UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of August, 2015

Commission File Number: 1-14678

CANADIAN

IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court

Toronto,

Ontario

Canada M5L 1A2

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨

Form 40-F x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by

furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934:

Yes ¨ No

x

If yes is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g 3-2(b): ¨

The information contained in this report under “Management’s Discussion and Analysis” on

pages 1-44 and “Interim Consolidated Financial Statements”, including the notes thereto on pages 45-67, is incorporated by reference into Registration Statements on Form S-8

File Nos. 333-130283 and 333-09874 and Form F-10 File No. 333-201259 and Form F-3 File No. 333-202584.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

|

| Date: August 27, 2015 |

|

|

|

By: |

|

/s/ Stephen Forbes |

|

|

|

|

|

|

Name: |

|

Stephen Forbes |

|

|

|

|

|

|

Title: |

|

Executive Vice President |

Exhibit 99.1

|

| Report to Shareholders for the

Third Quarter, 2015

www.cibc.com August 27, 2015

|

Report of the President and Chief Executive

Officer

Overview of results

CIBC today announced its financial

results for the third quarter ended July 31, 2015.

Third quarter highlights

| • |

|

Reported net income was $978 million, compared with $921 million for the third quarter a year ago, and $911 million for the prior quarter. |

| • |

|

Adjusted net income(1) was $990 million, compared with $908 million for the third quarter a year ago, and $924 million for the prior quarter.

|

| • |

|

Reported diluted earnings per share (EPS) was $2.42, compared with $2.26 for the third quarter a year ago, and $2.25 for the prior quarter. |

| • |

|

Adjusted diluted EPS(1) was $2.45, compared with $2.23 for the third quarter a year ago, and $2.28 for the prior quarter. |

| • |

|

Reported return on common shareholders’ equity (ROE) was 20.4% and adjusted ROE(1) was 20.6%. |

Results for the third quarter of 2015 were affected by the following items of note aggregating to a negative impact of $0.03 per share:

| • |

|

$10 million ($7 million after-tax) amortization of intangible assets; and |

| • |

|

$6 million ($5 million after-tax) loss from the structured credit run-off business. |

CIBC’s Basel III Common Equity

Tier 1 ratio at July 31, 2015 was 10.8%, and our Tier 1 and Total capital ratios were 12.5% and 15.0%, respectively, on an all-in basis compared with Basel III Common Equity Tier 1 ratio of 10.8%, Tier 1 capital ratio of 12.6% and Total capital

ratio of 15.3% in the prior quarter. At the end of this quarter, CIBC’s Basel III Leverage ratio was 3.9% on an all-in basis.

CIBC announced a quarterly

dividend increase of 3 cents per common share to $1.12 per share. In addition, we announced our intention to seek Toronto Stock Exchange approval for a normal course issuer bid that would permit us to purchase for cancellation up to a maximum of 8

million, or approximately 2% of our outstanding common shares, over the next 12 months.

Our strong performance this quarter was supported by excellent results in

Retail and Business Banking, Wealth Management and Wholesale Banking. We continue to build a strong, innovative relationship-oriented bank with industry leading ROE and capital strength to deliver sustainable shareholder value.

Core business performance

Retail and Business Banking reported net income of $636

million for the third quarter, up $47 million or 8% from the third quarter a year ago. Excluding items of note, adjusted net income(1) was $638 million, up $41 million or 7%, primarily due to

higher revenue and lower loan losses, partially offset by higher expenses. Revenue was up as a result of solid volume growth and wider spreads.

During the third quarter of 2015, Retail and Business Banking continued to make progress against our objectives of accelerating profitable revenue growth

and enhancing the client experience:

| • |

|

We became the first major Canadian bank to participate in suretap™, enabling our clients to pay with their smartphone by adding any of our credit cards to the

new suretap open mobile wallet; |

| • |

|

Forrester Research Inc., ranked CIBC mobile banking third worldwide, by overall score along with two other banks, in their 2015 Global Mobile Banking Functionality Benchmark report, and sharing the top overall score

ranking in North America; and |

| • |

|

With the opening of the Union Pearson Express, CIBC as lead partner is enhancing the banking experience for clients and travelers at Canada’s two busiest transportation hubs. |

Wealth

Management reported net income of $140 million for the third quarter, up $19 million or 16% from the third quarter a year ago. Excluding items of note, adjusted net income(1) was $143 million, up $19 million or 15%, due to higher revenue, partially offset by higher expenses. Revenue was up 11% primarily due to higher assets under management (AUM) driven by strong net

flows across businesses and market appreciation, and higher fee-based assets in our Retail Brokerage business.

During the third quarter of

2015, Wealth Management continued its progress in support of our strategic focus to strengthen our platforms for clients:

| • |

|

CIBC Asset Management achieved record year-to-date net sales of long-term mutual funds of $5.1 billion; |

| • |

|

CIBC Investor’s Edge had a strong quarter for new account openings and was recognized in the MoneySense Best Discount Brokerages Review as first in the Fees and Commissions category; and |

| • |

|

We launched new financial literacy initiatives including Financial Fluency seminars for young clients and a program for female clients called CIRCLE. |

Wholesale Banking reported net income of $270 million for the

third quarter, down $12 million or 4% from the third quarter a year ago. Excluding items of note, adjusted net income(1) was $275 million, up $21 million or 8%, primarily due to higher revenue

from capital markets trading, partially offset by lower revenue from underwriting and advisory activity.

As a leading wholesale bank in Canada

and active in core Canadian industries in the rest of the world, Wholesale Banking acted as:

| • |

|

Exclusive financial advisor to Calloway REIT on the $1.2 billion acquisition of interests in 24 properties as well as the SmartCentres leasing and development platform, and sole bookrunner on Calloway REIT’s $230

million equity offering to partially finance this acquisition; |

| • |

|

Sole bookrunner on the inaugural $1.0 billion senior unsecured notes offering for CPPIB Capital Inc.; and |

| • |

|

Joint bookrunner for a US$1.0 billion multi-tranche debt offering for Indiana Toll Road Concession Company, LLC. |

Making a difference in our Communities

CIBC is committed to building a bank

that is relevant to our clients, our team members and communities, and supports causes that matter to them. During the quarter we:

| • |

|

Brought the TORONTO 2015 Pan Am Games to life as Lead Partner by helping bring the iconic flame to more than 130 communities across Canada, hosting more than 4,000 clients and supporting CIBC Team Next athletes and

mentors at the Games, and raising the bar for inclusion as corporate sponsor of PridehouseTO; |

| • |

|

Awarded 30 CIBC ‘Class of Pan Am’ Youthvision Scholarships to grade 10 students across Canada. Each scholarship, valued at up to $38,000, includes tuition support, mentorship and guaranteed summer employment

in partnership with the YMCA and Big Brothers Big Sisters of Canada; and |

| • |

|

Marked our 10th year as title sponsor of the Tour CIBC Charles-Bruneau, which raised $3.2 million to support children with cancer and their families across the province of Quebec. |

