ETFs Race to Fastest Yearly Start Ever Based on Inflows, BlackRock Data Show

March 02 2017 - 7:34PM

Dow Jones News

By Asjylyn Loder

Investors poured $62.9 billion into exchange-traded funds in

February, pushing the year-to-date world-wide tally to $124

billion, the fastest start of any year in the history of the ETF

industry, according to data from BlackRock Inc.

U.S. ETFs accounted for $44 billion of that, pushing assets in

U.S. funds to almost $2.8 trillion.

Most of the money went to cheap, index-tracking ETFs, a sign

that the price war in ETFs isn't over yet. BlackRock's iShares ETFs

were the biggest winner, and its low-cost Core series garnered the

bulk of the $38 billion global haul.

"All of the money is going into the cheapest and most boring

ETFs. This is the retail investor getting back into the market with

a vengeance," said Dave Nadig, chief executive of ETF.com, an

industry website owned by Bats Global Markets, newly a subsidiary

of CBOE Holdings Inc.

The fastest-growing ETF so far this year is the iShares Core

Emerging Markets ETF, which took in $4.2 billion in the first two

months of the year, 18% of its assets, according to FactSet. Three

other Core ETFs that invest in U.S. stocks were also among the top

gainers last month.

Investment advisers are increasingly focused on low-cost

investments amid an industrywide shift to fee-based financial

advice, where advisers are paid by clients instead of commissions

on fund sales. BlackRock cut fees on its Core funds in October. The

shift has put pressure on asset managers to cut fees, and has cut

into their bottom line.

"The proliferation of passive management continued to pressure

both flows and effective fee rates, offsetting the positive impact

of higher markets," according to a Moody's Investors Service report

on Tuesday.

Asset managers need to gather more assets to offset the impact

of lower fees, something BlackRock has successfully done. Assets in

BlackRock ETFs surpassed $1 trillion in January.

"You can still grow revenue organically," said Martin Small,

head of U.S. iShares. "You just need to gather assets."

Write to Asjylyn Loder at asjylyn.loder@wsj.com

(END) Dow Jones Newswires

March 02, 2017 19:19 ET (00:19 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

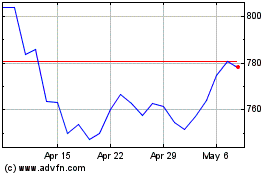

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

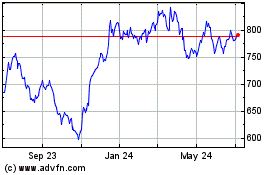

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024