UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 11, 2015

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Federally chartered instrumentality of the United States | | 001-14951 | | 52-1578738 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

1999 K Street, N.W., 4th Floor, Washington D.C. | | 20006 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (202) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On May 11, 2015, the Federal Agricultural Mortgage Corporation (“Farmer Mac”) issued a press release to announce (1) its financial results for the fiscal quarter ended March 31, 2015 and (2) a conference call to discuss those results and Farmer Mac’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2015. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference. All references to www.farmermac.com and www.farmermac2.com in Exhibit 99.1 are inactive textual references only and the information contained on those websites are not incorporated by reference into this Current Report on Form 8-K.

The information furnished in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On May 11, 2015, Farmer Mac posted an investor slide presentation for its equity investors to its website at www.farmermac.com under the tab “Investors — Events and Presentations.” Farmer Mac expects to use the slide presentation in connection with future investor presentations to analysts and investors. The slide presentation is attached to this Current Report on Form 8-K as Exhibit 99.2 and in incorporated herein by reference. All references to www.farmermac.com in Exhibit 99.2 are inactive textual references only and the information contained on Farmer Mac's website is not incorporated by reference into this Current Report on Form 8-K.

The information furnished in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release, dated May 11, 2015

99.2 Equity investor slide presentation

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Senior Vice President – General Counsel

Dated: May 11, 2015

Farmer Mac Reports First Quarter Financial Results

Core Earnings of $9.1 Million; $0.80 per Diluted Common Share

WASHINGTON, D.C., May 11, 2015 — The Federal Agricultural Mortgage Corporation (Farmer Mac; NYSE: AGM and AGM.A) today announced its results for the quarter ended March 31, 2015, which included $14.7 billion in outstanding business volume and continued strong asset quality in the portfolio. Farmer Mac's first quarter 2015 core earnings, a non-GAAP measure, were $9.1 million ($0.80 per diluted common share), compared to $9.5 million ($0.84 per diluted common share) in fourth quarter 2014, and $11.0 million ($0.97 per diluted common share) for first quarter 2014.

"Farmer Mac maintained good fundamental trends in business volumes and strong asset quality, and completed its capital restructuring this quarter, positioning itself for continued success in 2015," said President and Chief Executive Officer Tim Buzby. "We grew our outstanding business volume by $62.5 million during the quarter, driven by a new $200.0 million AgVantage funding with CFC and net growth in Farm & Ranch loan purchases, despite first quarter generally incurring significant loan repayments. Our credit quality continues to be extremely favorable, with the modest uptick in 90-day delinquencies primarily attributable to a single loan and not related to broader industry factors. Also during the quarter, we completed our capital restructuring by fully redeeming our more expensive preferred stock. Going forward, we expect to save $14.1 million in after-tax dividends annually, or $3.5 million per quarter, beginning in second quarter 2015, thus providing significant value to our common stockholders."

Earnings

Farmer Mac's net income attributable to common stockholders for first quarter 2015 was $1.8 million ($0.16 per diluted common share), compared to $0.8 million ($0.07 per diluted common share) for first quarter 2014. The increase compared to the previous year's quarter was attributable, in

part, to the effects of unrealized fair value changes on financial derivatives and hedged assets, which was a $0.6 million after-tax loss in first quarter 2015, compared to a $2.4 million after-tax loss in first quarter 2014. First quarter 2015 also included an $8.1 million ($6.2 million after-tax) loss on retirement of preferred stock from the write-off of deferred issuance costs upon the redemption of the Farmer Mac II LLC Preferred Stock on March 30, 2015. Additionally, the issuance of preferred stock during the first half of 2014, in advance of the time it was needed to fund the redemption of the Farmer Mac II LLC Preferred Stock, resulted in an increase of $2.3 million in preferred stock dividend payments in first quarter 2015 compared to first quarter 2014. First quarter 2014 included two items that did not recur in first quarter 2015: (1) $7.5 million after-tax of premium amortization as Farmer Mac refinanced certain Rural Utilities loans and (2) $2.1 million ($1.9 million after-tax) of dividend income on Farmer Mac's investment in CoBank preferred stock, which was called on October 1, 2014.

Core earnings in first quarter 2015 were $9.1 million ($0.80 per diluted common share), compared to $9.5 million ($0.84 per diluted common share) in fourth quarter 2014 and $11.0 million ($0.97 per diluted common share) in first quarter 2014. The decrease in first quarter 2015 core earnings compared to fourth quarter 2014 was primarily attributable to the recognition of a $0.8 million after-tax benefit in fourth quarter 2014, which did not occur in first quarter 2015, related to Farmer Mac's initiative to be accepted as a counterparty in the Federal Reserve Bank of New York reverse repurchase facility. The decrease was partially offset by a $0.5 million after-tax increase in net effective spread.

The decrease in core earnings for first quarter 2015 compared to first quarter 2014 was primarily attributable to:

| |

• | a $2.3 million increase in preferred stock dividend payments due to the issuance of preferred stock during the first half of 2014 in advance of the time it was needed to fund the redemption of the Farmer Mac II LLC Preferred Stock; |

| |

• | a $0.8 million after-tax increase in compensation expense due primarily to higher incentive compensation driven by meeting certain performance targets, increased headcount, and annual salary adjustments; |

| |

• | the loss of $1.4 million after-tax of dividend income and $0.5 million of tax benefits associated with the October 2014 redemption of CoBank preferred stock; |

| |

• | partially offset by a $3.2 million after-tax increase in net effective spread, excluding the loss of dividend income on the CoBank preferred stock. |

The loss on retirement of preferred stock from the write-off of deferred issuance costs upon the redemption of the Farmer Mac II LLC Preferred Stock does not affect core earnings because it is not a frequently occurring transaction and not indicative of future operating results. This treatment is consistent with Farmer Mac's previous treatment of securities issuance costs that are capitalized during the life of the securities and then written off when the securities are redeemed.

See "Non-GAAP Earnings Measures" below for more information about core earnings.

Business Volume Highlights

During first quarter 2015, Farmer Mac added $502.3 million of new business volume, with Institutional Credit AgVantage securities and Farm & Ranch loan purchases driving the volume. Specifically, Farmer Mac:

| |

• | purchased $214.9 million of AgVantage securities; |

| |

• | purchased $130.2 million of Farm & Ranch loans; |

| |

• | added $59.3 million of Farm & Ranch loans under LTSPCs; |

| |

• | purchased $89.2 million of USDA Securities; and |

| |

• | purchased $8.7 million of Rural Utilities loans. |

This total new business volume for first quarter 2015 was more than the $439.8 million of maturities and principal paydowns on existing business during the quarter, resulting in Farmer Mac's outstanding business volume increasing a net $62.5 million from December 31, 2014 to $14.7 billion as of March 31, 2015. In Farmer Mac's experience, the largest paydowns on the loans in its Farm & Ranch line of business usually occur in first quarter of each year because almost all loans have a required January 1 payment date, including most loans that pay on a quarterly, semi-annual, or annual basis. This seasonal effect can generally temper net loan growth in the first quarter, however, with the reduction in prepayment rates in the past year, this impact was less significant.

Farmer Mac has experienced continuing stable demand for its loan products in the Farm & Ranch line of business. However, as prepayment rates have slowed more than gross loan growth, net growth in

Farm & Ranch loans is expected to continue. Farmer Mac continues to expand its lender network, customer base, and product set, which may generate additional demand for Farmer Mac's products from new sources. As an example, $14.9 million of the AgVantage securities new business volume for first quarter 2015 was purchased under "Farm Equity AgVantage" facilities, a variation of Farmer Mac's AgVantage wholesale financing product. Although this product is in the early stages of development, Farmer Mac believes there is opportunity to expand this type of business as both the trend toward institutional investment in agricultural assets and awareness of the Farm Equity AgVantage product continues to grow. Since this product was introduced in third quarter 2014, Farmer Mac's total outstanding business volume related to the Farm Equity AgVantage product was $109.9 million as of March 31, 2015.

Net Effective Spread

Farmer Mac's net effective spread was $29.3 million (86 basis points) in first quarter 2015, compared to $28.4 million (91 basis points) in fourth quarter 2014 and $26.4 million (84 basis points) in first quarter 2014. Beginning January 1, 2015, Farmer Mac classified all of the income from Farmer Mac Guaranteed Securities that it holds in its portfolio as interest income. Prior to January 1, 2015, Farmer Mac classified a portion of the income from those securities as guarantee and commitment fees. This immaterial change in classification does not affect the timing or amount of income recognized from these securities, and all prior periods have been reclassified.

The increase in net effective spread in dollar terms in first quarter 2015 compared to fourth quarter 2014 was attributable to higher average loan and securities balances and an increase in nonaccrual income on Farm & Ranch loans. The decrease in net effective spread in percentage terms in first quarter 2015 compared to fourth quarter 2014 was primarily attributable to an increase in the average balance of cash and lower spread investments within the liquidity investment portfolio (to meet days-of-liquidity requirements) and to two fewer days for interest accrual on certain assets in first quarter.

