Roche Unfazed by Trump's Drug-Price Comments as Profit Rises -- 3rd Update

February 01 2017 - 8:02AM

Dow Jones News

By Denise Roland

BASEL, Switzerland-- Roche Holding AG Chief Executive Severin

Schwan shrugged off President Donald Trump's criticism of drug

prices Wednesday, saying he remained optimistic about the U.S.

market.

Mr. Schwan said the conditions in the U.S., which typically pays

more for medicines than other countries, were unlikely to shift

under the new administration, despite Mr. Trump's comments to a

group of drug company bosses Tuesday that "we have to get the

prices way down."

One reason for Mr. Schwan's confidence, he said, was the

fundamental belief in the U.S.--where Roche generates nearly half

of its total pharmaceuticals revenue--that it would be unacceptable

to block access to an innovative drug on the basis of price.

He said those "good overall conditions" had made the U.S. one of

the biggest beneficiaries of investment by the pharmaceutical

industry. He said Roche invested "over-proportionally" in the U.S.,

where it employs more than 25,000 people, in part through its

California-based Genentech division.

Mr. Schwan has also long argued that Roche is less exposed to

pricing pressure than some other companies because its drugs aren't

easily substitutable with those from rivals. "If you have true

innovation, with true added value, the U.S. will be the first

country to honor that innovation," he said.

His praise of the U.S. market stands in sharp contrast with the

criticism he reserves for the U.K. and some other European markets,

where government-run health systems routinely exclude innovative

medicines if they aren't considered cost-effective.

Mr. Schwan's comments came as Roche posted an upbeat set of

full-year results, as several of its top-selling drugs continued to

prosper in the absence of cheaper competitors.

Net profit rose 8% from a year earlier to 9.6 billion Swiss

francs ($9.7 billion), while revenue increased 5% to 50.6 billion

francs, with both measures missing analyst expectations. Core

operating profit--a measure that strips out certain items such as

impairments, tax and financing costs--rose 5% to 18.4 billion Swiss

francs.

Basel, Switzerland-based Roche has to date suffered less than

its pharmaceutical peers from the launch of cheap copycats to its

drugs, in part because its biggest medicines are manufactured with

living cells rather than by chemical processes, making them more

complex to imitate.

By contrast, its cross-town rival Novartis AG last week reported

flat revenue for 2016 as it battled falling sales of cancer

medicine Gleevec, which since last year has faced competition from

low-cost generic copies.

Still, Roche's strong position is likely to shift later this

year, when cheaper copycats of two of Roche's biggest-selling

treatments--cancer drugs Herceptin and Mabthera--are expected to be

launched in Europe in the second half of the year.

Mr. Schwan said Roche was prepared for this onset of new

competition with a lineup of new drugs that he said would offset a

decline in its older medicines.

Roche said it expects sales and core earnings per share to grow

by a low-to-mid single-digit percentage in 2017, at constant

exchange rates.

The company proposed a full-year dividend of 8.20 Swiss francs,

up from 8.10 francs last year.

It said sales of its medicines increased to 39.1 billion Swiss

francs, a 5% increase from 37.3 billion francs a year earlier.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

February 01, 2017 07:47 ET (12:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

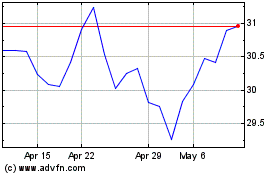

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

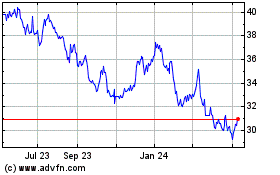

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024