SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2017

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL

Publicly-held Company

Corporate Taxpayer’s ID (CNPJ/MF): 33.042.730/0001-04

Corporate Registry (NIRE): 35300396090

MINUTES OF COMPANHIA SIDERÚRGICA NACIONAL ANNUAL AND SPECIAL SHAREHOLDERS’ MEETING HELD ON JULY 3, 2017, AND DRAWN UP IN SUMMARY FORMAT

1. Date, time and venue:

July 3, 2017, at 11:00 a.m., at the Company’s headquarters, located at Av. Brig. Faria Lima No. 3400, 20º andar, in the city and state of São Paulo.

2.

Call Notices:

Call notices were published on June 2, 3 and 6, 2017, in the Official Gazette of the State of São Paulo on pages 27, 19 and 23, respectively and in

Folha de São Paulo -

Regional Issue

newspaper on pages A20, A20 and A20, respectively, which will be filed at the Company’s headquarters.

3. Attendance:

The meeting was opened with the presence of shareholders representing 65.06% of the Company’s voting capital, as evidenced by the Shareholders Attendance Book, as well as the Company’s Executive Officer, Mr. David Moise Salama.

4.

Presiding:

appointed by the Chairman of the Company’s Board of Directors,

Mr. David Moise Salama chaired the meeting and invited Mrs. Claudia Maria Sarti to act as secretary.

5.

Agenda:

At the Special Shareholders’ Meeting

:

on second call, under the terms of article 124, §1 of Law 6.404, of December 15, 1976 (“Law No. 6.404/76”), to resolve on the proposed amendment to and restatement of the Company’s By-Laws;

At the Annual Shareholders’ Meeting

:

(i)

to establish the number of members of the Company’s Board of Directors and to elect its members; and (ii)

to

establish the annual global compensation of the managers for the fiscal year 2017.

6. Resolutions:

The following resolutions were taken, with abstentions registered as the case may be and vote instructions filed at the Company’s headquarters:

6.1.

In compliance with CVM Instructions No. 480/09 and 481/09, as amended by CVM Instruction No. 561/15, the Chairman informed that the total amount of one hundred and ninety (190) Distance Voting Bulletins have been received, containing votes relating to the matters of this Annual and Special Shareholders’ Meeting, contained in the consolidated voting map, which was read by the Board and made available to the attending shareholders for consultation.

Since there was a request for rectification of the votes sent by means of the Distance Voting Bulletins, the votes cast in person by shareholders Panagora Group Trust and Japan Trustee Services Bank, Ltd. RE: STB Daiwa EEFIMF shall be taken into consideration. Subsequently, the voting of the items of the Agenda started.

6.2.

Approval, by a majority of the attending shareholders, it being understood that 811,831,026 favorable votes and 162,600 contrary votes were counted, for drawing up these minutes in summary format and omitting the signatures of attending shareholders at the time of publication, as allowed by paragraphs 1 and 2, respectively, of article 130 of Law nº 6.404/76.

6.3.

Approval, by a majority of the attending

shareholders, it being understood that 803,237,238 favorable votes, 79,914,047

contrary votes and 10,000 abstentions were counted, with the declarations of

vote, initialed by the presiding officers, duly registered, the amendment to

and restatement of the By-Laws, to reflect the amendments hereby approved,

pursuant to the provisions of Exhibit I to these Minutes.

6.4

It is recorded that,

exceptionally, the Financial Statements relating to the fiscal year ended on December

31, 2016 (“DF 2016”) have not been provided in time to be included in the

matters subject to resolution of this Annual and Special Shareholders’ Meeting,

as already informed by means of the Relevant Fact disclosed on March 27, 2017

and of Communication to the Market of May 24, 2017. As soon as the DFs 2016 are

available, a new shareholders’ meeting shall be called to resolve on the review

of the managers’ accounts,

analysis, discussion and voting on the

financial statements, allocation of the net income of the fiscal year and

distribution of dividends.

6.5.

Approval, by the majority of the attending shareholders,

it being understood that 863,693,821 favorable votes, 19,259,400 contrary votes

and 208,064 abstentions were counted, with the declarations of vote, initialed

by the Board, duly registered, that the Board of Directors will be composed by seven

(7) members, with the election, with 789,412,734 favorable votes, 19,259,400

contrary votes and 74,489,151 abstentions, with the declarations of vote,

initialed by the presiding officers, duly registered, of the following sitting members

to compose the Company’s Board of Directors: (i) Firstly, in accordance with Article

14, paragraph 2, of the Bylaws, the shareholders reelected

FABIAM FRANKLIN

,

Brazilian, married, engineer, bearer of the identification document (IFP) no. 07563312-3,

enrolled with individual taxpayers (CPF/MF) under number 899.230.907-44, resident

and domiciled in the city of Volta Redonda, State of Rio de Janeiro, as appointed

by CSN Invest Fundo de Investimentos em Ações; and (ii) Immediately thereafter,

the majority of the attending shareholders reelected Messrs.

BENJAMIN STEINBRUCH

,

Brazilian, married, business administrator, bearer of the identification document

(RG) no. 3.627.815-4 SSP/SP, enrolled with individual taxpayers (CPF/MF) under number

618.266.778-87, resident and domiciled in the city and state of São Paulo;

FERNANDO

PERRONE

, Brazilian, married, lawyer, bearer of the identification document (IFP)

no. 2.048.837, enrolled with individual taxpayers (CPF/MF) under number 181.062.347-20,

resident and domiciled in the city and state of São Paulo;

YOSHIAKI NAKANO

,

Brazilian, married, business administrator, bearer of the identification document

(RG) no. 5.157.491-3 and enrolled with individual taxpayers (CPF/MF) under number

049.414.548-04, resident and domiciled in the city and state of São Paulo;

ANTONIO

BERNARDO VIEIRA MAIA

, Brazilian, married, business administrator, bearer of

the identification document (RG) no. 042416875 IFP/RJ, enrolled with individual

taxpayers (CPF/MF) under number 510.578.677-72, resident and domiciled in the city

and state of São Paulo and

LÉO STEINBRUCH

, Brazilian, divorced, businessman,

bearer of identification document (RG) no. 13.597.999-SSP/SP, enrolled with

individual taxpayers (CPF/MF) under number 110.885.048-09, resident and

domiciled in the city and state of São Paulo and reelected, and elected Mr.

JOSÉ

EDUARDO DE LACERDA SOARES

, Brazilian, married, business administrator, bearer

of the identification document (RG) no. 9.728.283, enrolled with individual taxpayers

(CPF/MF) under number 088.973.848-38, resident and domiciled in the city and state

of São Paulo.

As a result, the Company’s Board of Directors

will be composed by Fabiam Franklin, Benjamin Steinbruch, Fernando Perrone, Yoshiaki

Nakano, Antonio Bernardo Vieira Maia,

Léo Steinbruch and José Eduardo de Lacerda Soares, all with term of office until the 2019 Annual Shareholders’ Meeting.

The directors hereby elected and reelected represent not to have incurred in any of the crimes provided for in the Law which may prevent them from exercising business activities under the terms of Law No. 6.404/76. The instruments vesting the directors hereby elected in office shall be executed within up to 30 days.

It is registered that the shareholders Hagop Guerekmezian, Hagop Guerekmezian Filho, Osmar Ailton Alves da Cunha and Geração Futuro L. Par Fundo de Investimento em Ações, representing 1.4191% of the voting stock, appointed one member for separate election, However, since the minimum percentage of the capital stock required was not reached, pursuant to the provisions of article 141, paragraph 4 of Law 6.404/76, there was no separate election.

