Poland Looks to Buy Banks From Eurozone Owners

June 23 2016 - 8:30AM

Dow Jones News

WARSAW—Poland's government is looking at two banks that may be

available for sale in the country and might encourage financial

companies it controls to buy them, the country's treasury minister

said on Thursday.

Austrian cooperative lender Raiffeisen Bank International AG

said last year it was looking to sell its Polish unit Polbank.

Polish daily Puls Biznesu reported on Thursday that UniCredit SpA,

Italy's largest bank, is in touch with the Polish government amid a

review of its assets. The Italian bank controls Poland's

second-largest lender, Bank Pekao SA.

"The Treasury Ministry is looking at both transactions, we're

interested," Dawid Jackiewicz, Poland's treasury minister, told

reporters.

The transactions would likely take the form of takeovers by PZU

SA, Central Europe's largest insurer, or PKO Bank Polski SA,

Poland's largest bank by assets, he said.

The Polish government holds 34.19% in PZU and 29.43% in PKO,

being the largest and the controlling shareholder in both, listed

on the Warsaw Stock Exchange.

Poland has for years tried to regain more control over its

banking sector, where some 60% of assets are currently in the hands

of foreign financial groups. After 2008 and amid the global

financial crisis, Poland's banks avoided the kind of problems that

required bailouts with public cash in the eurozone, after years of

conservative lending.

More than 20 years of uninterrupted growth in Poland has made

the country's politicians more assertive and officials in the

European Union's largest emerging economy are eager to regain

national control over some industries that had been privatized

during the transition away from communism that began in 1989.

Across the political spectrum, leaders have expressed concern

that some business decisions are being made in the interest of

foreign owners rather than Poland. Former central bank chief Marek

Belka, whose term ended this month and is also a former prime

minister, has supported takeovers of banks by Polish owners, a

process dubbed re-Polonization.

Mr. Jackiewicz, who's part of a socially conservative Law and

Justice government that has ruled since November, said on Thursday

the level of Polish ownership of the banking sector remains too

small.

Polish attempts to gain a bigger share in the banking sector

through takeovers have so far produced only small results. PKO Bank

Polski was able to buy a relatively small Polish unit from Sweden's

Nordea Bank AB in 2013. Bigger deals went to Spain's Banco

Santander SA, which in 2011 acquired Bank Zachodni WBK SA, Poland's

third-largest lender, and in 2012 took over Kredyt Bank SA from

Belgium's KBC Group NV.

Write to Martin M. Sobczyk at martin.sobczyk@wsj.com

(END) Dow Jones Newswires

June 23, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

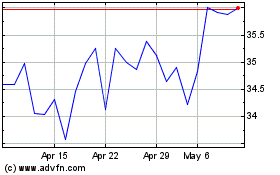

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024