The increase in net effective spread in first quarter 2015 compared to first quarter 2014 was

primarily attributable to lower funding costs, higher average loan and securities balances, and higher nonaccrual income on Farm & Ranch loans, which was partially offset by the loss of $2.1 million in preferred dividend income (7 basis points) from the October 2014 redemption of CoBank preferred stock. The early refinance of certain Rural Utilities loans and AgVantage securities in first quarter 2014 caused incremental financing costs of $1.3 million (4 basis points) in first quarter 2014 because the related original funding remained outstanding until the end of that quarter. Funding costs were also lower in first quarter 2015 compared to first quarter 2014 due to the maturity of older, higher-cost debt and the issuance of new debt at lower market spreads during the second half of 2014.

Credit Quality

Farmer Mac continues to maintain very favorable credit metrics in its four lines of business. In the Farm & Ranch portfolio, 90-day delinquencies were $32.1 million (0.60 percent of the Farm & Ranch portfolio) as of March 31, 2015, compared to $18.9 million (0.35 percent) as of December 31, 2014, and $29.4 million (0.56 percent) as of March 31, 2014. The increase in the 90-day delinquency rate in first quarter 2015 was primarily related to a single borrower to which Farmer Mac had $9.8 million of exposure as of March 31, 2015, and whose delinquency was not related to industry conditions or the profitability of the borrower's operation. Farmer Mac believes that it remains well-collateralized on that loan. However, Farmer Mac expects that over time its 90-day delinquency rate will eventually revert closer to Farmer Mac's historical averages due to macroeconomic and other potential factors. Farmer Mac's average 90-day delinquency rate for the Farm & Ranch line of business over the last fifteen years is approximately one percent.

During first quarter 2015, Farmer Mac recorded net releases from its allowance for losses of $0.7 million, primarily related to paydowns of processing loans (e.g., ethanol and canola processing facilities) underlying LTSPCs. Farmer Mac recorded no charge-offs to its allowance for losses during first quarter 2015. During first quarter 2014, Farmer Mac recorded provisions to its allowance for losses of $0.7 million primarily related to an increase in the estimated probable losses inherent in non-ethanol

related agricultural storage and processing loans due to a change in the potential loss assumptions related to those assets. Farmer Mac also recorded $29,000 of charge-offs to its allowance for loan losses during first quarter 2014.

For Farmer Mac's other lines of business, there are currently no delinquent AgVantage securities or Rural Utilities loans, and USDA Securities are backed by the full faith and credit of the United States. As a result, across all of Farmer Mac's lines of business, 90-day delinquencies represented 0.22 percent of total business volume as of March 31, 2015, compared to 0.13 percent as of December 31, 2014, and 0.21 percent as of March 31, 2014.

The western part of the United States, including California, continues to experience drought conditions, with the water level in many California reservoirs at historically low levels. Although to date Farmer Mac has not observed any material effect on its portfolio from drought conditions, the persistence of extreme drought conditions in the western states could have an adverse effect on Farmer Mac’s delinquency rates or loss experience. This is particularly true in the permanent plantings sector, where the value of the related collateral is closely tied to the production value and capability of the permanent plantings, and in the dairy sector, which may experience increased feed costs as water is diverted away from hay acreage commonly relied upon by dairy producers and toward land supporting other agricultural commodities. Farmer Mac continues to remain informed about the drought and its effects on the agricultural industries located in the western states and on Farmer Mac's Farm & Ranch portfolio through regular discussions with its loan servicers that service loans in drought-stricken areas.

Lines of Business

Farmer Mac's operations consist of four reportable lines of business, which are Farm & Ranch, USDA Guarantees, Rural Utilities, and Institutional Credit. The Institutional Credit business segment is comprised of all of Farmer Mac's wholesale funding products for agricultural and rural utility counterparties, and currently includes all of its AgVantage securities. Beginning in first quarter 2015, Farmer Mac revised its methodology for interest expense allocation among the Farm & Ranch, USDA

Guarantees, and Rural Utilities lines of business. As a result of this revision, a greater percentage of interest expense has been allocated to the longer-term assets (which are associated with more expensive longer-term financing) included within the USDA Guarantees and Rural Utilities lines of business. Net effective spread for periods prior to the quarter ended March 31, 2015 does not reflect this revision. Net effective spread by business segment for first quarter 2015 was $10.1 million (197 basis points) for Farm & Ranch, $4.2 million (95 basis points) for USDA Guarantees, $2.8 million (115 basis points) for Rural Utilities, and $10.4 million (77 basis points) for Institutional Credit.

Liquidity and Capital

Farmer Mac's core capital totaled $531.3 million as of March 31, 2015, exceeding the statutory minimum capital requirement by $97.1 million, or 22 percent, compared to $766.3 million as of December 31, 2014, which was $345.0 million, or 82 percent, above the statutory minimum capital requirement. The decrease in core capital was a direct result of the redemption of $250.0 million of Farmer Mac II LLC Preferred Stock on March 30, 2015. Farmer Mac issued an aggregate of $150 million of non-cumulative preferred stock during the first half of 2014 and used the proceeds of these preferred stock offerings and cash on hand to cause Farmer Mac II LLC to redeem all of the outstanding shares of Farmer Mac II LLC Preferred Stock. The preferred stock issued in 2014 qualifies as Tier 1 capital for Farmer Mac whereas the Farmer Mac II LLC Preferred Stock that was redeemed did not qualify as Tier 1 capital.

As of March 31, 2015, Farmer Mac's total stockholders' equity was $582.3 million, compared to $545.8 million as of December 31, 2014. The increase in total stockholder's equity was primarily attributable to an increase in accumulated other comprehensive income due to increases in fair value of available-for-sale securities. These increases in the fair value of available-for-sale securities were driven primarily by lower U.S. Treasury rates.

As prescribed by FCA regulations, Farmer Mac is required to maintain a minimum of 90 days of liquidity. In accordance with the methodology prescribed by those regulations, Farmer Mac maintained an

average of 176 days of liquidity during first quarter 2015 and had 183 days of liquidity as of March 31, 2015.

Non-GAAP Earnings Measure

Farmer Mac uses core earnings to measure corporate economic performance and develop financial plans because, in management's view, core earnings is a useful alternative measure in understanding Farmer Mac's economic performance, transaction economics, and business trends. Core earnings principally differs from net income attributable to common stockholders by excluding the effects of fair value fluctuations, which are not expected to have a cumulative net impact on financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is generally expected. Core earnings also differs from net income attributable to common stockholders by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business.

This non-GAAP financial measure may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of this non-GAAP measure is intended to be supplemental in nature, and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. During 2014, Farmer Mac presented core earnings excluding indicated items, a separate non-GAAP measure that related to two short-term initiatives: the cash management and liquidity initiative and the capital structure initiative described in Farmer Mac's previous SEC filings. The effects of these two initiatives had a minimal effect on Farmer Mac's results for the first quarters of both 2014 and 2015. Therefore, this separate non-GAAP measure is not provided for these two quarters; however, the effects of the two initiatives are discussed where applicable to facilitate an understanding of changes in core earnings.

A reconciliation of Farmer Mac's net income attributable to common stockholders to core earnings is presented in the following table along with a breakdown of the composition of core earnings:

|

| | | | | | | | | | | |

Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings |

| For the Three Months Ended |

| March 31, 2015 | | December 31, 2014 | | March 31, 2014 |

| (in thousands, except per share amounts) |

Net income attributable to common stockholders | $ | 1,818 |

| | $ | 5,647 |

| | $ | 813 |

|

Less the after-tax effects of: | | | |

| | |

|

Unrealized losses on financial derivatives and hedging activities | (582 | ) | | (3,717 | ) | | (2,395 | ) |

Unrealized gains on trading assets | 236 |

| | 679 |

| | 426 |

|

Amortization of premiums/discounts and deferred gains on assets consolidated at fair value(1) | (529 | ) | | (811 | ) | | (8,027 | ) |

Net effects of settlements on agency forward contracts | (164 | ) | | (30 | ) | | (176 | ) |

