Standard LifeInvProp Debt Refinancing

April 28 2016 - 2:00AM

UK Regulatory

TIDMSLI

To: RNS

From: Standard Life Investments Property Income Trust Limited

Date: 28 April 2016

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED

Debt Refinancing

Standard Life Investments Property Income Trust Limited (the "Company")

announces that Standard Life Investments Property Holdings Limited (the

"Property Subsidiary"), a wholly owned subsidiary of the Company, and various

subsidiaries of Standard Life Investments Property Holdings Limited (the

"Group") has entered into an agreement to extend GBP145 million of its existing GBP

155 million debt facility with The Royal Bank of Scotland plc ("RBS"). The

debt facility consists of a GBP110 million 7 year term loan facility (the "Term

Loan") and a GBP35 million 5 year revolving credit facility (the "Revolving

Credit Facility"). The Revolving Credit Facility may by agreement be extended

by one year on two occasions. GBP145 million has been drawn down by the Group

and its loan to value currently stands at approximately 29.5 per cent. which is

in line with the Board's stated target level of between 25 per cent. and 35 per

cent. loan to value. The interest cover for the Group is now approximately 780%

per cent.

Interest is payable on the Term Loan at LIBOR plus 1.375% and on the Revolving

Credit Facility at LIBOR plus 1.2%. This equates to a rate of 2.725% on the

Term Loan (including an interest rate swap entered into between the Property

Subsidiary and The Royal Bank of Scotland plc) and 1.78% on the Revolving

Credit Facility (based on LIBOR of 0.58% as at 27 April 2016) which together

give an attractive current blended rate of 2.5% (based on the Revolving Credit

Facility being fully drawn)

The loan is secured over the Group's existing property portfolio including new

security over the majority of the 22 properties acquired in December 2015.

The restated facility agreement includes terms that are typical for a facility

of this nature, including loan to value (a maximum of 60% for the first five

years and 55% thereafter) and interest cover ratio covenants (not less than

175% for the term of the facility) and the ability to substitute properties in

the security pool.

The Revolving Credit Facility is to be available for general purposes and may

be utilised to fund the acquisition of new assets by the Group. The Revolving

Credit Facility will allow aggregate debt to be increased or decreased

depending on the Investment Manager's view of the property market and ongoing

cash levels within the Group. It will also provide the Investment Manager with

additional finance that can be utilised in a quick and efficient manner should

acquisition or asset management opportunities arise.

The Group has also terminated its existing interest rate hedging arrangements

entered into in connection with the its previous facility arrangements and

terminated and replaced its existing interest rate hedging arrangements with

RBS. The cost of terminating these hedge positions was GBP2,735,000, all of which

was fully reflected in the 31 December 2015 NAV.

For further information please contact:

Jason Baggaley Standard Life Investments

Tel: 0131 245 2833

END

(END) Dow Jones Newswires

April 28, 2016 02:00 ET (06:00 GMT)

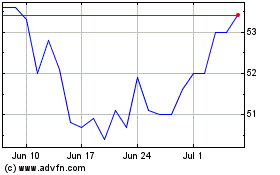

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024