During the quarter, CIBC was named:

| • |

|

The strongest publicly traded bank in Canada by Bloomberg Markets magazine and the only North American bank in the ranking for the last five years; |

| • |

|

Best 50 Corporate Citizens in Canada by Corporate Knights; and |

| • |

|

Top 50 Most Socially Responsible Corporations in Canada by Maclean’s. |

Victor G. Dodig

President and Chief Executive Officer

| (1) |

For additional information, see the “Non-GAAP measures” section. |

|

|

|

| ii |

|

CIBC THIRD QUARTER 2015 |

Enhanced Disclosure Task Force

The

Enhanced Disclosure Task Force (EDTF) was established by the Financial Stability Board in May 2012. The stated goal of the EDTF is to improve the quality, comparability and transparency of risk disclosures. On October 29, 2012, the EDTF

released its report “Enhancing the Risk Disclosures of Banks”, which includes thirty-two disclosure recommendations, principally in the areas of risk governance, credit risk, market risk, liquidity risk, and capital adequacy. The index

below provides the listing of disclosures prepared in response to the recommendations of the EDTF, along with their locations. EDTF disclosures are located in our 2014 Annual Report, quarterly Report to Shareholders, and supplementary packages,

which may be found on our website (www.cibc.com). No information on CIBC’s website, including the supplementary packages, should be considered incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Third quarter, 2015 |

|

|

| Topics |

|

Recommendations |

|

Disclosures |

|

Management’s

discussion and analysis |

|

Consolidated

financial

statements |

|

Supplementary

regulatory

capital

disclosure |

|

2014

Annual report |

| |

|

|

|

|

|

Page references |

| General |

|

1 |

|

Index of risk information – current page |

|

|

|

|

|

|

|

|

| |

|

2 |

|

Risk terminology and measures (1) |

|

|

|

|

|

34 |

|

|

| |

|

3 |

|

Top and emerging risks |

|

24 |

|

|

|

|

|

46 |

| |

|

4 |

|

Key future regulatory ratio requirements |

|

19, 35, 37 |

|

63 |

|

6 |

|

31, 69 |

| Risk governance, risk management and business model |

|

5 |

|

Risk management structure |

|

22, 23 |

|

|

|

|

|

41, 42 |

| |

6 |

|

Risk culture and appetite |

|

|

|

|

|

|

|

40, 43, 44 |

| |

7 |

|

Risks arising from business activities |

|

25 |

|

|

|

|

|

44, 47 |

| |

8 |

|

Bank-wide stress testing |

|

28 |

|

|

|

|

|

37, 50, 55,

63, 66, 71 |

| Capital adequacy and risk-weighted assets |

|

9 |

|

Minimum capital requirements |

|

18 |

|

63 |

|

|

|

30, 137 |

| |

10 |

|

Components of capital and reconciliation to the consolidated regulatory balance sheet |

|

|

|

|

|

1 – 4 |

|

|

| |

11 |

|

Regulatory capital flow statement |

|

|

|

|

|

5 |

|

|

| |

12 |

|

Capital management and planning |

|

|

|

|

|

|

|

36, 137 |

| |

13 |

|

Business activities and risk-weighted assets |

|

25 |

|

|

|

7 |

|

|

| |

14 |

|

Risk-weighted assets and capital requirements |

|

|

|

|

|

7 |

|

32, 34 |

| |

15 |

|

Credit risk by major portfolios |

|

|

|

|

|

13 – 25 |

|

49 – 54 |

| |

16 |

|

Risk-weighted assets flow statement |

|

|

|

|

|

8 |

|

|

| |

|

17 |

|

Back-testing of models |

|

|

|

|

|

26, 27 |

|

45, 50, 62, 71 |

| Liquidity |

|

18 |

|

Liquid assets |

|

34 |

|

|

|

|

|

|

| Funding |

|

19 |

|

Encumbered assets |

|

35 |

|

|

|

|

|

|

| |

|

20 |

|

Contractual maturities of assets, liabilities and off-balance sheet instruments |

|

38 |

|

|

|

|

|

|

| |

|

21 |

|

Funding strategy and sources |

|

36 |

|

|

|

|

|

68 |

| Market risk |

|

22 |

|

Reconciliation of trading and non-trading portfolios to the consolidated balance sheet |

|

31 |

|

|

|

|

|

|

| |

|

23 |

|

Significant trading and non-trading market risk factors |

|

31 – 33 |

|

|

|

|

|

61 – 65 |

| |

|

24 |

|

Model assumptions, limitations and validation procedures |

|

|

|

|

|

|

|

61 – 65 |

| |

|

25 |

|

Stress testing and scenario analysis |

|

|

|

|

|

|

|

37, 63 |

| Credit risk |

|

26 |

|

Analysis of credit risk exposures |

|

26 – 30 |

|

67 |

|

9 – 12 |

|

51 – 59,

119 – 121, 159 |

| |

|

27 |

|

Impaired loan and forbearance policies |

|

26, 28, 41 |

|

|

|

|

|

98 |

| |

|

28 |

|

Reconciliation of impaired loans and the allowance for credit losses |

|

26, 28 |

|

59 |

|

|

|

|

| |

|

29 |

|

Counterparty credit risk arising from derivatives |

|

28 |

|

|

|

12, 28 (2) |

|

48, 52,

131 – 132 |

| |

|

30 |

|

Credit risk mitigation |

|

26 |

|

|

|

12, 30 |

|

48, 54,

131 – 132 |

| Other risks |

|

31 |

|

Other risks |

|

39 |

|

|

|

|

|

70 – 72 |

| |

|

32 |

|

Discussion of publicly known risk events |

|

43 |

|

65 |

|

|

|

71, 151 |

| (1) |

A detailed glossary of our risk and capital terminology is included on page 170 of our 2014 Annual Report. |

| (2) |

Included in supplementary financial information package. |

|

|

|

|

|

| CIBC THIRD QUARTER 2015 |

|

|

iii |

|

Management’s discussion and analysis

|

| Management’s discussion and analysis (MD&A) is provided to enable readers to assess CIBC’s financial condition and results of

operations as at and for the quarter and nine months ended July 31, 2015 compared with corresponding periods. The MD&A should be read in conjunction with our 2014 Annual Report and the unaudited interim consolidated financial statements

included in this report. Unless otherwise indicated, all financial information in this MD&A has been prepared in accordance with International Financial Reporting Standards (IFRS or GAAP) and all amounts are expressed in Canadian dollars. This

MD&A is current as of August 26, 2015. Additional information relating to CIBC is available on SEDAR at www.sedar.com and on the U.S. Securities and Exchange Commission’s (SEC) website at www.sec.gov. No information on CIBC’s

website (www.cibc.com) should be considered incorporated herein by reference. A glossary of terms used throughout this quarterly report can be found on pages 168 to 172 of our 2014 Annual Report. |

A NOTE ABOUT FORWARD-LOOKING STATEMENTS: From time to time, we make written or oral forward-looking statements within the meaning

of certain securities laws, including in this report, in other filings with Canadian securities regulators or the SEC and in other communications. All such statements are made pursuant to the “safe harbour” provisions of, and are intended

to be forward-looking statements under applicable Canadian and U.S. securities legislation, including the U.S. Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements made in the