6.5.

Approval, by the majority of the attending shareholders, with 809,814,622 favorable votes, 3,013,383 contrary votes and 70,333,280 abstentions, with the declarations of vote, initialed by the presiding officers, duly registered, the annual global compensation of the managers in the amount of up to R$76,407,910.00.

6.6.

It is registered that the shareholders Hagop Guerekmezian and Hagop Guerekmezian Filho requested installation of the Fiscal Council, and the shareholders Geração Futuro L. Par Fundo de Investimento em Ações and Osmar Ailton Alves da Cunha joined the request for installation, which, added to the distance votes received in this respect, total 1.475% of the voting stock. However, since the minimum percentage of the capital stock required was not reached, pursuant to the provisions of CVM Instruction No. 324, of January 19, 2000, the Fiscal Council was not installed in the Company.

6.7.

It is registered that the shareholder Osmar Ailton Alves da Cunha questioned the publication of the Financial Statements, as well as the absence of the representative from the independent auditors at the Meeting.

7. Closure:

There being no further business to be discussed, the meeting was adjourned for the time necessary to draw up these Minutes. The meeting was resumed and these minutes were read, found in compliance and signed by the Chairman, the Secretary and all attending shareholders.

8. Documents Filed

: The Annual and Special Shareholders’ Meeting Call Notice, the Management Proposal, the voting guidelines presented and the Synthetic and Consolidated Voting Maps are filed at the Company’s headquarters.

9. Signatures:

DAVID MOISE SALAMA – CHAIRMAN

,

CLAUDIA MARIA SARTI – SECRETARY

.

Shareholders: VICUNHA TÊXTIL S.A.

;

VICUNHA AÇOS S.A.; RIO IACO PARTICIPAÇÕES S.A.; CFL PARTICIPAÇÕES S.A.; CAIXA BENEFICIENTE DOS EMPREGADOS DA CSN – CBS; OSMAR AILTON ALVES DA CUNHA; CLUBE DE INVESTIMENTO GUIDARA; CLUBE DE INVESTIMENTOS_FIBRA; CLUBE DE INVESTIMENTOS KOKUREN; FIBRA VIC FMIA CL; CSN INVEST FUNDO DE INVESTIMENTO EM ACOES; BUREAU OF LABOR FUNDS – LABOR PENSION FUND; CONSTRUCTION & BUILDING UNIONS SUPER FUND; JAPAN TRUSTEE SERVICES BANK, LTD. RE: STB DAIWA E E F I M F; PANAGORA GROUP TRUST; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MUTB400045795; AQR FUNDS - AQR EMERGING MOMENTUM STYLE FUND; JNL/MELLON CAPITAL EMERGING MARKETS INDEX FUND; PUBLIC EMPLOYEES RETIREMENT SYSTEM OF OHIO; THE MASTER TRUST BANK OF JAP, LTD. AS TR. FOR MTBJ400045828; THE MASTER TRUST BANK OF JAP., LTD. AS TR. FOR MTBJ400045829; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MTBJ400045833; THE MASTER TRUST BANK OF JAPAN LTD. AS T. FOR MTBJ400045835; THE MASTER TRUST BANK OF JAPAN, LTD.

AS TR FOR MUTB400045792; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MUTB400045796; VANGUARD TOTAL INTERNATIONAL STOCK INDEX FD, A SE VAN S F; STICHTING JURIDISCH EIGENAAR ACTIAM BELEGGINGSFONDSEN; GERACAO L.PAR FUNDO DE INVESTIMENTO EM ACOES; HAGOP GUEREKMEZIAN; HAGOP GUEREKMEZIAN FILHO; DISTANCE VOTING: ADVANCED SERIES TRUST - AST PARAMETRIC EME PORTFOLIO; ADVISER MANAGED TRUST - TACTICAL OFFENSIVE EQUITY FUND; ALASKA PERMANENT FUND; ALLIANCEBERNSTEIN DELAWARE BUSINESS TRUST - A I ALL-C P S; AMERICAN HEART ASSOCIATION, INC.; AQUILA EMERGING MARKETS FUND; ARIZONA PSPRS TRUST; AT&T UNION WELFARE BENEFIT TRUST; BELLSOUTH CORPORATION RFA VEBA TRUST; BLACKROCK ASSET MANAGEMENT SCHWEIZ AG ON B OF BIFS E M E I F; BLACKROCK CDN MSCI EMERGING MARKETS INDEX FUND; BLACKROCK GLOBAL INDEX FUNDS; BLACKROCK INSTITUTIONAL TRUST COMPANY NA; BLACKROCK LIFE LIMITED - DC OVERSEAS EQUITY FUND; BMO MSCI EMERGING MARKETS INDEX ETF; BNY MELLON TR & DEP (UK) LIMITED AS T OF BEME TRACKER FUND; BOARD OF PENSIONS OF THE EVANGELICAL LUTHERAN CHURCH IN AMER; CAISSE DE DEPOT ET PLACEMENT DU QUEBEC; CALIFORNIA PUBLIC EMPLOYEES RETIREMENT SYSTEM; CF DV EMERGING MARKETS STOCK INDEX FUND; CIBC EMERGING MARKETS INDEX FUND; CITY OF NEW YORK GROUP TRUST; COLLEGE RETIREMENT EQUITIES FUND; COMMONWEALTH OF PENNSYLV.PUB.SCHOOL EMP RET S; COMMONWEALTH SUPERANNUATION CORPORATION; CONSULTING GROUP CAPITAL MKTS FUNDS EMER MARKETS EQUITY FUND; COUNTY EMPLOYEES ANNUITY AND BENEFIT FD OF THE COOK COUNTY; DEUTSCHE X-TRACKERS MSCI ALL WORLD EX US HEDGED EQUITY ETF; DEUTSCHE X-TRACKERS MSCI BRAZIL HEDGED EQUITY ETF; DIVERSIFIED MARKETS (2010) POOLED FUND TRUST; DREYFUS OPPORTUNITY FUNDS - DREYFUS STRATEGIC BETA E M E F; E V INTER (IRL) F PLC - E V INTER (IRL) P EMERGING M CORE F; EATON VANCE COLLECTIVE INVESTMENT TFE BEN PLANS EM MQ EQU FD; EATON VANCE INT (IR) F PLC-EATON V INT (IR) PAR EM MKT FUND; EATON VANCE MANAGEMENT; EMERGING MARKETS EQUITY ESG SCREENED FUND B; EMERGING MARKETS EQUITY INDEX MASTER FUND; EMERGING MARKETS EQUITY INDEX PLUS FUND; EMERGING MARKETS EX-CONTROVERSIAL WEAPONS EQUITY INDEX FD B; EMERGING MARKETS INDEX NON-LENDABLE FUND; EMERGING MARKETS INDEX NON-LENDABLE FUND B; EMERGING MARKETS SUDAN FREE EQUITY INDEX FUND; EVTC CIT FOF EBP-EVTC PARAMETRIC SEM CORE EQUITY FUND TR; FIAM GLOBAL EX U.S. INDEX FUND, LP; FIDELITY SALEM STREET T: FIDELITY E M INDEX FUND; FIDELITY SALEM STREET T: FIDELITY G EX U.S INDEX FUND; FIDELITY SALEM STREET T: FIDELITY TOTAL INTE INDEX FUND; FIDELITY SALEM STREET TRUST: FIDELITY SERIES G EX US I FD; FIDELITY SALEM STREET TRUST: FIDELITY SAI EMERGING M I FUND; FIRST TRUST BRAZIL ALPHADEX FUND; FIRST TRUST LATIN AMERICA ALPHADEX FUND; FLORIDA RETIREMENT SYSTEM TRUST FUND; FORD MOTOR CO DEFINED BENEF MASTER TRUST; FORD MOTOR COMPANY OF CANADA, L PENSION TRUST; FSS EMERGING MARKET EQUITY TRUST; FTSE RAFI EMERGING INDEX NON-LENDABLE FUND; FUTURE FUND BOARD OF GUARDIANS; GE INVESTMENTS FUNDS, INC.; GMO ALPHA ONLY FUND, A SERIES OF GMO TRUST; GMO M R FD(ONSH) A S O GMO M PORTIFOLIOS (ONSHORE), L.P.; GOLDMAN SACHS TRUST II- GOLDMAN SACHS MULTI-MANAGER G E FUND; GOVERNMENT EMPLOYEES SUPERANNUATION BOARD; GUIDEMARK EMERGING MARKETS FUND; HARTFORD REAL TOTAL RETURN FUND; HC CAPITAL TRUST THE COMMODITY RETURNS STRATEGY PORTFOLIO; HIGHLAND COLLECTIVE INVESTMENT TRUST; IBM DIVERSIFIED GLOBAL EQUITY FUND; IBM 401 (K) PLUS PLAN; INTERNATIONAL EXPATRIATE BENEFIT MASTER TRUST; INTERNATIONAL MONETARY FUND; INVESTORS WHOLESALE EMERGING MARKETS EQUITIES TRUST; IRISH LIFE ASSURANCE PLC; ISHARES CORE MSCI EMERGING MARKETS ETF; ISHARES CORE MSCI TOTAL INTERNATIONAL STOCK ETF; ISHARES EMERGING MARKETS FUNDAMENTAL INDEX ETF; ISHARES II PUBLIC LIMITED COMPANY; ISHARES III PUBLIC LIMITED COMPANY; ISHARES MSCI ACWI EX U.S. ETF; ISHARES MSCI BRAZIL CAPPED ETF; ISHARES MSCI BRAZIL UCITS ETF USD (ACC); ISHARES MSCI BRIC ETF; ISHARES MSCI EMERGING MARKETS ETF; ISHARES MSCI GLOBAL METALS AND MINING PRODUCERS ETF; ISHARES PUBLIC LIMITED COMPANY; ISHARES V PUBLIC LIMITED COMPANY; JAPAN TRUSTEE SERVICES BANK, LTD. SMTB EMERGING EQUITY M F; JAPAN TRUSTEE SERVICES BK, LTD. RE: RTB NIKKO BEA MOTHER FD; JOHN HANCOCK FUNDS II INTERNATIONAL STRATEGIC EQUITY ALLOCAT; JOHN HANCOCK FUNDS II STRATEGIC EQUITY ALLOCATION FUND; JOHN HANCOCK VARIABLE INS TRUST INTERN EQUITY INDEX TRUST B; KAPITALFORENINGEN INVESTIN PRO, GLOBAL EQUITIES I; KAPITALFORENINGEN LAEGERNES PENSIONSINVESTERING, LPI AEM III; LACM EMERGING MARKETS FUND L.P.; LACM EMII, L.P.; LEGAL & GENERAL COLLECTIVE INVESTMENT TRUST; LEGAL & GENERAL GLOBAL EMERGING MARKETS INDEX FUND; LEGAL & GENERAL INTERNATIONAL INDEX TRUST; LEGAL AND GENERAL ASSURANCE PENSIONS MNG LTD; LEGAL AND GENERAL ASSURANCE SOCIETY LIMITED; LOS ANGELES CAPITAL GLOBAL FUNDS PLC; MANAGED PENSION FUNDS LIMITED; MERCER QIF FUND PLC; MM SELECT EQUITY ASSET FUND; MUNICIPAL E ANNUITY A B FUND OF CHICAGO; NATIONAL COUNCIL FOR SOCIAL SECURITY FUND; NAV CANADA PENSION PLAN; NEW

