Yen Falls Amid Risk Appetite

March 31 2015 - 1:35AM

RTTF2

The Japanese yen weakened against the other major currencies in

the Asian session on Tuesday amid risk appetite nurtured by the

overnight gains on Wall Street and optimism concerning Chinese

growth, as the nation took steps to bolster its struggling real

estate market.

China on Monday relaxed rules on downpayment requirements and

housing tax for home buyers, as policymakers try to revive momentum

in the slowing property market that poses risks to overall economic

growth.

Monday, the yen showed mixed trading against its major rivals.

While the yen fell against the Swiss franc and the U.S. dollar, it

held steady against the euro and the pound.

In the Asian trading today, the yen fell to nearly a 2-week low

of 120.35 against the U.S. dollar and a 4-day low of 130.25 against

the euro, from yesterday's closing quotes of 120.05 and 130.03,

respectively. If the yen extends its downtrend, it is likely to

find support around 121.80 against the greenback and 134.12 against

the euro.

The yen, which ended yesterday's deals at 177.81 against the

pound and 124.08 against the Swiss franc, depreciated to 178.06 and

124.35, respectively. The yen may test support near 181.30 against

the pound and 127.00 against the franc.

Against the Australia, the New Zealand and the Canadian dollars,

the yen slipped to 92.06, 90.25 and 94.82 from yesterday's closing

quotes of 91.88, 89.98 and 94.69, respectively. On the downside,

93.50 against the aussie, 91.90 against the kiwi and 96.20 against

the loonie are seen as the next support level for the yen.

Looking ahead, the German retail sales data for February is due

at 2:00 am ET.

In the European session, German unemployment rate for February,

final U.K. fourth-quarter GDP data , U.K. index of services for

January, Eurozone unemployment rate for February and CPI for March

are slated for release.

In the New York session, Canada GDP for January, U.S. S&P

Case Shiller home price index for January, Chicago PMI for March

and U.S. consumer confidence index for March are set to be

published.

At 7:55 am ET, U.S. Federal Reserve Bank of Richmond President

Jeffrey Lacker is expected to speak on Economic outlook in

Richmond.

Danièle Nouy, Chair of the ECB Supervisory Board, will deliver a

speech before the European Parliament's Committee on Economic and

Monetary Affairs on Brussels at 9:00 am ET. At the same time, U.S.

Federal Reserve Bank of Cleveland President Loretta Mester

moderates a policy session at a conference in Stone Mountain,

Georgia.

At 3:00 pm ET, U.S. Federal Reserve Bank of Kansas City

President Esther George is expected to speak on the U.S. economy in

New York.

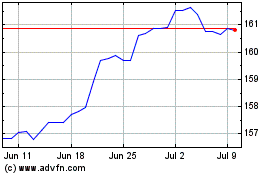

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024