Several Big Comerica Shareholders Urging Bank to Explore Sale

April 22 2016 - 12:40PM

Dow Jones News

Some of the biggest shareholders at Comerica Inc. are frustrated

with the Texas bank's results and are urging it to explore a sale,

a campaign that if successful would result in one of the largest

U.S. bank deals since the financial crisis.

Several investment firms that don't typically speak publicly,

including two top-ten Comerica holders, said in interviews the bank

has failed for too long to earn acceptable returns, needs to cut

costs dramatically and explore whether it would be better off

selling to a larger bank.

The bank is also facing heat from Hudson Executive Capital LP,

an activist fund started last year by former J.P. Morgan Chase

& Co. deal makers Douglas Braunstein and James Woolery. The

fund, which prefers to operate behind the scenes rather than

confront management, believes the bank needs to be proactive on

selling itself, according to a person familiar with the matter.

In an unusual twist, outspoken banking analyst Mike Mayo is

playing a central role in the effort. Mr. Mayo, who covers Comerica

at CLSA, has been urging investors to speak to the board at

Comerica's annual meeting in Dallas on Tuesday, and some large

holders plan to do so.

Mr. Mayo upgraded the bank last month after fielding calls from

investors that led him to think a sale could be forced. He says the

unrest is a chance to push bank investors to be more vocal, a

movement he supports.

In a statement, a Comerica spokesman said, "Our focus is, and

has always been, on our shareholders and delivering performance to

maximize value and meet their expectations."

The spokesman noted that the firm said in its first-quarter

earnings results earlier this week that it recently hired a

consultant to improve results. As part of that process, Comerica

will "put everything on the table by examining and pursuing all

realistic and achievable ways to create shareholder value."

On the earnings call, Chairman and Chief Executive Ralph W. Babb

Jr. acknowledged that investors have raised concerns about the

bank's performance.

"I know that we must earn our right to remain independent every

day," he said.

Comerica's first-quarter profit dropped by more than half as the

bank's earnings were hit hard by souring energy loans. The bank has

a market capitalization of about $7.4 billion.

Write to David Benoit at david.benoit@wsj.com and Rachel Louise

Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

April 22, 2016 12:25 ET (16:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

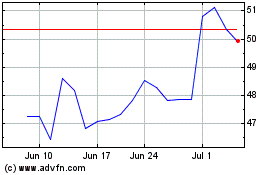

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

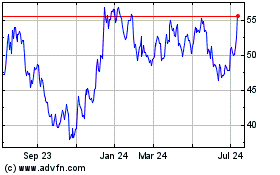

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024