Loss on retirement of Farmer Mac II LLC Preferred Stock(2) | (6,246 | ) | | — |

| | — |

|

Sub-total | (7,285 | ) | | (3,879 | ) | | (10,172 | ) |

Core earnings | $ | 9,103 |

| | $ | 9,526 |

| | $ | 10,985 |

|

| | | | | |

Composition of Core Earnings: | | | | | |

Revenues: | | | | | |

Net effective spread | $ | 29,257 |

| | $ | 28,443 |

| | $ | 26,436 |

|

Guarantee and commitment fees | 4,012 |

| | 4,096 |

| | 4,315 |

|

Other(3) | (405 | ) | | (1,285 | ) | | (410 | ) |

Total revenues | 32,864 |

| | 31,254 |

| | 30,341 |

|

| | | | | |

Credit related (income)/expense: | | | | | |

(Release of)/provision for losses | (696 | ) | | (479 | ) | | 674 |

|

REO operating expenses | (1 | ) | | 48 |

| | 2 |

|

Losses on sale of REO | 1 |

| | 28 |

| | 3 |

|

Total credit related (income)/expense | (696 | ) | | (403 | ) | | 679 |

|

| | | | | |

Operating expenses: | | | | | |

Compensation and employee benefits | 5,693 |

| | 4,971 |

| | 4,456 |

|

General and administrative | 2,823 |

| | 2,992 |

| | 2,794 |

|

Regulatory fees | 600 |

| | 600 |

| | 594 |

|

Total operating expenses | 9,116 |

| | 8,563 |

| | 7,844 |

|

| | | | | |

Net earnings | 24,444 |

| | 23,094 |

| | 21,818 |

|

Income tax expense(4) | 6,692 |

| | 4,858 |

| | 4,334 |

|

Non-controlling interest | 5,354 |

| | 5,414 |

| | 5,547 |

|

Preferred stock dividends | 3,295 |

| | 3,296 |

| | 952 |

|

Core earnings | $ | 9,103 |

| | $ | 9,526 |

| | $ | 10,985 |

|

| | | | | |

Core earnings per share: | | | | | |

Basic | $ | 0.83 |

| | $ | 0.87 |

| | $ | 1.01 |

|

Diluted | 0.80 |

| | 0.84 |

| | 0.97 |

|

| |

(1) | Includes $7.5 million related to the acceleration of premium amortization in first quarter 2014 due to refinancing activity in the Rural Utilities line of business. |

| |

(2) | Relates to the write-off of deferred issuance costs as a result of the retirement of Farmer Mac II LLC Preferred Stock. |

| |

(3) | Fourth quarter 2014 include $13.6 million of interest expense related to securities purchased under agreements to resell and securities sold, not yet purchased and $12.8 million of gains on securities sold, not yet purchased. |

| |

(4) | Fourth quarter 2014 reflects a reduction of $1.4 million in the tax valuation allowance against capital loss carryforwards related to capital gains on securities sold, not yet purchased. First quarter 2014 includes the reduction in tax valuation allowance of $0.8 million associated with certain gains on investment portfolio assets. |

More complete information about Farmer Mac's performance for first quarter 2015 is set forth in Farmer Mac's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015 filed today with the SEC.

Forward-Looking Statements

Management's expectations for Farmer Mac's future necessarily involve a number of assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events could cause Farmer Mac's actual results to differ materially from the expectations as expressed or implied by the forward-looking statements, including uncertainties regarding:

| |

• | the availability to Farmer Mac of debt and equity financing and, if available, the reasonableness of rates and terms; |

| |

• | legislative or regulatory developments that could affect Farmer Mac or its sources of business; |

| |

• | fluctuations in the fair value of assets held by Farmer Mac and its subsidiaries; |

| |

• | the rate and direction of development of the secondary market for agricultural mortgage and rural utilities loans, including lender interest in Farmer Mac credit products and the secondary market provided by Farmer Mac; |

| |

• | the general rate of growth in agricultural mortgage and rural utilities indebtedness; |

| |

• | the impact of economic conditions, including the effects of drought and other weather-related conditions and fluctuations in agricultural real estate values, on agricultural mortgage lending and borrower repayment capacity; |

| |

• | developments in the financial markets, including possible investor, analyst, and rating agency reactions to events involving government-sponsored enterprises, including Farmer Mac; |

| |

• | changes in the level and direction of interest rates, which could, among other things, affect the value of collateral securing Farmer Mac's agricultural mortgage loan assets; and |

| |

• | volatility in commodity prices relative to costs of production and/or export demand for U.S. agricultural products. |

Other risk factors are discussed in "Risk Factors" in Part I, Item 1A of in Farmer Mac's Annual Report on Form 10-K for the year ended December 31, 2014 filed with the U.S. Securities and Exchange Commission ("SEC") on March 16, 2015 and in the Quarterly Report on Form 10-Q for the quarter ended

March 31, 2015 filed with the SEC earlier today. In light of these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this release. The forward-looking statements contained in this release represent management's expectations as of the date of this release. Farmer Mac undertakes no obligation to release publicly the results of revisions to any forward-looking statements included in this release to reflect new information or any future events or circumstances, except as the SEC otherwise requires. The information contained in this release is not necessarily indicative of future results.

Earnings Conference Call Information

The conference call to discuss Farmer Mac's first quarter 2015 financial results and Form 10-Q will be held beginning at 11:00 a.m. eastern time on Monday, May 11, 2015 and can be accessed by telephone or live webcast as follows:

Telephone (Domestic): (888) 346-2616

Telephone (International): (412) 902-4254

Webcast: http://www.farmermac.com/Investors/ConferenceCall/

If you are dialing in to the call, please ask for the conference chairman Tim Buzby. You will receive additional instructions when you join the call. The call can be heard live and will also be available for replay on Farmer Mac’s website at the link provided above for two weeks following the conclusion of the call.

About Farmer Mac

Farmer Mac is the stockholder-owned company created to deliver capital and increase lender competition for the benefit of American agriculture and rural communities. Additional information about Farmer Mac (including the Annual Report on Form 10-K and Quarterly Report on Form 10-Q referenced above) is available on Farmer Mac's website at www.farmermac.com. Farmer Mac II LLC is a subsidiary of Farmer Mac that operates the USDA Guarantees line of business of purchasing and holding USDA-

guaranteed loans. Information about Farmer Mac II LLC is available on its website at www.farmermac2.com.

CONTACT: Jalpa Nazareth, Investor Relations

Chris Bohanon, Media Inquiries

(202) 872-7700

* * * *

FEDERAL AGRICULTURAL MORTGAGE CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited)

|

| | | | | | | |

| As of |

| March 31,

2015 | | December 31,

2014 |

| (in thousands) |

Assets: | | | |

Cash and cash equivalents | $ | 1,556,246 |

| | $ | 1,363,387 |

|

Investment securities: | |

| | |

|

Available-for-sale, at fair value | 2,139,544 |

| | 1,938,499 |

|

Trading, at fair value | 638 |

| | 689 |

|

Total investment securities | 2,140,182 |

| | 1,939,188 |

|

Farmer Mac Guaranteed Securities: | |

| | |

|

Available-for-sale, at fair value | 3,842,209 |

| | 3,659,281 |

|

Held-to-maturity, at amortized cost | 1,767,096 |

| | 1,794,620 |

|

Total Farmer Mac Guaranteed Securities | 5,609,305 |

| | 5,453,901 |

|

USDA Securities: | |

| | |

|

Available-for-sale, at fair value | 1,794,844 |

| | 1,731,222 |

|

Trading, at fair value | 37,593 |

| | 40,310 |

|

Total USDA Securities | 1,832,437 |

| | 1,771,532 |

|

Loans: | |

| | |

|

Loans held for investment, at amortized cost | 3,082,378 |

| | 2,833,461 |

|

Loans held for investment in consolidated trusts, at amortized cost | 457,117 |

| | 692,478 |

|

Allowance for loan losses | (5,940 | ) | | (5,864 | ) |

Total loans, net of allowance | 3,533,555 |

| | 3,520,075 |

|

Real estate owned, at lower of cost or fair value | 421 |

| | 421 |

|

Financial derivatives, at fair value | 4,808 |

| | 4,177 |

|

Interest receivable (includes $3,422 and $9,509, respectively, related to consolidated trusts) | 66,312 |

| | 106,874 |

|

Guarantee and commitment fees receivable | 38,342 |

| | 39,462 |

|

Deferred tax asset, net | 14,750 |

| | 33,391 |

|

Prepaid expenses and other assets | 53,327 |

| | 55,413 |

|

Total Assets | $ | 14,849,685 |

| | $ | 14,287,821 |

|

| | | |

Liabilities and Equity: | |

| | |

|

Liabilities: | |

| | |

|

Notes payable: | |

| | |

|

Due within one year | $ | 7,957,193 |

| | $ | 7,353,953 |

|

Due after one year | 5,648,752 |

| | 5,471,186 |

|

Total notes payable | 13,605,945 |

| | 12,825,139 |

|

Debt securities of consolidated trusts held by third parties | 457,903 |

| | 424,214 |

|

Financial derivatives, at fair value | 95,493 |

| | 84,844 |

|

Accrued interest payable (includes $2,740 and $5,145, respectively, related to consolidated trusts) | 36,383 |

| | 48,355 |

|

Guarantee and commitment obligation | 36,537 |

| | 37,925 |

|

Accounts payable and accrued expenses | 31,433 |

| | 81,252 |

|

Reserve for losses | 3,491 |

| | 4,263 |

|

Total Liabilities | 14,267,185 |

| | 13,505,992 |

|

| | | |

Equity: | |

| | |

|

Preferred stock: | |

| | |

|

Series A, par value $25 per share, 2,400,000 shares authorized, issued and outstanding | 58,333 |

