million for the six months ended June 28, 2015

and June 29, 2014, respectively.

(3)

Distribution segment EBIT included gains of $20 million on the fair

value adjustments resulting from the acquisitions of the

controlling interests in North American distributors for the six

months ended June 29, 2014.

A reconciliation of our segment information to the corresponding

amounts in the Condensed Consolidated Statements of Income is shown

in the table below:

Three months ended Six months ended

In millions

June 28, 2015

June 29, 2014

June 28, 2015

June 29, 2014

Total EBIT

$ 721 $ 657

$ 1,283 $ 1,185

Less: Interest expense

17 15

31

32 Income before income taxes

$ 704 $ 642

$ 1,252 $ 1,153

CUMMINS INC. AND SUBSIDIARIESSELECTED

FOOTNOTE DATA(Unaudited)

NOTE 1. EQUITY, ROYALTY AND INTEREST INCOME FROM

INVESTEES

Equity, royalty and interest income from investees included in

our Condensed Consolidated Statements of Income for the reporting

periods was as follows:

Three months ended Six months ended

In millions

June 28, 2015

June 29, 2014

June 28, 2015

June 29, 2014

Distribution Entities North American distributors

$

8 $ 30

$ 18 $ 62 Komatsu Cummins Chile, Ltda.

8 8

15 14 All other distributors

— 1

1

2

Manufacturing Entities Dongfeng Cummins Engine Company,

Ltd.

15 22

29 36 Beijing Foton Cummins Engine Co.,

Ltd. (Light-duty)

15 8

23 14 Chongqing Cummins Engine

Company, Ltd.

11 15

23 26 Beijing Foton Cummins

Engine Co., Ltd. (Heavy-duty)

7 (7 )

6 (13 ) All

other manufacturers

21 19

28 34

Cummins share of net income

85 96

143 175

Royalty and interest income

9 9

19

20 Equity, royalty and interest income from investees

$ 94 $ 105

$ 162 $

195

NOTE 2. INCOME TAXES

The effective tax rate for the three and six month periods ended

June 28, 2015, was 29.5 percent and 28.1 percent,

respectively. The six month tax rate included an $18 million

discrete tax benefit to reflect the release of reserves for

uncertain tax positions related to a favorable federal audit

settlement.

CUMMINS INC. AND

SUBSIDIARIESFINANCIAL MEASURES THAT SUPPLEMENT

GAAP(Unaudited)

Net income and diluted earnings per share (EPS) attributable

to Cummins Inc. excluding special items

We believe this is a useful measure of our operating performance

for the periods presented as it illustrates our operating

performance without regard to special items including tax

adjustments. This measure is not in accordance with, or an

alternative for, accounting principles generally accepted in the

United States of America (GAAP) and may not be consistent with

measures used by other companies. It should be considered

supplemental data. The following table reconciles net income

attributable to Cummins Inc. to net income attributable to Cummins

Inc. excluding special items for the following periods:

Six months ended June 28, 2015

June 29, 2014 In millions Net Income

Diluted EPS Net Income Diluted EPS Net

income attributable to Cummins Inc.

$ 858 $

4.76 $ 784 $ 4.26 Less Tax items

18

0.10 — — Net income attributable to Cummins

Inc. excluding special items

$ 840 $

4.66 $ 784 $ 4.26

Earnings before interest, taxes and noncontrolling

interests

We define EBIT as earnings before interest expense, income tax

expense and noncontrolling interests in income of consolidated

subsidiaries (EBIT). We use EBIT to assess and measure the

performance of our operating segments and also as a component in

measuring our variable compensation programs. This measure is not

in accordance with, or an alternative for, GAAP and may not be

consistent with measures used by other companies. It should be

considered supplemental data. Below is a reconciliation of EBIT to

“Net income attributable to Cummins Inc.,” for each of the

applicable periods:

Three months ended Six months ended

In millions

June 28, 2015

June 29, 2014 June 28, 2015 June 29,

2014 Earnings before interest expense and income taxes

$

721 $ 657

$ 1,283 $ 1,185

EBIT as a percentage of net sales

14.4

% 13.6 %

13.2 % 12.8 % Less Interest

expense

17 15

31 32 Income tax expense

208

170

352 323 Consolidated net

income

496 472

900 830

Less Net income attributable to noncontrolling interests

25 26

42 46 Net income

attributable to Cummins Inc.

