AutoNation CEO Sees Slowdown In High-End Luxury Cars -- 2nd Update

January 06 2016 - 1:41PM

Dow Jones News

By Jeff Bennett

AutoNation Inc. Chief Executive Mike Jackson warned Wednesday

that a glut of car inventory--especially in the high-end luxury

segment--is beginning to erode the profit margins dealers and auto

makers have enjoyed amid the sizzling pace of U.S. auto sales.

"December was not the month everybody thought it was," Mr.

Jackson said. "The industry has a hard time spotting changes so I

am acting as the canary in the coal mine here. We are entering a

new chapter. Yes, sales will still be above 17 million this year,

but the quality of those sales in terms of lower incentives are now

a challenge."

December sales for the nation's largest dealership operator rose

9% to 35,962 vehicles compared with the same period a year earlier.

However, Mr. Jackson said the 9% is misleading since the boost was

propped up by "significant retail discounts" within the high-end

luxury vehicle segment and a few more selling days. Subtract those

two elements and year-over-year sales were flat.

Auto makers such as BMW AG and Daimler AG bet December would be

a strong month, with customers wanting to go big on holiday gifts.

But after the hype and discount, BMW branded U.S. sales dropped

16.6% while Daimler AG's Mercedes-Benz brand posted a small 0.6%

sales increase.

AutoNation dealers had to offer more cash on the hood to close

the deals, Mr. Jackson said. The move reduced the company's

per-vehicle gross profit for new and used vehicles by as much as

$300 in the fourth quarter of 2015 compared with the same period a

year earlier. A total figure wasn't provided.

Mr. Jackson intends to cut back car orders and fill his

dealership lots with more pickup trucks and sport utility

vehicles.

On Tuesday, the U.S. auto industry posted a record year with

17.5 million new vehicles sold in 2015. Those results eclipsed the

last sales peak of 17.4 million set in 2000. The average

transaction price--the amount customers are paying to buy--also hit

a record of more than $34,000. Trucks and SUVs accounted for 55.7%

of U.S. sales last year while cars were at 44.3%, according to

Autodata Corp.

Despite the celebration, there were some signs that not

everything was right. The industry's seasonally adjusted annual

selling pace fell to 17.3 million in December from 18.2 million the

month before. It was the first time since August the selling rate

had failed to come in above 18 million.

AutoNation shares dropped as much as 10% early Wednesday. The

stock was hovering in the mid-$51 range in late morning

trading.

Write to Jeff Bennett at jeff.bennett@wsj.com

(END) Dow Jones Newswires

January 06, 2016 13:26 ET (18:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

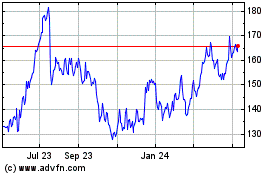

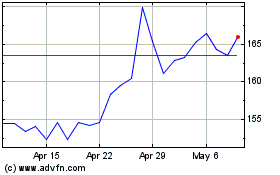

AutoNation (NYSE:AN)

Historical Stock Chart

From Mar 2024 to Apr 2024

AutoNation (NYSE:AN)

Historical Stock Chart

From Apr 2023 to Apr 2024