“Overview – Financial results”, “Overview – Significant event”, “Overview – Outlook for calendar year 2015”, “Financial condition – Capital resources”, “Management of risk – Risk

overview”, “Management of risk – Credit risk”, “Management of risk – Market risk”, “Management of risk – Liquidity risk”, “Accounting and control matters – Critical accounting policies and

estimates”, and “Accounting and control matters – Regulatory developments” sections of this report and other statements about our operations, business lines, financial condition, risk management, priorities, targets, ongoing

objectives, strategies and outlook for calendar year 2015 and subsequent periods. Forward-looking statements are typically identified by the words “believe”, “expect”, “anticipate”, “intend”,

“estimate”, “forecast”, “target”, “objective” and other similar expressions or future or conditional verbs such as “will”, “should”, “would” and “could”. By their

nature, these statements require us to make assumptions, including the economic assumptions set out in the “Overview – Outlook for calendar year 2015” section of this report, and are subject to inherent risks and uncertainties that

may be general or specific. A variety of factors, many of which are beyond our control, affect our operations, performance and results, and could cause actual results to differ materially from the expectations expressed in any of our forward-looking

statements. These factors include: credit, market, liquidity, strategic, insurance, operational, reputation and legal, regulatory and environmental risk; the effectiveness and adequacy of our risk management and valuation models and processes;

legislative or regulatory developments in the jurisdictions where we operate, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the regulations issued and to be issued thereunder, the U.S. Foreign Account Tax Compliance Act

and regulatory reforms in the United Kingdom and Europe, the Basel Committee on Banking Supervision’s global standards for capital and liquidity reform, and those relating to the payments system in Canada; amendments to, and interpretations of,

risk-based capital guidelines and reporting instructions, and interest rate and liquidity regulatory guidance; the resolution of legal and regulatory proceedings and related matters; the effect of changes to accounting standards, rules and

interpretations; changes in our estimates of reserves and allowances; changes in tax laws; changes to our credit ratings; political conditions and developments; the possible effect on our business of international conflicts and the war on terror;

natural disasters, public health emergencies, disruptions to public infrastructure and other catastrophic events; reliance on third parties to provide components of our business infrastructure; potential disruptions to our information technology

systems and services; increasing cyber security risks which may include theft of assets, unauthorized access to sensitive information, or operational disruption; social media risk; losses incurred as a result of internal or external fraud;

anti-money laundering; the accuracy and completeness of information provided to us concerning clients and counterparties; the failure of third parties to comply with their obligations to us and our affiliates or associates; intensifying competition

from established competitors and new entrants in the financial services industry including through internet and mobile banking; technological change; global capital market activity; changes in monetary and economic policy; currency value and

interest rate fluctuations, including as a result of oil price volatility; general business and economic conditions worldwide, as well as in Canada, the U.S. and other countries where we have operations, including increasing Canadian household debt

levels and Europe’s sovereign debt crisis; our success in developing and introducing new products and services, expanding existing distribution channels, developing new distribution channels and realizing increased revenue from these channels;

changes in client spending and saving habits; our ability to attract and retain key employees and executives; our ability to successfully execute our strategies and complete and integrate acquisitions and joint ventures; and our ability to

anticipate and manage the risks associated with these factors. This list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place

undue reliance on our forward-looking statements. Additional information about these factors can be found in the “Management of risk” section of this report. Any forward-looking statements contained in this report represent the views of

management only as of the date hereof and are presented for the purpose of assisting our shareholders and financial analysts in understanding our financial position, objectives and priorities and anticipated financial performance as at and for the

periods ended on the dates presented, and may not be appropriate for other purposes. We do not undertake to update any forward-looking statement that is contained in this report or in other communications except as required by law.

|

|

|

|

|

| CIBC THIRD QUARTER 2015 |

|

|

1 |

|

External reporting change

The following external reporting change was made in the first quarter of 2015. Prior period amounts were reclassified accordingly.

Income statement presentation

We reclassified certain amounts relating to our

insurance business within Retail and Business Banking from non-interest expenses to non-interest income. There was no impact on consolidated net income due to this reclassification.

|

|

|

| 2 |

|

CIBC THIRD QUARTER 2015 |

Third quarter financial highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

As at or for the three

months ended |

|

|

|

|

As at or for the nine

months ended |

|

| Unaudited |

|

|

|

2015

Jul. 31 |

|

|

2015

Apr. 30 |

|

|

2014

Jul. 31 (1) |

|

|

|

|

2015

Jul. 31 |

|

|

2014

Jul. 31 (1) |

|

| Financial results ($ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

2,021 |

|

|

$ |

1,895 |

|

|

$ |

1,875 |

|

|

|

|

$ |

5,872 |

|

|

$ |

5,578 |

|

| Non-interest income |

|

|

|

|

1,499 |

|

|

|

1,499 |

|

|

|

1,480 |

|

|

|

|

|

4,501 |

|

|

|

4,572 |

|

| Total revenue |

|

|

|

|

3,520 |

|

|

|

3,394 |

|

|

|

3,355 |

|

|

|

|

|

10,373 |

|

|

|

10,150 |

|

| Provision for credit losses |

|

|

|

|

189 |

|

|

|

197 |

|

|

|

195 |

|

|

|

|

|

573 |

|

|

|

743 |

|

| Non-interest expenses |

|

|

|

|

2,179 |

|

|

|

2,104 |

|

|

|

2,044 |

|

|

|

|

|

6,478 |

|

|

|

6,429 |

|

| Income before taxes |

|

|

|

|

1,152 |

|

|

|

1,093 |

|

|

|

1,116 |

|

|

|

|

|

3,322 |

|

|

|

2,978 |

|

| Income taxes |

|

|

|

|

174 |

|

|

|

182 |

|

|

|

195 |

|

|

|

|

|

510 |

|

|

|

574 |

|

| Net income |

|

|

|

$ |

978 |

|

|

$ |

911 |

|

|

$ |

921 |

|

|

|

|

$ |

2,812 |

|

|

$ |

2,404 |

|

| Net income (loss) attributable to non-controlling interests |

|

|

|

$ |

5 |

|

|

$ |

4 |

|

|

$ |

3 |

|

|

|

|

$ |

12 |

|

|

$ |

(5 |

) |

| Preferred shareholders |

|

|

|

|

11 |

|

|

|

12 |

|

|

|

19 |

|

|

|

|

|

36 |

|

|

|

69 |

|

| Common shareholders |

|

|

|

|

962 |

|

|

|

895 |

|

|

|

899 |

|

|

|

|

|

2,764 |

|

|

|

2,340 |

|

| Net income attributable to equity shareholders |

|

|

|

$ |

973 |

|

|

$ |

907 |

|

|

$ |

918 |

|

|

|

|

$ |

2,800 |

|

|

$ |

2,409 |

|

| Financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reported efficiency ratio |