YORK STATE TEACHERS RETIREMENT SYSTEM; NEW ZEALAND SUPERANNUATION FUND; NORTHERN EMERGING MARKETS EQUITY INDEX FUND; NORTHERN TRUST COLLECTIVE ALL COUNTRY WORLD I (ACWI) E-U F-L; NORTHERN TRUST COLLECTIVE EMERGING MARKETS INDEX FUND-LEND; NORTHERN TRUST INVESTIMENT FUNDS PLC; NORTHERN TRUST UCITS FGR FUND; NTGI QM COMMON DAILY ALL COUNT WORLD EXUS EQU INDEX FD LEND; NTGI QUANTITATIVE MANAGEMENT COLLEC FUNDS TRUST; NTGI-QM COMMON DAC WORLD EX-US INVESTABLE MIF – LENDING; NTGI-QM COMMON DAILY EMERGING MARKETS EIF – LENDING; NTGI-QM COMMON DAILY EMERGING MARKETS EQUITY I F- NON L; PARAMETRIC EMERGING MARKETS CORE FUND; PARAMETRIC EMERGING MARKETS FUND; PARAMETRIC TAX-MANAGED EMERGING MARKETS FUND; PICTET - EMERGING MARKETS INDEX; PICTET FUNDS S.A RE: PI(CH)-EMERGING MARKETS TRACKER; POWERSHARES FTSE RAFI EMERGING MARKETS PORTFOLIO; POWERSHARES FTSE RAFI EMERGING MARKETS UCITS ETF; POWERSHARES S&P EMERGING MARKETS HIGH BETA PORTFOLIO; PUBLIC EMPLOYEE RETIREMENT SYSTEM OF IDAHO; PUBLIC SECTOR PENSION INVESTMENT BOARD; RUSSELL INVESTMENT COMPANY PUBLIC LIMITED COMPANY; SCHWAB EMERGING MARKETS EQUITY ETF; SCHWAB FUNDAMENTAL EMERGING MARKETS LARGE COMPANY INDEX FUND; SCHWAB FUNDAMENTAL EMERG0ING MARKETS LARGE COMPANY INDEX ETF; SCOTTISH WIDOWS INVESTMENT SOLUTIONS FUNDS ICVC- FUNDAMENTAL; SOUTHERN CAL ED C N F Q C DC MT S ON P VD N G; SPDR MSCI EMERGING MARKETS STRATEGICFACTORS ETF; SPDR S&P EMERGING MARKETS FUND; SSGA MSCI BRAZIL INDEX NON-LENDING QP COMMON TRUST FUND; SSGA SPDR ETFS EUROPE I PLC; ST STR RUSSELL FUND GL EX-U.S. INDEX NON-LEND COMMON TR FD; ST STR MSCI ACWI EX USA IMI SCREENED NON-LENDING COMM TR FD; ST. JAMES S PLACE GLOBAL EQUITY UNIT TRUST; STANLIB FUNDS LIMITED; STATE GENERAL RESERVES FUND; STATE OF MINNESOTA STATE EMPLOYEES RET PLAN; STATE OF NEW JERSEY COMMON PENSION FUND D; STATE STREET BANK AND TRUST COMPANY INVESTMENT FUNDS FOR TAX EXEMPT RETIREMENT PLANS; STATE STREET C S JERSEY L T O T COSM I F; STATE STREET EMERGING MARKETS EQUITY INDEX FUND; STATE STREET GLOBAL ADVISORS LUX SICAV. S S G E M I E FUND; STATE STREET GLOBAL EQUITY EX-US INDEX PORTFOLIO; STATE STREET IRELAND UNIT TRUST; STICHTING PENSIOENFONDS VAN DE ABN AMRO BK NV; STICHTING PENSIOENFONDS VAN DE NEDERLANDSCHE BANK N.V; STICHTING PGGM DEPOSITARY; STICHTING PHILIPS PENSIOENFONDS; SUNSUPER SUPERANNUATION FUND; TEACHER RETIREMENT SYSTEM OF TEXAS; TEACHERS RETIREMENT SYSTEM OF THE STATE OF ILLINOIS; THE BANK OF NEW YORK MELLON EMP BEN COLLECTIVE INVEST FD PLA; THE BOARD OF.A.C.E.R.S.LOS ANGELES, CALIFORNIA; THE GOVERNMENT OF HIS M THE S AND Y D-P OF BRUNEI DARUSSALAM; THE HARTFORD GLOBAL REAL ASSET FUND; THE NOMURA T AND B CO LTD RE I E S INDEX MSCI E NO HED M FUN; THE PENSION RESERVES INVESTMENT MANAG.BOARD; THE REGENTS OF THE UNIVERSITY OF CALIFORNIA; THE SEVENTH SWEDISH NATIONAL PENSION FUND - AP7 EQUITY FUND; THE STATE TEACHERS RETIREMENT SYSTEM OF OHIO; THE TEXAS EDUCATION AGENCY; TIAA-CREF FUNDS - TIAA-CREF EMERGING MARKETS EQUITY I F; TOTAL INTERNATIONAL EX U.S. I MASTER PORT OF MASTER INV PORT; TRUST & CUSTODY SERVICES BANK, LTD. RE: EMERGING E P M F; UAW RETIREE MEDICAL BENEFITS TRUST; UPS GROUP TRUST; UTAH STATE RETIREMENT SYSTEMS; VANG FTSE ALL-WORLD EX-US INDEX FD, A S OF V INTER E I FDS; VANGUARD EMERGING MARKETS STOCK INDEX FUND; VANGUARD FUNDS PUBLIC LIMITED COMPANY; VANGUARD INV FUNDS ICVC-VANGUARD FTSE GLOBAL ALL CAP INDEX F; VANGUARD INVESTMENT SERIES PLC; VANGUARD TOTAL WSI FD, A SOV INTERNATIONAL EQUITY INDEX FDS; VOYA EMERGING MARKETS INDEX PORTFOLIO; WASHINGTON STATE INVESTMENT BOARD; WELLINGTON DIVERSIFIED INFLATION HEDGES FUND; WELLINGTON TRUST COMPANY N.A.; WELLS FARGO BK D OF T ESTABLISHING INV F FOR E BENEFIT TR; WILSHIRE MUTUAL FUNDS, INC. - WILSHIRE INTERNATIONAL EQUITY; WISDOMTREE EMERGING MARKETS EX-STATE-OWNED ENTERPRISES FUND; WSIB INVESTMENTS PUBLIC EQUITIES POOLED FUND TRUST.

