Tyco International Files 8K - Other Events

May 31 2016 - 4:38PM

Dow Jones News

Tyco International PLC (TYC) filed a Form 8K - Other Events -

with the U.S Securities and Exchange Commission on May 31,

2016.

As previously reported, Tyco International plc (the "Company"),

as Audit Managing Party under each Tax Sharing Agreement dated

September 25, 2007 (among the Company, TE Connectivity Ltd. and

Covidien plc (which on January 26, 2015 was acquired by and now

operates as a subsidiary of Medtronic plc) and dated September 28,

2012 (among the Company, The ADT Corporation and Pentair Ltd.

(along with TE Connectivity and Covidien, the "Parties")), entered

into Stipulations of Settled Issues with the Internal Revenue

Service (the "IRS") intended to resolve all Federal tax disputes

related to the previously disclosed intercompany debt issues for

the Company's 1997 - 2000 audit cycle before the U.S. Tax Court.

The Stipulations of Settled Issues were contingent upon the IRS

Appeals Division applying the same settlement terms to all

intercompany debt issues on appeal for subsequent audit cycles

(2001 - 2007). On May 17, 2016 the IRS Office of Appeals issued

fully-executed Forms 870-AD that effectively settle the matters on

appeal on the same terms as those set forth in the Stipulations of

Settled Issues, and on May 31, 2016, the U.S. Tax Court entered

decisions consistent with the Stipulations of Settled Issues. As a

result, all aspects of this controversy that were before the U.S.

Tax Court and Appeals Division of the IRS have been finally

resolved for audit cycles 1997 - 2007. During the second quarter of

fiscal 2016, the Company paid $120 million to TE Connectivity Ltd.

and $2 million to Covidien, representing its share of the total

amount payable to the IRS in connection with this matter. The

Company does not expect to recognize any additional charges related

to this matter, as the Company had previously recorded sufficient

reserves with respect to this controversy and its obligations under

the Tax Sharing Agreements.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000083344416000181/form8-k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000083344416000181/0000833444-16-000181-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

May 31, 2016 16:23 ET (20:23 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

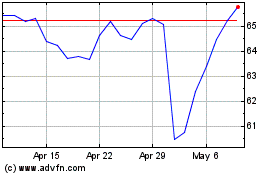

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

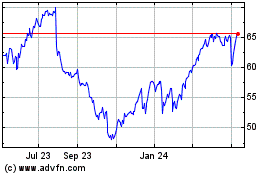

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024