Two More Caesars Bondholder Lawsuits Must Go to Trial

January 06 2016 - 3:30PM

Dow Jones News

A federal judge has dealt another blow to bondholders suing

Caesars Entertainment Corp. over deals involving its bankrupt

operating unit, refusing to decide an important issue in two

lawsuits without a trial.

At stake in the dispute is whether Caesars remains on the hook

for guarantees of billions of dollars of its operating unit's debt,

as the bondholders argue, or whether a series of deals effectively

erased those guarantees, as Caesars argues.

Judge Shira A. Scheindlin of the U.S. District Court in

Manhattan explained her decision in a ruling on Tuesday, saying

that "because I have now concluded that there is a disputed issue

of fact with respect to whether [Caesars' bankrupt unit] continued

to be a wholly owned subsidiary of [Caesars]…plaintiffs cannot

prevail here."

The decision ends the bondholders' hope of an immediate decision

from Judge Scheindlin on key claims but doesn't exclude the

possibility that a decision at the end of trial will be in their

favor. On the other hand, a bankruptcy judge could rule to prevent

Caesars from having to go to trial while its operating unit's

chapter 11 case is pending.

The ruling, which applies to two lawsuits, comes on the heels of

Judge Scheindlin's decision to deny a similar bid in other lawsuits

brought by another group of bondholders, including MeehanCombs

Global Credit Opportunities Master Fund LP, and a class-action

lawsuit led by bondholder Frederick Barton Danner.

The two lawsuits were brought by bondholder trustees BOKF and

UMB Bank and concern whether Caesars is responsible for roughly $7

billion in junior and senior bonds issued by its bankruptcy

unit.

Ahead of the unit's bankruptcy filing last January, Caesars

engineered several transactions that moved assets between it and

the unit, the legality of which has been questioned.

Neither a spokesman for Caesars nor lawyers for BOKF and UMB

immediately responded to requests for comment on Wednesday.

Caesars has been scrambling to hold off these pretrial decisions

by Judge Scheindlin while it continues to argue in Chicago courts

that the shield protecting its bankrupt unit from these lawsuits

should apply to it as well, even though it isn't under bankruptcy

protection.

Caesars has lost twice in efforts to get Chicago judges to bar

bondholders from continuing the barrage of litigation. On Dec. 23,

however, a federal appeals court asked the bankruptcy judge to take

another look at the question of whether Caesars deserves the

litigation shield.

Previously, Caesars has said losses in the New York bondholder

suits could jeopardize its ability to make a significant

contribution to the reorganization of its operating unit and could

force it to join its unit in bankruptcy.

Peg Brickley contributed to this article.

Write to Stephanie Gleason at stephanie.gleason@wsj.com

(END) Dow Jones Newswires

January 06, 2016 15:15 ET (20:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

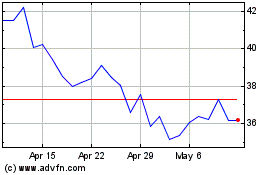

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

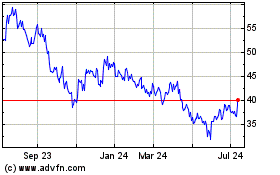

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024