|

|

|

|

61.9 |

% |

|

|

62.0 |

% |

|

|

60.9 |

% |

|

|

|

|

62.4 |

% |

|

|

63.3 |

% |

| Adjusted efficiency ratio (2) |

|

|

|

|

59.3 |

% |

|

|

59.6 |

% |

|

|

59.5 |

% |

|

|

|

|

59.3 |

% |

|

|

58.6 |

% |

| Loan loss ratio |

|

|

|

|

0.25 |

% |

|

|

0.30 |

% |

|

|

0.33 |

% |

|

|

|

|

0.28 |

% |

|

|

0.40 |

% |

| Reported return on common shareholders’ equity |

|

|

|

|

20.4 |

% |

|

|

19.9 |

% |

|

|

21.0 |

% |

|

|

|

|

20.0 |

% |

|

|

18.5 |

% |

| Adjusted return on common shareholders’ equity (2) |

|

|

|

|

20.6 |

% |

|

|

20.2 |

% |

|

|

20.7 |

% |

|

|

|

|

20.5 |

% |

|

|

21.1 |

% |

| Net interest margin |

|

|

|

|

1.75 |

% |

|

|

1.73 |

% |

|

|

1.81 |

% |

|

|

|

|

1.75 |

% |

|

|

1.82 |

% |

| Net interest margin on average interest-earning assets |

|

|

|

|

2.01 |

% |

|

|

2.01 |

% |

|

|

2.05 |

% |

|

|

|

|

2.02 |

% |

|

|

2.07 |

% |

| Return on average assets |

|

|

|

|

0.85 |

% |

|

|

0.83 |

% |

|

|

0.89 |

% |

|

|

|

|

0.84 |

% |

|

|

0.79 |

% |

| Return on average interest-earning assets |

|

|

|

|

0.97 |

% |

|

|

0.97 |

% |

|

|

1.01 |

% |

|

|

|

|

0.97 |

% |

|

|

0.89 |

% |

| Total shareholder return |

|

|

|

|

(2.40 |

)% |

|

|

11.10 |

% |

|

|

4.65 |

% |

|

|

|

|

(6.12 |

)% |

|

|

17.74 |

% |

| Reported effective tax rate |

|

|

|

|

15.1 |

% |

|

|

16.7 |

% |

|

|

17.5 |

% |

|

|

|

|

15.4 |

% |

|

|

19.3 |

% |

| Adjusted effective tax

rate (2) |

|

|

|

|

15.2 |

% |

|

|

16.8 |

% |

|

|

16.2 |

% |

|

|

|

|

15.5 |

% |

|

|

15.5 |

% |

| Common share information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share ($) |

|

– basic earnings |

|

|

|

$ |

2.42 |

|

|

$ |

2.25 |

|

|

$ |

2.26 |

|

|

|

|

$ |

6.96 |

|

|

$ |

5.88 |

|

|

|

– reported diluted earnings |

|

|

|

|

2.42 |

|

|

|

2.25 |

|

|

|

2.26 |

|

|

|

|

|

6.95 |

|

|

|

5.87 |

|

|

|

– adjusted diluted earnings (2) |

|

|

|

|

2.45 |

|

|

|

2.28 |

|

|

|

2.23 |

|

|

|

|

|

7.09 |

|

|

|

6.70 |

|

|

|

– dividends |

|

|

|

|

1.09 |

|

|

|

1.06 |

|

|

|

1.00 |

|

|

|

|

|

3.18 |

|

|

|

2.94 |

|

|

|

– book value |

|

|

|

|

50.02 |

|

|

|

47.08 |

|

|

|

43.02 |

|

|

|

|

|

50.02 |

|

|

|

43.02 |

|

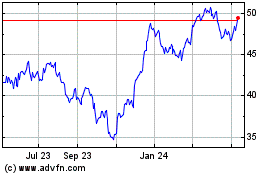

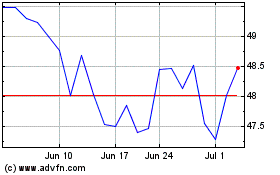

| Share price ($) |

|

– high |

|

|

|

|

96.99 |

|

|

|

97.62 |

|

|

|

102.06 |

|

|

|

|

|

107.16 |

|

|

|

102.06 |

|

|

|

– low |

|

|

|

|

89.55 |

|

|

|

89.26 |

|

|

|

95.66 |

|

|

|

|

|

88.18 |

|

|

|

85.49 |

|

|

|

– closing |

|

|

|

|

93.46 |

|

|

|

96.88 |

|

|

|

101.21 |

|

|

|

|

|

93.46 |

|

|

|

101.21 |

|

| Shares outstanding (thousands) |

|

– weighted-average basic |

|

|

|

|

397,270 |

|

|

|

397,212 |

|

|

|

397,179 |

|

|

|

|

|

397,199 |

|

|

|

397,826 |

|

|

|

– weighted-average diluted |

|

|

|

|

397,828 |

|

|

|

397,785 |

|

|

|

398,022 |

|

|

|

|

|

397,830 |

|

|

|

398,584 |

|

|

|

– end of period |

|

|

|

|

397,234 |

|

|

|

397,262 |

|

|

|

396,974 |

|

|

|

|

|

397,234 |

|

|

|

396,974 |

|

| Market capitalization ($ millions) |

|

|

|

$ |

37,126 |

|

|

$ |

38,487 |

|

|

$ |

40,178 |

|

|

|

|

$ |

37,126 |

|

|

$ |

40,178 |

|

| Value measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend yield (based on closing share price) |

|

|

|

|

4.6 |

% |

|

|

4.5 |

% |

|

|

3.9 |

% |

|

|

|

|

4.5 |

% |

|

|

3.9 |

% |

| Reported dividend payout ratio |

|

|

|

|

45.0 |

% |

|

|

47.1 |

% |

|

|

44.2 |

% |

|

|

|

|

45.7 |

% |

|

|

50.0 |

% |

| Adjusted dividend payout ratio (2) |

|

|

|

|

44.5 |

% |

|

|

46.4 |

% |

|

|

44.8 |

% |

|

|

|

|

44.8 |

% |

|

|

43.8 |

% |

| Market value to book value ratio |

|

|

|

|

1.87 |

|

|

|

2.06 |

|

|

|

2.35 |

|

|

|

|

|

1.87 |

|

|

|

2.35 |

|

| On- and off-balance sheet information ($ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, deposits with banks and securities |

