Specialty Drugs Force High Medicare Out-Of-Pocket Costs

March 01 2010 - 7:52PM

Dow Jones News

Specialty prescription drugs are taking a big bite out of

seniors' wallets, according to the Government Accountability

Office.

A report issued by the GAO states that high-cost

drugs--classified as drugs with a monthly cost of at least $500--in

recent years have imposed far higher out-of-pocket costs for

seniors on Medicare who used them than for those who didn't. The

report focused on a class of drugs known as "specialty-tier," which

tend to be the most expensive drugs on the market.

The drugs are designated by private prescription-drug plans that

participate in the Medicare Part D program. Because of a "doughnut

hole" in Part D coverage, which forces seniors to pay the entire

cost for prescription drugs within a certain cost range, the price

of the specialty-tier drugs can weigh heavily on Part D

enrollees.

The gap in coverage under which enrollees have to pay the full

price of drugs takes effect between the cost range of $2,700 and

$6,154 per year. Above $6,154 in drug costs, Medicare pays the

majority of the cost of purchasing drugs, which is considered

catastrophic coverage.

According to the GAO, seniors using specialty-tier drugs reached

the catastrophic-coverage threshold 55% of the time, while those

who did not reached the threshold only 8% of the time. According to

report, some drug plans said that the high costs came in part

because Centers for Medicare and Medicaid Services limited their

ability to exclude drugs from their plans in favor of

less-expensive competing drugs.

Examples of specialty-tier drugs cited by GAO included Enbrel,

which is manufactured by Pfizer Inc. (PFE) for the treatment of

rheumatoid arthritis, and Gleevec, which is manufactured by

Novartis AG (NVS) for treatment of leukemia.

Rep. Pete Stark (D., Calif.), who heads the House Ways and Means

Health Subcommittee, said in a statement that "the best way to

reduce out-of-pocket drug costs is to provide coverage through the

doughnut hole, so that seniors aren't ever paying 100 percent of

their drug costs." Democrats have pushed to close the doughnut hole

as part of health-care overhaul legislation.

The Pharmaceutical Care Management Association, a trade group

that represents pharmacy benefit managers, said the report shows a

need to allow more generic versions of biologic drugs to come on to

the market. The group's members include companies such as Medco

Health Solutions Inc. (MHS) and CVS Caremark Corp (CVS).

"Generic competition lowers costs because it gives patients the

power to choose and gives manufacturers an incentive to reduce

prices," the group said in a statement.

-By Patrick Yoest, Dow Jones Newswires; 202-862-3554;

patrick.yoest@dowjones.com

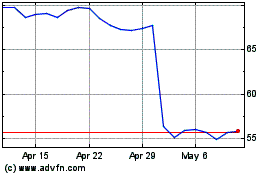

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

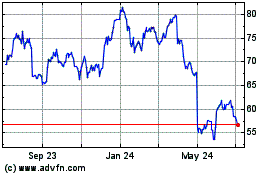

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024