Pound Climbs On Strong U.K. Retail Sales Data

December 18 2014 - 5:41AM

RTTF2

The pound gained ground against its major rivals in European

deals on Thursday, after data showed that the U.K.'s retail sales

growth accelerated unexpectedly in November, indicating that

economy on track for recovery.

Retail sales volume including automotive fuel increased 1.6

percent in November from October, the Office for National

Statistics said. The monthly growth was expected to slow to 0.4

percent from 1 percent in October.

Excluding automotive fuel, retail sales advanced 1.7 percent

versus 1 percent increase in October. Economists had forecast sales

to rise marginally by 0.3 percent.

On a yearly basis, the increase in overall sales volume

accelerated to 6.4 percent in November from 4.6 percent. The growth

was forecast to ease to 4.4 percent.

Likewise, the annual growth in sales excluding auto fuel

improved to 6.9 percent from 4.9 percent, while it was expected to

ease to 4.5 percent.

A rally in European stocks also benefited the pound. The Swiss

National Bank's surprise rate cut and the Federal Reserve's

assurance to begin tightening by next year restored confidence over

global growth.

The pound advanced 0.7 percent to 1.5662 against the greenback,

from a low of 1.5548 hit at 2:15 am ET. Continuation of the pound's

uptrend may take it to a resistance around the 1.58 zone. The pair

was worth 1.5572 at yesterday's close.

The pound remained firm at early 10-day against the franc,

trading at 1.5312. At Wednesday's close, the pair was quoted at

1.5150. If the pound extends rise, 1.54 is seen as its next

possible resistance level.

The Swiss National Bank decided to introduce negative interest

rate to contain the demand for the currency and reaffirmed that it

will defend the currency ceiling at an unscheduled meeting

today.

The central bank imposed an interest rate of -0.25 percent on

sight deposit account balances at the SNB, with an intention to

take the key three-month libor into negative zone.

Continuing early rally, the pound spiked up to 0.7861 against

the euro, a 10-day high. The pound is poised to find resistance

around the 0.77 mark. The pair traded at 0.7923 when it ended

yesterday's deals.

Bouncing off from an early low of 184.41 against the yen, the

pound climbed to a 3-day high of 185.84. Next key resistance for

the pound-yen pair is likely seen around the 190.00 area. The

pound-yen pair closed yesterday's trading at 184.73.

Looking ahead, U.S. weekly jobless claims for the week ended

Decmber 13 are due in the New York session.

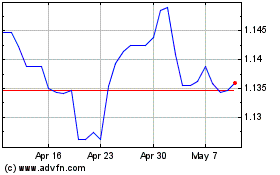

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024