| | 58,333 |

|

Series B, par value $25 per share, 3,000,000 shares authorized, issued and outstanding | 73,044 |

| | 73,044 |

|

Series C, par value $25 per share, 3,000,000 shares authorized, issued and outstanding | 73,382 |

| | 73,382 |

|

Common stock: | |

| | |

|

Class A Voting, $1 par value, no maximum authorization, 1,030,780 shares outstanding | 1,031 |

| | 1,031 |

|

Class B Voting, $1 par value, no maximum authorization, 500,301 shares outstanding | 500 |

| | 500 |

|

Class C Non-Voting, $1 par value, no maximum authorization, 9,406,392 shares and 9,406,267 shares outstanding, respectively | 9,406 |

| | 9,406 |

|

Additional paid-in capital | 114,364 |

| | 113,559 |

|

Accumulated other comprehensive income, net of tax | 51,184 |

| | 15,533 |

|

Retained earnings | 201,081 |

| | 201,013 |

|

Total Stockholders' Equity | 582,325 |

| | 545,801 |

|

Non-controlling interest | 175 |

| | 236,028 |

|

Total Equity | 582,500 |

| | 781,829 |

|

Total Liabilities and Equity | $ | 14,849,685 |

| | $ | 14,287,821 |

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

| | | | | | | |

| For the Three Months Ended |

| March 31, 2015 | | March 31, 2014 |

| (in thousands, except per share amounts) |

Interest income: | | | |

Investments and cash equivalents | $ | 2,865 |

| | $ | 5,237 |

|

Farmer Mac Guaranteed Securities and USDA Securities | 33,122 |

| | 32,846 |

|

Loans | 27,964 |

| | 14,369 |

|

Total interest income | 63,951 |

| | 52,452 |

|

Total interest expense | 33,162 |

| | 34,726 |

|

Net interest income | 30,789 |

| | 17,726 |

|

Provision for loan losses | (76 | ) | | (573 | ) |

Net interest income after provision for loan losses | 30,713 |

| | 17,153 |

|

Non-interest income: | | | |

Guarantee and commitment fees | 3,377 |

| | 3,784 |

|

Losses on financial derivatives and hedging activities | (3,882 | ) | | (7,578 | ) |

Gains on trading securities | 362 |

| | 655 |

|

Gains on sale of available-for-sale investment securities | 6 |

| | 15 |

|

Losses on sale of real estate owned | (1 | ) | | (3 | ) |

Other income | 613 |

| | 92 |

|

Non-interest income/(loss) | 475 |

| | (3,035 | ) |

Non-interest expense: | | | |

Compensation and employee benefits | 5,693 |

| | 4,456 |

|

General and administrative | 2,823 |

| | 2,794 |

|

Regulatory fees | 600 |

| | 594 |

|

Real estate owned operating costs, net | (1 | ) | | 2 |

|

(Release of)/provision for reserve for losses | (772 | ) | | 101 |

|

Non-interest expense | 8,343 |

| | 7,947 |

|

Income before income taxes | 22,845 |

| | 6,171 |

|

Income tax expense/(benefit) | 4,231 |

| | (1,141 | ) |

Net income | 18,614 |

| | 7,312 |

|

Less: Net income attributable to non-controlling interest | (5,354 | ) | | (5,547 | ) |

Net income attributable to Farmer Mac | 13,260 |

| | 1,765 |

|

Preferred stock dividends | (3,295 | ) | | (952 | ) |

Loss on retirement of preferred stock | (8,147 | ) | | — |

|

Net income attributable to common stockholders | $ | 1,818 |

| | $ | 813 |

|

| | | |

Earnings per common share and dividends: | | | |

Basic earnings per common share | $ | 0.17 |

| | $ | 0.07 |

|

Diluted earnings per common share | $ | 0.16 |

| | $ | 0.07 |

|

Common stock dividends per common share | $ | 0.16 |

| | $ | 0.14 |

|

The following table sets forth information regarding outstanding volume in each of Farmer Mac's four lines of business as of the dates indicated:

|

| | | | | | | |

Lines of Business - Outstanding Volume |

| As of March 31, 2015 | | As of December 31, 2014 |

| (in thousands) |

On-balance sheet: | | | |

Farm & Ranch: | | | |

Loans | $ | 2,113,795 |

| | $ | 2,118,867 |

|

Loans held in trusts: | | | |

Beneficial interests owned by third party investors | 457,117 |

| | 421,355 |

|

USDA Guarantees: | | | |

USDA Securities | 1,778,973 |

| | 1,756,224 |

|

Farmer Mac Guaranteed USDA Securities | 23,098 |

| | 27,832 |

|

Rural Utilities: | | | |

Loans(1) | 968,117 |

| | 718,213 |

|

Loans held in trusts: | | | |

Beneficial interests owned by Farmer Mac(1) | — |

| | 267,396 |

|

Institutional Credit: | | | |

AgVantage Securities | 5,543,405 |

| | 5,410,413 |

|

Total on-balance sheet | $ | 10,884,505 |

| | $ | 10,720,300 |

|

Off-balance sheet: | | | |

Farm & Ranch: | | | |

LTSPCs | 2,178,100 |

| | 2,240,866 |

|

Guaranteed Securities | 598,236 |

| | 636,086 |

|

USDA Guarantees: | | | |

Farmer Mac Guaranteed USDA Securities | 12,847 |

| | 13,978 |

|

Institutional Credit: | | | |

AgVantage Securities | 986,529 |

| | 986,528 |

|

Total off-balance sheet | $ | 3,775,712 |

| | $ | 3,877,458 |

|

Total | $ | 14,660,217 |

| | $ | 14,597,758 |

|

| |

(1) | Reflects the unwinding of certain consolidated trusts with the effect that loans previously consolidated on the balance sheet as "Loans held in trusts" currently are included within "Loans." |

The following table presents the quarterly net effective spread by segment:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Effective Spread by Line of Business | | |

| Farm & Ranch | | USDA Guarantees | | Rural Utilities | | Institutional Credit(1) | | Corporate | | Net Effective Spread |

| Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield |

| (dollars in thousands) |

For the quarter ended: | | | | | | | | | | | | | | | | | | | | | | | |

March 31, 2015(2) | $ | 10,114 |

| | 1.97 | % | | $ | 4,225 |

| | 0.95 | % | | $ | 2,804 |

| | 1.15 | % | | $ | 10,425 |

| | 0.77 | % | | $ | 1,689 |

| | 0.20 | % | | $ | 29,257 |

| | 0.86 | % |

December 31, 2014(3) | 8,682 |

| | 1.71 | % | | 5,250 |

| | 1.19 | % | | 2,908 |

| | 1.18 | % | | 9,871 |

| | 0.78 | % | | 1,732 |

| | 0.26 | % | | 28,443 |

| | 0.91 | % |

September 30, 2014 | 8,207 |

| | 1.68 | % | | 5,073 |

| | 1.18 | % | | 2,890 |

| | 1.16 | % | | 9,822 |

| | 0.78 | % | | 3,773 |

| | 0.59 | % | | 29,765 |

| | 0.97 | % |

June 30, 2014 | 7,820 |

| | 1.64 | % | | 4,159 |

| | 0.99 | % | | 2,953 |

| | 1.16 | % | | 9,957 |

| | 0.78 | % | | 4,160 |

| | 0.57 | % | | 29,049 |

| | 0.92 | % |

March 31, 2014(4) | 7,114 |

| | 1.53 | % | | 3,784 |

| | 0.91 | % | | 1,990 |

| | 0.73 | % | | 9,406 |

| | 0.74 | % | | 4,142 |

| | 0.56 | % | | 26,436 |

| | 0.84 | % |

December 31, 2013(4) | 10,113 |

| | 2.20 | % | | 4,022 |

| | 0.97 | % | | 2,379 |

| | 0.89 | % | | 9,088 |

| | 0.72 | % | | 4,420 |

| | 0.58 | % | | 30,022 |

| | 0.94 | % |

September 30, 2013 | 7,980 |

| | 1.86 | % | | 4,505 |

| | 1.09 | % | | 2,974 |

| | 1.12 | % | | 9,117 |

| | 0.72 | % | | 4,117 |

| | 0.57 | % | | 28,693 |

| | 0.93 | % |

June 30, 2013 | 8,228 |

| | 2.08 | % | | 4,508 |

| | 1.12 | % | | 3,056 |

| | 1.14 | % | | 8,805 |

| | 0.71 | % | | 4,294 |

| | 0.63 | % | | 28,891 |

| | 0.97 | % |

March 31, 2013 | 8,083 |

| | 2.20 | % | | 4,694 |

| | 1.17 | % | | 3,183 |

| | 1.20 | % | | 8,576 |

| | 0.73 | % | | 4,440 |

| | 0.61 | % | | 28,976 |

| | 0.99 | % |

| |

(1) | See Note 1(d) to the consolidated financial statements in Farmer Mac's Quarterly Report on Form 10-Q filed with the SEC on May 11, 2015 for more information about the reclassification of certain amounts in prior periods from guarantee and commitment fees to interest income related to on-balance sheet Farmer Mac Guaranteed Securities. |

| |

(2) | Beginning in first quarter 2015, Farmer Mac revised its methodology for interest expense allocation among the Farm & Ranch, USDA Guarantees, and Rural Utilities lines of business. As a result of this revision, a greater percentage of interest expense has been allocated to the longer-term assets included within the USDA Guarantees and Rural Utilities lines of business. Net effective spread for periods prior to the quarter ended March 31, 2015 does not reflect this revision. |

| |

(3) | On October 1, 2014, $78.5 million of preferred stock issued by CoBank was called, resulting in a loss of net effective spread of $2.1 million or 30 basis points in the corporate segment. The impact on consolidated net effective spread for first quarter 2015 and fourth quarter 2014 was 7 basis points. |

| |

(4) | First quarter 2014 includes the impact of spread compression in the Rural Utilities line of business from the early refinancing of loans (41 basis points). Fourth quarter 2013 includes the impact in net effective spread in the Farm & Ranch line of business of one-time adjustments for recovered buyout interest and yield maintenance (40 basis points in aggregate) and the impact of spread compression in the Rural Utilities line of business from the early refinancing of loans (26 basis points). |