I attest that this is a true copy of the original document, drawn up in the appropriate book.

São Paulo, July 3, 2017.

___________________________

Claudia Maria Sarti

EXHIBIT I

COMPANHIA

SIDERÚRGICA NACIONAL

Bylaws

Chapter I

NAME, OBJECT,

HEADQUARTERS AND DURATION

Article 1

-

Companhia

Siderúrgica Nacional, a publicly-held corporation established on April 9, 1941,

shall be governed by these Bylaws and the applicable legislation.

Article 2

- The purpose of the

Company is to manufacture, transform and sell steel products and by products,

including importing and exporting thereof, and to exploit any other similar

activities that may, directly or indirectly, be related to the purposes of the

Company, such as: mining, cement and carbon-chemical industries, metallic

structure manufacture and assembly, construction, transportation, navigation

and port activities, as well as energy generation, management and trade in

different forms and modalities, and holding equity interest in other domestic

or international business incorporated under any form of partnership.

Article 3

- The Company has

its head office and jurisdiction in the city of São Paulo, State of São Paulo,

and may, as resolved by the Executive Board, open, transfer or close branches,

branch offices, agencies or representation offices, or establishments of any

other type, in any part of the country or abroad.

Article 4

- The Company shall

remain in existence for an indefinite term.

Chapter

II

CAPITAL

AND SHARES

Article 5

- The capital stock of

the Company, fully subscribed and paid in, is four billion, five hundred and

forty million

Reais

(R$4,540,000,000.00), divided into one billion,

three hundred and eighty-seven million, five hundred and twenty-four thousand

and forty-seven (1,387,524,047) common, book-entry shares with no par value.

Article 6

- Each common share shall

entitle the holder to one (01) vote in the resolutions of the General Meeting.

Article 7 -

The

capital stock of the Company may be increased to up two billion four hundred

million (2,400,000,000) shares, by decision of the Board of Directors,

regardless of any statutory reform.

Paragraph 1 -

The authorized capital stock may be reached, upon one or more share issues, at

the discretion of the Board of Directors.

Paragraph 2 - Shareholders shall have preemptive rights in

the case of subscription to a capital increase in proportion to the number of

shares held.

Paragraph 3 -

At the discretion of the Board of Directors, preemptive rights for former

shareholders may be excluded or the deadline for their exercise may be reduced

in the case of the issue of shares and share-convertible debentures or

subscription warrants, which are placed through sale on the stock exchange or

by public subscription or through an exchange of shares in a public offer for

the acquisition of control, pursuant to the prevailing legislation.

Paragraph 4 -

The Board of Directors shall establish the price, term and conditions of each

issue.

Paragraph 5 -

Shareholders who fail to pay in the subscribed shares, as per the subscription

order or call, shall be declared, for all legal purposes, to be in default and

shall pay the Company interest of one percent (1%) per month or a fraction

thereof, from the first (1st) day as of the failure to perform the obligation,

adjusted for inflation pursuant to the law, in addition to a fine equivalent to

ten per cent (10%) of the amount in arrears and not paid in.

Chapter

III

GENERAL

MEETING

Article 8

-

The

General Meeting is empowered to decide on all business related to the Company,

take any resolutions it deems appropriate for its defense and development, and

shall be called, with an indication of the agenda, as provided for by the law.

Art. 9º

- The General

Meeting shall be convened by the Board of Directors and chaired by the chairman

of the Board of Directors or, in his or her absence, by whomever he or she

appoints. The chairman shall appoint the secretary of the General Meeting.

Paragraph 1 - Prior

to convening the General Meeting, shareholders must sign the Attendance Book

informing their name, nationality, residence and the quantity of shares held by

them.

Paragraph 2 -

The list of shareholders attending the meeting shall be closed by the chairman

immediately after the General Meeting is convened. Shareholders arriving to the

General Meeting after the closing of the list shall be able to participate in

the meeting, although they shall not be entitled to vote any corporate

decisions, and their actions shall not be valid for purposes of quorum or the

votes attributed to each shareholder.

Paragraph 3 - In

order to participate and vote in General Meetings, shareholders must evidence

their condition as such, by presenting a document issued by the financial

institution that is the depositary of book-entry shares, as well as the

identification documents of the shareholder, or, as the case may be, of the

attorney in fact, together with the power of attorney. Should the shareholder

be a legal entity or investment fund, it must also present the documents

evidencing the authority and the identification of the persons attending the

Meeting.

