U.S. Dollar Extends Gain Ahead Of Consumer Price Inflation Data

April 14 2016 - 1:44AM

RTTF2

The U.S. dollar continued to be higher against its most major

rivals in early European deals on Thursday, as traders await U.S.

consumer price inflation later in the day, to gauge more clues

regarding the timing of Fed's next rate hike.

Data from the Labor Department is expected to show that the US

consumer price index gained 0.2 percent on month in March following

a 2 percent drop in February.

Core inflation, excluding food and energy, may have risen to 0.2

percent, compared to 0.3 percent increase a month earlier.

Separate data from the same agency may show that the first-time

claims for unemployment benefits may have fallen to 270,000, barely

unchanged from 267,000 claims registered a week earlier.

Speeches from Richmond Fed President Jeffrey Lacker, San

Francisco Fed President John Williams and Philadelphia Fed

President Patrick Harker early this week indicated the possibility

of several hikes this year.

European stocks are mostly lower, amid a sell-off in oil and as

earnings season kicked off.

The greenback has been trading in a positive territory in Asian

deals.

The greenback firmed to a 6-day high of 1.4090 against the

pound, more than 2-week highs of 0.9687 against the franc and

1.1234 against the euro, from its early lows of 1.4207, 0.9661 and

1.1284, respectively. If the greenback extends rise, it may find

resistance around 1.39 against the pound, 0.98 against the franc

and 1.11 against the euro.

The greenback advanced to a 2-day high of 1.2897 against the

loonie and a 3-day high of 0.6824 against the kiwi, off its

previous lows of 1.2808 and 0.6920, respectively. On the upside,

the greenback may target resistance around 1.30 against the loonie

and 0.665 against the kiwi.

On the flip side, the greenback eased against the yen with the

pair trading at 109.17, off its early weekly high of 109.55. The

pair was worth 109.33 when it ended Wednesday's trading.

Looking ahead, at 7:00 am ET, the Bank of England announces

decision on monetary policy. The bank is forecast to hold rates at

0.50 percent and asset purchase target at GBP 375 billion.

At 10 am ET, the Atlanta Fed's Dennis Lockhart will speak in

Chicago, while Fed Governor Jerome Powell will be testifying before

the Senate Banking Subcommittee in Washington at the same time.

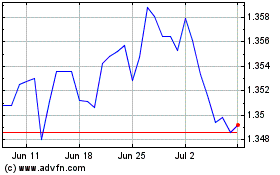

US Dollar vs SGD (FX:USDSGD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs SGD (FX:USDSGD)

Forex Chart

From Apr 2023 to Apr 2024