The following table presents quarterly core earnings reconciled to net income attributable to common stockholders:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core Earnings by Quarter Ended |

| March 2015 | | December 2014 | | September 2014 | | June 2014 | | March 2014 | | December 2013 | | September 2013 | | June 2013 | | March 2013 |

| | | |

Revenues: | | | | | | | | | | | | | | | | | |

Net effective spread(1) | $ | 29,257 |

| | $ | 28,443 |

| | $ | 29,765 |

| | $ | 29,049 |

| | $ | 26,436 |

| | $ | 30,022 |

| | $ | 28,693 |

| | $ | 28,891 |

| | $ | 28,976 |

|

Guarantee and commitment fees | 4,012 |

| | 4,096 |

| | 4,153 |

| | 4,216 |

| | 4,315 |

| | 4,252 |

| | 4,134 |

| | 4,126 |

| | 4,079 |

|

Other(2) | (405 | ) | | (1,285 | ) | | (2,001 | ) | | (520 | ) | | (410 | ) | | 427 |

| | (466 | ) | | 3,274 |

| | 186 |

|

Total revenues | 32,864 |

| | 31,254 |

| | 31,917 |

| | 32,745 |

| | 30,341 |

| | 34,701 |

| | 32,361 |

| | 36,291 |

| | 33,241 |

|

| | | | | | | | | | | | | | | | | |

Credit related (income)/expense: | | | | | | | | | | | | | | | | | |

(Release of)/provision for losses | (696 | ) | | (479 | ) | | (804 | ) | | (2,557 | ) | | 674 |

| | 12 |

| | (36 | ) | | (704 | ) | | 1,176 |

|

REO operating expenses | (1 | ) | | 48 |

| | 1 |

| | 59 |

| | 2 |

| | 3 |

| | 35 |

| | 259 |

| | 126 |

|

Losses/(gains) on sale of REO | 1 |

| | 28 |

| | — |

| | (168 | ) | | 3 |

| | (26 | ) | | (39 | ) | | (1,124 | ) | | (47 | ) |

Total credit related (income)/expense | (696 | ) | | (403 | ) | | (803 | ) | | (2,666 | ) | | 679 |

| | (11 | ) | | (40 | ) | | (1,569 | ) | | 1,255 |

|

| | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | |

Compensation and employee benefits | 5,693 |

| | 4,971 |

| | 4,693 |

| | 4,889 |

| | 4,456 |

| | 4,025 |

| | 4,523 |

| | 4,571 |

| | 4,698 |

|

General and administrative | 2,823 |

| | 2,992 |

| | 3,123 |

| | 3,288 |

| | 2,794 |

| | 3,104 |

| | 2,827 |

| | 2,715 |

| | 2,917 |

|

Regulatory fees | 600 |

| | 600 |

| | 593 |

| | 594 |

| | 594 |

| | 594 |

| | 593 |

| | 594 |

| | 594 |

|

Total operating expenses | 9,116 |

| | 8,563 |

| | 8,409 |

| | 8,771 |

| | 7,844 |

| | 7,723 |

| | 7,943 |

| | 7,880 |

| | 8,209 |

|

| | | | | | | | | | | | | | | | | |

Net earnings | 24,444 |

| | 23,094 |

| | 24,311 |

| | 26,640 |

| | 21,818 |

| | 26,989 |

| | 24,458 |

| | 29,980 |

| | 23,777 |

|

Income tax expense/(benefit)(3) | 6,692 |

| | 4,858 |

| | 6,327 |

| | (4,734 | ) | | 4,334 |

| | 5,279 |

| | 6,263 |

| | 7,007 |

| | 6,081 |

|

Non-controlling interest | 5,354 |

| | 5,414 |

| | 5,412 |

| | 5,819 |

| | 5,547 |

| | 5,546 |

| | 5,547 |

| | 5,547 |

| | 5,547 |

|

Preferred stock dividends | 3,295 |

| | 3,296 |

| | 3,283 |

| | 2,308 |

| | 952 |

| | 882 |

| | 881 |

| | 881 |

| | 851 |

|

Core earnings | $ | 9,103 |

| | $ | 9,526 |

| | $ | 9,289 |

| | $ | 23,247 |

| | $ | 10,985 |

| | $ | 15,282 |

| | $ | 11,767 |

| | $ | 16,545 |

| | $ | 11,298 |

|

| | | | | | | | | | | | | | | | | |

Reconciling items (after-tax effects): | | | | | | | | | | | | | | | | | |

Unrealized (losses)/gains on financial derivatives and hedging activities | (582 | ) | | (3,717 | ) | | 2,685 |

| | (3,053 | ) | | (2,395 | ) | | 8,003 |

| | 4,632 |

| | 11,021 |

| | 5,712 |

|

Unrealized gains/(losses) on trading assets | 236 |

| | 679 |

| | (21 | ) | | (46 | ) | | 426 |

| | (50 | ) | | (407 | ) | | (212 | ) | | 136 |

|

Amortization of premiums/discounts and deferred gains on assets consolidated at fair value | (529 | ) | | (811 | ) | | (440 | ) | | (179 | ) | | (8,027 | ) | | (10,864 | ) | | (421 | ) | | (564 | ) | | (618 | ) |

Net effects of settlements on agency forwards | (164 | ) | | (30 | ) | | 73 |

| | 236 |

| | (176 | ) | | 114 |

| | (158 | ) | | 955 |

| | (338 | ) |

Loss on retirement of Farmer Mac II LLC Preferred Stock | (6,246 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Net income attributable to common stockholders | $ | 1,818 |

| | $ | 5,647 |

| | $ | 11,586 |

| | $ | 20,205 |

| | $ | 813 |

| | $ | 12,485 |

| | $ | 15,413 |

| | $ | 27,745 |

| | $ | 16,190 |

|

| |

(1) | The difference between first quarter 2014 and fourth quarter 2013 net effective spread was due to the impact of one-time adjustments for recovered buyout interest and yield maintenance of $1.8 million in fourth quarter 2013, $0.6 million associated with the early refinancing of AgVantage securities and the recasting of certain Rural Utilities loans, and a lower day count in first quarter 2014. |

| |

(2) | Fourth quarter 2014 and third quarter 2014 include $13.6 million and $17.9 million, respectively, of interest expense related to securities purchased under agreements to resell and securities sold, not yet purchased and $12.8 million and $16.4 million, respectively of gains on securities sold, not yet purchased. First quarter 2014 includes additional hedging costs of $0.6 million. Fourth quarter 2013 includes gains on the repurchase of debt of $1.5 million, partially offset by realized losses on the sale of available-for-sale securities of $0.9 million and additional hedging costs of $0.2 million. Second quarter 2013 includes $3.1 million of realized gains from the sale of an available-for-sale investment security. |

| |

(3) | Fourth quarter 2014 and second quarter 2014 reflect a reduction of $1.4 million and $11.6 million, respectively, in the tax valuation allowance against capital loss carryforwards related to capital gains on securities sold, not yet purchased. First quarter 2014 and fourth quarter 2013 reflect a reduction in tax valuation allowance of $0.8 million and $2.1 million, respectively, associated with certain gains on investment portfolio assets. Second quarter 2013 includes the reduction of $1.1 million of tax valuation allowance against capital loss carryforwards related to realized gains from the sale of an available-for-sale investment security. |

2015 EQUITY INVESTOR PRESENTATION FIRST QUARTER

FARMER MAC Forward-Looking Statements In addition to historical information, this presentation includes forward- looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve a number of assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward-looking statements. Some of these factors are identified and discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the U.S. Securities and Exchange Commission (“SEC”) on March 16, 2015, and Quarterly Report on Form 10-Q filed with the SEC on May 11, 2015, each of which are also available on Farmer Mac’s website (www.farmermac.com). In light of these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of March 31, 2015. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements to reflect any future events or circumstances, except as otherwise mandated by the SEC. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2015 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac. EQUITY INVESTOR PRESENTATION 2015 02