Article 10

The General Meeting shall

meet ordinarily in the first four months following the end of the fiscal year

in order to discuss matters referred to in article 132 of Law 6.404 of December

15, 1976, and extraordinarily whenever corporate interests so require.

Article 11

Shareholders represented by a legal representative must

submit the power-of-attorney to the company's headquarters up to forty-eight (48)

hours before the time established for the Meeting.

Chapter

IV

MANAGEMENT

Section

I

Standard Rules

Article 12

- The management of the

Company shall be incumbent upon the Board of Directors and the Board of

Executive Officers.

Article 13

-

The

remuneration of the managers shall be established by the General Meeting in

accordance with the provisions of this article.

Paragraph 1 - The

fixed overall or individual remuneration of the managers, at the discretion of

the General Meeting, shall comprise a fixed monthly amount, which are the fees,

and in the case of the executive officers, may also include a variable amount

to be paid yearly, calculated on the net income of the Company after formation

of the reserves required by law, including for the payment of income tax, and

of the provision for mandatory dividends.

Paragraph 2 -

In the event that the General Meeting establishes an aggregate amount for the

managers’ remuneration, it is incumbent on the Board of Directors to distribute

said amount.

Section

II

BOARD

OF DIRECTORS

Article 14

- The Board of Directors

is composed of up to eleven (11) members, elected or dismissed at any time by

resolution of the General Meeting, with a term of office of two (2) years,

reelection being allowed. One member shall be the Chairman and another the

Vice-Chairman. The term of office of the Board Members shall extend until the

investiture of their successors.

Paragraph 1 - The

Chairman and Vice-Chairman of the Board of Directors shall be chosen by their

peers, by majority vote, at the first meeting held after their investiture.

Paragraph 2 -

In the event that the employees of the Company, whether or not joined in an

investment club or as co-owners, do not have a sufficient shareholding to

guarantee membership on the Board of Directors, one position on the Board shall

be reserved for the person chosen by the employees and in such a capacity,

indicated to the General Meeting, through a specific procedure, to be elected

to fill said position.

Article 15

- The Board of Directors

shall meet, ordinarily at least once each quarter, and extraordinarily whenever

called by the Chairman, the Vice-Chairman, when exercising the role of chairman,

or the majority of its Members.

Paragraph 1 - The

meetings of the Board of Directors shall only be installed with the attendance

of a majority of its members, and shall be presided over by its Chairman.

Paragraph 2 - The Board of Directors meetings may be held,

exceptionally, by conference call, video conferencing, electronic mail, or

other means of communication, computing as present those members who manifest

by any of these means.

Paragraph 3 -

Minutes of the meetings shall be drawn up in a book for this purpose and, after

being read and approved by those members present, shall be signed by a

sufficient number to constitute the majority required for approval of the

matters under examination.

Paragraph 4 -

Board resolutions shall be passed by a majority vote of those present. In the

event of a tie, the Chairman of the meeting shall have the casting vote, in

addition to his own.

Paragraph 5 -

Meetings shall be called at least seventy-two (72) hours prior to the date of

the meeting, except in case of urgency. The presence of all members of the

Board of Directors shall wave any call formality.

Paragraph 6 -

The Board of Directors shall have a General Secretary, in whose absence shall

be replaced by another employee or manager designated by the Chairman of the

Board.

Article 16

- In the cases of

vacancy, temporary impediment, or absence of a member of the Board of

Directors, the following rules shall be observed:

I. In the case

of vacancy of any member of the Board of Directors, the remaining members shall

appoint a substitute to serve until the Company's next General Meeting, if the

number of remaining members is less than the minimum provided for in the law,

and who, if confirmed by the respective General Meeting, shall complete the

term of the member replaced.

II. In the

case of temporary impediment or absence of any member of the Board of

Directors, the absent or impeded member may indicate a replacement from among

the other members, who shall replace and represent the impeded or absent member

as long as the impediment lasts. If said impediment lasts for more than ninety

days, however, the position shall be deemed to be vacant.

III. If the

vacancy occurs in the position of Chairman, the Vice-Chairman shall assume the

office of Chairman or, in the lack thereof, by another member chosen by the

remaining members. In the case of the Chairman's temporary impediment or

absence, he shall be replaced by the Vice-Chairman or, in the lack thereof, by

another member appointed by him.

IV. In the

cases of temporary impediment or absence under this Article 16, representatives

shall act on their own behalf and on that of the members represented.

Article 17

- Board Members shall,

upon request, receive copies of the minutes of meetings of the Board of

Executive Officers and any special committees created by the Board of Directors

hereunder.

Article 18

- The Board of Directors

may form special committees to assist it, with defined purposes and limited

terms of activities, designating the members thereof.

Sole Paragraph

- The special committees created by the Board of Directors shall have neither

an executive nor a deliberative function and their recommendations, proposals

and/or opinions should be submitted for consideration by the Board of

Directors.

Article 19

- In addition to the

duties established by law, it is incumbent upon the Board of Directors:

I. to

establish the general policy for the businesses of the Company, its

wholly-owned subsidiaries and controlled companies;

II. to approve

the annual and pluriannual budgets, expansion projects and investment programs,

and to follow up on execution and performance thereof;

III. to call

on the general meeting;

IV. to elect

and dismiss the members of the Board of Executive Officers and assign their

duties;

V. to elect

and dismiss the members of the Audit Committee and, if a position becomes

vacant, to elect a substitute to complete the term of office of the replaced

member;

VI. to assign

to an Executive Officer the function of investor relations officer, which may

or may not be exercised concurrently with other executive functions and whose

powers are establish by law;

VII. to

appoint and dismiss the Company's independent auditors after hearing the

recommendation of the Audit Committee;

VIII. to

appoint and dismiss the person responsible for the internal audit, who shall be

a legally qualified employee of the Company and report to the Chairman of the

Board of Directors;

IX. to decide

on capital increases within the limits of authorized capital, observing the provisions

of Article 7 of these Bylaws;

X. to

authorize trading by the Company of its own shares for maintenance in treasury

for subsequent sale or cancellation;

XI. to

establish the terms and other conditions for the placement of debentures,

including those convertible to shares, specifying the limit of the capital

increase resulting from the conversion of the debentures and the type and class

of shares to be issued, as well as determining the conditions stated in items

VI to VIII inclusive of article 59 of Law 6.404/76 and the opportunity for

issuance;

XII. to decide on the issuance by the Company of commercial

papers, bonds, notes, and other securities intended to raise funds through

primary or secondary distribution on the domestic or international capital

markets;

XIII. to

delegate and establish criteria for the following acts by the Executive

Officers, independently of prior authorization by the Board of Directors;

a) acquisition

or disposal of any assets of the Company;

b) performance

of any transaction, operation, agreement or arrangement of any nature,

including financing and loans in isolation or jointly, with due regard for the

matters incumbent on the Executive Board, as provided for in article 21 hereof;

and

c)

constitution of any type of guarantee or encumbrance on any asset of the

Company, including for the benefit or in favor of third parties, as long as the

party is a subsidiary entity, subsidiary or affiliate of the Company;

d)

representation of the Company at General Meetings, shareholders meetings and/or

equivalent meetings held by the companies, consortiums and other entities in

which the Company may hold an equity interest, as well as regarding the matters

submitted to said meetings;

XIV. to decide

on the operation or action constituting a transfer of the Company's funds to

others, including employee associations, recreational assistance entities,

pension funds, foundations and public corporations;

XV. to resolve

on any acts involving transformation, consolidation, spin-off, incorporation or

liquidation of companies in which the Company has corporate holding, directly

or indirectly, as well as regarding the incorporation of companies in Brazil or

abroad, by the Company and its subsidiaries;

XVI. to

resolve on the Company’s interest in (i) other companies or undertakings, as

partner or shareholder, including through consortiums or special partnerships,

(ii) in partnership agreements, shareholders’ agreements or partners’

agreements; and (iii) in capital increases in the companies in which the

Company holds an equity interest;

XVII. to

appoint and dismiss the General Secretary of the Board of Directors and define

his duties;

XVIII. to

establish policies for taking up tax incentives;

XIX. to

establish the remuneration, determine the duties, and approve the operational

rules for the functioning of the Audit Committee and any other committees that

may be created to support it;

XX. to resolve any omissions and perform other legal

duties that do not conflict with those established by these Bylaws or by Law;

XXI. to

resolve on any matters listed in item XIII of article 19 hereof, except for the

possibility that the Board delegates and gives powers of authority to the

Executive Board, as provided for in said item.

