Promontory Settles With NY Regulator on Standard Chartered Investigation -- Update

August 18 2015 - 7:08PM

Dow Jones News

By Christopher M. Matthews

Promontory Financial Group and New York's top banking regulator

girded themselves over the last two weeks for a legal battle that

could have left both sides scarred.

On Tuesday, in a sudden about-face, Promontory settled with the

Department of Financial Services, agreeing to pay $15 million and

acknowledging that it didn't follow the regulator's requirements

for consultants.

"We are pleased that Promontory has agreed to resolve this

matter and to work constructively with the department moving

forward to help strengthen integrity within the consulting

industry," acting DFS Superintendent Anthony Albanese said.

"We are glad to have resolved this matter," said Eugene Ludwig,

Promontory's chief executive officer. "We remain committed to

quality and integrity in carrying out our work."

As recently as Sunday, Promontory was preparing to challenge the

regulator's move earlier in August to block the firm from advising

some New York-based banks on regulatory compliance matters,

according to people familiar with the matter.

The department took that step after saying that Promontory

watered down reports about potential sanctions violations by

Standard Chartered PLC, which had hired the consultancy to conduct

an internal investigation.

The same day DFS announced it was barring Promontory, the firm

said in a statement, "We will litigate the matter and defend our

firm against this regulatory overreach."

But in a last-minute change of course, Promontory

representatives and Mr. Albanese spoke Sunday evening and agreed to

a meeting Monday, according to people familiar with the matter. Mr.

Ludwig traveled to the department's offices in Manhattan's

financial district Monday and by the afternoon, the deal's contours

had been worked out, the people said.

Both sides appear to have gotten some of what they wanted.

Promontory relented on a main sticking point that had been blocking

a settlement: an acknowledgment that the firm had fallen short of

the regulator's requirements. But the admission was milder than

those in DFS's other cases involving consultants.

Under the terms of Tuesday's agreement, Promontory agreed that

"in certain instances, Promontory's actions in [the Standard

Chartered] engagement did not meet the department's current

requirements for consultants performing regulatory compliance work

for entities supervised by the department."

A Promontory competitor, Deloitte LLP, settled with DFS in 2013

over allegations it mishandled its anti-money-laundering work for

Standard Chartered and paid $10 million. In that settlement, it

agreed that it violated banking law and its own policies by

"knowingly disclosing confidential supervisory information."

PricewaterhouseCoopers settled in 2015, paying $25 million to

resolve allegations it sanitized reports about sanctions controls

at Bank of Tokyo-Mitsubishi. It agreed that it did not demonstrate

"the necessary objectivity, integrity and autonomy that is now

required of consultants" by DFS.

Paul Shechtman, Promontory's lawyer, said that "throughout the

negotiations, Promontory insisted that it would not admit it lacked

independence, integrity and autonomy--the words in prior

agreements. The matter did not settle until it was agreed those

words weren't required."

In addition to the $15 million penalty, Promontory agreed to a

voluntary six-month abstention from new consulting engagements that

would require the use of confidential reports sent to DFS by the

banks it regulates.

DFS established itself as a regulatory player in its 2012

settlement with Standard Chartered. The bank agreed to a $340

million settlement in 2012 for allegedly scheming to hide $250

billion of transactions for Iranian customers. The penalty came

before other U.S. authorities were ready to settle, and the bank

eventually reached a separate settlement for $327 million with the

Justice Department, Federal Reserve and others. Standard Chartered

admitted wrongdoing in its settlement with prosecutors.

Promontory got involved with the matter before Standard

Chartered reached its settlements and was paid $54.5 million for

the work.

The Justice Department and the New York Fed are also now

examining Promontory's investigation of Standard Chartered's

sanctions violations, according to people familiar with the

matter.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 18:53 ET (22:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

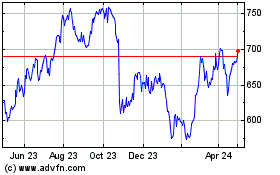

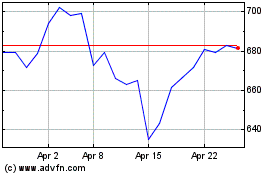

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024