MARKET SNAPSHOT: U.S. Stocks Edge Up After Recent Selloff, FOMC Minutes Squarely In View

October 12 2016 - 10:45AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Energy stocks tumble, pressured by oil prices

U.S. stocks edged slightly higher on Wednesday as investors

digested a sharp decline in the previous session, sparked by a weak

start to the corporate earnings season, and looked ahead to the

latest minutes from the Federal Reserve for potential clarity on

interest rates.

Minutes from the Federal Open Market Committee's September

meeting are due for release at 2 p.m. Eastern Time, and market

participants will scour them for any insight about the Fed's

interest rate policies. Currently, many expect the U.S. central

bank to raise rates at its December meeting. That expectation has

lifted the U.S. dollar of late, which has been a drag on stocks

with multinational exposure.

"The FOMC minutes will be the most exciting thing that happens

today, in terms of input, but we still have to deal with a

lackluster start to the earnings season, a stronger dollar, and

weakness in commodities," said Art Hogan, chief market strategist

at Wunderlich Securities in New York.

Ahead of the release of the minutes, New York Fed President Bill

Dudley told CNBC that U.S. inflation expectations appeared to be

"well-anchored," and that "slack" in the labor market was a reason

the central bank hasn't been more aggressive in raising interest

rates.

Tuesday's session was the harshest day of selling in weeks, with

equities hit by a weak quarterly report

(http://www.marketwatch.com/story/losses-on-tap-for-wall-street-stocks-as-oil-backs-away-from-highs-2016-10-11)

from Alcoa Inc. (AA) The former Dow component, which is seen as the

unofficial start to the season, reported results that were below

expectations. Major indexes dropped more than 1% on Tuesday, their

weakest session since early September.

Read: S&P 500's 'triangle' chart pattern is warning of a big

selloff, analysts says

(http://www.marketwatch.com/story/sp-500s-triangle-chart-pattern-warns-of-a-big-selloff-analyst-says-2016-10-10)

Corporate earnings are expected to drop this quarter, making for

a sixth straight quarter of declines

(http://www.marketwatch.com/story/5-things-to-expect-this-earnings-season-2016-10-07),

according to FactSet data. While sales are expected to rebound,

breaking their own six-quarter streak of weakness, that may not

reassure investors about the state of American corporations at a

time when stock indexes are near record levels. At current levels,

the S&P 500 is 2.7% below an intraday record hit in August.

The Dow Jones Industrial Average rose 0.1%, or 14 points, to

18,142, while the S&P 500 rose 0.1% to 2,140 and the Nasdaq

Composite Index was unchanged at 5,248.

Energy stocks were by far the weakest sector on Wednesday, with

the S&P Energy sector down 1.1%. The group was pressured as

crude oil fell 1.4%, hurt by heightened uncertainty over Russia's

willingness

(http://www.marketwatch.com/story/oil-prices-rise-but-doubts-grow-over-russias-deal-commitment-2016-10-12)

to cut production. Many analyst view output cuts as necessary to

address oversupply in the oil market, especially amid weak global

demand.

"The question investors need to ask is whether oil can hold on

to some of its recent gains, or whether it will continue to put

pressure on the energy complex, which is an important part of the

over S&P," Hogan said.

In corporate news, Amazon.com Inc. (AMZN) plans to introduce

convenience stores and curbside pickup locations

(http://www.marketwatch.com/story/amazon-to-add-to-grocery-business-with-convenience-stores-curbside-pickup-2016-10-11)

as it pushes deeper into the grocery business. The move puts the

online retailer in competition with Wal-Mart Stores Inc.(WMT)(WMT),

The Wall Street Journal reported. Shares of Amazon rose 0.4% to

$834.37.

Samsung Electronics Co.(005930.SE) slashed its operating profit

forecast

(http://www.marketwatch.com/story/samsung-cuts-profit-view-by-a-third-in-wake-of-galaxy-note-7-recall-2016-10-12)

for the third quarter to 5.2 trillion Korean won ($4.6 billion)

from an original estimate of 7.8 trillion won, in the wake of a

recall and production halt of its Galaxy 7 Note smartphone. Apple

Inc. (AAPL) rose 0.7% to $117.17 amid speculation by analysts that

the iPhone maker could sell millions of phones on the back of

Samsung's troubles

(http://www.marketwatch.com/story/apple-could-sell-another-15-million-iphones-because-of-samsungs-note-7-explosions-2016-10-10).

The stock is poised for its longest winning streak since a

seven-day run in February 2015. Shares are up 3.6% this month

Read:Why Samsung's exploding-phone nightmare should terrify

Apple

(http://www.marketwatch.com/story/why-samsungs-exploding-phone-nightmare-should-terrify-apple-2016-10-11)

In other markets, Europe's stock market fell 0.3% while the FTSE

100 index slipped

(http://www.marketwatch.com/story/rising-pound-losses-for-miners-send-ftse-100-lower-2016-10-12)

0.4% as sterling continued its recent weakness.

Gold prices edged higher, up 0.1% on the day.

(END) Dow Jones Newswires

October 12, 2016 10:30 ET (14:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

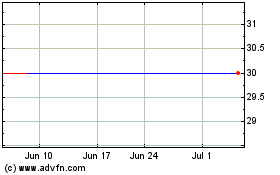

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

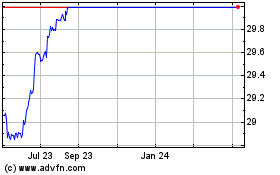

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024