By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

A new trade battleground is forming and it's in the laundry

room. Whirlpool Corp. is asking the U.S. International Trade

Commission to support tough new actions to stave off what the

washing machine maker says is unfair competition from South Korea.

Moves to back Whirlpool would push the increasingly aggressive U.S.

trade stance into new and strongly protectionist territory, the

WSJ's Andrew Tangel writes, by reviving a long-dormant measure that

requires only that a U.S. industry has suffered "serious injury"

from foreign competition. Whirlpool says it's getting dinged by

South Korea's Samsung Electronics Co. and LG Electronics Inc.,

which have made inroads in the U.S. in recent years with their

sleek appliance designs. Whirlpool has won some regulatory

skirmishes with the South Korean producers, but its push for

stronger actions are putting the manufacturer at the center of a

larger tug-of-war in Washington between free-trade skeptics and

those who argue the competition from abroad builds a market that's

more efficient and affordable for consumers.

While the appliance makers battle over potential tariffs, the

U.S. and South Korea are moving toward changing their trade

agreement. The countries' top trade officials agreed in a meeting

in Washington to amend the U.S.-Korea pact known as Korus, the

WSJ's William Mauldin and Kwanwoo Jun report, although there was no

suggestion of what parts of the deal they want to address. Business

groups that back the free trade agreement are likely to be

reassured by the relative calm of this week's meeting, which came

after sharp criticism of the deal a few weeks ago from President

Donald Trump. The Trump administration recently considered taking

steps to exit from the trade pact, but those deliberations

coincided with North Korean missile tests. And unlike the barbs

that have marked the talks around the North American Free Trade

Agreement, the countries in this case are aiming to change the deal

rather than start from scratch with a complete renegotiation.

Sears is barely hanging on in Canada, caught between lenders who

want to liquidate the retailer and managers who want to keep a

slimmed-down version of the business open. Sears Canada Inc.'s top

executive is making a last-ditch effort to patch together financing

to buy the business, the WSJ's Andrew Scurria and Jacquie McNish

report, while creditors want to sell off the assets and quickly get

what they can. They're rushing to get Sears' fate settled before

the Christmas selling season, when the inventory will lose its

value as the holidays near. The battle marks a grim finale for the

Canadian edition of the iconic retailer, and the latest result of

the dramatic change in the retail landscape triggered by online

sales. A decision on Sears Canada Executive Chairman Brandon

Stranzl's buyout bid could come this week. Among the pieces

potentially up for grabs: the company's S.L.H. Transport Inc.

logistics business.

ECONOMY & TRADE

The U.S. is becoming an export powerhouse in an unlikely

arena.U.S. crude oil exports surged to 1.984 million barrels a day

last week, the WSJ's Alison Sider reports, busting by nearly

500,000 barrels a day a record that had been set only the week

before. The crude export rate is approaching a level that is almost

as much as Kuwait sends abroad and the latest sign that the U.S. is

remaking the global oil distribution map as it resets its own

domestic energy production. The U.S. is still an oil importer. But

net imports of crude fell to a record low last week, and analysts

at Citigroup said almost all of the imported crude last week was

from Canada, writing that the data was "a harbinger of a more

sustainable trend to come." The U.S. is gaining sales because the

crude is cheaper than oil from other markets, and the revenue may

help draw investment for even more exporting capacity.

Apparently not satisfied with cornering the market in various

retail sectors Amazon.com Inc. is also looking to lock up the top

business talent. The Seattle-based retail giant is now the No. 1

recruiter at some of the top business schools in the country, the

WSJ's Kelsey Gee writes, and the biggest internship destination at

prestigious schools including the Massachusetts Institute of

Technology, Dartmouth College and the University of Chicago Booth

School of Business. Amazon's aggressive approach is drawing a big

following, upending campus recruiting and blocking other companies

that rely on B-school hires. It's a familiar pattern in other areas

such as logistics, where Amazon has scaled up quickly by luring

large numbers of executives that have helped build a sprawling

fulfillment network. At business schools, Amazon is outpacing

traditional big recruiters like Bain & Co. or McKinsey &

Co. -- consultants that typically hire hundreds of graduates a year

to help companies figure out how to respond to tough market

competition.

QUOTABLE

IN OTHER NEWS

European antitrust regulators ordered Luxembourg to recoup $294

million from Amazon in allegedly unpaid taxes. (WSJ)

Duke Realty Corp. is buying logistics properties from Bridge

Development Partners LLC as the company shifts its focus from

office buildings. (WSJ)

Private employers in the U.S. added a less-than-expected 135,000

jobs in September. (WSJ)

A measure of service-sector activity across the U.S. rose in

September to a 12-year high. (WSJ)

Retail sales declined across the euro area for the second

straight month in August. (WSJ)

Monsanto Co. says new strains of seeds helped swing the company

to a $20 million net profit in its latest quarter. (WSJ)

Foxconn Technology Group named the Mount Pleasant, Wis., as the

site of its new display screen factory. (Associated Press)

Vietnam is trying to help garment exporters cut labor and

logistics costs after seeing demand for products waver. (Sourcing

Journal)

South Dakota is petitioning the U.S. Supreme Court to reconsider

a 25-year-old ruling restricting states' ability to tax remote

retailers. (Bloomberg)

French supermarket chain Leclerc says Amazon has approached the

company about a potential logistics partnership. (Reuters)

Wal-Mart Stores Inc. is boosting its investment in a new

distribution center in Mexico's Yucatan region. (Yucatan Times)

Chicago is considering a plan setting health, fair labor and

environmental standards for city food purchases. (WTTW)

Google will work with Rolls-Royce Holdings PLC on technology for

autonomous ships. (Port Technology)

Global airfreight traffic rose 12.1% in August, far ahead of a

4.7% gain in capacity. (Air Cargo News)

Workers at Royal Mail voted to authorize a strike in a dispute

over pensions and pay. (BBC)

Deutsche Post is testing use of a small robot that would

accompany mail delivery workers. (Stat Trade Times)

Industrial supplier Carlisle Companies Inc. is buying Accella

Performance Materials for $670 million. (Industrial

Distribution)

San Diego will allow cultivation of marijuana so products don't

have to be trucked to the city. (Los Angeles Times)

A Georgia town is offering to create a city called Amazon to

attract the e-commerce company's second headquarters. (Atlanta

Journal-Constitution)

Missouri is funding a study on use of Hyperloop transport to

move across the state in 25 minutes. (New Atlas)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 05, 2017 06:42 ET (10:42 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

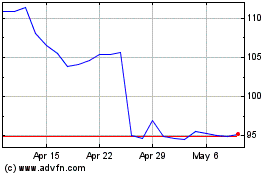

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

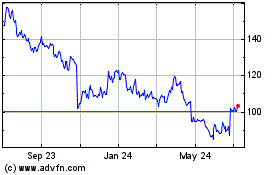

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024