By Joseph Adinolfi and Sara Sjolin, MarketWatch

Juniper Networks falls 9% in late-morning trade

U.S. stocks rose to fresh session highs Tuesday as gains in oil

prices boosted energy shares.

The Dow Jones Industrial Average rose 124 points, or 0.7% to

17,683.

The S&P 500 index was up 12 points, or 0.6%, at 2,054, after

briefly dipping into the red. Gains in the broad-market index were

led by a 2.3% rise in energy stocks and a 0.9% rise in health

care.

Paul Nolte, a portfolio manager at Kingsview Asset Management,

attributed the weakness in tech shares to Juniper Networks(JNPR)

saying its results for the quarter ended in March would disappoint.

(http://www.marketwatch.com/story/juniper-networks-cuts-guidance-for-march-quarter-2016-04-11-17485374)The

company's shares were down 9.2% in recent trade.

Cisco Systems Inc. (CSCO), which competes directly with Juniper,

was the worst-performer among the blue-chip gauge's components.

"Certainly Juniper isn't one of the big leaders [in tech] but

it's dragged a few of them down," Nolte said.

The tech-heavy Nasdaq Composite Index was up 15.50 points, or

0.1%, to 4,849.20 after briefly turning red.

All three benchmarks fell on Monday,

(http://www.marketwatch.com/story/stock-futures-rise-as-dollar-steadies-investors-wait-for-alcoa-2016-04-11)

erasing early gains in afternoon trade as investors braced for the

start of what's expected to be an ugly earnings season. The

declines came ahead of the closely watched first-quarter earnings

report from Alcoa(AA), which posted a 92% drop

(http://www.marketwatch.com/story/alcoa-hurt-by-weak-aluminum-prices-2016-04-11-174853616)

in profit and lowered its 2016 outlook for the aerospace market.

Its shares were down 4.6% Tuesday.

Alcoa's weak showing sowed the seeds of worry that more earnings

weakness could be ahead. Many expect financial-sector earnings to

be particularly weak as banks are squeezed by the fallout from low

oil prices and low interest rates

(http://www.marketwatch.com/story/heres-why-banks-are-the-black-sheep-of-this-earnings-season-2016-04-11).

What to watch: S&P 500 earnings for the first quarter are

forecast to slide 8.3% year-over-year, S&P Global Market

Intelligence said in a report. That would mark a third quarterly

decline in a row, it said.

"Such a steep decline in growth hasn't been recorded since Q2

2009," the report said.

Only three of the 10 S&P sectors are projected to see a rise

in earnings, with the consumer discretionary, telecommunications

and health care sectors leading for the fourth quarter in a row,

S&P said.

Analysts are expecting J.P. Morgan Chase & Co. to report its

first year-over-year earnings decline

(http://www.marketwatch.com/story/what-to-expect-from-jp-morgan-chase-earnings-2016-04-11)

in five quarters ahead of the bell on Wednesday.

Read:Here's why banks are the black sheep of this earnings

season

(http://www.marketwatch.com/story/heres-why-banks-are-the-black-sheep-of-this-earnings-season-2016-04-11)

The pace of earnings releases continues to ramp up on Tuesday,

with transportation company CSX Corp. (CSX) slated to post results

after the bell.

Oil rally: After a wobbly start to the day, oil futures traded

higher on Tuesday on hopes that key oil producers will agree on an

output freeze at their meeting this Sunday.

U.S.-traded crude oil

(http://www.marketwatch.com/story/oil-prices-dip-as-investors-cash-in-on-overnight-surge-2016-04-12)

and Brent crude , the global benchmark, rose, helping lift shares

of energy-related companies, with Transocean Ltd. (RIG), Chesapeake

Energy Corp. (CHK) and Anadarko Petroleum Corp. (APC) rising in

early trade.

Data and Fed speakers: Philadelphia Fed President Patrick Harker

told the Greater Philadelphia Chamber of Commerce that it makes

sense to delay another interest rate increase

(http://www.marketwatch.com/story/feds-harker-backs-delaying-another-interest-rate-hike-until-inflation-picks-up-2016-04-12)

until inflation picks ups. Harker isn't a voting member of the

Fed's policy-setting committee this year.

A weaker dollar and higher oil prices helped drive U.S. import

prices higher in March. Data about the federal budget is expected

at 2 p.m. Eastern.

The NFIB small-business index slipped to a two-year low in March

(http://www.marketwatch.com/story/small-business-sentiment-falls-to-two-year-low-nfib-says-2016-04-12).

San Francisco Fed President John Williams, also a nonvoter, will

speak in San Francisco at 3 p.m. Eastern.

Finally, Richmond Fed President Jeffrey Lacker, another

non-voter, will speak about "economic leadership in an uncertain

world" at the University of North Carolina at Wilmington at 4 p.m.

Eastern.

Movers and shakers: Wholesale distributor Fastenal Co.(FAST)

reported its profit was 1.1% lower in the first quarter of the year

amid weakness in its core business of making fasteners. Its shares

slumped 3.2%.

Perry Ellis International Inc. (PERY) shares rose 1.1% after the

company said its margins benefited from its domestic menswear

business

(http://www.marketwatch.com/story/perry-ellis-narrows-loss-as-margins-expand-2016-04-12).

Shares of Marathon Oil Corp.(MRO) rose 7% after the oil

production company said late Monday that it plans to sell $950

million worth of assets

(http://www.marketwatch.com/story/marathon-plans-950-million-asset-sale-2016-04-11),

and vowed to focus on lower-risk U.S. resources to protect its

balance sheet against the oil price slump.

Hertz Global Holdings Inc. (HTZ) shares slumped 2.5% after the

car rental company late Monday cut its 2016 outlook on U.S. car

rental revenue

(http://www.marketwatch.com/story/hertz-cuts-2016-outlook-on-us-car-rental-revenue-2016-04-11-84852736).

Other markets: Asia markets closed mostly higher

(http://www.marketwatch.com/story/nikkei-lifted-by-weaker-yen-as-shanghai-stocks-slip-2016-04-12),

with Japan's Nikkei 225 index getting a boost from a weaker yen

(http://www.marketwatch.com/story/dollar-rises-after-japans-finance-minister-fires-a-warning-shot-over-yen-2016-04-12).

The dollar edged higher against its main rivals

(http://www.marketwatch.com/story/dollar-rises-after-japans-finance-minister-fires-a-warning-shot-over-yen-2016-04-12).

Gold prices were about 0.2% in late-morning trade as stocks

climbed.

Stocks across European main benchmarks

(http://www.marketwatch.com/story/european-stocks-choppy-as-italian-banks-rise-luxury-shares-pull-back-2016-04-12)

were mostly mixed, with Stoxx Europe 600 Index up 0.2% as gains

were capped by losses in luxury companies.

(END) Dow Jones Newswires

April 12, 2016 11:21 ET (15:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

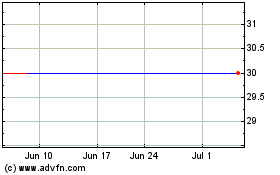

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

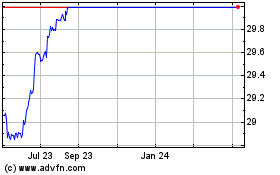

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024