MARKET SNAPSHOT: U.S. Stock Futures Look To Extend Record Climb

July 13 2016 - 9:28AM

Dow Jones News

By Sara Sjolin and Joseph Adinolfi, MarketWatch

Fed's Beige Book to grab the spotlight

U.S. stock futures moved higher Wednesday, aiming to add to a

blistering rally after the S&P 500 and Dow industrials closed

at fresh all-time highs.

Futures for the Dow Jones Industrial Average rose 34 points, or

0.2%, to 18,298, while those for the S&P 500 index gained 5

points, or 0.2%, to 2,1451. Futures for the Nasdaq-100 index rose

13 points, or 0.3%, to 4,583.

The small moves come after another upbeat trading day on Wall

Street on Tuesday, when the S&P 500 and Dow both rose 0.7% to

close at record highs

(http://www.marketwatch.com/story/sp-500-poised-for-fresh-record-as-alcoa-spurs-earnings-optimism-2016-07-12),

supported by a rally in energy shares and stronger-than-expected

earnings from Alcoa Inc. (AA)

Also on Tuesday, the Nasdaq Composite was in the green for the

first time this year as technology shares and other momentum stocks

joined in the rally.

The economic uncertainty caused by Brexit has been a key driver

of the recent push to record levels, as investors in Europe and the

U.K. look to the U.S. for a sense of safety, said Mohannad Aama,

managing director at Beam Capital Management.

And while economic and financial fundamentals may not justify

further gains, record-low sovereign bond yields and a cautious

Federal Reserve will likely keep values elevated, Aama added.

"All these factors push you into U.S. stocks and it's unclear

what was the hair that broke the camel's back that made us break

through this S&P level, he said. "But for now, it looks like we

have a few more points to go."

Economic news: With few prominent earnings on tap for Wednesday,

attention is turning to Federal Reserve news: the Beige Book survey

of current economic conditions is due at 2 p.m. Michael Hewson,

chief market analyst at CMC Markets, said the report could

reinforce the view that the U.S. economy is doing well and "in so

doing start to shift the dial in terms of the timing of a potential

U.S. rate rise."

"While a July and September rate rise would seem out of the

question given current global concerns a decent survey won't deter

some Fed members from rattling the prospect of a rise in rates,

even if they know they won't be able to deliver one," he said in a

note.

On Tuesday, St. Louis Fed President James Bullard reiterated his

view of only one rate increase until 2018, and Minneapolis Fed

President Neel Kashkari said there's "not a huge urgency to raise

rates because inflation is coming up low."

On Wednesday, Dallas Fed President Rob Kaplan is due to appear

at 9 a.m. Eastern Time at an event run by the World Affairs Council

of Greater Houston.

At 6 p.m. Eastern, Philadelphia Fed President Harker will give a

speech on the economic outlook at the 2016 World Class Summit in

Philadelphia.

In other economic news on Wednesday, U.S. import prices climbed

0.2% in June. Investors are also looking ahead to the Federal

budget for the same month, which is due at 2 p.m.

Movers and shakers: Shares of Juno Therapeutics Inc.(JUNO)

rallied 28% ahead of the bell after the drugmaker late Tuesday said

it would resume a drug trial

(http://www.marketwatch.com/story/juno-shares-jump-after-clinical-trial-of-cancer-treatment-resumed-2016-07-12)

of a potential leukemia treatment. The trial had been placed on

clinical hold last week following two patient deaths.

SemiLEDS Corp.(LEDS) tanked 17% premarket after the LED chips

maker late Tuesday said third-quarter revenue slumped 18% and that

is loss widened to $3.3 million.

Amazon.com Inc.(AMZN) could be active after Benchmark lifted the

price target on the stock to $915 from $750.

After the market closes, Yum! Brands Inc.(YUM) is slated to

report earnings

(http://www.marketwatch.com/story/what-to-expect-from-yum-brands-earnings-2016-07-12).

Other markets: Asian stocks closed mostly higher, but were off

intraday highs after the Japanese government denied it would use

"helicopter money"

(http://www.marketwatch.com/story/asian-markets-gain-but-off-highs-after-japan-says-no-helicopter-money-coming-2016-07-13)

to boost the economy.

Europe's main stock benchmark rose for a fifth straight session

(http://www.marketwatch.com/story/european-stocks-aiming-higher-for-a-fifth-consecutive-session-2016-07-13),

getting closer to erasing its entire post-Brexit loss.

Oil prices slumped

(http://www.marketwatch.com/story/crude-prices-back-off-ahead-of-possible-supply-rise-2016-07-13),

while gold inched higher. The dollar was down against

(http://www.marketwatch.com/story/dollar-slips-after-japan-rules-out-helicopter-money-2016-07-13)

other major currencies.

(END) Dow Jones Newswires

July 13, 2016 09:13 ET (13:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

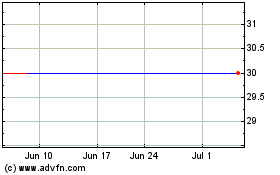

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

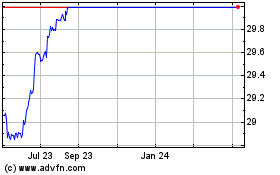

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024