Sole paragraph

– Relating to item XIII hereof, the Board of Directors may delegate and give

powers of authority regarding the practice of said acts by two Executive

Officers, who must always sign jointly, regardless of approval by the meetings

of the Executive Board and/or the Board of Directors.

Section

III

EXECUTIVE

BOARD

Article 20

The Company shall

have a Board of Executive Officers composed of two (2) to nine (9) Executive

Officers, at the discretion of the Board of Directors, one of whom to be the

Chief Executive Officer and the other, Executive Officers, each having an area

of activity determined by the Board of Directors, one of whom shall be

designated as the investor relations officer.

Paragraph 1 - The

term of office of the Executive Officers is two (2) years, reelection being

allowed, and shall last until their respective successors take office;

Paragraph 2 - In

the case of impediment or vacancy of any Officer, said Officer shall be

replaced in accordance with the determination of the Board of Directors.

Paragraph 3 - The

Executive Officers shall perform their duties on a full-time basis.

Article 21

- With due regard for

the guidelines and resolutions of the Board of Directors and the General

Meeting, the Board of Executive Officers shall have authority to administer and

manage the business of the Company, with powers to perform all acts and carry

out all transactions related to the purpose of the Company, with due regard for

the provisions established by the Board of Directors (Article 19, item XIII)

and other provisions provided for herein.

Paragraph 1 –

In addition to the attributions provided for herein, it shall be incumbent on

the Executive Board to resolve on the following matters:

I. to appoint

an Executive Officer or attorney in fact with specific powers to represent the

Company severally in certain acts, except as provided for in article 25, II;

II. to

authorize the opening, transfer or closing of branches, agencies,

representation offices or establishments of any other kind of the Company, in

any region of Brazil or abroad; and

III. to

approve the names of the persons to be appointed by the Company to the

executive boards and boards of directors, advisory, fiscal and decision-making

councils of subsidiaries directly or indirectly controlled

by

or associated with the Company, as well as associations, foundations and other

types of corporate groups in which the Company participates.

Paragraph 2 -

It is incumbent on the Executive Officers, always in pairs, regardless of the

approval by the meetings of the Executive Board or the Board of Directors:

I. authorize

audits in companies, associations, foundations and similar entities in which

the Company participates;

II. to

negotiate confidentiality agreements;

III. to engage

routine bank services, under any modality, which are in line with the practices

of the Company;

IV. to enter

into loan and export prepayment agreements (exports advance payments) between

the Company and subsidiaries in which the Company has equity interest of at

least 99%; and

V. to authorize

the provision of surety in real estate lease agreements for employees and

Executive Officers.

Article 22

- The Board of Executive

Officers shall meet whenever summoned by the Chief Executive Officer or by two

Executive Officers, and shall be installed if a majority of its members are

present.

Paragraph 1 - The

Board of Executive Officers shall decide always by a majority vote of those

present. In the event of a tie, the Board of Executive Officers shall submit

the matter to the Board of Directors for resolution.

Paragraph 2 - Resolutions

of the Board of Executive Officers shall be recorded in minutes drawn up in the

proper book and signed by a number of attendants that is sufficient to

constitute the majority required for approval of the matters discussed, the

copies of all minutes being sent to the members of the Board of Directors upon

request.

Article 23

- The Chief Executive

Officer shall:

I - preside

over meetings of the Board of Executive Officers;

II. carry out

the executive direction of the Company, to that end coordinating and

supervising the activities of the other Executive Officers, ensuring full

observance of the resolutions and policies established by the Board of

Directors and General Meeting;

III. organize,

coordinate and supervise the activities of the areas directly subordinated to

him;

IV. assign

special activities and duties to any of the Executive Officers independently of

their normal ones, ad referendum of the Board of Directors;

V. keep the

Board of Directors informed of the activities of the Company;

VI - prepare, with the assistance of the other Executive Officers, and submit to the Board of Directors proposals to (i) define the duties of the other Executive Officers; and (ii) establish the criteria as to amounts or limit for expenditure for acts by each of the Executive Officers; and

VII - prepare the annual report and draw up the balance sheet, together with the other Executive Officers.

Article 24

- It is incumbent upon each of the Executive Officers, within the specific sphere of activity assigned to them by the Board of Directors:

I. to represent the Company in accordance with the law and these Bylaws;

II. to organize, coordinate and supervise the services for which they are responsible;

III. to attend Board of Executive Officers meetings, helping define the policies to be followed by the Company and reporting on matters in their respective areas of supervision and coordination; and

IV - to comply and cause compliance with the policies and general guidelines for the business of the Company established by the Board of Directors, each Executive Officer being responsible for his specific area of activity.

Article 25

The representation of the Company and the practice of acts necessary for its normal operation shall be the responsibility of the Executive Officers, subject to the following provisions.

I. All acts, agreements or documents that imply responsibility for the Company or that release third parties from responsibilities or obligations with the Company shall be signed (a) by two Executive Officers, (b) by an Executive Officer and one attorney in fact with these specific powers, or (c) by two attorneys in fact with these specific powers, under penalty of not being binding upon the Company;

II. With the exception of the provisions in these Bylaws, the Company may be represented in isolation by any one Executive Officers or attorney in fact with special powers in the following circumstances: (i) when performing simple routine administrative acts, including those in connection with government departments in general, autonomous government entities, government-owned companies, mixed-capital companies, the Commercial Registry, Labor Courts, National Social Security Institute, Unemployment Compensation Fund, and its banks, (ii) before public service concessionaires or licensees in acts that do not imply the assumption or release of third party obligations; (iii) to protect its rights in administrative proceedings or of any nature, and in meeting its tax, labor, or social security obligations; (iv) in the endorsement of securities for purposes of collection or deposit in the Company's bank accounts; (v) in general meetings of shareholders, partners’ meetings and/or the equivalent of companies, consortia, and other entities in which the Company holds equity, (vi) for the purpose of receiving

subpoenas, citations,

notices, or judicial notifications in active and passive representation of the

Company in court and testify in person, or similar acts, without the power of confession,

and (vii) the signature of documents of any kind that may result in the

assumption of commitments in circumstances in which the presence of a second

representative is not possible and if authorized by the Board of Executive

Officers (Art. 21, Paragraph 1, Item I)

Paragraph 1 - The

acts for which these Bylaws require prior authorization by the Board of

Directors may only be performed after said condition has been met;

Paragraph 2 -

The Board of Directors shall define the amount above which the acts and

instruments entailing liabilities for the Company shall necessarily be signed

by an Executive Officer jointly with an attorney in fact with specific powers;

Article 26

- The following rules

shall be observed as regards the appointment of attorneys in fact:

I. all powers

of attorney shall be signed by two Executive Officers or by one Executive

Officer jointly with an attorney in fact appointed by the Board of Directors;

and

II. all powers

of attorney shall be granted for a specific term of no more than one year, with

specific and limited powers, except for “ad judicia” powers of attorney, or

those granted to lawyers regarding administrative proceedings filed with the

Brazilian Federal Revenue Service, State Departments, Municipal Departments and

the National Department of Mineral Production – DNPM, which may be granted for

an indefinite period.

