Publishers Aren't Seeing Revenue From Instagram's New Ads

January 11 2017 - 5:55PM

Dow Jones News

By Mike Shields

For publishers Instagram Stories are, for now, the

anti-Discover.

Unlike Snapchat's ultra -exclusive Discover platform, which is

limited to a few dozen partners who commit to creating unique

content on a daily basis, any media company can set up an Instagram

Stories account.

And while Snapchat's partners get a piece of the ad revenue

generated on their Discover channels, publishers as of now are not

getting any revenue cut from Instagram Stories, which just rolled

out its first advertising on Wednesday.

Most publishers told CMO Today they are patient, as they expect

Instagram to eventually share ad revenue or create some other form

of ad revenue for Stories.

A spokeswoman for Instagram, which is owned by Facebook Inc.,

said the company has no comment on how the Stories business model

may evolve.

In the meantime, publishers see a growing opportunity to weave

marketers' messages into their Story content. Currently, publishers

are permitted to charge marketers for this "sponsored content" and

keep all the revenue.

The new Instagram Stories ads sold by Instagram are very

Snapchat like: the placements are full screen vertical videos that

can run for 15-seconds, or static photos that run for five seconds.

The charter list of advertisers includes L'Oreal, Bacardi,

McDonald's and Wendy's, Instagram said.

To be sure, Instagram only launched the Stories product last

summer, and only so many publishers have committed to regularly

creating content for the service. That content ranges from an

occasional behind-the-scenes image from a photoshoot to snippets of

interviews with celebrities, like the ones recently posted by by

Entertainment Weekly on Alec Baldwin and the cast of ABC's

"Blackish."

Instagram said Wednesday that Stories now reaches an astonishing

150 million people a day (the same number that use Snapchat on a

daily basis).

James Quarles, vice president of Instagram Business, said that

one third of the most-viewed Stories to date come from businesses,

including media companies.

"Publishers are great Stories creators," he said. "They have so

many great content assets."

Brian Sugar, co-founder and chief executive of women-centric

content company PopSugar Inc., raved about the viewership the

company is seeing via Instagram Stories, and said he was confident

a viable business will emerge.

"Somehow publishers must see value in producing content for

these platforms," he said.

Indeed, producing content for any social platform consistently

takes time and resources. Brian Goldberg, chief executive at the

women-aimed digital outlet Bustle, noted that producing such

content is "not simple" and is different from shooting photos that

can be used in Instagram's traditional feed.

"It's still really early days on Instagram," he said. "It really

helps publishers build their brand. It's not yet at the center of

our revenue strategy."

Mr. Goldberg said that Bustle's audience on Instagram has surged

from 200,000 to close to 1.4 million over the past year. That

should make the publisher's Instagram Stories appealing to brands

looking to do sponsored content.

"The fact that they opened the door with ads should lead to more

things down the road," Mr. Goldberg added.

One publishing executive said he was surprised that Instagram

didn't launch a revenue share program for Stories as part of the ad

rollout, simply to put pressure on Snapchat. Another top media

executive said she thought it would be a matter of time.

Philippe von Borries, co-founder and co-chief executive of

Refinery29 said that, historically, Instagram has followed

Facebook's lead when it comes to ad products. Given that Facebook

has started testing mid-roll ads in videos, that could signal a

similar move by Instagram down the road.

In the meantime, Mr. von Borries is also bullish on the creative

potential for doing Stories on behalf of paying marketers.

"Instagram Stories are a lot more organic, and the content tends

to be very loose and experimental," he said. I don't think anyone

is up in arms [about monetization]."

Write to Mike Shields at mike.shields@wsj.com

(END) Dow Jones Newswires

January 11, 2017 17:40 ET (22:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

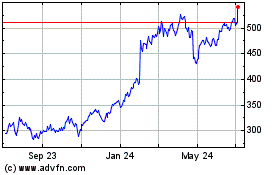

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Aug 2024 to Sep 2024

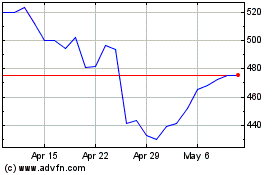

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Sep 2023 to Sep 2024