|

|

|

$ |

92,997 |

|

|

$ |

76,406 |

|

|

$ |

80,653 |

|

|

|

|

$ |

92,997 |

|

|

$ |

80,653 |

|

| Loans and acceptances, net of allowance |

|

|

|

|

285,502 |

|

|

|

276,543 |

|

|

|

262,489 |

|

|

|

|

|

285,502 |

|

|

|

262,489 |

|

| Total assets |

|

|

|

|

457,842 |

|

|

|

439,203 |

|

|

|

405,422 |

|

|

|

|

|

457,842 |

|

|

|

405,422 |

|

| Deposits |

|

|

|

|

360,525 |

|

|

|

341,188 |

|

|

|

322,314 |

|

|

|

|

|

360,525 |

|

|

|

322,314 |

|

| Common shareholders’ equity |

|

|

|

|

19,869 |

|

|

|

18,703 |

|

|

|

17,076 |

|

|

|

|

|

19,869 |

|

|

|

17,076 |

|

| Average assets |

|

|

|

|

457,774 |

|

|

|

448,912 |

|

|

|

411,036 |

|

|

|

|

|

448,120 |

|

|

|

409,144 |

|

| Average interest-earning assets |

|

|

|

|

399,444 |

|

|

|

385,938 |

|

|

|

363,422 |

|

|

|

|

|

388,820 |

|

|

|

360,631 |

|

| Average common shareholders’ equity |

|

|

|

|

18,733 |

|

|

|

18,437 |

|

|

|

16,989 |

|

|

|

|

|

18,431 |

|

|

|

16,911 |

|

| Assets under administration (3) (4) |

|

|

|

|

1,887,070 |

|

|

|

1,909,576 |

|

|

|

1,713,076 |

|

|

|

|

|

1,887,070 |

|

|

|

1,713,076 |

|

| Assets under

management (4) |

|

|

|

|

158,351 |

|

|

|

152,417 |

|

|

|

137,109 |

|

|

|

|

|

158,351 |

|

|

|

137,109 |

|

| Balance sheet quality (All-in basis) and liquidity measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Risk-weighted assets (RWA) ($ billions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1 (CET1) capital RWA |

|

|

|

$ |

153.9 |

|

|

$ |

147.0 |

|

|

$ |

139.9 |

|

|

|

|

$ |

153.9 |

|

|

$ |

139.9 |

|

| Tier 1 capital RWA |

|

|

|

|

154.2 |

|

|

|

147.2 |

|

|

|

140.2 |

|

|

|

|

|

154.2 |

|

|

|

140.2 |

|

| Total capital RWA |

|

|

|

|

154.4 |

|

|

|

147.4 |

|

|

|

140.6 |

|

|

|

|

|

154.4 |

|

|

|

140.6 |

|

| Capital ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CET1 ratio |

|

|

|

|

10.8 |

% |

|

|

10.8 |

% |

|

|

10.1 |

% |

|

|

|

|

10.8 |

% |

|

|

10.1 |

% |

| Tier 1 capital ratio |

|

|

|

|

12.5 |

% |

|

|

12.6 |

% |

|

|

12.2 |

% |

|

|

|

|

12.5 |

% |

|

|

12.2 |

% |

| Total capital ratio |

|

|

|

|

15.0 |

% |

|

|

15.3 |

% |

|

|

14.8 |

% |

|

|

|

|

15.0 |

% |

|

|

14.8 |

% |

| Basel III leverage ratio |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 capital |

|

A |

|

$ |

19.3 |

|

|

$ |

18.6 |

|

|

$ |

17.1 |

|

|

|

|

$ |

19.3 |

|

|

$ |

17.1 |

|

| Leverage ratio exposure |

|

B |

|

$ |

493.5 |

|

|

$ |

474.3 |

|

|

|

n/a |

|

|

|

|

$ |

493.5 |

|

|

|

n/a |

|

| Leverage ratio |

|

A/B |

|

|

3.9 |

% |

|

|

3.9 |

% |

|

|

n/a |

|

|

|

|

|

3.9 |

% |

|

|

n/a |

|

| Liquidity coverage ratio |

|

|

|

|

120.7 |

% |

|

|

128.5 |

% |

|

|

n/a |

|

|

|

|

|

n/a |

|

|

|

n/a |

|

| Other information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Full-time equivalent employees |

|

|

|

|

44,385 |

|

|

|

43,566 |

|

|

|

45,161 |

|

|

|

|

|

44,385 |

|

|

|

45,161 |

|

| (1) |

Certain information has been reclassified to conform to the presentation adopted in the first quarter of 2015. See “External reporting change” for additional details. |

| (2) |

For additional information, see the “Non-GAAP measures” section. |

| (3) |

Includes the full contract amount of assets under administration or custody under a 50/50 joint venture between CIBC and The Bank of New York Mellon of $1,489.8 billion (April 30, 2015: $1,519.0 billion;

July 31, 2014: $1,345.2 billion). |

| (4) |

Assets under management amounts are included in the amounts reported under assets under administration. |

|

|

|

|

|

| CIBC THIRD QUARTER 2015 |

|

|

3 |

|

Overview

Financial results

Reported net income for the quarter

was $978 million, compared with $921 million for the same quarter last year, and $911 million for the prior quarter. Reported net income for the nine months ended July 31, 2015 was $2,812 million, compared with $2,404 million for the

same period in 2014.

Adjusted net income(1) for the quarter was $990 million, compared with

$908 million for the same quarter last year, and $924 million for the prior quarter. Adjusted net income(1) for the nine months ended July 31, 2015 was $2,870 million, compared with

$2,746 million for the same period in 2014.

Reported diluted earnings per share (EPS) for the quarter was $2.42, compared with $2.26 for the same

quarter last year, and $2.25 for the prior quarter. Reported diluted EPS for the nine months ended July 31, 2015 was $6.95, compared with $5.87 for the same period in 2014.

Adjusted diluted EPS(1) for the quarter was $2.45, compared with $2.23 for the same quarter last

year, and $2.28 for the prior quarter. Adjusted diluted EPS(1) for the nine months ended July 31, 2015 was $7.09, compared with $6.70 for the same period in 2014.

Net income for the current quarter was affected by the following items of note:

| • |

|

$10 million ($7 million after-tax) amortization of intangible assets ($2 million after-tax in Retail and Business Banking, $3 million after-tax in Wealth Management, and $2 million after-tax in

Corporate and Other); and |

| • |

|

$6 million ($5 million after-tax) loss from the structured credit run-off business (Wholesale Banking). |

The

above items of note decreased revenue by $4 million, increased non-interest expenses by $12 million, and decreased income tax expenses by $4 million. In aggregate, these items of note decreased net income by $12 million.

Net interest income(2)

Net interest income was up $146 million or 8% from the same quarter last year, primarily due to volume growth across retail products and wider spreads, and higher

net interest income from Wholesale Banking, partially offset by lower treasury revenue.

Net interest income was up $126 million or 7% from the

prior quarter, primarily due to additional days in the quarter, volume growth across retail products, and higher net interest income from Wholesale Banking.

Net interest income for the nine months ended July 31, 2015 was up $294 million or 5% from the same period in 2014, primarily due to volume

growth across retail products, higher trading income, a gain arising from accounting adjustments on credit card-related balance sheet amounts, shown as an item of note, and higher revenue from corporate banking. These factors were partially offset

by lower treasury revenue, lower card revenue as a result of the Aeroplan transactions with Aimia Canada Inc. (Aimia) and the Toronto-Dominion Bank (TD) in the same period last year, and narrower retail spreads.

Non-interest income(2)

Non-interest income was up $19 million or 1% from the same quarter last year, primarily due to higher mutual fund and investment management and custodial fees, and higher

trading income, partially offset by lower underwriting and advisory fees. The same quarter last year included a gain within an equity-accounted investment in our merchant banking portfolio, shown as an item of note.