FARMER MAC Non-GAAP Financial Measures This presentation is for general informational purposes only, is current only as of March 31, 2015, and should be read in conjunction with Farmer Mac’s Quarterly Report on Form 10-Q filed with the SEC on May 11, 2015. Farmer Mac uses core earnings, a non-GAAP financial measure, to measure corporate economic performance and develop financial plans because, in management's view, core earnings is a useful alternative measure in understanding Farmer Mac's economic performance, transaction economics, and business trends. Core earnings principally differs from net income attributable to common stockholders by excluding the effects of fair value fluctuations, which are not expected to have a cumulative net impact on financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is generally expected. Core earnings also differs from net income attributable to common stockholders by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Accordingly, the loss from retirement of the Farmer Mac II LLC Preferred Stock in first quarter 2015 has been excluded from core earnings because it is not a frequently occurring transaction and not indicative of future operating results. This is also consistent with Farmer Mac’s previous treatment of these types of origination costs associated with securities underwriting that are capitalized and deferred during the life of the security. This non-GAAP financial measure may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of this non-GAAP measure is intended to be supplemental in nature, and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. EQUITY INVESTOR PRESENTATION 2015 03

FARMER MAC Table of Contents 05 OVERVIEW AND HIGHLIGHTS 12 PORTFOLIO AND LINES OF BUSINESS 16 FINANCIAL PERFORMANCE 20 FUNDING AND RISK MANAGEMENT 24 APPENDIX EQUITY INVESTOR PRESENTATION 2015 04

Overview and Highlights

FARMER MAC Farmer Mac Overview CREATED IN THE 1980S TO HELP PREVENT FUTURE AGRICULTURAL CREDIT CRISES • Provides a secondary market for agricultural and rural utilities loans • Broadens access and drives more efficient loan pricing • Reduces agricultural credit market volatility LINES OF BUSINESS • Farm & Ranch • USDA Guarantees • Rural Utilities • Institutional Credit DIVERSE PRODUCT SUITE PROVIDED TO LENDERS • Loan Purchases • Wholesale Funding • Credit Protection OVERVIEW AND HIGHLIGHTS 06 1987 1996 1998 1999 2008 FARMER MAC INITIALLY CHARTERED BY CONGRESS AS AN INSTRUMENTALITY OF THE UNITED STATES FIRST MAJOR CHARTER REVISION AND EXPANSION OF AUTHORITY (E.G., DIRECT LOAN PURCHASES) OUTSTANDING BUSINESS VOLUME REACHES $1 BILLION FIRST LISTED ON NYSE (AGM & AGM.A) SECOND MAJOR CHARTER REVISION AND EXPANSION OF AUTHORITY (RURAL UTILITIES) OUTSTANDING BUSINESS VOLUME REACHES $10 BILLION

FARMER MAC Farmer Mac Investment Highlights •Rigorous underwriting standards •Low delinquencies •Low cumulative historical credit losses Quality Assets •Business directly financed through issuance of low-cost debt to capital markets • Issue debt at narrow, GSE spreads to U.S. Treasuries Funding Advantage •Robust worldwide demand for agricultural products •Increase market share through significant business development efforts •Increasing financial investment in agriculture leads to new wholesale financing opportunities Growth Prospects •Overhead / outstanding business volume ~ 25 bps •Outstanding business volume / total employees ~$200 million per employee Operational Efficiency •Steady core earnings growth •Annual core earnings return on equity ~ 15% to 25% •Steady growth in common dividends Consistent Returns OVERVIEW AND HIGHLIGHTS 7

FARMER MAC $9.1 $11.7 $11.3 $11.0 $9.1 $10.0 $12.9 $16.5 $23.2 $11.2 $13.4 $11.8 $9.3 $12.6 $11.6 $15.3 $9.5 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2011 2012 2013 2014 2015 $ I N M IL L IO N S 1Q 2Q 3Q 4Q $42.9 $49.6 $54.9 $53.0 $9.1 Core Earnings OVERVIEW AND HIGHLIGHTS 8 Core earnings for 2014 include the effects of the cash management and liquidity initiative implemented in the second quarter 2014, and the capital structure initiative under which Farmer Mac issued $150 million of preferred stock in advance of the planned March 30, 2015 redemption of all outstanding Farmer Mac II Preferred Stock and related FALConS. (1) (1)

FARMER MAC Business Volume OVERVIEW AND HIGHLIGHTS 9 $4.8 $5.2 $5.4 $5.3 $5.4 $5.6 $6.0 $6.4 $6.1 $6.5 $1.6 $1.7 $1.8 $1.7 $1.8 $1.0 $1.1 $1.0 $1.0 $1.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 2012 2013 2014 1Q14 1Q15 $ I N B IL L IO N S Farm & Ranch Institutional Credit USDA Guarantees Rural Utilities $14.6 AS OF YEAR-END AS OF QUARTER-END (1) Includes on- and off-balance sheet outstanding business volume $13.0 $14.0 $14.1 $14.7 (1)

FARMER MAC Credit Quality OVERVIEW AND HIGHLIGHTS 10 $53.1 $39.7 $29.4 $32.1 1.21% 0.83% 0.56% 0.60% 0.44% 0.30% 0.21% 0.22% 0.00% 0.50% 1.00% 1.50% $0.0 $20.0 $40.0 $60.0 $80.0 1Q12 1Q13 1Q14 1Q15 $ I N M IL L IO N S 90-Day Delinquencies 90-Day Delinquencies % of Farm & Ranch Portfolio Only % of Total Portfolio

FARMER MAC $519 $591 $766 $664 $531 $145 $192 $345 $261 $97 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $0 $200 $400 $600 $800 2012 2013 2014 1Q14 1Q15 E X C E S S S T A T U TO R Y C A P IT A L $ IN M IL L IO N S C O R E C A P IT A L $ I N M IL L IO N S Core Capital Excess Statutory Capital AS OF YEAR-END AS OF QUARTER-END Capital OVERVIEW AND HIGHLIGHTS 11 (1) Core capital defined as total equity less accumulated other comprehensive income (2) Excess statutory capital defined as core capital less statutory minimum capital (1) (2)

Portfolio and Lines of Business

FARMER MAC Lines of Business and Products Product Type Potential Customers Lines of Business $ IN BILLIONS AND PERCENTAGE OF TOTAL LOAN PURCHASES • Ag Banks • Insurance Companies • Rural Utilities Cooperatives F & R USDA RU IC Total $2.6 17% $1.8 12% $1.0 7% -- $5.4 36% WHOLESALE FUNDING • AgVantage • Farm Equity AgVantage • Ag Banks • Insurance Companies • Ag Investment Funds • Rural Utilities Cooperatives -- -- -- $6.5 45% $6.5 45% CREDIT PROTECTION • Purchase Commitments/ AMBS Guarantees • FCS Institutions • Ag Banks • Insurance Companies • Rural Utility Cooperatives $2.8 19% -- -- -- $2.8 19% Total $5.4 $1.8 $1.0 $6.5 $14.7 = Allowances and provisions recorded on these assets PORTFOLIO AND LINES OF BUSINESS 13 AS OF MARCH 31, 2015

FARMER MAC Portfolio Summary Farm & Ranch 36% USDA 12% Rural Utilitie s 7% Institut ional Credit 45% Outstanding Business Volume by Line of Business AgVan tage 45% On- Balanc e Sheet Loans 24% Stand bys 15% AMBS 4% USDA Guaran tees 12% Outstanding Business Volume by Product Type Crops 55% Perma nent Plantin gs 17% Livest ock 23% Part- time Farm 3% Ag. Storag e and Proces sing 2% Farm & Ranch Loans by Commodity Type AS OF MARCH 31, 2015 PORTFOLIO AND LINES OF BUSINESS 14 (1) Farm & Ranch Loans include on-Balance Sheet loans and standby purchase commitments (1)

FARMER MAC Credit Quality FARMER MAC’S RURAL UTILITIES, USDA GUARANTEES, AND INSTITUTIONAL CREDIT LINES OF BUSINESS HAVE HISTORICALLY NOT HAD ANY CREDIT LOSSES FARM & RANCH HAS HISTORICAL CUMULATIVE LOSSES OF 0.15%, OR APPROXIMATELY 1BP/YEAR • Cumulative losses of $31 million • On $20 billion of cumulative originations PORTFOLIO AND LINES OF BUSINESS 15 -$2 $0 $2 $4 $6 $8 $10 $12 1995 & Prior 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 N E T L OS S / ( GA IN ) $ I N M IL L IO N S Historical Credit Losses Ag Storage & Processing Crops Livestock Permanent Plantings Part-Time Farm / Rural Housing

