Karson and BNY Mellon Collaborate on Innovative Capital Financing Transaction

January 19 2016 - 8:00AM

Business Wire

First K-Note Transaction in Canada

Karson Management (Bermuda) Limited and affiliates (Karson), a

provider of reserve, capital and collateral financing solutions,

and BNY Mellon, a global leader in investment management and

investment services, today announced the successful completion of

the first K-Note reinsurance collateral financing transaction in

Canada. The patented K-Note financing platform has been designed by

Karson around a number of BNY Mellon’s corporate trust, custody and

collateral management services.

The multi-million Canadian dollar transaction involved the

issuance and deposit of a K-Note into a reinsurance security

arrangement (RSA) account established in accordance with the

Canadian regulator, the Office of the Superintendent of Financial

Institutions (OSFI). The K-Note is backed by a payment obligation

of a third-party financial institution and a portfolio of

investment assets.

Derrell Hendrix, CEO of Karson, said: “We are pleased to have

concluded this first of what we hope to be many Canadian reserve

financing transactions based on clear guidance from the Canadian

regulator. The Karson program has again successfully transformed

its access to market capacity into the issuance of an instrument, a

K-Note, that satisfied our client’s reinsurance collateral

financing need. We have been able to meet a very challenging client

requirement while continuing to develop a scalable and sustainable

execution platform with our partners at BNY Mellon.”

BNY Mellon is Karson’s service partner of choice and its London

service team was appointed in 2009 for the forerunners to this new

transaction.

“With the influx of new regulations there is a continual need to

scrutinise effective ways of meeting capital adequacy

requirements,” said Dean Fletcher, head of Corporate Trust EMEA at

BNY Mellon. “This is a landmark transaction and will provide a

template for us to work with Karson to help their clients navigate

the new regulatory landscape following the financial crisis.”

Having completed a number of K-Note transactions in the U.S.

between 2009 and 2011, Karson obtained favourable guidance from

OSFI in June of 2011, which OSFI re-confirmed in December of 2013

following a revision of capital requirement regulations for

Canadian insurance and reinsurance companies. Under the

transaction, the K-Note was rated by both Standard & Poor’s and

DBRS.

Notes to editors:

KarsonKarson is a specialist financial solutions

structuring firm established in 2007 to provide an alternative

approach (e.g. capital-markets-funded) for financing “qualifying

collateral” and “admitted assets” for major financial

institutions.

To date, Karson has completed 16 K-Note transactions with $8.2

billion in reserve collateral and capital financing capacity raised

on behalf of its clients. While Karson remains very committed to

its roots in the reserve financing space, it has expanded its

platform capabilities to address financing needs for derivatives

collateral, liquidity transactions and contingent capital

requirements worldwide. Karson is currently launching a unique

asset reclassification and loan transformation platform which will

allow clients to convert illiquid assets and loans into a tri-party

eligible security that can be used for liquidity financing purposes

and general collateral applications.

The Karson platform offers a unique blend of client-focused deal

flexibility within an effective, scalable and efficient execution

framework. This indirectly provides clients with access to an

expanded range of capacity providers, as well as the cost and price

efficiencies of a standardized legal and operating platform.

BNY MellonBNY Mellon is a leading provider of corporate

trust services to the debt capital markets, offering customized and

market-driven solutions to investors, bondholders and lenders. As

of September 30, 2015, BNY Mellon Corporate Trust served as

trustee and/or paying agent on more than 60,000 debt-related issues

globally. The corporate trust business utilizes its global

footprint and expertise to deliver a full range of issuer and

related investor services including trustee, paying agency,

fiduciary, escrow, and other financial services. The business

administers a wide array of assets and types of programs to

multinational corporations, financial institutions, governments and

their agencies, and the banking, securities, and insurance

industries.

BNY Mellon is a global investments company dedicated to helping

its clients manage and service their financial assets throughout

the investment lifecycle. Whether providing financial services for

institutions, corporations or individual investors, BNY Mellon

delivers informed investment management and investment services in

35 countries and more than 100 markets. As of September 30,

2015, BNY Mellon had $28.5 trillion in assets under custody

and/or administration, and $1.6 trillion in assets under

management. BNY Mellon can act as a single point of contact for

clients looking to create, trade, hold, manage, service, distribute

or restructure investments. BNY Mellon is the corporate brand of

The Bank of New York Mellon Corporation (NYSE: BK). Additional

information is available on www.bnymellon.com. Follow us on

Twitter @BNYMellon or visit our newsroom

at www.bnymellon.com/newsroom for the latest company

news.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160119005994/en/

KarsonDerrell Hendrix, +44 1372 476

440dhendrix@karson.comorRichard Black, +1 441 236

6813rblack@karson.comorBNY MellonMalcolm Borthwick, +44 20 7163

4109malcolm.borthwick@bnymellon.com

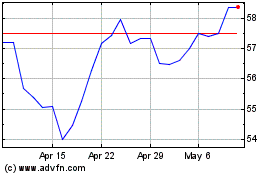

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

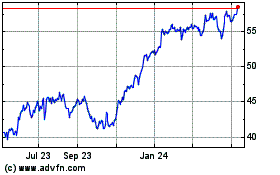

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024