$ 471 $ 446

$ 858 $ 784 Net income

attributable to Cummins Inc. as a percentage of net sales

9.4 % 9.2 %

8.8 % 8.5 %

CUMMINS INC. AND SUBSIDIARIESBUSINESS

UNIT SALES DATA(Unaudited)

Engine Segment Net Sales by Market

In the first quarter of 2015, our Engine segment reorganized its

reporting structure to include the following markets: heavy-duty

truck, medium-duty truck and bus, light-duty automotive (pickup and

light commercial vehicle), industrial and stationary power. Sales

by market for our Engine segment by business (including 2014 and

2013 reorganized balances) were as follows:

2015 In millions

Q1 Q2 Q3 Q4 YTD Heavy-duty truck

$ 757

$ 875 $ — $ — $ 1,632 Medium-duty truck and bus

608

674 — — 1,282 Light-duty automotive 381

354 — —

735 Industrial 616

624 — — 1,240 Stationary power 234

270 — — 504 Total sales $ 2,596

$ 2,797 $ — $ — $ 5,393

2014 In millions Q1 Q2 Q3

Q4 YTD Heavy-duty truck $ 718 $ 769 $ 801 $ 784 $

3,072 Medium-duty truck and bus 575 605 599 652 2,431 Light-duty

automotive 391 392 396 388 1,567 Industrial 669 739 768 775 2,951

Stationary power 210 239 252 240 941

Total sales $ 2,563 $ 2,744 $ 2,816 $ 2,839

$ 10,962

2013 In millions YTD

Heavy-duty truck $ 2,618 Medium-duty truck and bus 2,064 Light-duty

automotive 1,465 Industrial 2,921 Stationary power 945 Total

sales $ 10,013

Unit shipments by engine classification (including unit

shipments to Power Generation):

2015 Units

Q1 Q2 Q3 Q4 YTD Mid-range

112,400

120,000 — — 232,400 Heavy-duty 28,700

32,800

— — 61,500 High-horsepower 3,500

3,700 —

— 7,200 Total units 144,600

156,500

— — 301,100

2014 Units

Q1 Q2 Q3 Q4 YTD Mid-range

118,900 118,700 117,700 115,900 471,200 Heavy-duty 28,800 30,300

32,300 30,700 122,100 High-horsepower 3,400 3,900

3,900 3,600 14,800 Total units 151,100 152,900

153,900 150,200 608,100

Distribution

Segment Sales by Business

2015 In millions Q1 Q2 Q3

Q4 YTD Parts and filtration $ 573

$ 598

$ — $ — $ 1,171 Engines 321

318 — — 639 Power generation 298

272 — — 570 Service 284

307 — —

591 Total sales $ 1,476

$ 1,495

$ — $ — $ 2,971

2014 In millions

Q1 Q2 Q3 Q4 YTD Parts and

filtration $ 382 $ 461 $ 491 $ 590 $ 1,924 Engines 174 249 270 368

1,061 Power generation 193 278 279 413 1,163 Service 201 250

252 323 1,026 Total sales $ 950 $ 1,238

$ 1,292 $ 1,694 $ 5,174

Component Segment Sales by

Business

2015 In millions

Q1 Q2 Q3 Q4 YTD Emission

Solutions $ 613

$ 679 $ — $ — $ 1,292 Turbo

Technologies 301

307 — — 608 Filtration 255

266 — —

521 Fuel systems 130

145 — — 275

Total sales $ 1,299

$ 1,397 $ —

$ — $ 2,696

2014 In millions Q1

Q2 Q3 Q4 YTD Emission Solutions $ 543 $

582 $ 598 $ 620 $ 2,343 Turbo Technologies 313 307 297 305 1,222

Filtration 265 275 268 267 1,075 Fuel systems 109 116

124 129 478 Total sales $ 1,230 $ 1,280

$ 1,287 $ 1,321 $ 5,118

Power Generation Segment Sales by Business

In the first quarter of 2015, our Power Generation segment

reorganized its reporting structure to include the following

businesses: power systems, alternators and power solutions. Sales

for our Power Generation segment by business (including 2014 and

2013 reorganized balances) were as follows:

2015 In millions

Q1 Q2 Q3 Q4 YTD Power systems $

543

$ 611 $ — $ — $ 1,154 Alternators 98

92 —

— 190 Power solutions 39

44 — —

83 Total sales $ 680

$ 747 $ — $

— $ 1,427

2014 In millions Q1

Q2 Q3 Q4 YTD Power systems $ 510 $ 586

$ 598 $ 606 $ 2,300 Alternators 105 126 115 103 449 Power solutions

24 31 41 51 147 Total sales $ 639

$ 743 $ 754 $ 760 $ 2,896

2013 In millions YTD Power systems $ 2,381

Alternators 496 Power solutions 154 Total sales $ 3,031

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150728005207/en/

Cummins Inc.Carole Casto, Executive Director - Corporate

Communications, 317-610-2480carole.casto@cummins.com

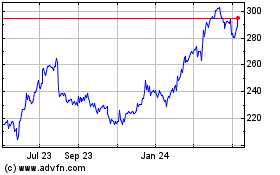

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024