Financial Performance

FARMER MAC First Quarter 2015 Performance NET EFFECTIVE SPREAD OF 86 BPS, COMPARED TO 84 BPS LAST YEAR • Increase mostly attributable to lower funding costs (improved spreads on refinanced assets) and higher nonaccrual income in first quarter 2015 compared to first quarter 2014 CORE EARNINGS OF $9.1 MILLION ($0.80 PER DILUTED COMMON SHARE), COMPARED TO $11.0 MILLION ($0.97 PER DILUTED COMMON SHARE) IN FIRST QUARTER 2014 • Decline primarily due to the loss of $2.1 million dividend income/tax benefits on the CoBank preferred stock; and • $2.3 million in additional dividends paid on the Farmer Mac preferred stock issued in the first half of 2014 TOTAL BUSINESS VOLUME OF $14.7 BILLION • Purchased $215 million of AgVantage securities • Purchased $130 million of Farm & Ranch loans • Purchased $89 million of USDA securities • Total business volume growth of $63 million after repayments CREDIT QUALITY REFLECTS THE STRENGTH OF THE AGRICULTURAL AND RURAL UTILITIES SECTORS • 90-day delinquencies of $32 million (0.60% of Farm & Ranch loans), up from $19 million (0.35% of Farm & Ranch loans) in 2014 – Increase in 90-day delinquencies during first quarter 2015 was primarily driven by one borrower in the Northwest geographic region, to which Farmer Mac had exposure of $9.8 million as of March 31 2015, whose delinquency was not related to industry conditions or the profitability of the borrower’s operation • Average 90-day delinquency rate for the Farm & Ranch line of business over the last fifteen years is approximately 1% REGULATORY CAPITAL LEVEL EXCEEDS STATUTORY MINIMUM CAPITAL LEVELS BY $97 MILLION, OR 22% • Redeemed all $250 million of the outstanding Farmer Mac II Preferred Stock on March 30, 2015, which triggered the redemption of all outstanding related Farm Asset Linked Capital Securities (“FALConS”) on the same date FINANCIAL PERFORMANCE 17

FARMER MAC ($ in thousands) Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Revenues: Net effective spread 29,257$ 28,443$ 29,765$ 29,049$ 26,436$ 30,022$ 28,693$ 28,891$ 28,976$ Guarantee and commitment fees 4,012 4,096 4,153 4,216 4,315 4,252 4,134 4,126 4,079 Other (405) (1,285) (2,001) (520) (410) 427 (466) 3,274 187 Total revenues 32,864 31,254 31,917 32,745 30,341 34,701 32,361 36,291 33,241 Credit related (income)/expense: (Release of)/provisions for losses (696) (479) (804) (2,557) 674 12 (36) (704) 1,176 REO operating expenses (1) 48 1 59 2 3 35 259 126 Losses/(gains) on sale of REO 1 28 - (168) 3 (26) (39) (1,124) (47) Total credit related (income)/expense (696) (403) (803) (2,666) 679 (11) (40) (1,569) 1,255 Operating expenses: Compensation and employee benefits 5,693 4,971 4,693 4,889 4,456 4,025 4,523 4,571 4,698 General and administrative 2,823 2,992 3,123 3,288 2,794 3,104 2,827 2,715 2,917 Regulatory fees 600 600 593 594 594 594 593 594 594 Total operating expenses 9,116 8,563 8,409 8,771 7,844 7,723 7,943 7,880 8,209 Net earnings 24,444 23,094 24,311 26,640 21,818 26,989 24,458 29,980 23,777 Income tax expense/(benefit) 6,692 4,858 6,327 (4,734) 4,334 5,279 6,263 7,007 6,081 Non-controlling interest 5,354 5,414 5,412 5,819 5,547 5,546 5,547 5,547 5,547 Preferred stock dividends 3,295 3,296 3,283 2,308 952 882 881 881 851 Core earnings 9,103$ 9,526$ 9,289$ 23,247$ 10,985$ 15,282$ 11,767$ 16,545$ 11,298$ Core Earnings by Quarter Ended Farmer Mac’s Core Earnings History FINANCIAL PERFORMANCE 18 (1) See page 28 of Appendix for reconciliation of GAAP net income attributable to common stockholders to core earnings (1)

FARMER MAC Summary Balance Sheets FINANCIAL PERFORMANCE 19 ($ in millions) March 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Cash and cash equivalents $ 1,556.2 $ 1,363.4 $ 749.3 $ 785.6 $ 817.0 Investment securities 2,140.2 1,939.2 2,484.1 2,499.6 2,184.5 Farmer Mac Guaranteed Securities 5,609.3 5,453.9 5,091.6 4,766.3 4,289.3 USDA Securities 1,832.4 1,771.5 1,612.0 1,590.8 1,491.9 Total loans 3,539.5 3,525.9 3,200.1 2,741.2 2,904.4 Allowance for loan losses (5.9 ) (5.9 ) (6.9 ) (11.4 ) (10.2 ) Total loans, net of allowance 3,533.6 3,520.1 3,193.2 2,729.8 2,894.2 Other assets 178.0 239.8 231.6 250.1 206.6 Total assets $ 14,849.7 $ 14,287.8 $ 13,361.8 $ 12,622.2 $ 11,883.5 Notes payable $ 13,605.9 $ 12,825.1 $ 12,340.0 $ 11,602.1 $ 10,192.8 Reserve for losses 3.5 4.3 6.5 5.5 7.4 Other liabilities 657.8 676.6 440.8 421.6 1,128.8 Total liabilities 14,267.2 13,506.0 12,787.3 12,029.2 $11,329.0 Total stockholders’ equity 582.3 545.8 332.6 351.1 312.6 Non-controlling interest 0.2 236.0 241.9 241.9 241.9 Total equity 582.5 781.8 574.5 593.0 554.5 Total liabilities and equity $ 14,849.7 $ 14,287.8 $ 13,361.8 $ 12,622.2 $ 11,883.5

Funding and Risk Management

FARMER MAC Funding FINANCE ASSET PURCHASES WITH PROCEEDS OF DEBT ISSUANCES • 20+ dealers • Match-funding effectively locks in net spread FARMER MAC’S DEBT SECURITIES CARRY PRIVILEGES FOR CERTAIN HOLDERS • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for federally supervised financial institutions FUNDING & RISK MANAGEMENT 21 Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries MATURITY (YEARS) 1 3 5 10 SPREAD TO TREASURY (AS OF MARCH 31, 2015) 13 bps 21 bps 24 bps 64 bps

FARMER MAC Interest Rate Risk MATCH FUND ASSET PURCHASES WITH LIABILITIES THAT HAVE SIMILAR INTEREST RATE CHARACTERISTICS • Duration and convexity matching • Coupon type • Reset frequency MANAGE PRE-PAYMENT RISK ON MORTGAGES • Callable debt and bullet issuances across spectrum of maturities • Can adjust effective asset and debt coupon and duration characteristics through the use of interest rate swaps PERFORM REGULAR STRESS TESTING AND DISCLOSE A VARIETY OF SENSITIVITY MEASURES • Duration Gap • Market Value of Equity (MVE) Sensitivity • Net Interest Income (NII) Sensitivity FUNDING & RISK MANAGEMENT 22

FARMER MAC Liquidity – Investment Portfolio FARMER MAC MAINTAINS AN INVESTMENT PORTFOLIO TO PROVIDE BACK-UP SOURCE OF LIQUIDITY IN EXCESS OF REGULATORY REQUIREMENTS • A Minimum of 90 days of liquidity required by regulation $3.7 BILLION INVESTMENT PORTFOLIO AT MARCH 31, 2015 • Cash and highly-rated investment securities • Conservative portfolio goals – Minimize exposure to market volatility – Preservation of capital – Ready access to cash • Provided 183 days of liquidity at March 31, 2015 FARMER MAC ALSO HAS A $1.5 BILLION LINE OF CREDIT WITH THE U.S. TREASURY • Supports Farmer Mac’s guarantee obligations • Farmer Mac has never used this line of credit FUNDING & RISK MANAGEMENT 23 Cash & Equiv. 42% Guar. by GSEs and other U.S. Gov't Agencies 54% Corporate Debt Securities 1% Asset- Backed Securities 3% Liquidity Portfolio

Appendix

FARMER MAC Key Company Metrics APPENDIX 25 ($ in thousands, except per share amounts) 1Q15* 2014 2013 2012 Core Earnings $9,103 $53,047 $54,892 $49,642 Core Earnings per Diluted Share $0.80 $4.67 $4.90 $4.51 Net Effective Spread ($) $29,257 $113,693 $116,582 $117,190 Net Effective Spread (%) 0.86% 0.91% 0.96% 1.04% Guarantee & Commitment Fees $4,012 $16,780 $16,591 $15,989 Excess Regulatory Capital $97,100 $332,900 $192,200 $145,000 Common Stock Dividends per Share $0.16 $0.56 $0.48 $0.40 Outstanding Business Volume $14,660,217 $14,597,758 $13,950,312 $13,015,188 90-Day Delinquencies – Farm & Ranch 0.60% 0.35% 0.55% 0.70% Charge-Offs $0.0 $86 $4,004 $2,501 Book Value per Share $29.84 $29.76 $26.68 $20.52 Core Earnings Return on Equity 11% 17% 22% 25% Core earnings for 2014 include the effects of the cash management and liquidity initiative implemented in the second quarter 2014 and the capital structure initiative under which Farmer Mac issued $150 million of preferred stock in advance of the planned March 30, 2015 redemption of all outstanding Farmer Mac II Preferred Stock and related FALConS. (1) (1) * Through and as of March 31, 2015

