Colgate Shuffles Leadership, Sets Up Race to Succeed CEO Cook

March 29 2016 - 5:00PM

Dow Jones News

Colgate-Palmolive Inc. promoted two company veterans as part of

a plan to line up an eventual successor to Chief Executive Ian

Cook, who has run the company for nine years, according to people

familiar with the moves.

Justin Skala and Noel Wallace are now the front runners to

succeed Mr. Cook, 63, who is expected to step down within the next

five years, the people said. Both men will assume chief operating

officer roles starting Friday, according to a regulatory filing by

the company.

Fabian Garcia, a third potential successor to Mr. Cook, is

resigning as a chief operating officer to be head of Revlon Inc.,

the embattled beauty company. Mr. Garcia, 56 years old, was ready

to be a CEO and believed Mr. Cook didn't plan to retire soon,

people familiar with the matter said.

In their new roles, Mr. Skala, 56 years old, will oversee North

America, Europe, Africa and global sustainability; Mr. Wallace, 51

years old, will be in charge of global innovation and growth and

the company's Hill's pet food line.

Mr. Skala and Mr. Wallace will receive options to purchase $2.3

million each in stock that vests gradually over five years. The

executives also received performance-based restricted stock that

could be worth $750,000 and will vest in five years.

The two executives "are in an absolutely dead heat" to succeed

Mr. Cook, one person familiar with the matter said. Several other

executives were reassigned as part of a larger plan to develop a

next generation of leaders within the company, people familiar with

the moves said.

Franck Moison, another senior executive, will become vice

chairman in charge of Colgate's Asia Pacific and Latin America

operations and business development. Mr. Moison, 62 years old,

isn't in the running for CEO partly because he is close in age to

Mr. Cook, the people familiar said.

The New York-based company didn't respond to requests for

comment and to speak with the newly promoted executives or Mr.

Garcia.

Colgate has historically been deliberate in its grooming of

future CEOs. Mr. Cook, who has been with the company for 40 years,

was picked as the likely successor to then Chief Executive Reuben

Mark in 2004, three years before he would assume the role from the

veteran leader.

This CEO race is happening in a time of greater uncertainty for

the maker of its namesake toothpaste, Palmolive dish soap and Speed

Stick deodorant. After decades as a steady and solid

performer—between 1994 and 2014 Colgate stock rose by more than

800%, while the S&P 500 tripled—the company has hit some

bumps.

Like many consumer-products companies that do a lot of business

abroad, Colgate sales have been hit hard by the stronger U.S.

dollar. The company said earlier this month that it would cut

additional jobs as part of a restructuring program that was

originally slated to end this year.

Amid continuing dollar pressure, Colgate has raised prices in

recent quarters in an attempt to support profit. The company lifted

prices 4% in the December period. In addition to raising prices,

the company has moved to cut costs and brought overhead expenses

down 10% in the December quarter.

Suzanne Kapner contributed to this article.

Write to Joann S. Lublin at joann.lublin@wsj.com and Sharon

Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

March 29, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

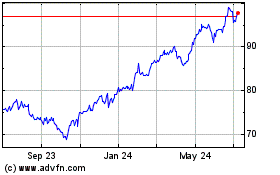

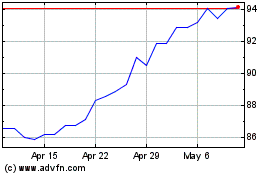

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024