Rank and 888 Eye Merger With William Hill

July 25 2016 - 7:00AM

Dow Jones News

LONDON—Shares in bookmaker William Hill PLC jumped 10% on Monday

after it acknowledged a takeover approach from a consortium made up

of 888 Holdings PLC and Rank Group PLC in the latest sign of

consolidation in the British gambling industry.

William Hill said the consortium didn't put forward a proposal

or set out a position on price, timing, terms, form of

consideration or transaction structure.

William Hill has a market capitalization of £ 2.72 billion

($3.56 billion), while Rank Group is valued at £ 926.3 million and

888 is valued at £ 795.8 million.

888 and Rank shares were trading up about 3% pence and 2%,

respectively, shortly after the announcement. William Hill shares

continued to trade up more than 6% nearly three hours after their

surge.

888 and Rank said the deal would make sense given the three

companies' "complementary online and land-based operations" and

potential for cost savings.

William Hill, meanwhile, expressed doubts but said it would

consider an offer.

"It is not clear that a combination of William Hill with 888 and

Rank will enhance William Hill's strategic positioning or deliver

superior value to William Hill's strategy," the company said.

According to U.K. takeover rules, the consortium is required to

announce a firm intention to make an offer, or walk away, by 5 p.m.

London time on Aug. 21.

The merger talks are part of broader consolidation in the

European gambling sector amid rising competition and taxation and

tighter regulation.

In February last year, 888 terminated talks and rejected a

possible offer from William Hill as the companies failed to agree

on an offer value. Later in 2015, 888 lost a bid to GVC Holdings

PLC after the latter clinched a deal to buy online gambling firm

Bwin.party digital PLC for £ 1.12 billion.

A U.K. "point of consumption" tax that came into effect in

December 2014 levies a 15% tax on profit made on bets by U.K.

consumers. The tax has led to more transparency, giving investors

better understanding of the income of online gambling firms and

prompting possible M&A activity.

The regulations have also constrained growth and focused

companies' attention on lowering costs.

Last year, Ireland's Paddy Power PLC and smaller U.K. rival

Betfair Group agreed to a near $8 billion merger. Likewise, betting

and gambling services firm Ladbrokes PLC merged with rival Gala

Coral Group Ltd.

Write to Razak Musah Baba at Razak.Baba@wsj.com

(END) Dow Jones Newswires

July 25, 2016 06:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

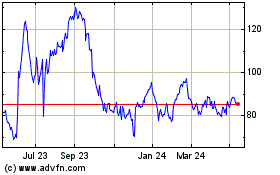

888 (LSE:888)

Historical Stock Chart

From Mar 2024 to Apr 2024

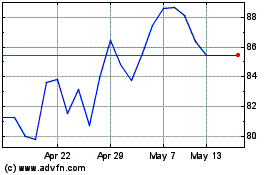

888 (LSE:888)

Historical Stock Chart

From Apr 2023 to Apr 2024