Spanish Bank BBVA Posts Drop in Profit but Beats Analysts' Forecasts

July 29 2016 - 3:30AM

Dow Jones News

MADRID—Banco Bilbao Vizcaya Argentaria SA said Friday that net

profit fell in the second quarter from a year earlier, but it still

beat analysts' estimates on slightly better-than-expected lending

income.

BBVA, Spain's No. 2 bank by market value, said net profit

dropped 8.2% to €1.12 billion ($1.24 billion) in the second quarter

from €1.22 billion a year earlier.

Analysts had expected that a onetime contribution to a European

Union fund—aimed at ending bank bailouts by taxpayers as well as

currency volatility—would lead BBVA to report a net profit of €932

million ($1.03 billion) in the second quarter, according to a poll

by data provider FactSet.

The bank booked dividends from Spanish telecommunications giant

Telefó nica SA and China Citic Bank Corp in the second

quarter.

BBVA, run by Executive Chairman Francisco Gonzalez, said net

interest income in the second quarter was €4.2 billion, compared

with €3.86 billion a year earlier. That was better than the €4.17

billion analysts had expected.

Net interest income, a key profit driver for retail banks, is

the difference between what lenders pay clients for deposits and

charge for loans.

BBVA reported a capital ratio in the second quarter of 10.71%

under international regulations known as "fully loaded" Basel III

criteria, a slight increase from the 10.54% the bank reported in

the first quarter. The bank said it was on track to reach a target

of 11% in 2017.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

July 29, 2016 03:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

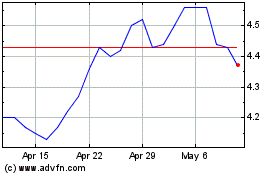

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

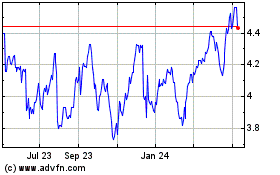

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024