Singapore Exchange in Exclusive Talks to Buy Baltic Exchange

May 25 2016 - 7:30AM

Dow Jones News

SINGAPORE—Singapore's stock exchange, Singapore Exchange Ltd.,

said Wednesday that it has entered into exclusive talks to buy the

Baltic Stock Exchange Ltd., a deal that could put the nearly

300-year-old London exchange under new ownership.

SGX said it and the Baltic Exchange would meet with Baltic

Exchange shareholders over several weeks to explain and discuss the

offer.

"The period of exclusivity will start from Wednesday and expire

on June. 30," SGX said in a news release. But it emphasized that

there was no certainty a deal would happen.

Baltic Exchange Ltd., a 272-year-old shipping marketplace

credited with helping expand British trade during the country's

imperial heyday, had attracted a handful of potential suitors

interested in its globally traded shipping contracts and indexes.

Apart from SGX, Platts, a division of S&P Global Inc., and CME

Group Inc., the operator of the Chicago Mercantile Exchange, were

among the parties interested, people familiar with the matter said

earlier.

The Baltic exchange in February confirmed that it had received

"a number of exploratory approaches and that it [was] in

confidential discussions with selected third parties regarding its

future strategy and ownership."

The Baltic exchange is tiny compared with some other exchanges

considering mergers. Bids were expected to range between $100

million and $120 million, people familiar with the matter said. By

comparison, London Stock Exchange Group PLC and Deutsche Bö rse AG

are in talks to merge in a deal that could create a combined

company with a value of about $30 billion.

In its statement Wednesday, SGX said the proposed transaction

would bring together complementary strengths of Singapore and

London, two of the world's most important maritime hubs.

SGX proposals include keeping the Baltic Exchange's headquarters

in St. Mary Axe in London and maintaining existing market benchmark

production and governance models.

Both SGX and the Baltic Exchange would also benefit from new

growth opportunities, including potential new shipping benchmarks

and clearing solutions that meet the market's evolving needs for

data and trading, SGX said.

The deal would significantly boost the Singapore exchange's

derivatives business and further advance its ambitions of becoming

a global maritime financial center. It is also the first big

acquisition attempt by Singapore Exchange since its unsuccessful,

US$8 billion bid for Australian bourse operator ASX Ltd. in

2011.

Write to P.R. Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

May 25, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

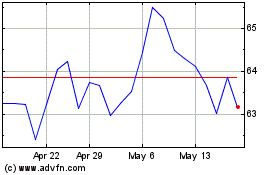

ASX (ASX:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

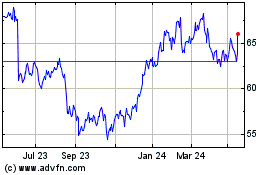

ASX (ASX:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024