Strong Dollar Hits Colgate-Palmolive Sales

November 02 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/2/15)

By Ezequiel Minaya

Colgate-Palmolive Co. said its sales slipped 8.7% in the third

quarter, hurt once again by significant currency-related headwinds,

though profit climbed during the period, helped by cost cuts,

increased prices and a more favorable tax rate.

Many consumer-product companies that do a large chunk of

business abroad have blamed the stronger U.S. dollar for lackluster

results, as it makes their products more expensive abroad and

diminishes revenue once repatriated. For Colgate, roughly 80% of

revenue is generated abroad.

Foreign-exchange volatility had a 13% drag on sales, the company

said.

Colgate has raised prices in recent quarters in an attempt to

offset the hit from foreign exchange. Over the latest quarter,

Colgate -- the maker of its namesake oral-care products, Lady Speed

Stick deodorant and Science Diet pet food -- said it raised prices

3.5%.

The company also has been working to cut costs. Colgate brought

down selling, general and administrative expenses to 33.7% of sales

from 34.2% during the same period a year ago. The effective tax

rate during the latest quarter fell to 31.9% from 38.6% the earlier

year.

Overall, the company posted a profit of $726 million, or 80

cents a share, up from $542 million, or 59 cents a share a year

earlier.

Revenue dropped 8.7% to $4 billion.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 02, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

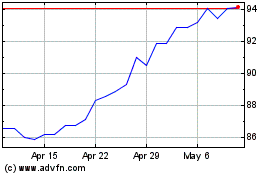

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Mar 2024 to Apr 2024

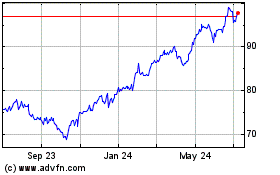

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Apr 2023 to Apr 2024