Yen Retreats Amid BoJ Intervention Rumors

February 11 2016 - 4:19AM

RTTF2

The Japanese yen pulled away from its early highs against its

key counterparts in European deals on Thursday, amid rumors about

the Bank of Japan intervening in the forex market to curb sharp

gains in the currency.

The BoJ is said to have sold-off the yen, as officials are

overly concerned about a high valued currency that poses threat to

growth and raises the fear of deflationary pressures in the

economy.

The yen fell to 113.15 against the greenback, 127.97 against the

euro, 115.94 against the franc and 163.13 against the pound, from

its early more than 1-year high of 110.97, 2-1/2-year high of

125.78, 13-month high of 114.47 and more than 2-year high of

159.81, respectively.

The yen reversed from its early 3-1/2-year high of 77.59 against

the aussie, 8-month high of 73.20 against the kiwi and more than

3-week high of 79.27 against the loonie, edging down to 79.92,

75.35 and 81.03, respectively.

The yen is likely to find support around 116.00 against the

greenback, 129.00 against the euro, 117.00 against the franc,

165.00 against the pound, 81.00 against the aussie, 77.00 against

the kiwi and 82.00 against the loonie.

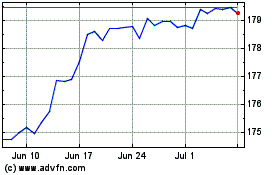

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Aug 2024 to Sep 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Sep 2023 to Sep 2024