Deutsche Bank's Asset Management Head to Leave

June 08 2016 - 9:40AM

Dow Jones News

Deutsche Bank AG's asset management chief, Quintin Price, will

depart the lender effective June 15, after being on medical leave

for two months, according to people familiar with the matter.

Mr. Price submitted his resignation to the bank's supervisory

board this week, and it was accepted on Wednesday, one of the

people said.

His planned departure has prompted a search for a new head of

the asset management division, one of four main operating units

under Deutsche Bank's recently revamped corporate structure. Mr.

Price declined to comment through a Deutsche Bank spokesman.

He joined the German bank in January, as part of an overhaul

announced last year by Chief Executive Officer John Cryan. Mr.

Price also served on the bank's management board.

In mid-April, the 54-year-old former senior BlackRock Inc.

executive went on medical leave for unspecified health reasons. An

April 18 note from Mr. Cryan to Deutsche Bank employees that was

posted on the bank's public Web site said that Mr. Price's medical

treatment plan was being finalized and he needed to focus full-time

on his health "for the foreseeable future."

Mr. Cryan then took over representing asset management on the

management board, and the division's global operations chief, Jon

Eilbeck, took over Mr. Price's day-to-day oversight of the

business. Mr. Eilbeck, 48 years old, is vice chairman of the asset

management executive committee and its regional Asia Pacific head.

He'll continue in all of those roles for the time being, according

to a person familiar with Deutsche Bank's plans.

Asset management generated €3.3 billion ($3.8 billion) in

revenue during 2015, making it the smallest of Deutsche Bank's four

main business divisions by that measure. However, asset management

has the highest return on equity, fueled by fund-management fees

and other relatively steady income, especially compared to Deutsche

Bank's much larger securities-trading business.

The division previously was part of a larger asset and wealth

management unit now broken up under Mr. Cryan's restructuring. In

the first quarter of this year, asset management suffered a 12%

revenue decline from the same period in 2015.

Mr. Price's pending departure after so brief a tenure adds to

the complexities Deutsche Bank faces as it struggles to make

profits while settling a range of legal matters, shrinking its

trading business and trying to cut costs.

The bank is under increasing pressure from investors to decrease

its leverage, or level of borrowings used to generate profits, and

has been hurt by weakness in its core trading and deal-advisory

businesses. Its shares have declined 33% this year, compared to the

19% decline of the Stoxx Europe 600 banks index.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

June 08, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

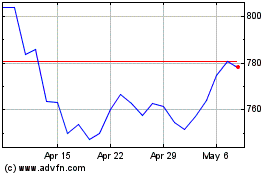

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

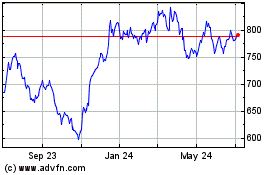

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024