Non-interest income was comparable with the prior quarter. The current quarter included higher mutual fund and deposit and payment fees, and the prior

quarter included mark-to-market (MTM) losses on corporate loan hedges. These factors were offset by lower underwriting and advisory fees, and lower available-for-sale (AFS) securities gains in the current quarter.

Non-interest income for the nine months ended July 31, 2015 was down $71 million or 2% from the same period in 2014, as the same period last

year included the gains relating to the Aeroplan transactions, and the sale of an equity investment in our exited European leveraged finance portfolio, shown as items of note. The current period included higher mutual fund and investment management

and custodial fees.

Provision for credit losses

Provision for credit

losses was down $6 million or 3% from the same quarter last year. In Retail and Business Banking, the provision was down primarily due to lower write-offs and bankruptcies in the card portfolio. In Wholesale Banking, the provision was up

primarily due to higher losses in our U.S. real estate finance portfolio. In Corporate and Other, the provision was up primarily due to an increase in the collective allowance, partially offset by lower losses in FirstCaribbean International Bank

Limited (CIBC FirstCaribbean).

Provision for credit losses was down $8 million or 4% from the prior quarter. In Retail and Business Banking, the

provision was down primarily due to lower losses in the business lending portfolio, and lower write-offs and bankruptcies in the card portfolio. In Wholesale Banking, the provision was up primarily due to higher losses in our U.S. real estate

finance and corporate lending portfolios. In Corporate and Other, the provision was up primarily due to an increase in the collective allowance.

Provision for credit losses for the nine months ended July 31, 2015 was down $170 million or 23% from the same period in 2014. In Retail and

Business Banking, the same period last year included a charge resulting from operational changes in the processing of write-offs, shown as an item of note. Lower loan losses in the card portfolio in the current period reflect credit improvements, as

well as the impact of an initiative to enhance account management practices, and the sold Aeroplan portfolio. This was partially offset by higher losses in the business lending portfolio. In Wholesale Banking, the provision was down as the same

period last year included loan losses in our exited U.S. leveraged finance portfolio, shown as an item of note, partially offset by higher losses in our U.S. real estate finance portfolio in the current period. In Corporate and Other, the provision

was down as the same period last year included loan losses relating to CIBC FirstCaribbean, partially offset by a reduction in the collective allowance, including lower estimated credit losses relating to the Alberta floods, both shown as items of

note.

| (1) |

For additional information, see the “Non-GAAP measures” section. |

| (2) |

Trading activities and related risk management strategies can periodically shift trading income between net interest income and non-interest income. Therefore, we view total trading income as the most appropriate

measure of trading performance. |

|

|

|

| 4 |

|

CIBC THIRD QUARTER 2015 |

Non-interest expenses

Non-interest expenses were up $135 million or 7% from the same quarter last year, and up $75 million or 4% from the prior quarter, primarily due to higher

performance-based compensation and other employee-related costs, and higher spending on strategic initiatives.

Non-interest expenses for the nine

months ended July 31, 2015 were up $49 million or 1% from the same period in 2014. The current period included restructuring charges relating to employee severance, shown as an item of note, higher performance-based compensation and other

employee-related costs, and higher spending on strategic initiatives. The same period last year included the goodwill impairment charge relating to CIBC FirstCaribbean, and the costs relating to the development of our enhanced travel rewards program

and to the Aeroplan transactions, shown as items of note.

Income taxes

Income tax expense was down $21 million or 11% from the same quarter last year and down $8 million or 4% from the prior quarter, notwithstanding higher income,

primarily due to higher tax-exempt income.

Income tax expense for the nine months ended July 31, 2015 was down $64 million or 11% from the same

period in 2014. Income tax expense was lower notwithstanding higher income, primarily due to no tax recovery being booked in the prior period in respect of the CIBC FirstCaribbean goodwill impairment charge and loan losses.

In prior years, the Canada Revenue Agency issued reassessments disallowing the deduction of approximately $3 billion of the 2005 Enron settlement payments

and related legal expenses. The matter is currently in litigation. The Tax Court of Canada trial on the deductibility of the Enron payments is scheduled to commence in October 2015.

Should we successfully defend our tax filing position in its entirety, we would recognize an additional accounting tax benefit of $234 million and

taxable refund interest of approximately $198 million. Should we fail to defend our position in its entirety, we would incur an additional tax expense of approximately $817 million and non-deductible interest of approximately

$159 million.

For developments regarding the new “synthetic equity arrangements” rules in the 2015 Canadian federal budget, see the

“Wholesale Banking” section.

Foreign exchange

The estimated

impact of U.S. dollar translation on key lines of our interim consolidated statement of income, as a result of changes in average exchange rates, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three

months ended |

|

|

|

|

For the nine

months ended |

|

| $ millions |

|

Jul. 31, 2015

vs.

Jul. 31, 2014 |

|

|

Jul. 31, 2015

vs.

Apr. 30, 2015 |

|

|

|

|

Jul. 31, 2015

vs.

Jul. 31, 2014 |

|

| Estimated increase in: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

$ 88 |

|

|

|

$ 12 |

|

|

|

|

|

$ 195 |

|

| Provision for credit losses |

|

|

1 |

|

|

|

– |

|

|

|

|

|

6 |

|

| Non-interest expenses |

|

|

40 |

|

|

|

6 |

|

|

|

|

|

94 |

|

| Income taxes |

|

|

1 |

|

|

|

– |

|

|

|

|

|

6 |

|

| Net income |

|

|

46 |

|

|

|

6 |

|

|

|

|

|

89 |

|

| Average USD appreciation relative to CAD |

|

|

17.2 |

% |

|

|

2.1 |

% |

|

|

|

|

13.4 |

% |

Impact of items of note in prior periods

Net

income for the prior quarters was affected by the following items of note:

Q2, 2015

| • |

|

$10 million ($8 million after-tax) amortization of intangible assets ($1 million after-tax in Retail and Business Banking, $5 million after-tax in Wealth Management, and $2 million after-tax in Corporate and Other); and

|

| • |

|

$8 million ($5 million after-tax) loss from the structured credit run-off business (Wholesale Banking). |

The above items

of note decreased revenue by $9 million, increased non-interest expenses by $9 million, and decreased income tax expenses by $5 million. In aggregate, these items of note decreased net income by $13 million.

Q1, 2015

| • |

|

$85 million ($62 million after-tax) in restructuring charges relating to employee severance (Corporate and Other); |

| • |

|

$46 million ($34 million after-tax) gain arising from accounting adjustments on credit card-related balance sheet amounts (Retail and Business Banking); |

| • |

|

$23 million ($13 million after-tax) gain on sale of an investment in our merchant banking portfolio (Wholesale Banking); |

| • |

|

$12 million ($9 million after-tax) loss from the structured credit run-off business (Wholesale Banking); and |

| • |

|

$11 million ($9 million after-tax) amortization of intangible assets ($2 million after-tax in Retail and Business Banking, $4 million after-tax in Wealth Management, and $3 million after-tax in Corporate and Other).

|

The above items of note increased revenue by $55 million and non-interest expenses by $94 million, and decreased income tax expenses by $6 million. In

aggregate, these items of note decreased net income by $33 million.