FARMER MAC Core Earnings (Non-GAAP Measure) APPENDIX 26 ($ in millions) 1Q15* 2014 2013 2012 Net effective spread: Interest income $65.1 $ 256.9 $ 267.1 $ 285.5 Interest expense 35.8 143.2 150.5 168.3 Net effective spread 29.3 113.7 116.6 117.2 Non-interest income: Guarantee and commitment fees 4.0 16.8 16.6 16.0 Other (expense)/income (0.4 ) (4.2 ) 3.4 1.4 Non-interest income 32.9 12.6 20.0 17.4 Non-interest expenses: (Release of)/provision for losses (0.7 ) (3.2 ) (0.4 ) 1.9 Compensation and employee benefits 5.7 19.0 17.8 19.2 General and administrative 2.9 12.2 11.6 11.1 Other non-interest expenses 0.6 2.4 2.4 2.4 Non-interest expense 8.5 30.4 31.4 34.6 Core earnings before income taxes 24.4 95.9 105.2 100.0 Income tax expense 6.6 10.8 24.6 25.3 Core earnings before preferred stock dividends 17.8 85.1 80.6 74.7 Preferred stock dividends (8.7 ) (32.0 ) (25.7 ) (25.1 ) Core earnings $ 9.1 $ 53.0 $ 54.9 $ 49.6 * Through and as of March 31, 2015

FARMER MAC ($ in thousands) 1Q15* 2014 2013 2012 Net income attributable to common stockholders 1,818$ 38,251$ 71,833$ 43,894$ Less the after-tax effects of: Unrealized (losses)/gains on financial derivatives and hedging activities (582) (6,480) 29,368 4,325 Unrealized gains/(losses) on trading assets 236 1,038 (533) 200 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value (529) (9,457) (12,467) (7,266) Net effects of settlements on agency forwards (164) 103 573 856 Lower of cost or fair value adjustments on loans held for sale - - - (3,863) Loss on retirement of Farmer Mac II LLC Preferred Stock (6,246) - - - Core earnings 9,103$ 53,047$ 54,892$ 49,642$ Core Earnings by Period Ended Reconciliation of Net Income to Core Earnings APPENDIX 27 Relates to the write-off of deferred issuance costs as a result of the retirement of Farmer Mac II LLC Preferred Stock (1) (1) * Through and as of March 31, 2015

FARMER MAC Reconciliation of Net Income to Core Earnings APPENDIX 28 ($ in thousands) Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Net income attributable to common stockholders 1,818$ 5,647$ 11,586$ 20,205$ 813$ 12,485$ 15,413$ 27,745$ 16,190$ Reconciling items (after-tax effects): Unrealized (losses)/gains on f inancial derivatives and hedging activities (582) (3,717) 2,685 (3,053) (2,395) 8,003 4,632 11,021 5,712 Unrealized gains/(losses) on trading assets 236 679 (21) (46) 426 (50) (407) (212) 136 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value (529) (811) (440) (179) (8,027) (10,864) (421) (564) (618) Net effects of settlements on agency forw ards (164) 30 73 236 (176) 114 (158) 955 (338) Loss on retirement of Farmer Mac II LLC Preferred Stock (6,246) - - - - - - - - Core earnings 9,103$ 9,526$ 9,289$ 23,247$ 10,985$ 15,282$ 11,767$ 16,545$ 11,298$ Core Earnings by Quarter Ended

FARMER MAC Farmer Mac’s Net Effective Spread History APPENDIX 29 ($ in thousands) Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield For the quarter ended: March 31, 2015 (2) 10,114$ 1.97% 4,225$ 1.18% 2,804$ 1.15% 10,425$ 0.77% 1,689$ 0.20% 29,257$ 0.86% December 31,2014 (3) 8,682 1.71% 5,250 1.19% 2,908 1.18% 9,871 0.78% 1,732 0.26% 28,443 0.91% September 30, 2014 8,207 1.68% 5,073 1.18% 2,890 1.16% 9,822 0.78% 3,773 0.59% 29,765 0.97% June 30, 2014 7,820 1.64% 4,159 0.99% 2,953 1.16% 9,957 0.78% 4,160 0.57% 29,049 0.92% March 31, 2014 (4) 7,114 1.53% 3,784 0.91% 1,990 0.73% 9,406 0.74% 4,142 0.56% 26,436 0.84% December 31, 2013 (4) 10,113 2.20% 4,022 0.97% 2,379 0.89% 9,088 0.72% 4,420 0.58% 30,022 0.94% September 30, 2013 7,980 1.86% 4,505 1.09% 2,974 1.12% 9,117 0.72% 4,117 0.57% 28,693 0.93% June 30, 2013 8,228 2.08% 4,508 1.12% 3,056 1.14% 8,805 0.71% 4,294 0.63% 28,891 0.97% March 31, 2013 8,083 2.20% 4,694 1.17% 3,183 1.20% 8,576 0.73% 4,440 0.61% 28,976 0.99% (1) See Note 1(d) to the consolidated f inancial statements in Farmer Mac's Quarterly Report on Form 10-Q filed w ith the SEC on May 11, 2015 for more information about the reclassif ication of certain amounts in prior periods from guarantee and commitment fees to interest income related to on-balance sheet Farmer Mac Guaranteed Securities. (2) Beginning in f irst quarter 2015, Farmer Mac revised it's methodology for interest expense allocation amongst Farm & Ranch, USDA Guarantees, and Rural Utilities lines of business. As a result of this revision, a greater percentage of interest expense has been allocated to the longer term assets included w ithin the USDA Guarantees and Rural Utilities lines of business. Net effective spread for periods prior to the quarter ended March 31, 2015 does not reflect this revision. (3) On October 1, 2014, $78.5 million of preferred stock issued by CoBank w as called, resulting in a loss of net effective spread of $2.1 million or 30 basis points in the corporate segment. The impact on consolidated net effective spread for f irst quarter 2015 and fourth quarter 2014 w as 7 basis points. (4) First quarter 2014 includes the impact of spread compression in Rural Utilities line of business from the early refinancing of loans (41 basis points). Fourth quarter 2013 includes the impact in net effective spread in the Farm & Ranch line of business of one-time adjustments for recovered buyout interest and yield maintenance (40 basis points in aggregate) and the impact of spread compression in the Rural Utilities line of business from the early refinancing of loans (26 basis points). Net Effective SpreadInstitutional Credit (1) Net Effective Spread by Business Segment Farm & Ranch USDA Guarantees Rural Utilities Corporate

FARMER MAC Regulatory/Congressional Oversight SEC REGULATION UNDER FEDERAL SECURITIES LAWS SUBJECT TO NYSE RULES AND REGULATIONS SINCE 1999 REGULATED BY THE FARM CREDIT ADMINISTRATION (FCA) THROUGH ITS OFFICE OF SECONDARY MARKET OVERSIGHT CONGRESSIONAL OVERSIGHT THROUGH SENATE AND HOUSE AG COMMITTEES APPENDIX 30

FARMER MAC Three Classes of Common Stock NUMBER OF SHARES CLASS A VOTING COMMON STOCK • NYSE: AGM.A • Ownership restricted to financial institutions 1.0 million CLASS B VOTING COMMON STOCK • Not publicly traded • Ownership restricted to Farm Credit System institutions 0.5 million CLASS C NON-VOTING COMMON STOCK • NYSE: AGM • No ownership restrictions 9.4 million APPENDIX 31

FARMER MAC Three Classes of Preferred Stock NUMBER OF SHARES SERIES A NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.A • Dividend Yield: 5.875%** • Option to redeem at any time on or after January 17, 2018 • Redemption Value: $25 per share 2.4 million SERIES B NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.B • Dividend Yield: 6.875%** • Option to redeem at any time on or after April 17, 2019 • Redemption Value: $25 per share 3.0 million SERIES C FIXED-TO-FLOATING NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.C • Dividend Yield: 6.000%** • Option to redeem at any time on or after July 18, 2024 • Redemption Value: $25 per share 3.0 million APPENDIX 32 **Par value annual dividend yield

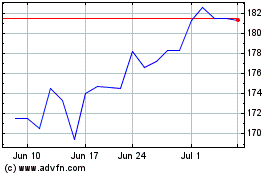

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Agricultural Mor... (NYSE:AGM)

Historical Stock Chart

From Apr 2023 to Apr 2024