PureFunds to Fold 2 Mining ETFs - ETF News And Commentary

January 22 2014 - 8:09AM

Zacks

2013 was pretty rough for mining ETFs. A stronger dollar, the Fed’s

QE taper concerns and overall demand-supply imbalance left the

space in distress. And with the ongoing Fed tapering, though

measured, mining ETFs might stay out of favor even this year.

This has made it difficult for mining ETFs to accumulate assets, as

investors are opting for high potential sectors, a rebounding

Europe, and to some extent, a fast-improving Japan. Amid such

a scenario, PureFunds’ decision to shut down 2 mining ETFs does not

come as too much of a surprise (read: Metal Mining ETFs in

Trouble?).

The funds to be closed –

PureFunds ISE Diamond/Gemstone

ETF (

GEMS) and

PureFunds ISE

Mining Service ETF (

MSXX) –entered the

market in late November 2012. The duo will trade for the last

time on January 23, 2014.

Why the Closure?

Notably, GEMS and MSXX had the smallest share of assets of the

commodity producers’ equities ETFs space. While the space

bellwether

Market Vectors Gold Miners ETF

(GDX) boasts $4.3

billion in assets,

GEMS and MSXX accumulated only

$1.1 million and $0.8 million of assets, respectively. Such poor

asset bases even after a year of launch suggests that the funds

never took off in that sense.

This clearly explains why PureFunds chose to abandon these funds.

With these closures, PureFunds will have only one ETF –

PureFunds ISE Junior Silver (Small Cap Miners/Explorers)

ETF (

SILJ) – trading in the mining space,

that too with low assets under management.

Bottom Line

However, investors need not be bogged down by these closures. Many

other mining ETFs still seem to have a bullish future. Though

demand for hard assets will likely be low in 2013,

Market

Vectors Gold Miners ETF (GDX) has still managed to gather

a huge asset base of $4.3 billion. GDX has returned about 10% so

far in 2014, though it was a disastrous pick in 2013 (read: Gold or

Bitcoins: Which Will Perform Better in 2014?).

Many are hoping that after such a horrible 2013, ETFs related to

the yellow metal might be worthy of slight revival.

Especially for investors seeking to invest in gold mining

ETFs with a long-term view, the ongoing low valuation might open up

buying options.

Also, silver mining ETFs like

Global X Silver Miners

ETF (

SIL) and PureFunds’ SILJ have gained

considerably to start 2014, suggesting there might be some hope for

this space in the months ahead, at least for investors willing to

fight through some serious volatility first (read: 3 Mining

ETFs Finally on the Upswing).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-GOLD MI (GDX): ETF Research Reports

PF ISE-DIAMOND (GEMS): ETF Research Reports

PF ISE-MIN SVC (MSXX): ETF Research Reports

GLBL-X SILVER (SIL): ETF Research Reports

PF ISE-JS SC ME (SILJ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

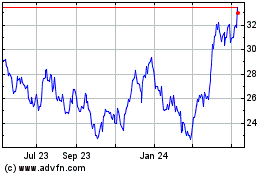

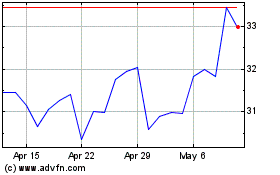

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Apr 2023 to Apr 2024