Q3, 2014

| • |

|

$52 million ($30 million after-tax) gain within an equity-accounted investment in our merchant banking portfolio (Wholesale Banking); |

| • |

|

$9 million ($7 million after-tax) expenses relating to the development of our enhanced travel rewards program and in respect of the Aeroplan transactions with Aimia and TD (Retail and Business Banking);

|

| • |

|

$9 million ($8 million after-tax) amortization of intangible assets ($1 million after-tax in Retail and Business Banking, $3 million after-tax in Wealth Management, and $4 million after-tax in Corporate and Other); and

|

| • |

|

$2 million ($2 million after-tax) loss from the structured credit run-off business (Wholesale Banking). |

The above items

of note increased revenue by $49 million, non-interest expenses by $17 million, and income tax expenses by $19 million. In aggregate, these items of note increased net income by $13 million.

|

|

|

|

|

| CIBC THIRD QUARTER 2015 |

|

|

5 |

|

Q2, 2014

| • |

|

$543 million ($543 million after-tax) of charges relating to CIBC FirstCaribbean, comprising a goodwill impairment charge of $420 million ($420 million after-tax) and loan losses of $123 million ($123 million

after-tax), reflecting revised expectations on the extent and timing of the anticipated economic recovery in the Caribbean region (Corporate and Other); |

| • |

|

$22 million ($16 million after-tax) expenses relating to the development of our enhanced travel rewards program and in respect of the Aeroplan transactions with Aimia and TD (Retail and Business Banking);

|

| • |

|

$22 million ($12 million after-tax) loan losses in our exited U.S. leveraged finance portfolio (Wholesale Banking); |

| • |

|

$9 million ($7 million after-tax) amortization of intangible assets ($1 million after-tax in Retail and Business Banking, $4 million after-tax in Wealth Management, and $2 million after-tax in Corporate and Other); and

|

| • |

|

$4 million ($3 million after-tax) loss from the structured credit run-off business (Wholesale Banking). |

The above items

of note decreased revenue by $8 million, increased provision for credit losses by $145 million, non-interest expenses by $447 million, and decreased income tax expenses by $19 million. In aggregate, these items of note decreased net income by $581

million.

Q1, 2014

| • |

|

$239 million ($183 million after-tax) gain in respect of the Aeroplan transactions with Aimia and TD, net of costs relating to the development of our enhanced travel rewards program ($123 million after-tax in Retail and

Business Banking, and $60 million after-tax in Corporate and Other); |

| • |

|

$78 million ($57 million after-tax) gain, net of associated expenses, on the sale of an equity investment in our exited European leveraged finance portfolio (Wholesale Banking); |

| • |

|

$26 million ($19 million after-tax) reduction in the portion of the collective allowance recognized in Corporate and Other(1), including lower estimated credit losses

relating to the Alberta floods (Corporate and Other); |

| • |

|

$26 million ($19 million after-tax) charge resulting from operational changes in the processing of write-offs in Retail and Business Banking; |

| • |

|

$11 million ($8 million after-tax) loss from the structured credit run-off business (Wholesale Banking); and |

| • |

|

$8 million ($6 million after-tax) amortization of intangible assets ($1 million after-tax in Retail and Business Banking, $3 million after-tax in Wealth Management, and $2 million after-tax in Corporate and Other).

|

The above items of note increased revenue by $353 million, non-interest expenses by $55 million, and income tax expenses by $72 million. In aggregate,

these items of note increased net income by $226 million.

| (1) |

Relates to collective allowance, except for (i) residential mortgages greater than 90 days delinquent; (ii) personal loans and scored small business loans greater than 30 days delinquent; and (iii) net

write-offs for the card portfolio, which are all reported in the respective strategic business units (SBUs). |

Significant event

Sale of equity investment

On April 30, 2015, CIBC sold its equity investment in The Bank of N.T. Butterfield & Son Limited, which was accounted for as an associate within

Corporate and Other, for an amount, net of associated expenses, that approximated its carrying value.

Review of quarterly financial

information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ millions, except per share amounts,

for the three months ended |

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

2014 (1) |

|

|

2013 (1) |

|

| |

|

Jul. 31 |

|

|

Apr. 30 |

|

|

Jan. 31 |

|

|

Oct. 31 |

|

|

Jul. 31 |

|

|

Apr. 30 |

|

|

Jan. 31 |

|

|

Oct. 31 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retail and Business Banking |

