Report of Foreign Issuer (6-k)

August 01 2017 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

DATED: August 1, 2017

Commission File

No. 001-33811

NAVIOS MARITIME PARTNERS L.P.

7 Avenue de

Grande Bretagne, Office 11B2

Monte Carlo, MC 98000 Monaco

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to

Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g3-2(b):

N/A

Omnibus Agreement

On June 8, 2017, Navios Maritime Partners L.P. (“

Navios Partners

”) entered into an omnibus agreement with Navios Maritime Containers, Inc.

(“

Navios Containers

”), Navios Maritime Acquisition Corporation (“

Navios Acquisition

”), Navios Maritime Holdings Inc. (“

Navios Holdings

”), and Navios Maritime Midstream Partners L.P. (“

Navios

Midstream

”), pursuant to which Navios Acquisition, Navios Holdings, Navios Partners and Navios Midstream have granted to Navios Containers a right of first refusal over any container vessels to be sold or acquired in the future. The omnibus

agreement contains significant exceptions that will allow Navios Acquisition, Navios Holdings, Navios Partners and Navios Midstream to compete with Navios Containers under specified circumstances.

A copy of the Omnibus Agreement is attached as Exhibit 10.1 to this report and is incorporated by reference herein.

Appointment of Director

On June 23, 2017,

Navios Partners announced both the appointment of Mrs. Orthodoxia Zisimatou to its Board of Directors and the prior resignation of Dimitris Papastefanou Gkouras. A copy of the press release is attached as Exhibit 99.1 to this report and is

incorporated by reference herein.

BNP Credit Facility

On June 26, 2017, Navios Partners entered into a new credit facility with BNP PARIBAS (the “

BNP Facility

”) of up to

$32.0 million (divided into two tranches) in order to finance a portion of the purchase price payable in connection with the acquisition of two Capesize vessels, the Navios Ace and the Navios Sol.

On June 28, 2017, Navios Partners drew on the first tranche of the BNP Facility of $17.0 million. The first tranche will be repayable in 16 equal

consecutive quarterly installments of $0.4 million each, with a final balloon payment of $10.8 million to be repaid on the last repayment date. The facility matures in the second quarter of 2021 and bears interest at the London Interbank

Offered Rate (“

LIBOR

”) plus 300 basis points (“

bps

”) per annum.

A copy of the BNP Facility is attached as Exhibit 10.2

to this report and is incorporated by reference herein.

Commerzbank/DVB Credit Facility

On June 28, 2017, Navios Partners entered into a new credit facility with DVB Bank S.E. (the “

New DVB Facility

”) for an amount of up to

$39.0 million, in order to refinance the $32.0 million outstanding under the existing facility with Commerzbank/DVB entered into in July 2012, which was supposed to mature in the third quarter of 2017, and provide an additional

$7.0 million to partially finance the acquisition of the Navios Prosperity I, a Panamax vessel. The New DVB Facility matures in the third quarter of 2020 and bears interest at LIBOR plus 310 bps per annum. A copy of the New DVB Facility is

attached as Exhibit 10.3 to this report and is incorporated by reference herein.

Both the BNP Facility and the New DVB Facility require compliance with

certain financial covenants. Among other events, it will be an event of default under both credit facilities if the financial covenants are not complied with.

Issuance of Units

In connection with the

acquisition of the Rickmers Maritime Trust Pte. fleet (the “

Rickmers transaction

”), Navios Partners agreed to issue USD600,000 worth of common units to a third party as consideration for providing certain consulting and advisory

services. The obligation to issue the units is subject to the occurrence of certain events, including the successful completion of delivery of all vessels under the Rickmers transaction.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

|

|

|

|

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

10.1

|

|

Omnibus Agreement, dated June 7, 2017.

|

|

|

|

|

10.2

|

|

Credit Agreement for $32.0 million credit facility, dated June 26, 2017.

|

|

|

|

|

10.3

|

|

Credit Agreement for $39.0 million credit facility, dated June 28, 2017.

|

|

|

|

|

99.1

|

|

Press release, dated June 23, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

NAVIOS MARITIME PARTNERS L.P.

|

|

|

|

|

By:

|

|

/s/ Angeliki Frangou

|

|

|

|

Angeliki Frangou

|

|

|

|

Chief Executive Officer

|

Date: August 1, 2017

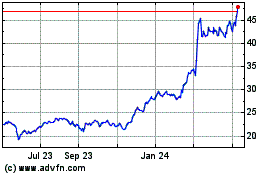

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

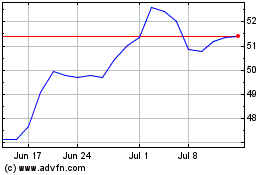

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024