Article 27

- Any acts performed

without due regard for the rules established in these Bylaws, particularly in

articles 25 and 26, shall be null and void, and shall not give rise to any

liabilities for the Company.

Chapter

V

FISCAL

COUNCIL

Article 28

- Designed to function in

the fiscal years in which it is constituted at the request of shareholders, the

Fiscal Council shall be composed of three (3) sitting members and three (3) alternates

elected by the General Meeting, which shall establish the compensation of the

sitting members.

Sole Paragraph

- The Fiscal Council's term of office ends upon the first Annual General

Meeting held after it has been constituted.

Chapter

VI

AUDIT

COMMITTEE

Article 29 -

The

Company shall have an Audit Committee composed of three (3) members elected by

the Board of Directors from among its members, with term of office of

two (2) years, reelection

being allowed.

Sole Paragraph - The Board of Directors shall approve the Internal Rules

of the Committee, whereby its functions and duties, which shall comply with the

laws and regulations applicable to audit committees, shall be determined.

Chapter

VII

FISCAL

YEAR, BALANCE SHEETS AND PROFITS

Article 30

- The fiscal year shall

end on December 31 of each year, when the Financial Statements shall be drawn

up and, after examination by the Board of Directors, submitted to the General

Meeting, along with the proposal for allocation of net income for the year.

Paragraph 1 - The

accumulated losses and provision for income and social contribution taxes shall

be deducted from the result of the year, prior to any profit sharing.

Paragraph 2 - The

net income shall mandatorily have the following allocation:

I – five per

cent (5%) shall be allocated to the legal reserve fund until reaching twenty

per cent (20%) of the subscribed capital stock;

II – payment

of mandatory dividends (Article 33);

III –

allocation of the remaining income shall be resolved by the General Meeting,

observing the legal precepts.

Paragraph 3 - The

Board of Directors may propose, for the deliberation of the Meeting, the

deduction of at least one percent (1%) from net income for the year for the

establishment of a Working Capital and Investment Reserve, in accordance with

the following precepts:

I – its

constitution shall not jeopardize the right to minimum mandatory dividends

referred to in Article. 33;

II – its

balance in conjunction with the other income reserves, excluding reserves for

contingencies and unrealized profits, may not exceed the Company’s capital

stock, under penalty of capitalization or distribution in cash of the surplus

at the discretion of the General Meeting;

III. the

Working Capital and Investment Reserve is intended to ensure the maintenance

and development of activities that constitute the Company's corporate purpose

and investments in fixed assets, and/or additions to working capital including

through amortizations of the Company’s debt, independently of the retention of

profits linked to the capital budget;

IV. its

balance may be used (i) to absorb losses whenever necessary, (ii) for the

distribution of dividends at any time, (iii) for the redemption, refund, or

purchase of shares as authorized by law, and (iv) be incorporated into the

Company’s capital, including through stock bonuses

consisting of new shares.

Article

31

- In addition,

it shall be incumbent upon the Board of Directors:

I – to

determine the drawing up of half-yearly and quarterly balance sheets, or for

shorter periods, observing the legal precepts;

II – to

approve the payment of any additional or interim dividends, including as a

total or partial advance on the mandatory dividend for the year in progress,

observing the legal provisions;

III – to

declare dividends to the year’s profit account verified in the half-yearly

balance sheets, retained earnings or profit reserves existing in the last

annual or half-yearly balance sheet; and

IV – pay

interest on equity attributing the interest paid or credited to the mandatory

dividend (Article 33), pursuant to Article 9, paragraph 7 of Law 9.249 of

December 26, 1995.

Article

32

- The Board of

Directors’ act to resolve on the advance payment of the mandatory dividend

shall determine if these payments shall be monetarily restated, deducted from

the mandatory dividend for the year and once this deduction is determined, the

Annual General Meeting shall be the payment of the mandatory balance, if any,

as well as the reversal to the original account of the amount paid in advance.

Article 33

The

dividend distribution in each year shall not be less than twenty-five percent

(25%) of the net income, adjusted pursuant to article 202 of Law 6.404 of

December 15, 1976, and in compliance with Article 30 hereof.

Article 34

- Dividends and interest

on shareholders’ equity shall be paid on the dates and at the places indicated

by the Executive Officer in charge of the Investor Relations area, in

accordance with the terms established by the General Shareholders’ Meeting or

the Board of Directors, when applicable. If not claimed within three (3) years

as from the beginning of the payment, dividends shall become time-barred in

favor of the Company.

Chapter

VIII

DISSOLUTION

AND LIQUIDATION

Article

35

- The Company

shall be dissolved, liquidated or extinguish in the events established by Law,

with due regard for the applicable rules, or as resolved by the General

Meeting.

Sole Paragraph

- The General Meeting that approves the liquidation shall appoint the

liquidator and the members of the Fiscal Council that shall function during the

liquidation period, establishing their respective fees and the guidelines for

its operation.

|

_______________________

|

________________________

|

|

David Moise Salama

|

Claudia Maria Sarti

|

|

Chief Executive Officer

|

Secretary

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 11973

|

1 / 1

06/30/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Company

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

J.P. MORGAN S.A. - DISTRIBUIDORA DE TÍTULOS E VALORES MOBILIÁRIOS

|

|

Date of the Event

|

03/07/2017 11:00

AM

|

|

EVENT - Annual Shareholders’ Meeting - 2nd Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

AQR FUNDS - AQR EMERGING MOMENTUM STYLE FUND

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

261411-4

|

3200

|

20.047.294/0001-14

|

|

2

|

JNL/MELLON CAPITAL EMERGING MARKETS INDEX FUND

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

259002-9

|

178300

|

13.981.241/0001-00

|

|

3

|

PUBLIC EMPLOYEES RETIREMENT SYSTEM OF OHIO

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

261038-0

|

77700

|

97.540.082/0001-07

|

|

4

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045828

I.1.(F) I.2.(A) I.3.(A) II.(F)

|

261456-4

|

662900

|

20.196.632/0001-80

|

|

5

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045829

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

261457-2

|

692700

|

20.196.633/0001-24

|

|

6

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045833

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

260018-0

|

132900

|

14.819.360/0001-24

|

|

7

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045835

I.1.(F) I.2.(A) I.3.(A)II.(C)

|

260020-2

|

308100

|

14.819.363/0001-68

|

|

8

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045792

I.1.(F) I.2.(A) I.3.(A) II.(F)

|

261350-9

|

700400

|

19.822.653/0001-84

|

|

9

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045795

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

261483-1

|

569100

|

20.270.308/0001-64

|

|

10

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB4000405796

I.1.(F) I.2.(A) I.3.(A) II.(C)

|

261332-0

|

617200

|

19.808.699/0001-49

|

|

11

|

VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND, A SERIES OF VANGUARD STAR FUNDS

I.1.(F) I.2.(A) I.3.(A) II.(F)

|

251363-6

|

6003344

|

97.540.615/0001-42

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

1.1.

