Pinewood Studios Owner Considers Sale

February 10 2016 - 8:20AM

Dow Jones News

LONDON—The owner of the British film studio where the Millennium

Falcon soared back into action sent its shares into hyperdrive

Wednesday, after it said it has launched a strategic review that

could lead to a sale of the business.

Pinewood Group PLC, the home of the new "Star Wars" films as

well as the James Bond series, is Europe's largest stage and

studio space provider.

The company, thriving of late thanks to large-scale productions

like the blockbuster " Star Wars: The Force Awakens" and the latest

Bond adventure, "Spectre," in December reported strong profits for

the fiscal first half ended Sept. 30 and raised its dividend.

The company's shares, listed on London's small-capitalization

AIM market, jumped 19% to 535 pence in Wednesday morning trading

after it said ithas appointed investment bank Rothschild to assist

with a review of its capital base and structure.

"We believe Pinewood has the potential to build on the strong

performance of the last few years to grow further," said Chief

Executive Ivan Dunleavy. "The board is now looking to identify the

best ways to create the appropriate capital structure to allow the

company to realize its goals in the best interests of

shareholders."

Pinewood's storied history dates back more than 80 years. Films

shot at its facilities range from "Oliver Twist," "The Omen" and

1978's "Superman" to more recent megaproductions including

"Avengers: Age of Ultron" and "Mission: Impossible - Rogue

Nation."

Pinewood acquired its nearby rival Shepperton Studios, where

"Blade Runner" and "Top Gun" were shot, in 2001.

Mr. Dunleavy saidin an interview thatthe company hasn't been

approached yet and that there is no timetable for the review. "We

will be updating the market on the process and...we want to get on

with it so that it's a speedy process," he said.

Pinewood previously planned to move to the main market of the

London Stock Exchange but said its "tightly held" shareholder base

has stifled liquidity in its shares and prevented the company from

achieving its aim of obtaining a main-market listing.

More than 78% of shares are held by three shareholders:

Goodweather Investment Management Ltd., with about 39%; Warren

James Holdings Ltd., with about 26%; and Aviva PLC, with about

13%.

Pinewood also said its current expectations for the year ending

March 31 are higher than at the time of the interim results last

December.

Write to Jana Simmons at Jana.Simmons@wsj.com

(END) Dow Jones Newswires

February 10, 2016 08:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

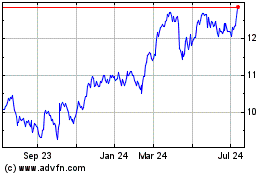

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Apr 2023 to Apr 2024