|

$ |

2,127 |

|

|

$ |

2,037 |

|

|

$ |

2,093 |

|

|

$ |

2,046 |

|

|

$ |

2,029 |

|

|

$ |

1,936 |

|

|

$ |

2,252 |

|

|

$ |

2,083 |

|

| Wealth Management |

|

|

628 |

|

|

|

615 |

|

|

|

619 |

|

|

|

584 |

|

|

|

568 |

|

|

|

548 |

|

|

|

502 |

|

|

|

470 |

|

| Wholesale Banking (2) |

|

|

696 |

|

|

|

661 |

|

|

|

706 |

|

|

|

468 |

|

|

|

670 |

|

|

|

606 |

|

|

|

680 |

|

|

|

520 |

|

| Corporate and Other (2) |

|

|

69 |

|

|

|

81 |

|

|

|

41 |

|

|

|

115 |

|

|

|

88 |

|

|

|

74 |

|

|

|

197 |

|

|

|

103 |

|

| Total revenue |

|

$ |

3,520 |

|

|

$ |

3,394 |

|

|

$ |

3,459 |

|

|

$ |

3,213 |

|

|

$ |

3,355 |

|

|

$ |

3,164 |

|

|

$ |

3,631 |

|

|

$ |

3,176 |

|

| Net interest income |

|

$ |

2,021 |

|

|

$ |

1,895 |

|

|

$ |

1,956 |

|

|

$ |

1,881 |

|

|

$ |

1,875 |

|

|

$ |

1,798 |

|

|

$ |

1,905 |

|

|

$ |

1,893 |

|

| Non-interest income |

|

|

1,499 |

|

|

|

1,499 |

|

|

|

1,503 |

|

|

|

1,332 |

|

|

|

1,480 |

|

|

|

1,366 |

|

|

|

1,726 |

|

|

|

1,283 |

|

| Total revenue |

|

|

3,520 |

|

|

|

3,394 |

|

|

|

3,459 |

|

|

|

3,213 |

|

|

|

3,355 |

|

|

|

3,164 |

|

|

|

3,631 |

|

|

|

3,176 |

|

| Provision for credit losses |

|

|

189 |

|

|

|

197 |

|

|

|

187 |

|

|

|

194 |

|

|

|

195 |

|

|

|

330 |

|

|

|

218 |

|

|

|

271 |

|

| Non-interest expenses |

|

|

2,179 |

|

|

|

2,104 |

|

|

|

2,195 |

|

|

|

2,083 |

|

|

|

2,044 |

|

|

|

2,409 |

|

|

|

1,976 |

|

|

|

1,926 |

|

| Income before income taxes |

|

|

1,152 |

|

|

|

1,093 |

|

|

|

1,077 |

|

|

|

936 |

|

|

|

1,116 |

|

|

|

425 |

|

|

|

1,437 |

|

|

|

979 |

|

| Income taxes |

|

|

174 |

|

|

|

182 |

|

|

|

154 |

|

|

|

125 |

|

|

|

195 |

|

|

|

119 |

|

|

|

260 |

|

|

|

154 |

|

| Net income |

|

$ |

978 |

|

|

$ |

911 |

|

|

$ |

923 |

|

|

$ |

811 |

|

|

$ |

921 |

|

|

$ |

306 |

|

|

$ |

1,177 |

|

|

$ |

825 |

|

| Net income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

$ |

5 |

|

|

$ |

4 |

|

|

$ |

3 |

|

|

$ |

2 |

|

|

$ |

3 |

|

|

$ |

(11 |

) |

|

$ |

3 |

|

|

$ |

(7 |

) |

| Equity shareholders |

|

|

973 |

|

|

|

907 |

|

|

|

920 |

|

|

|

809 |

|

|

|

918 |

|

|

|

317 |

|

|

|

1,174 |

|

|

|

832 |

|

| EPS |

|

– basic |

|

$ |

2.42 |

|

|

$ |

2.25 |

|

|

$ |

2.28 |

|

|

$ |

1.99 |

|

|

$ |

2.26 |

|

|

$ |

0.73 |

|

|

$ |

2.88 |

|

|

$ |

2.02 |

|

| |

|

– diluted |

|

|

2.42 |

|

|

|

2.25 |

|

|

|

2.28 |

|

|

|

1.98 |

|

|

|

2.26 |

|

|

|

0.73 |

|

|

|

2.88 |

|

|

|

2.02 |

|

| (1) |

Certain information has been reclassified to conform to the presentation adopted in the first quarter of 2015. See “External reporting change” for additional details. |

| (2) |

Wholesale Banking revenue and income taxes are reported on a taxable equivalent basis (TEB) with an equivalent offset in the revenue and income taxes of Corporate and Other. |

Our quarterly results are modestly affected by seasonal factors. The second quarter has fewer days as compared with the other quarters, generally leading to lower

earnings. The summer months (July – third quarter and August – fourth quarter) typically experience lower levels of capital markets activity, which affects our brokerage, investment management, and wholesale banking activities.

Revenue

Retail and Business Banking revenue has benefited from volume growth

across most retail products, largely offset by the impact of the sold Aeroplan portfolio in the first quarter of 2014, the continued low interest rate environment, and attrition in our exited FirstLine mortgage broker business. The first quarter of

2015

|

|

|

| 6 |

|

CIBC THIRD QUARTER 2015 |

included the gain arising from accounting adjustments on credit card-related balance sheet amounts, and the first quarter of

2014 included the gain relating to the Aeroplan transactions with Aimia and TD.

Wealth Management revenue has benefited from the impact of the

acquisition of Atlantic Trust Private Wealth Management (Atlantic Trust) on December 31, 2013, including annual performance fees earned in the first quarter of 2015, and has also experienced growth in fee-based average assets under management

(AUM) and strong net sales of long-term mutual funds.

Wholesale Banking revenue is influenced, to a large extent, by capital markets conditions and

growth in the equity derivatives business, which has generally resulted in higher tax-exempt income. Revenue has also been impacted by the volatility in the structured credit run-off business. The first quarter of 2015 included the gain on sale of

an investment in our merchant banking portfolio. The fourth quarter of 2014 included the charge related to funding valuation adjustments (FVA), while the third quarter and the first quarter of 2014 included gains within an equity-accounted

investment in our merchant banking portfolio and on the sale of an equity investment in our exited European leveraged finance portfolio, respectively. The fourth quarter of 2013 included the impairment of an equity position in our exited U.S.

leveraged finance portfolio.

Corporate and Other includes the offset related to the TEB component of tax-exempt income noted above. The first quarter

of 2014 included the gain relating to the Aeroplan transactions noted above.

Provision for credit losses

Provision for credit losses is dependent upon the credit cycle in general and on the credit performance of the loan portfolios. In Retail and Business Banking, losses in

the card portfolio have been generally trending lower due to credit improvements, as well as the impact of an initiative to enhance account management practices, and the sold Aeroplan portfolio. A charge resulting from operational changes in the

processing of write-offs was included in the first quarter of 2014. In Wholesale Banking, the second quarter of 2014 included losses in the exited U.S. leveraged finance portfolio. In Corporate and Other, the second quarter of 2014 had elevated loan

losses relating to CIBC FirstCaribbean. The first and third quarters of 2014 included a decrease in the collective allowance, including the partial reversal of the credit losses relating to the Alberta floods.

Non-interest expenses

Non-interest expenses have fluctuated over the period

largely due to changes in employee-related compensation and benefits, as well as higher spending on strategic initiatives. The first quarter of 2015 included restructuring charges relating to employee severance. The second quarter of 2014 had a

goodwill impairment charge and the fourth quarter of 2013 had a restructuring charge relating to CIBC FirstCaribbean. All quarters in 2014 and the fourth quarter of 2013 had expenses relating to the development of our enhanced travel rewards program

and to the Aeroplan transactions with Aimia and TD.

Income taxes

Income

taxes vary with changes in income subject to tax, and the jurisdictions in which the income is earned. Taxes can also be affected by the impact of significant items and the level of tax-exempt income, which has generally been trending higher for the

periods presented in the table above. No tax recovery was booked in the second quarter of 2014 in respect of the CIBC FirstCaribbean goodwill impairment charge and loan losses.

Outlook for calendar year 2015

Global growth is on

track to be slower than the prior year’s mediocre pace, as a deceleration in China and a recession in Russia offset better results in Europe and an acceleration in the U.S. after a slow first quarter. The U.S. economy should gather momentum

from improved credit access for households and the income gains associated with healthy job growth, setting the stage for about a 2.5% real gross domestic product (GDP) growth in 2015. Canada’s economy declined in the first half and could post

just over 1% growth for the year as a drop in resource sector capital spending and fiscal tightening by affected provinces offsets the lift to non-energy exports arising from U.S. growth and a weaker Canadian dollar. The U.S. Federal Reserve is

likely to begin increasing interest rates moderately before the end of the calendar year, but after cutting interest rates twice, the Bank of Canada is expected to hold rates flat, given the drag on growth from weaker oil prices. Long-term yields

could rise in both countries in the remainder of the year due to anticipated U.S. interest rate hikes and diminished fears of a global slump.

Retail

and Business Banking could benefit from improvement in industry demand for household credit in the wake of the Bank of Canada’s actions, but the impact should be modest given that interest rates have already been low for a prolonged period of

time. Demand for business credit should continue to grow at a healthy pace outside the resource-based provinces, but will be impacted by recessions or very slow growth in the resource-based provinces. Although the weaker picture for resource prices

represents a risk to business and household credit quality in the affected regions, the deterioration should be modest given that only a slight increase is expected in unemployment and business bankruptcy rates.