Archer Daniels Midland Profit, Revenue Slide

November 03 2015 - 9:00AM

Dow Jones News

Archer Daniels Midland Co. reported steeper-than-expected drops

in revenue and profit in its third quarter, as the grain trader and

processor was hurt by weak ethanol margins and lower North American

export volumes.

Shares fell 2.8% in premarket trading.

ADM, among the world's largest agribusinesses and a major

ethanol producer, has been buffeted recently by lower

ethanol-production margins and sluggish overseas demand for North

American crops.

The Chicago company has also faced weakness in its grain-trading

business as a strong U.S. dollar and large crops in South America

crimped export demand for North American grain.

In the third quarter, revenue in ADM's corn-processing business

fell 17% to $2.52 billion.

Revenue in ADM's agricultural-services segment fell 6.2% to $6.6

billion.

ADM's oilseed-processing business posted a 12% drop in revenue

to $6.75 billion.

The wild flavors and specialty ingredients segment was a bright

spot, as revenue more than doubled to $588 million in the

quarter.

Overall, the company posted earnings of $252 million, or 41

cents a share, down from $747 million, or $1.14 a share, a year

earlier.

The quarter included $65 million in impairment, exit and

restructuring costs.

Excluding those charges and other special items, per-share

earnings fell to 60 cents a share from 86 cents a year earlier.

Revenue slid 8.6% to $16.57 billion.

Analysts had projected per-share earnings of 70 cents a share on

revenue of $17.77 billion.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 08:45 ET (13:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

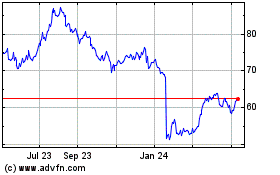

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2024 to May 2024

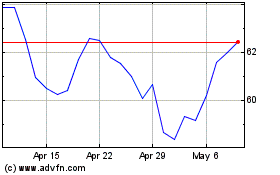

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2023 to May 2024