|

(11)

|

FAVORABLE

|

(F)

|

9,945,844

|

|

1.2.

|

(11)

|

ABSTENTION

|

(A)

|

9,945,844

|

|

1.3.

|

(11)

|

ABSTENTION

|

(A)

|

9,945,844

|

|

II.

|

(8)

|

CONTRARY

|

(C)

|

2,579,200

|

|

II.

|

(3)

|

FAVORABLE

|

(F)

|

7,366,644

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 11973

|

1 / 1

6/29/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Companhia

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

ITAU UNIBANCO S.A.

|

|

Date of the Event

|

3/7/2017 11:00

AM

|

|

EVENT - Annual Shareholders’ Meeting - 2nd Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

STICHTING JURIDISCH EIGENAAR ACTIAM BELEGGINGSFONDSEN

I.1.(F) I.2.(A) I.3.(F) II.(F)

|

9669-2

|

46240

|

24.992.329/0001-44

|

|

|

|

|

|

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

I.1.

|

(1)

|

FAVORABLE

|

(F)

|

46,240

|

|

I.2.

|

(1)

|

ABSTENTION

|

(A)

|

46,240

|

|

I.3.

|

(1)

|

FAVORABLE

|

(F)

|

46,240

|

|

II.

|

(1)

|

FAVORABLE

|

(F)

|

46,240

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 11976

|

1 / 1

6/29/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Company

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

ITAU UNIBANCO S.A.

|

|

Date of the Event

|

3/7/2017 11:00 AM

|

|

EVENT

–

Special Shareholders’ Meeting

–

2nd Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

STICHTING JURIDISCH EIGENAAR ACTIAM BELEGGINGSFONDSEN

I.(C)

|

9669-2

|

46240

|

24.992.329/0001-44

|

|

|

|

|

|

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

I.

|

(1)

|

CONTRARY

|

(C)

|

46,240

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 11976

|

1 / 2

6/30/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Company

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

J.P. MORGAN S.A. - DISTRIBUIDORA DE T

Í

TULOS E VALORES MOBILI

Á

RIOS

|

|

Date of the Event

|

3/7/2017 11:00 AM

|

|

EVENT

–

Special Shareholders’ Meeting

–

2nd Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

AQR FUNDS - AQR EMERGING MOMENTUM STYLE FUND

I.(C)

|

261411-4

|

3200

|

20.047.294/0001-14

|

|

2

|

BUREAU OF LABOR FUNDS-LABOR PENSION FUND

I.(C)

|

261188-3

|

6000

|

97.539.774/0001-27

|

|

3

|

BUREAU OF LABOR FUNDS-LABOR PENSION FUND

I.(C)

|

253773-0

|

34109

|

97.539.774/0001-27

|

|

4

|

BUREAU OF LABOR FUNDS-LABOR PENSION FUND

I.(C)

|

253772-1

|

23041

|

97.539.774/0001-27

|

|

5

|

BUREAU OF LABOR FUNDS-LABOR PENSION FUND

I.(C)

|

252107-8

|

7400

|

97.539.774/0001-27

|

|

6

|

CONSTRUCTION & BUILDING UNIONS SUPERANNUATION FUND

I.(C)

|

262274-5

|

39200

|

20.065.292/0001-58

|

|

7

|

CONSTRUCTION & BUILDING UNIONS SUPERANNUATION FUND

I.(C)

|

261420-3

|

88314

|

20.065.292/0001-58

|

|

8

|

JNL/MELLON CAPITAL EMERGING MARKETS INDEX FUND

I.(C)

|

259002-9

|

178300

|

13.981.241/0001-00

|

|

9

|

PUBLIC EMPLOYEES RETIREMENT SYSTEM OF OHIO

I.(C)

|

261038-0

|

77700

|

97.540.082/0001-07

|

|

10

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045828

I.(F)

|

261456-4

|

662900

|

20.196.632/0001-80

|

|

11

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045829

I.(C)

|

261457-2

|

692700

|

20.196.633/0001-24

|

|

12

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045833

I.(C)

|

260018-0

|

132900

|

14.819.360/0001-24

|

|

13

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MTBJ400045835

I.(C)

|

260020-2

|

308100

|

14.819.363/0001-68

|

|

14

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045792

I.(C)

|

261350-9

|

700400

|

19.822.653/0001-84

|

|

15

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045795

I.(C)

|

261483-1

|

569100

|

20.270.308/0001-64

|

|

16

|

THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045796

I.(C)

|

261332-0

|

617200

|

19.808.699/0001-49

|

|

17

|

VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND, A SERIES OF VANGUARD STAR FUNDS

I.(C)

|

251363-6

|

6003344

|

97.540.615/0001-42

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

I.

|

(16)

|

CONTRARY

|

(C)

|

9,481,008

|

|

I.

|

(1)

|

FAVORABLE

|

(F)

|

662,900

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 12012

|

1 / 1

6/29/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Company

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

CITIBANK N.A.

|

|

Date of the Event

|

3/7/2017 11:00 AM

|

|

EVENT - Annual Shareholders’ Meeting - 2nd Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

PANAGORA GROUP TRUST

1.(F) 2.(F) 3.(A) 4.(A) 5.(A) 6.1.(A) 6.2.(A) 6.3.(A) 6.4.(A) 6.5.(A) 7.(C) 8.(A)

|

204963-8

|

10000

|

05.987.588/000-132

|

|

|

|

|

|

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

1.

|

(1)

|

FAVORABLE

|

(F)

|

10,000

|

|

2.

|

(1)

|

FAVORABLE

|

(F)

|

10,000

|

|

3.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

4.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

5.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

6.1.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

6.2.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

6.3.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

6.4.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

6.5.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

7.

|

(1) '

|

CONTRARY

|

(C)

|

10,000

|

|

8.

|

(1)

|

ABSTENTION

|

(A)

|

10,000

|

|

|

MESQUITA PEREIRA, ALMEIDA, ESTEVES ADVOGADOS

LIST OF VOTES - 12012

|

1 / 1

6/29/2017

|

|

COMPANY’S DATA

|

VOTING LEGEND

(A) ABSTENTION

(C) CONTRARY

(F) FAVORABLE

(O) OTHERS

|

|

Company

|

COMPANHIA SIDERURGICA NACIONAL

|

|

Custodian

|

CITIBANK N.A.

|

|

Date of the Event

|

3/7/2017 11:00 AM

|

|

EVENT

–

Special Shareholders’ Meeting

–

2

nd

Call

|

|

ISIN

-

BRCSNAACNOR6 -

CSNA3

|

|

|

|

|

|

|

PASSENGER

|

SK

|

POSITION

|

CNPJ

|

|

1

|

JAPAN TRUSTEE SERVICES BANK

,

LTD. RE: STB DAIWA EMERGING EQUITY FUNDAMENTAL INDEX MOTHER FUND

1. (C)

|

235177-6

|

10000

|

12.120.411/0001-08

|

|

|

|

|

|

|

|

ITEM

|

(Number)

|

Description

|

(Vote)

|

Position

|

|

1.

|

(1)

|

CONTRARY

|

(C)

|

10,000

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 27, 2017

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ David Moise Salama

|

|

|

David Moise Salama

Executive Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

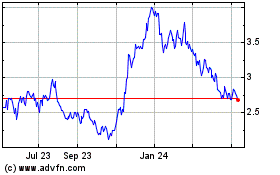

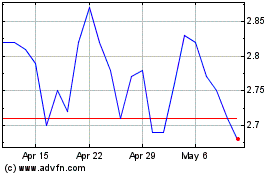

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024