KKR to Buy Software Maker Epicor From Apax Partners

July 05 2016 - 6:00PM

Dow Jones News

KKR & Co. has agreed to buy business software company Epicor

Software Corp. from Apax Partners, the latest in a streak of

technology company buyouts.

The buyer paid about $3.3 billion, including the assumption of

Epicor's existing debt, according to people familiar with the

matter. For Apax, the transaction amounted to a return that is more

than four times its investment in the company, one of the people

said.

The companies announced the deal Monday morning, following an

earlier report by The Wall Street Journal.

Epicor, based in Austin, Texas, provides back-office and sales

software to manufacturers, retailers and distributors such as Ace

Hardware and AutoZone Inc.

Apax bought Epicor and a peer, Activant Solutions Inc., in 2011

and combined them. Under the private-equity firm's ownership,

Epicor took on new management and spun off a division serving

apparel and specialty retailers. Apax will continue to own that

business, called Aptos Inc.

Apax shopped Epicor in 2014 but opted not to sell, turning down

offers of about $3 billion from bidders including CVC Capital

Partners, The Wall Street Journal reported at the time.

The tech sector has remained active amid an anemic deal-making

environment this year. As of last week, computers-and-electronics

companies were the object of five of private-equity firms' top 10

buyout agreements year to date and half the top 10 in 2015,

according to Dealogic.

In recent months, technology-focused buyout firm Thoma Bravo LLC

agreed to buy data-analysis company Qlik Technologies Inc. for $3

billion, while Vista Equity Partners agreed to acquire marketing

software provider Marketo Inc. for $1.8 billion and event-planning

software company Cvent Inc. for $1.65 billion.

Write to Matt Jarzemsky at matthew.jarzemsky@wsj.com

(END) Dow Jones Newswires

July 05, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

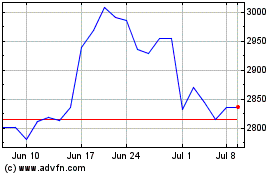

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

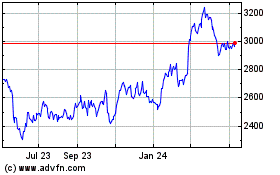

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024