Pound Remains Higher As U.K. GDP Growth Confirmed

August 26 2016 - 1:59AM

RTTF2

The pound remained strong against its key counterparts in

European trading on Friday, after data showed that U.K. economy

expanded at a faster pace in the second quarter as previously

estimated, in run-up to the EU referendum.

The second estimate from the Office for National Statistics

showed that gross domestic product grew 0.6 percent sequentially

after rising 0.4 percent in the first quarter. The growth figures

matched preliminary estimate published on July 27.

This was the 14th consecutive quarter of positive growth since

the first quarter 2013.

On a yearly basis, GDP rose 2.2 percent in the second quarter,

unrevised from previous estimate. In the first quarter, the annual

growth figure was 2 percent.

However, the pound's gains were capped on risk aversion, as

caution prevailed ahead of Fed Chair Janet Yellen's speech at

Jackson Hole later today on the economy and monetary policy.

Investors are looking for hints about trajectory of interest

rate hike from Yellen's address against the backdrop of improving

U.S. data, hawkish comments from several Fed officials and looming

global risks to the world's largest economy.

The currency exhibited mixed performance in Asian trading. While

the pound rose against the greenback and the yen, it held steady

against the euro and the franc.

The pound reached as high as 1.3233 against the greenback, up

from Thursday's closing value of 1.3189. If the pound extends rise,

it may challenge resistance around the 1.34 mark.

The pound that closed yesterday's trading at 132.55 against the

yen climbed to 133.02. The pound is seen finding resistance around

the 135.00 region.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's consumer prices fell 0.4 percent on year in

July - in line with expectations and unchanged from June's annual

reading.

Core CPI, which excludes volatile food costs, slid 0.5 percent

on year - missing forecasts for -0.4 percent, which would have been

unchanged.

The pound climbed to 0.8528 against the euro and 1.2787 against

the franc in early deals and held steady thereafter. On the upside,

the pound is likely to test resistance around 1.30 against the

franc and 0.84 against the euro.

Looking ahead, the second estimate of U.S. second quarter GDP

data and the University of Michigan's final consumer sentiment

index for August are set for release in the New York session.

At 10:00 am ET, the Fed Chair Janet Yellen speaks at the Jackson

Hole symposium, Wyoming.

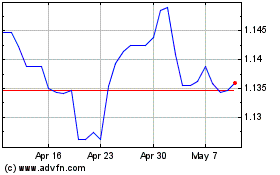

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024